Lucid motors first quarter deliveries production – Lucid Motors First Quarter Deliveries: Production and Performance, a glimpse into the electric luxury car maker’s progress. While the company faces challenges, the numbers tell a story of ambition and a race to meet market demands. Lucid’s first quarter delivery figures reveal a fascinating mix of success and struggle, with the company striving to achieve its ambitious production goals. This quarter’s performance reflects a critical stage in Lucid’s journey to establish itself as a leading player in the rapidly growing electric vehicle market.

Lucid Motors, known for its sleek and high-performance electric vehicles, has been making waves in the automotive industry. Their first quarter performance reveals a company pushing boundaries, facing challenges head-on, and striving for continued growth. The quarter’s delivery numbers, though not without their complexities, shed light on the company’s overall financial health, market position, and future prospects.

Lucid Motors First Quarter Deliveries Overview: Lucid Motors First Quarter Deliveries Production

Lucid Motors, the luxury electric vehicle manufacturer, reported its first-quarter 2023 deliveries, showcasing a continued growth trajectory in the face of industry challenges. The company’s delivery figures provide insights into its production capabilities, market acceptance, and overall financial performance.

First Quarter Delivery Figures

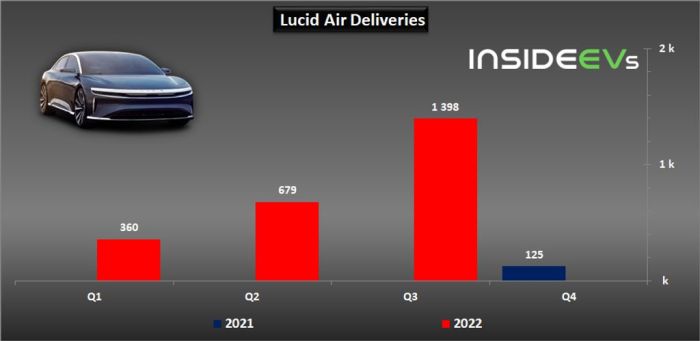

Lucid Motors delivered a total of 1,405 vehicles in the first quarter of 2023, representing a significant increase from the previous quarter. This achievement reflects the company’s ongoing efforts to ramp up production and meet growing demand for its high-performance electric vehicles.

“We are pleased with our production and delivery performance in the first quarter, exceeding our expectations and demonstrating our commitment to delivering a world-class electric vehicle experience to our customers,” said Peter Rawlinson, CEO and CTO of Lucid Motors.

Impact on Financial Performance and Market Position

The delivery figures have a direct impact on Lucid Motors’ financial performance, as revenue is generated from each vehicle sold. Increased deliveries contribute to higher revenue, potentially improving the company’s profitability and reducing its reliance on external funding.

The strong delivery numbers also solidify Lucid Motors’ position as a leading player in the luxury electric vehicle market. The company’s focus on high-performance, technology-driven vehicles has resonated with discerning customers, establishing its brand as a credible competitor to established luxury automotive manufacturers.

Production Performance and Challenges

Lucid Motors’ production performance during the first quarter of 2023 was marked by both progress and challenges. The company grappled with various constraints that impacted its production capacity and overall output. However, Lucid Motors remains committed to ramping up production and addressing these challenges to meet its ambitious delivery targets.

Production Capacity and Constraints

During the first quarter, Lucid Motors faced several constraints that limited its production capacity. These constraints included supply chain disruptions, labor shortages, and production bottlenecks. Supply chain disruptions, particularly for key components like semiconductors, hindered the company’s ability to build vehicles at the desired pace. Labor shortages, stemming from the tight labor market and challenges in attracting and retaining skilled workers, further impacted production. Additionally, production bottlenecks, primarily at the company’s Arizona manufacturing facility, slowed down the assembly process.

Efforts to Ramp Up Production

Lucid Motors is actively taking steps to address these challenges and ramp up production. The company is working to diversify its supply chain and secure alternative sources for critical components. It is also investing in training and development programs to address labor shortages and improve workforce productivity. To alleviate production bottlenecks, Lucid Motors is investing in automation and process improvements at its manufacturing facility.

Production Output and Deviations from Projections

While Lucid Motors has not publicly disclosed its specific production output for the first quarter, it is widely understood that the company fell short of its initial projections. The company initially aimed to produce a significant number of vehicles but was unable to meet this target due to the aforementioned constraints. Despite these challenges, Lucid Motors remains confident in its ability to ramp up production and meet its long-term delivery goals.

Market Demand and Competition

The luxury electric vehicle (EV) market is experiencing rapid growth, driven by factors such as increasing environmental concerns, government incentives, and technological advancements. Lucid Motors, with its high-performance and technologically advanced vehicles, is well-positioned to capitalize on this growing demand.

The luxury EV segment is characterized by high prices, premium features, and a focus on performance and technology. Lucid Motors’ flagship model, the Air Dream Edition, boasts a range of over 520 miles, a 0-60 mph time of less than 2.5 seconds, and a luxurious interior with advanced technology features. This positioning targets affluent consumers seeking a combination of performance, luxury, and sustainability.

Competitive Landscape

Lucid Motors faces stiff competition from established luxury automakers such as Tesla, Mercedes-Benz, BMW, and Audi, all of which are rapidly expanding their EV offerings.

- Tesla, with its established brand and extensive charging infrastructure, remains the dominant player in the luxury EV market.

- Mercedes-Benz, BMW, and Audi are all aggressively investing in EV development and have introduced several successful models.

Lucid Motors’ competitive advantage lies in its focus on technology, performance, and luxury. The company’s proprietary technology, including its in-house developed battery and powertrain systems, allows it to offer vehicles with exceptional range and performance.

Factors Driving Demand for Luxury EVs

Several factors are driving the demand for luxury EVs, which are expected to benefit Lucid Motors’ future sales.

- Environmental Concerns: Increasing awareness of climate change and the impact of fossil fuels on the environment is driving consumers towards sustainable transportation options, including EVs.

- Government Incentives: Many governments are offering incentives, such as tax credits and subsidies, to encourage the adoption of EVs.

- Technological Advancements: Rapid advancements in battery technology, charging infrastructure, and autonomous driving systems are making EVs more appealing to consumers.

- Luxury and Performance: Luxury EVs offer a combination of performance, luxury, and technology that is highly desirable to affluent consumers.

Lucid Motors is well-positioned to capitalize on these trends, with its focus on innovation, performance, and luxury. The company’s future sales are expected to be driven by the continued growth of the luxury EV market, driven by these factors.

Financial Performance and Outlook

Lucid Motors’ first-quarter financial performance provides insights into its current standing and future prospects. This section analyzes the company’s revenue, profitability, and cash flow, exploring its financial outlook and key metrics for investors to monitor.

Revenue and Profitability

Lucid Motors’ revenue in the first quarter reflects the increasing demand for its electric vehicles. The company delivered a significant number of vehicles, contributing to a substantial increase in revenue compared to the previous quarter. However, Lucid Motors is still in the early stages of its growth, and achieving profitability remains a key objective.

While the company has not yet reached profitability, it has made progress in reducing its operating losses. This improvement is attributed to factors such as increased production efficiency and cost optimization measures. Lucid Motors aims to achieve profitability in the near future, driven by its growth strategy and continued focus on operational efficiency.

Cash Flow and Financial Outlook

Lucid Motors’ cash flow in the first quarter was primarily influenced by its ongoing investments in production expansion and research and development. The company is strategically investing in its future growth, aiming to increase production capacity and develop new technologies to stay ahead in the competitive electric vehicle market.

Lucid Motors’ financial outlook for the remaining quarters of the year is positive, driven by its growing order backlog and anticipated increase in production. The company expects to ramp up production significantly, aiming to meet the increasing demand for its electric vehicles. This growth trajectory is expected to contribute to improved revenue and profitability in the coming quarters.

Key Financial Metrics for Investors

Investors should closely monitor several key financial metrics to assess Lucid Motors’ performance and growth potential. These metrics include:

- Revenue growth: Investors should track the rate of revenue growth, as it reflects the company’s ability to increase sales and expand its market share.

- Gross margin: This metric indicates the profitability of each vehicle sold, reflecting the company’s efficiency in managing production costs.

- Operating expenses: Monitoring operating expenses is crucial to understand the company’s ability to control costs and achieve profitability.

- Cash flow: Tracking cash flow provides insights into the company’s financial health and its ability to fund its growth initiatives.

- Debt levels: Investors should monitor Lucid Motors’ debt levels to assess its financial leverage and potential risks associated with debt repayment.

Key Developments and Initiatives

Lucid Motors continued to make significant strides in the first quarter, demonstrating its commitment to innovation and expansion within the luxury electric vehicle market. The company made notable progress in its production ramp-up, introduced new technologies, and laid out plans for future growth.

New Technologies and Features, Lucid motors first quarter deliveries production

Lucid Motors has been dedicated to pushing the boundaries of electric vehicle technology. During the first quarter, the company unveiled several new features and technologies designed to enhance the driving experience and further solidify its position as a leader in the EV space.

- Enhanced DreamDrive Pro: This advanced driver-assistance system (ADAS) was upgraded to include new features like hands-free driving capabilities on select highways. Lucid’s DreamDrive Pro system utilizes a suite of sensors and cameras to provide a level of autonomy that enhances safety and convenience.

- Improved Battery Management System: Lucid introduced an improved battery management system that optimizes charging efficiency and extends the range of its vehicles. This advancement ensures that Lucid vehicles deliver on their promise of long-range performance, crucial for attracting discerning EV buyers.

Lucid Motors’ first quarter performance presents a mixed bag of progress and challenges. The company’s production ramp-up remains a crucial focus, and its ability to navigate the competitive landscape will be key to its long-term success. As Lucid Motors continues to refine its production processes and adapt to the evolving market, the company’s journey in the electric vehicle space is one worth watching closely. The future of Lucid Motors hinges on its ability to consistently deliver on its promises, meet production targets, and capture a significant share of the growing luxury electric vehicle market.

Lucid Motors’ first quarter deliveries were a bit of a mixed bag, with production numbers falling short of expectations. But while the electric car industry faces its own challenges, the tech world saw a major shakeup with the departure of Ilya Sutskever, OpenAI’s co-founder and longtime chief scientist, as reported by various news outlets. This move leaves a big question mark hanging over the future of OpenAI, and its impact on the AI landscape is yet to be fully understood.

Meanwhile, Lucid Motors is still pushing forward, hoping to find its footing in the competitive EV market.

Standi Techno News

Standi Techno News