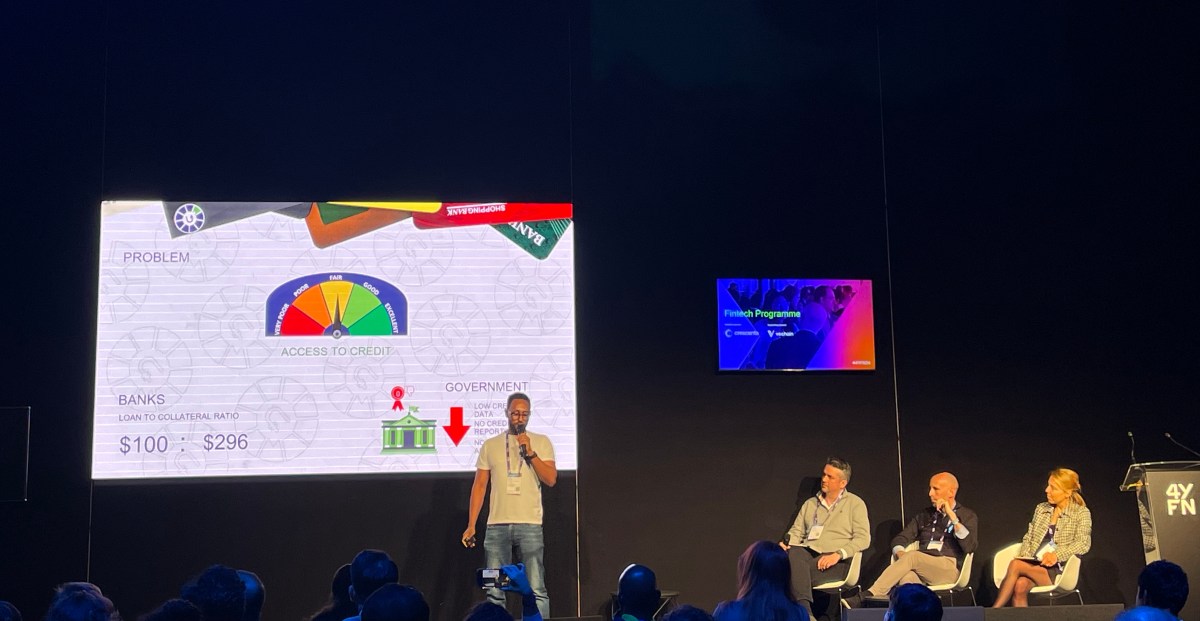

Mwc ethiopian fintech equb digitizes peer to peer credit – MWC Ethiopian Fintech: Equb Digitizes Peer-to-Peer Credit sets the stage for a captivating narrative, revealing how a traditional Ethiopian financial system is embracing the digital age. Equb, a centuries-old practice of rotating savings and credit associations, is being transformed by fintech platforms like MWC, bringing financial inclusion and modern efficiency to communities across Ethiopia.

The digitalization of Equb is driven by a desire to overcome the limitations of traditional practices, which often involve cumbersome paperwork, limited access, and potential for fraud. MWC’s platform offers a secure and transparent way for individuals to participate in Equb, enabling them to access loans and manage their finances digitally. This shift is not only changing the way people manage their money but also empowering communities and fostering economic growth.

Equb

Equb, a traditional Ethiopian financial system, has played a vital role in the country’s economy for centuries. It is a unique form of community-based credit and savings system that has deeply ingrained itself in Ethiopian culture.

Origins and Historical Context

Equb’s roots trace back to ancient Ethiopian traditions, where communities relied on mutual support systems for survival. In the absence of formal financial institutions, Equb emerged as a reliable way for people to access credit and manage savings. Its origins are deeply intertwined with the Ethiopian agricultural cycle, where farmers relied on collective efforts to manage risks and share resources.

Traditional Practices and Structure, Mwc ethiopian fintech equb digitizes peer to peer credit

Equb operates on a rotating basis, with a group of individuals contributing a fixed amount of money at regular intervals. The accumulated funds are then distributed to each member in turn, creating a cycle of lending and borrowing. The system is typically managed by a trusted member, who acts as a facilitator and ensures the smooth functioning of the group.

Equb’s structure relies on trust, transparency, and a strong sense of community. Members are expected to adhere to agreed-upon rules and contribute consistently, fostering a collective responsibility for the group’s success. The system’s strength lies in its ability to provide immediate access to credit for essential needs, such as medical expenses, education, or business ventures.

Benefits and Challenges of Traditional Equb Practices

Equb offers numerous benefits, including:

- Access to credit: It provides a readily available source of funds for individuals and families, particularly those who lack access to traditional banking services.

- Community empowerment: Equb fosters a sense of solidarity and collective responsibility within communities, promoting financial inclusion and supporting local businesses.

- Financial flexibility: The rotating nature of Equb allows members to access funds when they need them, providing flexibility and meeting immediate financial needs.

However, traditional Equb practices also present challenges:

- Risk of default: If a member fails to contribute, it can disrupt the entire system, impacting the group’s financial stability.

- Limited scalability: The traditional structure of Equb makes it difficult to scale up and reach larger populations, limiting its potential for broader financial inclusion.

- Vulnerability to fraud: Cases of fraud or mismanagement can arise, leading to financial losses and eroding trust within the group.

Digital Transformation of Equb

The digitization of Equb in Ethiopia is driven by a confluence of factors, reflecting a broader trend of technological advancement and financial inclusion in the country. The traditional, informal system of Equb, while deeply embedded in Ethiopian culture, faces challenges in efficiency, transparency, and scalability. The adoption of digital technologies offers a path to overcome these limitations, creating a more accessible and modern financial ecosystem.

Key Factors Driving Equb Digitalization

The digital transformation of Equb is driven by a combination of factors, including:

- Growing Mobile Penetration: Ethiopia boasts a rapidly growing mobile phone penetration rate, exceeding 90%, providing a readily available platform for digital financial services. This widespread access to mobile technology creates a fertile ground for Equb platforms to thrive.

- Government Initiatives: The Ethiopian government has actively promoted financial inclusion and digitalization through initiatives like the National Financial Inclusion Strategy. These policies provide a favorable environment for fintech companies to innovate and expand their reach.

- Demand for Efficiency and Transparency: Traditional Equb systems can be cumbersome and lack transparency, leading to disputes and mistrust. Digital platforms offer a solution by providing clear records, automated processes, and increased accountability.

- Expanding Financial Services: Digital platforms enable the provision of a wider range of financial services beyond traditional Equb, such as microloans, savings accounts, and insurance. This expansion caters to the diverse needs of individuals and communities.

Challenges and Opportunities of Integrating Technology into Equb

The integration of technology into Equb presents both challenges and opportunities:

- Digital Literacy: A significant portion of the population may lack digital literacy skills, hindering their ability to utilize digital platforms effectively. This requires targeted training and awareness programs to bridge the digital divide.

- Infrastructure: Reliable internet connectivity and robust financial infrastructure are essential for the smooth operation of digital Equb platforms. Addressing gaps in infrastructure is crucial for widespread adoption.

- Security and Trust: Building trust in digital platforms is paramount. Robust security measures and transparent practices are essential to mitigate risks of fraud and data breaches.

- Regulatory Framework: A clear and comprehensive regulatory framework is needed to govern the operations of digital Equb platforms, ensuring fair competition, consumer protection, and financial stability.

- Cultural Acceptance: Integrating technology into a deeply ingrained cultural practice like Equb requires careful consideration of cultural sensitivities and preferences. Platforms need to be designed in a way that aligns with existing practices while offering modern benefits.

Examples of Fintech Companies Digitizing Equb

Several fintech companies and platforms are actively digitizing Equb in Ethiopia:

- MWC (Mobile World Congress): MWC is a global platform for mobile technology and innovation. It has played a significant role in showcasing the potential of digital platforms for Equb and facilitating partnerships between fintech companies and traditional Equb groups.

- Other Fintech Platforms: Various fintech platforms are emerging in Ethiopia, offering digital Equb services. These platforms utilize mobile apps, online platforms, and other technologies to streamline the Equb process, enhance transparency, and expand access to financial services.

MWC’s Role in Digitizing Equb

MWC, a leading provider of fintech solutions, has played a crucial role in the digital transformation of Equb, a traditional Ethiopian peer-to-peer credit system. MWC’s platform provides the necessary infrastructure and tools to modernize Equb, making it more accessible, efficient, and transparent.

Facilitating Peer-to-Peer Credit within Equb

MWC’s platform enables the seamless flow of credit within Equb by providing a secure and transparent digital environment for transactions. This digital platform streamlines the entire process, from loan applications to repayments, eliminating the need for physical interactions and paperwork.

- Digital Loan Applications: MWC’s platform allows borrowers to apply for loans online, simplifying the process and reducing the time needed for approval.

- Automated Loan Matching: The platform uses algorithms to match borrowers with lenders based on factors like creditworthiness and loan requirements, facilitating efficient and transparent loan allocation.

- Secure Payment Processing: MWC’s platform provides a secure and reliable payment gateway for both borrowers and lenders, ensuring safe and timely transactions.

- Real-Time Tracking: The platform allows borrowers and lenders to track loan status, payment history, and outstanding balances in real-time, promoting transparency and accountability.

Impact of MWC’s Platform on Efficiency and Accessibility

MWC’s platform has significantly enhanced the efficiency and accessibility of Equb, making it a more attractive option for both borrowers and lenders.

- Increased Efficiency: The digital platform has streamlined the entire loan process, reducing processing times and minimizing administrative burdens. This allows Equb to handle a larger volume of transactions with greater efficiency.

- Improved Accessibility: MWC’s platform has made Equb accessible to a wider range of individuals, including those in remote areas with limited access to traditional financial institutions. This has significantly expanded the reach of Equb, bringing financial services to a larger segment of the population.

- Enhanced Transparency: The platform’s real-time tracking capabilities promote transparency, providing borrowers and lenders with clear visibility into loan details, repayment history, and transaction records.

Benefits of Digitized Equb

The digitization of Equb brings numerous advantages, transforming traditional practices into a modern, efficient, and accessible system. This shift empowers individuals and communities by enhancing transparency, increasing financial inclusion, and fostering economic growth.

Enhanced Transparency and Accountability

Digitizing Equb fosters transparency by providing a clear and accessible record of all transactions. Members can easily track contributions, repayments, and interest earned, eliminating any ambiguity or potential for disputes. This increased transparency promotes trust and accountability among members, strengthening the Equb system.

Increased Efficiency and Convenience

Digital platforms streamline Equb operations, simplifying contribution and repayment processes. Members can easily make contributions and access funds through mobile apps or online portals, eliminating the need for physical meetings and reducing administrative overhead. This efficiency saves time and resources, allowing members to focus on other aspects of their lives.

Expanded Financial Inclusion

Digitized Equb extends financial services to individuals who might not have access to traditional banking systems. This is particularly relevant in rural communities where access to financial institutions is limited. By providing a secure and accessible platform for saving and borrowing, digitized Equb promotes financial inclusion and empowers individuals to participate in the formal economy.

Improved Risk Management and Financial Stability

Digital platforms facilitate robust risk management practices, allowing for better assessment of creditworthiness and potential risks. This helps to mitigate financial losses and ensure the long-term sustainability of the Equb system. By reducing the risk of default, digitized Equb promotes financial stability and fosters a more secure environment for members.

Empowering Individuals and Communities

Digitized Equb empowers individuals by providing them with access to affordable credit and financial services. This can help them to start businesses, invest in education, or meet other financial needs. Equb also strengthens communities by promoting financial inclusion and economic development. By providing a platform for collective savings and lending, digitized Equb can contribute to the overall well-being of communities.

Challenges and Future Directions: Mwc Ethiopian Fintech Equb Digitizes Peer To Peer Credit

While digitizing Equb holds immense promise, it’s essential to acknowledge the challenges that lie ahead. These challenges range from regulatory hurdles and cybersecurity concerns to the need to bridge the digital literacy gap. Addressing these issues will be crucial to realizing the full potential of digitized Equb in Ethiopia.

Regulatory Landscape

Navigating the regulatory landscape is a critical challenge. Ethiopia’s financial sector is still evolving, and regulations surrounding fintech and digital lending are relatively new. The National Bank of Ethiopia (NBE) is actively working on developing a robust regulatory framework for the fintech industry, but clarity and consistency are essential for Equb’s successful digitization.

- Ensuring compliance with existing regulations, such as those governing data privacy and anti-money laundering, is paramount.

- The NBE’s regulatory sandbox initiative, which allows for testing and piloting of innovative financial products and services, provides a valuable opportunity for Equb to refine its digital platform and gain regulatory insights.

- Close collaboration with the NBE and other relevant stakeholders is crucial for fostering a conducive regulatory environment that supports the growth of digitized Equb.

Cybersecurity and Data Privacy

Cybersecurity threats are a major concern for any financial institution, especially in the digital age. Equb must prioritize robust cybersecurity measures to protect its platform and user data.

- Investing in state-of-the-art security infrastructure, including firewalls, intrusion detection systems, and encryption technologies, is essential.

- Regular security audits and penetration testing can help identify and address vulnerabilities before they can be exploited.

- Training employees on cybersecurity best practices and raising awareness about potential threats are crucial for mitigating risks.

- Equb must also adhere to data privacy regulations, such as the General Data Protection Regulation (GDPR), to safeguard user information and maintain trust.

Digital Literacy

Bridging the digital literacy gap is essential for the successful adoption of digitized Equb. While Ethiopia has made significant progress in increasing internet penetration, a significant portion of the population still lacks access to technology and the skills needed to use digital financial services.

- Equb can play a role in promoting digital literacy by partnering with educational institutions and community organizations to provide training programs.

- Developing user-friendly interfaces and providing multilingual support can enhance accessibility for users with varying levels of digital literacy.

- Collaborating with mobile network operators to offer mobile banking services can also help expand access to digital financial services.

Addressing Challenges: Potential Solutions

| Challenge | Potential Solutions |

|---|---|

| Regulatory Uncertainty | – Proactive engagement with the NBE and other stakeholders to clarify regulations and ensure compliance. – Participation in the NBE’s regulatory sandbox initiative to test and refine the digital platform. |

| Cybersecurity Risks | – Investing in robust security infrastructure, including firewalls, intrusion detection systems, and encryption technologies. – Regular security audits and penetration testing to identify and address vulnerabilities. – Training employees on cybersecurity best practices and raising awareness about potential threats. |

| Digital Literacy Gap | – Partnering with educational institutions and community organizations to provide digital literacy training. – Developing user-friendly interfaces and providing multilingual support. – Collaborating with mobile network operators to offer mobile banking services. |

The digitization of Equb through platforms like MWC represents a significant leap forward in financial inclusion and economic development in Ethiopia. By bridging the gap between traditional practices and modern technology, Equb is becoming more accessible, transparent, and efficient. This innovative approach is not only empowering individuals but also paving the way for a more inclusive and prosperous future for Ethiopian communities.

While the world of fintech continues to evolve, with Ethiopian company Equb digitizing peer-to-peer credit at MWC, the autonomous vehicle industry is facing some headwinds. Hyundai-backed autonomous company Motional cuts 5% of its workforce , signaling a potential shift in the autonomous vehicle landscape. This highlights the contrasting fortunes of different sectors, as Equb’s innovation in fintech aims to bridge financial gaps, while the autonomous vehicle sector navigates its own path to maturity.

Standi Techno News

Standi Techno News