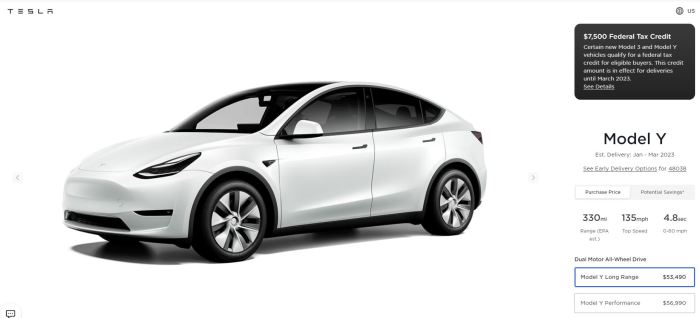

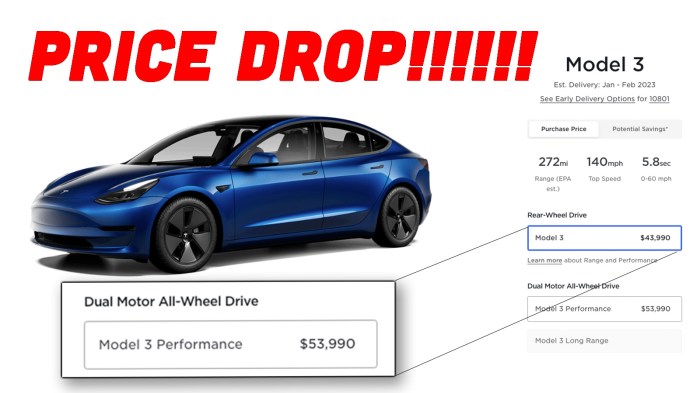

Tesla slashes model y inventory prices cut – Tesla Slashes Model Y Inventory Prices: A Bold Move – The electric vehicle giant has made a surprising move, slashing prices for its popular Model Y SUV. This decision has sent shockwaves through the automotive industry, sparking questions about Tesla’s strategy and its potential impact on the market.

The price cuts, which range from a few thousand dollars to over $10,000 depending on the Model Y configuration, are a significant shift for Tesla. This bold move could be driven by a variety of factors, including the need to boost sales in a slowing market, increased competition from other EV manufacturers, and the company’s desire to maintain its market share dominance.

Tesla’s Price Reduction Strategy: Tesla Slashes Model Y Inventory Prices Cut

Tesla’s recent decision to slash prices on its Model Y inventory has sent shockwaves through the automotive industry. This move, which saw significant price reductions across various Model Y configurations, has sparked widespread discussion about the rationale behind this strategy and its potential impact on the electric vehicle market.

Rationale for Price Reduction

Tesla’s price reduction strategy can be attributed to several key factors. One primary driver is the need to boost sales amidst increasing competition in the electric vehicle (EV) market. Tesla faces growing pressure from established automakers like Ford and General Motors, as well as emerging EV startups, all vying for a slice of the rapidly expanding EV market. By lowering prices, Tesla aims to make its vehicles more accessible to a wider range of consumers and stimulate demand.

Another factor is the need to clear out inventory. As Tesla ramps up production, it has faced challenges in moving its Model Y inventory, particularly in the face of slowing demand and rising interest rates. Price reductions offer a strategic way to accelerate sales and prevent inventory buildup, which can negatively impact profitability.

Tesla’s price cuts are expected to have a significant impact on its sales and market share. The reduced prices could attract new customers who were previously priced out of the Tesla market, potentially leading to a surge in demand. This could further solidify Tesla’s position as a market leader in the EV space.

However, the impact on market share is not guaranteed. Competitors could respond with their own price reductions, potentially creating a price war that could benefit consumers but erode profit margins for all players. The effectiveness of Tesla’s strategy will depend on how its competitors react and how consumers respond to the lower prices.

Comparison to Competitors’ Pricing Strategies

Tesla’s price reduction strategy contrasts with the pricing strategies of some of its key competitors. For example, Ford and General Motors have generally focused on offering competitive pricing on their EV models, but have not engaged in the same level of aggressive price cuts as Tesla. This suggests that Tesla is willing to sacrifice some profit margins in the short term to gain market share and establish itself as a dominant force in the EV market.

Impact on the Used Car Market

The price reductions on new Model Ys are likely to have a ripple effect on the used car market. As new Model Ys become more affordable, the value of used Model Ys could decline. This could present a buying opportunity for consumers seeking a more affordable entry point into the Tesla ecosystem, but could also lead to losses for owners who purchased their Model Ys at higher prices.

Market Response to the Price Cuts

Tesla’s decision to slash prices for its Model Y inventory has sparked widespread discussion and speculation about the potential impact on the market. Industry analysts and experts are closely monitoring the situation, attempting to predict how consumers will react to these significant price reductions.

Consumer Demand and Purchasing Behavior

The price cuts are expected to have a significant impact on consumer demand and purchasing behavior. Analysts believe that the lower prices will attract a wider range of potential buyers, particularly those who were previously hesitant due to the high cost of Tesla vehicles. This could lead to a surge in sales, especially for the Model Y, which is already one of Tesla’s most popular models.

“The price cuts are a clear indication that Tesla is feeling the pressure from competition, and they’re willing to make concessions to attract more buyers,” said one industry analyst. “This could be a game-changer for Tesla, as they’re now positioned to compete more effectively in the mass market.”

Existing Customers vs. Potential New Buyers

The reaction to the price cuts is likely to differ between Tesla’s existing customers and potential new buyers. Existing customers who purchased their vehicles at higher prices may feel disappointed or even cheated, especially if they bought their cars recently. This could lead to negative sentiment and potential backlash from loyal Tesla owners.

On the other hand, potential new buyers are likely to be enthusiastic about the lower prices, seeing it as an opportunity to acquire a premium electric vehicle at a more affordable price. This could translate into increased demand and higher sales figures for Tesla.

Impact on Tesla’s Brand Image and Perceived Value

The price cuts could have a mixed impact on Tesla’s brand image and perceived value. While lower prices may make the brand more accessible and attractive to a wider audience, it could also be seen as a sign of weakness or desperation, potentially diminishing the perception of Tesla as a premium, high-end brand.

“The price cuts could erode Tesla’s image as a luxury brand, as it suggests that they’re willing to compromise on pricing to compete with more affordable electric vehicles,” said another industry expert. “However, if the price cuts lead to a significant increase in sales, it could also be seen as a strategic move that strengthens Tesla’s position in the market.”

Financial Implications of the Price Cuts

Tesla’s decision to slash prices on its Model Y inventory has sent shockwaves through the automotive industry and raised significant questions about the company’s financial strategy. The price cuts, while potentially boosting sales and market share, could also have a profound impact on Tesla’s profitability and overall financial performance.

Short-Term Financial Implications

The immediate impact of the price cuts on Tesla’s financials is likely to be a decrease in revenue per vehicle sold. This could lead to a decline in profitability, particularly in the short term, as the company absorbs the cost of reduced pricing. However, the price cuts could also stimulate demand, leading to higher sales volumes. This increase in sales volume could potentially offset the reduced revenue per vehicle, potentially leading to a net positive impact on Tesla’s overall revenue.

Long-Term Financial Implications, Tesla slashes model y inventory prices cut

The long-term implications of the price cuts are more complex and depend on a number of factors. If the price cuts succeed in attracting new customers and expanding Tesla’s market share, the company could see a significant increase in revenue and profitability in the long run. However, if the price cuts lead to a decline in profit margins and do not result in a substantial increase in sales, the long-term financial implications could be negative.

Potential Financial Benefits of the Price Cuts

- Increased Sales Volume: The price cuts could lead to a significant increase in demand for Tesla vehicles, particularly in price-sensitive markets. This increased sales volume could help Tesla achieve its ambitious growth targets and solidify its position as a market leader in the electric vehicle industry.

- Expansion of Market Share: By making its vehicles more affordable, Tesla could attract a wider range of customers, including those who were previously priced out of the market. This could lead to a significant expansion of Tesla’s market share and a more dominant position in the electric vehicle industry.

- Improved Brand Perception: Lower prices could improve Tesla’s brand perception among consumers, making it appear more accessible and value-oriented. This could lead to increased brand loyalty and customer satisfaction.

Potential Risks of the Price Cuts

- Reduced Profit Margins: The price cuts will likely lead to a decrease in profit margins per vehicle sold. If the increase in sales volume does not offset the reduced profit margins, Tesla’s overall profitability could decline.

- Negative Impact on Investor Sentiment: Investors may view the price cuts as a sign of weakness or a desperate attempt to boost sales. This could lead to a decline in Tesla’s stock price and investor confidence.

- Potential for Price Wars: The price cuts could trigger a price war in the electric vehicle industry, as other manufacturers respond with their own price reductions. This could lead to a downward spiral in pricing, eroding profit margins for all players in the market.

Impact on Tesla’s Stock Price and Investor Sentiment

Tesla’s stock price has been volatile in recent months, and the price cuts could further exacerbate this volatility. Investors will be closely watching the company’s sales figures and financial performance in the coming months to assess the impact of the price cuts. If the price cuts lead to a significant increase in sales and revenue, Tesla’s stock price could rebound. However, if the price cuts do not result in a substantial improvement in financial performance, Tesla’s stock price could decline further.

Impact on the Electric Vehicle Industry

Tesla’s price cuts have sent shockwaves through the electric vehicle (EV) industry, triggering a wave of reactions and raising questions about the future of the market. The move has forced competitors to reassess their pricing strategies and sparked a broader discussion about the competitive landscape in the EV sector.

Potential Impact on Competitors

Tesla’s price cuts have put pressure on its competitors to follow suit or risk losing market share. Companies like Ford, General Motors, Volkswagen, and Hyundai have already announced price reductions on their EV models in response to Tesla’s move. This price war could benefit consumers in the short term, as they enjoy lower prices on EVs. However, it could also lead to a decrease in profit margins for manufacturers, potentially slowing down investment in research and development for future EV models.

Future Outlook for Tesla

Tesla’s recent price cuts have sent shockwaves through the automotive industry, raising questions about the company’s future strategy and growth prospects. The price cuts signal a shift in Tesla’s approach, potentially impacting its production, manufacturing, and product development plans.

Impact on Tesla’s Future Strategy and Growth Prospects

Tesla’s price cuts could be a strategic move to boost sales and market share, especially in the face of growing competition from established automakers. By making its vehicles more affordable, Tesla aims to attract a wider customer base and increase demand. This could lead to higher production volumes, potentially benefiting Tesla’s economies of scale and profitability. However, the price cuts might also impact Tesla’s brand image and perceived value. If the price cuts are perceived as a sign of weakness or desperation, it could erode customer confidence and harm Tesla’s premium positioning.

Implications for Tesla’s Production and Manufacturing Plans

The price cuts could necessitate adjustments to Tesla’s production and manufacturing plans. To meet the anticipated increase in demand, Tesla might need to ramp up production at its existing factories or even consider expanding its manufacturing capacity. This could involve investments in new facilities, equipment, and personnel, potentially straining Tesla’s resources. On the other hand, if the price cuts fail to significantly boost demand, Tesla might need to scale back production, potentially leading to layoffs or reduced investment.

Influence on Tesla’s Future Product Development and Innovation

Tesla’s price cuts could influence its future product development and innovation strategies. The company might prioritize developing more affordable models to cater to a broader market segment. This could mean focusing on cost-effective technologies and designs, potentially impacting Tesla’s commitment to cutting-edge features and innovations. However, Tesla could also use the price cuts as an opportunity to refine its existing models and introduce new features to maintain its competitive edge.

Key Takeaways and Potential Future Implications of Tesla’s Price Cuts

| Key Takeaways | Potential Future Implications |

|---|---|

| Tesla’s price cuts signal a shift in strategy to boost sales and market share. | Increased demand and production volumes, potentially benefiting Tesla’s economies of scale and profitability. |

| The price cuts could impact Tesla’s brand image and perceived value. | Potential erosion of customer confidence and harm to Tesla’s premium positioning. |

| Tesla might need to adjust its production and manufacturing plans to meet increased demand. | Investments in new facilities, equipment, and personnel, potentially straining Tesla’s resources. |

| The price cuts could influence Tesla’s future product development and innovation strategies. | Prioritization of developing more affordable models, potentially impacting Tesla’s commitment to cutting-edge features and innovations. |

Tesla’s decision to slash Model Y prices is a game-changer, and its impact on the electric vehicle industry is likely to be felt for years to come. The price cuts have already sparked a wave of speculation and analysis, and it remains to be seen how this bold move will ultimately play out for Tesla and the wider EV market. One thing is for sure, this move will force other manufacturers to take notice and potentially respond with their own pricing strategies, setting the stage for an even more competitive landscape in the electric vehicle sector.

Tesla’s recent price cuts on the Model Y are a bold move, aimed at boosting sales and clearing inventory. It’s a similar strategy to what we saw with the Reliance Disney India media merger , where they aimed to dominate the streaming market by securing a massive chunk of the audience. Tesla is hoping that their price cuts will have a similar effect, attracting more buyers and ultimately increasing their market share.

Standi Techno News

Standi Techno News