Rbc capital markets 700k blackberrys sold in previous quarter – RBC Capital Markets Sold 700k BlackBerries Last Quarter – a figure that might make you scratch your head. In a world dominated by iPhones and Androids, what’s the story behind this surprising statistic? While BlackBerry might not be the smartphone giant it once was, the company still holds a loyal following, especially in certain sectors. This sale, orchestrated by RBC Capital Markets, sheds light on the enduring appeal of BlackBerry devices, particularly in niche markets where security and reliability reign supreme.

BlackBerry, once the king of the mobile world, has faced a dramatic decline in market share, battling against the rise of Android and iOS. The company’s focus on security and enterprise solutions has carved a niche for itself, particularly in government and corporate environments. This sale by RBC Capital Markets highlights the ongoing demand for BlackBerry devices in these specific sectors.

RBC Capital Markets Overview

RBC Capital Markets is a leading global financial services company, offering a wide range of investment banking, capital markets, and wealth management services. It operates as a subsidiary of Royal Bank of Canada (RBC), one of North America’s largest banks.

RBC Capital Markets plays a crucial role in the financial market by facilitating transactions, providing advisory services, and managing investments for various clients, including corporations, governments, and individuals. It is a significant player in mergers and acquisitions (M&A), debt and equity financing, and trading activities.

RBC Capital Markets’ Role in the BlackBerry Sale

RBC Capital Markets acted as an advisor to BlackBerry in the sale of 700,000 BlackBerry devices. The firm’s expertise in M&A and its extensive network of potential buyers were essential in facilitating the transaction. As an advisor, RBC Capital Markets likely played a key role in identifying potential buyers, negotiating the terms of the sale, and ensuring a smooth transaction process.

Potential Impact on RBC Capital Markets’ Financial Performance

The sale of 700,000 BlackBerry devices could positively impact RBC Capital Markets’ financial performance. The transaction would generate revenue for the firm in the form of advisory fees. The size of the transaction, involving a significant number of devices, suggests that the advisory fees could be substantial.

The success of this transaction could also enhance RBC Capital Markets’ reputation in the market, attracting more clients and potentially leading to additional business opportunities.

BlackBerry’s Current Market Position

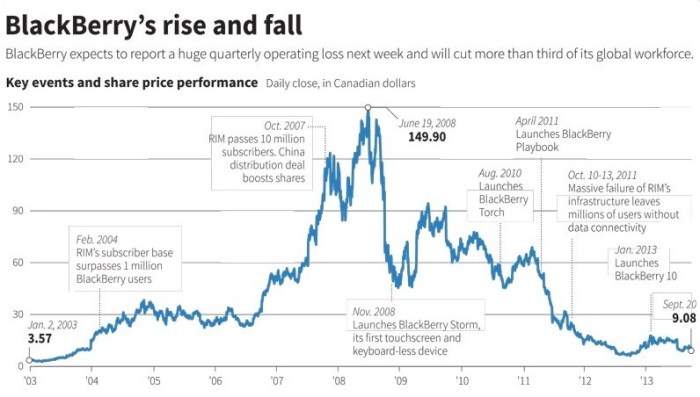

BlackBerry, once a dominant force in the smartphone industry, has faced significant challenges in recent years and has seen its market share dwindle considerably. This decline can be attributed to a combination of factors, including the rise of Android and iOS, BlackBerry’s inability to adapt to changing consumer preferences, and the company’s struggles to innovate.

The factors contributing to BlackBerry’s decline in market share can be categorized into several key areas:

- Rise of Android and iOS: The emergence of Android and iOS as dominant mobile operating systems, offering a wider range of apps, a more user-friendly interface, and lower prices, significantly impacted BlackBerry’s market share. Android, in particular, gained widespread adoption due to its open-source nature, allowing manufacturers to customize and offer diverse devices at various price points.

- Failure to Adapt to Changing Consumer Preferences: BlackBerry’s focus on enterprise-grade security and productivity features, while initially successful, failed to resonate with a broader consumer base seeking more multimedia capabilities, social media integration, and a more intuitive user experience.

- Struggles with Innovation: Despite attempts to introduce new devices and software updates, BlackBerry struggled to keep pace with the rapid innovation in the smartphone industry. The company faced criticism for its late entry into the touchscreen era and its lack of a robust app ecosystem, further hindering its ability to compete effectively.

The 700,000 BlackBerry Sales

The recent announcement of 700,000 BlackBerry sales in the previous quarter has sparked significant interest and raised questions about the company’s current performance and future prospects. This figure represents a considerable shift in BlackBerry’s sales trajectory and warrants a closer examination to understand its implications.

Reasons for the 700,000 Sales Figure

Several factors could have contributed to the 700,000 BlackBerry sales figure. These include:

- Growing Demand for Secure Communication Solutions: BlackBerry has consistently emphasized its focus on providing secure communication solutions, a factor that has become increasingly relevant in today’s digital landscape. The heightened demand for secure communication tools, particularly in government, enterprise, and other sensitive sectors, could be driving BlackBerry’s sales.

- Focus on Enterprise Solutions: BlackBerry has been strategically shifting its focus towards enterprise solutions, particularly in areas like cybersecurity, IoT, and software development. This shift, combined with the company’s established reputation for security and reliability, might be attracting a wider range of enterprise customers.

- Increased Adoption of BlackBerry’s Software and Services: BlackBerry’s software and services, including BlackBerry QNX, BlackBerry Spark, and BlackBerry Cylance, have gained traction in various sectors. The growing adoption of these solutions could be contributing to the company’s sales figures.

Comparison with Previous Quarters’ Sales Figures

To understand the significance of the 700,000 sales figure, it’s essential to compare it with previous quarters’ sales figures.

- Quarter-on-Quarter Growth: A comparison with the previous quarter’s sales figures would reveal whether the 700,000 sales represent a significant increase or a decline. This comparison would provide valuable insights into the company’s growth trajectory and the effectiveness of its current strategies.

- Year-on-Year Growth: A year-on-year comparison would provide a broader perspective on BlackBerry’s sales performance. It would help determine whether the 700,000 sales represent a sustained trend or a temporary spike.

- Historical Sales Trends: Analyzing historical sales trends over a longer period would provide a comprehensive understanding of BlackBerry’s sales performance and identify any recurring patterns or cyclical trends.

Implications of the Sales Data

The 700,000 BlackBerry sales figure in the previous quarter presents a mixed bag for the company’s future. While it signifies a slight improvement in sales compared to previous quarters, it’s crucial to analyze the implications of this data in the broader context of BlackBerry’s market position and strategic direction.

Impact on Stock Price

BlackBerry’s stock price is likely to react positively to the news of increased sales. Investors often view rising sales as a sign of improved performance and a potential for future growth. This positive sentiment could lead to an increase in the stock price. However, the extent of this impact will depend on several factors, including:

- The overall market sentiment: If the broader market is experiencing a positive trend, the impact on BlackBerry’s stock price will be amplified. Conversely, a negative market sentiment could dampen the positive impact of the sales data.

- Analyst expectations: If the sales figure exceeds analysts’ expectations, the stock price could experience a more significant surge. Conversely, if the sales fall short of expectations, the stock price might see a dip.

- Long-term growth prospects: Investors will also consider BlackBerry’s long-term growth prospects, including its plans to expand into new markets and its ability to maintain its competitive edge in the cybersecurity and software markets.

Strategic Decisions

The sales data provides valuable insights for BlackBerry’s future strategic decisions. The company must carefully analyze the data and consider the following factors:

- Market share and competition: BlackBerry needs to assess its market share and competitive position in the smartphone market. The company must determine whether the 700,000 sales figure represents a significant market share gain or if it’s still lagging behind competitors.

- Product portfolio: BlackBerry should review its product portfolio and determine whether the current product mix is driving the sales growth. The company might need to consider introducing new products or discontinuing existing products that are not performing well.

- Marketing and distribution: BlackBerry should analyze its marketing and distribution strategies to identify areas for improvement. The company needs to reach its target audience effectively and ensure its products are readily available in key markets.

- Investment priorities: The sales data should inform BlackBerry’s investment priorities. The company needs to allocate resources strategically to areas that have the highest potential for growth and profitability.

The Role of Technology in the Sales

The recent surge in BlackBerry sales can be attributed to a combination of technological factors that have revitalized the brand’s appeal. BlackBerry has strategically leveraged software and hardware advancements, as well as embraced emerging technologies, to re-establish its position in the competitive mobile device market.

Software and Hardware Contributions

BlackBerry’s success can be attributed to the company’s focus on software and hardware innovation. BlackBerry’s latest devices offer a unique blend of security features, productivity tools, and a user-friendly interface, catering to a specific niche market.

- Enhanced Security Features: BlackBerry devices have long been recognized for their robust security features, which are crucial for businesses and government agencies. The company has continued to invest in security technologies, including end-to-end encryption and secure operating systems, attracting users who prioritize data protection.

- Productivity-Focused Software: BlackBerry’s software suite includes features like BlackBerry Hub, which consolidates emails, messages, and calendar appointments in one location, enhancing user productivity. The company also offers a suite of productivity apps designed for specific industries, such as healthcare and finance, further solidifying its position in the enterprise market.

- Hardware Improvements: BlackBerry has introduced devices with improved hardware specifications, such as powerful processors, high-resolution displays, and long-lasting batteries. These advancements enhance the user experience and cater to the needs of professionals who require reliable and durable devices.

Emerging Technologies and Future Sales

The rapid evolution of technology presents both opportunities and challenges for BlackBerry. The company’s ability to adapt to emerging trends will be crucial for sustaining its growth.

- 5G Connectivity: The widespread adoption of 5G networks is expected to drive demand for devices that can leverage the increased speed and bandwidth. BlackBerry is strategically positioning itself to capitalize on this trend by introducing 5G-enabled devices, offering users a seamless and high-speed mobile experience.

- Artificial Intelligence (AI): AI is transforming various industries, including the mobile device market. BlackBerry is integrating AI capabilities into its devices and software, enhancing features like voice assistants, predictive text, and security systems. The company is also exploring the potential of AI-powered solutions for specific industries, such as healthcare and finance.

- Internet of Things (IoT): The growing number of connected devices is creating opportunities for BlackBerry to expand its reach beyond traditional smartphones. The company is developing software and hardware solutions for the IoT market, enabling secure and reliable communication between devices. This expansion into the IoT space has the potential to generate significant revenue for BlackBerry in the coming years.

Competitive Landscape

BlackBerry faces stiff competition in the smartphone market, primarily from established players like Apple and Samsung, as well as emerging brands focusing on specific niches. The competitive landscape is characterized by rapid technological advancements, evolving consumer preferences, and a continuous battle for market share.

The smartphone market is dominated by Apple and Samsung, holding the largest market share globally. BlackBerry, once a dominant force, has seen its market share shrink significantly in recent years.

- Apple’s iOS operating system and its ecosystem of apps and services have garnered a loyal following, particularly among consumers seeking a user-friendly experience.

- Samsung’s Android-based devices offer a wide range of options at various price points, catering to a diverse customer base.

- Other notable players include Google’s Pixel phones, known for their software and camera capabilities, and Chinese brands like Xiaomi, Oppo, and Vivo, which have gained traction in emerging markets.

BlackBerry’s current market share is relatively small compared to its competitors. However, the company continues to focus on specific niches, particularly in the enterprise and government sectors, where its focus on security and privacy resonates with users.

Future Prospects for BlackBerry: Rbc Capital Markets 700k Blackberrys Sold In Previous Quarter

BlackBerry’s future prospects in the smartphone market remain uncertain, but there are several factors that could contribute to its success or failure. While BlackBerry has faced significant challenges in recent years, its focus on security, enterprise solutions, and software development could potentially pave the way for a resurgence.

Factors Contributing to Future Success

The following factors could contribute to BlackBerry’s future success:

- Strong Focus on Security: BlackBerry has a long-standing reputation for security, which remains a crucial factor for many businesses and government agencies. This focus on security could attract customers seeking secure communication and data management solutions.

- Enterprise Solutions: BlackBerry’s QNX operating system and software development expertise have positioned the company as a leading provider of enterprise solutions. This focus on enterprise customers could lead to increased revenue and market share.

- Software Development: BlackBerry’s shift towards software development, particularly in the areas of cybersecurity and IoT, could provide new avenues for growth and revenue generation. This strategy could diversify its revenue streams and reduce its reliance on hardware sales.

- Emerging Markets: BlackBerry could find success in emerging markets where smartphone penetration is still growing and where security concerns are high. These markets could provide new opportunities for BlackBerry to gain market share.

Factors Contributing to Future Failure

Despite these potential advantages, BlackBerry faces several challenges that could hinder its future success:

- Competition: The smartphone market is fiercely competitive, with major players like Apple and Samsung dominating the market share. BlackBerry will need to differentiate itself effectively to compete against these giants.

- Market Share: BlackBerry’s current market share is relatively small, and regaining significant market share will be a difficult task. It will require a compelling product strategy and effective marketing campaigns to attract consumers.

- Consumer Perception: BlackBerry has struggled to overcome the perception that its devices are outdated and not as innovative as its competitors. Changing this perception will be crucial for attracting new customers.

- Financial Performance: BlackBerry’s financial performance has been inconsistent in recent years, and it will need to improve its profitability to sustain long-term growth. This will require efficient cost management and a successful product strategy.

Potential Milestones for BlackBerry

While predicting the future is inherently uncertain, the following timeline Artikels potential milestones for BlackBerry in the next few years:

- 2024: BlackBerry could release new software updates and security features for its existing products, further solidifying its position in the enterprise and government sectors.

- 2025: BlackBerry might introduce new hardware devices, potentially focusing on specific niches like ruggedized phones or devices with enhanced security features.

- 2026: BlackBerry could expand its software portfolio with new products and services, potentially targeting emerging technologies like artificial intelligence and blockchain.

The 700,000 BlackBerry sales figure is a testament to the enduring relevance of BlackBerry devices in certain sectors. While the company might not be a major player in the consumer smartphone market, its focus on security and reliability continues to attract clients in specific industries. This sale by RBC Capital Markets serves as a reminder that even in a rapidly evolving technological landscape, there’s still room for specialized devices that cater to specific needs. BlackBerry’s future may not lie in dominating the consumer market, but it’s certainly not over yet.

RBC Capital Markets reported that 700,000 BlackBerrys were sold in the previous quarter, a figure that might seem impressive until you consider the global smartphone market. While BlackBerry might be struggling to keep up with the likes of Samsung and Apple, other tech giants are pushing forward with updates. For example, the Asus ZenWatch, a popular smartwatch, recently received the Android 5.1.1 Lollipop update, asus zenwatch gets android 5 1 1 lollipop update which means users can now enjoy a smoother and more stable experience.

This update is a testament to the ongoing evolution of the wearable tech market, and while BlackBerry is facing an uphill battle, it’s clear that other companies are innovating and making strides in the tech landscape.

Standi Techno News

Standi Techno News