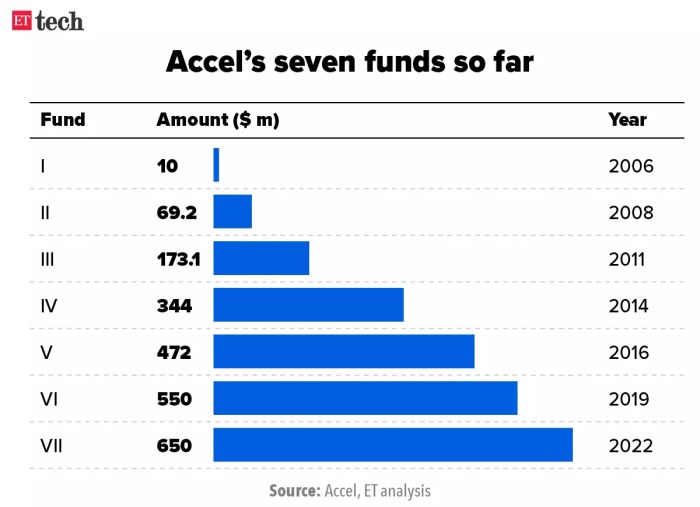

Accel has a fresh 650m to back european early stage startups – Accel, a renowned venture capital firm, has just announced a fresh $650 million fund dedicated to backing European early-stage startups. This significant investment marks a bold move by Accel, highlighting their belief in the burgeoning European startup ecosystem and its potential for growth.

Accel’s history is marked by a keen eye for identifying and nurturing successful companies. This new fund reflects their ongoing commitment to supporting innovative ventures at their nascent stages. With a focus on backing startups across various sectors, Accel’s investment is poised to inject a much-needed boost into the European startup landscape.

The Role of Funding in Startup Growth

Funding is the lifeblood of any startup. It provides the necessary resources to develop a product or service, build a team, and market the business. Without adequate funding, startups would struggle to survive, let alone thrive.

In the early stages of a startup’s journey, funding is crucial for establishing a solid foundation. It allows entrepreneurs to test their ideas, validate their market, and build a minimum viable product (MVP).

Funding Stages and Their Significance

The funding landscape for startups is a dynamic one, with various stages representing different milestones and needs. Understanding these stages is essential for navigating the fundraising process and securing the right type of capital for each stage.

- Seed Stage: This is the initial stage where startups receive funding to validate their idea and develop a prototype or MVP. Seed funding typically comes from angel investors, friends, and family, or seed accelerators. It is used for initial product development, market research, and team building.

- Series A Funding: This is the first institutional round of funding, typically obtained after a startup has achieved some traction and validated its market. Series A funding is used to scale the business, hire key personnel, and expand operations. It often comes from venture capitalists (VCs) or private equity firms.

- Series B Funding: This stage follows Series A and is typically used to further scale the business, expand into new markets, and invest in marketing and sales. Series B funding can also be used to acquire other companies or technologies. It often comes from VCs or private equity firms.

- Series C Funding and Beyond: These later stages are often used to fund major growth initiatives, such as mergers and acquisitions, expansion into new markets, or significant product development. They are typically obtained from larger institutional investors or private equity firms.

Typical Uses of Funding at Different Stages, Accel has a fresh 650m to back european early stage startups

The following table provides a summary of the typical uses of funding at different stages of a startup’s journey.

| Funding Stage | Typical Uses of Funding |

|---|---|

| Seed Stage | Product development, market research, team building, legal and accounting fees, initial marketing expenses. |

| Series A Funding | Hiring key personnel, scaling operations, marketing and sales, product development, expansion into new markets. |

| Series B Funding | Further scaling operations, expanding into new markets, investing in marketing and sales, acquisitions, product development. |

| Series C Funding and Beyond | Major growth initiatives, mergers and acquisitions, expansion into new markets, significant product development. |

Impact of Accel’s Investment on European Startups: Accel Has A Fresh 650m To Back European Early Stage Startups

Accel’s recent commitment of €650 million to back European early-stage startups signifies a significant boost for the region’s burgeoning tech scene. This investment has the potential to fuel innovation, create new jobs, and establish Europe as a global leader in the tech industry.

Potential Benefits of Accel’s Investment

Accel’s investment can benefit European startups in several ways.

- Access to Capital: Accel’s substantial fund provides startups with much-needed financial resources to scale their operations, hire talent, and develop their products. This access to capital is crucial for startups, especially in the early stages, as they navigate the challenging path to growth and profitability.

- Expertise and Mentorship: Accel brings a wealth of experience and expertise in building successful tech companies. Their team of seasoned investors and advisors can provide valuable guidance to startups, helping them navigate the complexities of the startup ecosystem and make informed decisions.

- Network and Connections: Accel’s extensive network of investors, entrepreneurs, and industry experts can open doors for European startups, providing access to new markets, partnerships, and potential customers.

- Increased Visibility: Accel’s investment can bring significant media attention and public recognition to European startups, boosting their brand awareness and attracting talent and customers.

Challenges in Receiving Funding from Accel

While Accel’s investment presents significant opportunities for European startups, there are also challenges associated with securing funding from such a prominent venture capital firm.

- Competition: Accel receives numerous pitches from startups across Europe, making the competition for funding intense. Startups need to demonstrate strong traction, a compelling value proposition, and a clear path to market dominance to stand out from the crowd.

- Strict Due Diligence: Accel conducts rigorous due diligence before investing in any company, scrutinizing their business model, team, financials, and market potential. Startups need to be prepared to provide comprehensive information and documentation to satisfy Accel’s due diligence process.

- Alignment with Accel’s Investment Strategy: Accel has a specific investment strategy and focuses on companies that fit their criteria. Startups need to ensure that their business aligns with Accel’s areas of interest and investment thesis to be considered for funding.

- Potential for Dilution: Receiving investment from Accel typically involves giving up a significant equity stake in the company. This dilution can impact the founders’ control and ownership of the business.

Impact of Accel’s Investment on the European Startup Ecosystem

Accel’s investment can have both positive and negative impacts on the European startup ecosystem.

| Positive Impact | Negative Impact |

|---|---|

| Increased Investment in European Startups: Accel’s investment can encourage other venture capitalists to invest in European startups, creating a more robust and competitive ecosystem. | Increased Competition: The influx of capital from Accel can lead to increased competition among startups for funding, resources, and talent. |

| Attracting Top Talent: Accel’s investment can attract top talent to European startups, further strengthening the region’s tech industry. | Potential for Overvaluation: The influx of capital can lead to an overvaluation of some startups, creating an unsustainable bubble in the market. |

| Increased Innovation and Growth: Accel’s investment can fuel innovation and growth within the European startup ecosystem, leading to the development of new technologies and businesses. | Potential for Exits to Non-European Companies: Accel’s investment can lead to increased acquisitions of European startups by non-European companies, potentially hindering the development of a strong European tech industry. |

The Future of European Startups

Accel’s recent commitment of €650 million to back European early-stage startups signals a significant vote of confidence in the region’s burgeoning innovation ecosystem. This investment is poised to have a profound impact on the future of European startups, potentially accelerating growth and propelling the region to the forefront of global innovation.

Factors Contributing to Continued Growth

The continued growth of European startups is fueled by a confluence of factors. These include:

- A thriving talent pool: Europe boasts a rich talent pool of skilled engineers, designers, and entrepreneurs, providing startups with access to a highly qualified workforce.

- Government support: European governments are increasingly recognizing the importance of fostering a thriving startup ecosystem and are implementing policies to support entrepreneurship, such as tax incentives and grants.

- Growing investor interest: Investors are increasingly recognizing the potential of European startups, particularly in sectors like fintech, artificial intelligence, and sustainability. Accel’s investment is a prime example of this growing interest.

- A culture of collaboration: European startups are known for their collaborative spirit, fostering a network of support and knowledge sharing among entrepreneurs.

Impact of Accel’s Investment on European Innovation

Accel’s investment will have a multifaceted impact on European innovation:

- Fueling early-stage growth: The funding will provide crucial capital for startups in their early stages, enabling them to develop their products, expand their teams, and reach new markets.

- Attracting top talent: Accel’s reputation as a leading venture capital firm will attract top talent to European startups, further strengthening the region’s innovation ecosystem.

- Enhancing competitiveness: By providing startups with the resources they need to scale, Accel’s investment will help European startups compete on a global stage.

- Driving innovation in key sectors: Accel’s focus on sectors like fintech, artificial intelligence, and sustainability will accelerate innovation in these critical areas, contributing to Europe’s economic growth and societal progress.

Accel’s $650 million commitment signifies a vote of confidence in the European startup scene, sending ripples of excitement through the tech community. This investment not only provides vital funding for startups but also signals a broader trend of increasing global interest in the European market. As Accel continues to identify promising ventures, the future of European innovation looks brighter than ever.

Accel, the renowned venture capital firm, is ready to fuel European innovation with a fresh €650 million fund dedicated to early-stage startups. While this news is exciting for the European tech scene, the tech world is also buzzing about the oneplus 2 processor confrimed. This latest investment by Accel will likely accelerate the growth of promising European companies, making them serious contenders in the global tech landscape.

Standi Techno News

Standi Techno News