Cyber criminals stealing one time passcodes sim swap raiding bank accounts – Cybercriminals stealing one-time passcodes via SIM swap attacks, raiding bank accounts, is a growing threat in the digital age. This sophisticated scheme exploits vulnerabilities in mobile phone security, allowing attackers to intercept sensitive information and gain access to financial accounts. Imagine this: your phone number, your gateway to online banking, is suddenly in the hands of a stranger. This is the chilling reality of SIM swap attacks, where criminals manipulate mobile carriers to redirect your phone number to their devices, effectively stealing your digital identity.

These attacks are becoming increasingly common, fueled by the rise of mobile banking and the reliance on one-time passcodes for authentication. The financial gains for cybercriminals are substantial, as they can drain bank accounts, steal cryptocurrencies, and even take over social media accounts.

The Rise of SIM Swap Attacks

In the ever-evolving landscape of cybercrime, SIM swap attacks have emerged as a serious threat, targeting individuals and businesses alike. These attacks exploit vulnerabilities in mobile network security, allowing attackers to gain control of victims’ phone numbers and access sensitive information.

How SIM Swap Attacks Work

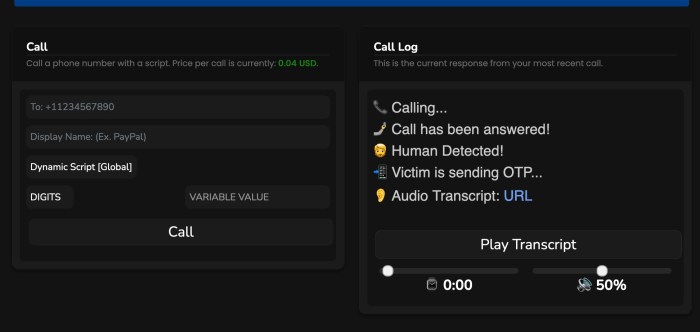

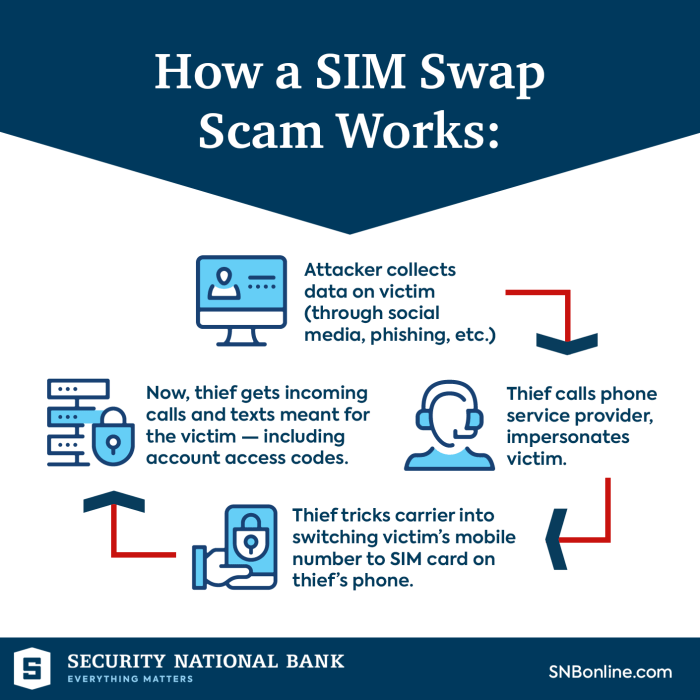

SIM swap attacks involve a malicious actor convincing a mobile carrier to transfer a victim’s phone number to a new SIM card controlled by the attacker. This process typically involves the attacker:

- Gathering personal information about the victim, such as their name, date of birth, Social Security number, and address.

- Contacting the victim’s mobile carrier, impersonating the victim, and providing the gathered information to gain access to the account.

- Requesting a SIM card swap, claiming the victim’s existing SIM card is lost or stolen.

Once the attacker has successfully swapped the SIM card, they gain control of the victim’s phone number and can intercept SMS messages, including one-time passcodes used for two-factor authentication (2FA).

Motivations Behind SIM Swap Attacks

The primary motivation behind SIM swap attacks is financial gain. Attackers exploit their access to victims’ accounts to:

- Transfer funds from bank accounts.

- Gain access to cryptocurrency wallets.

- Make unauthorized purchases using credit cards.

- Take control of social media accounts.

High-Profile SIM Swap Attacks

SIM swap attacks have been used in several high-profile cases, resulting in significant financial losses for victims.

- In 2019, a group of hackers known as the “SIM Swappers” stole millions of dollars from cryptocurrency exchanges by targeting high-profile individuals. They used social engineering techniques to convince mobile carriers to transfer victims’ phone numbers to their control, enabling them to bypass 2FA and gain access to cryptocurrency wallets.

- In 2020, a well-known social media influencer lost over $1 million in cryptocurrency after falling victim to a SIM swap attack. The attacker gained control of the influencer’s phone number and accessed their cryptocurrency wallet, transferring the funds to their own account.

One-Time Passcodes and Their Vulnerability

One-time passcodes (OTPs) are a vital security measure employed by various online services to authenticate users and safeguard sensitive data. These codes, typically generated by an app or a physical token, are designed to be unique and valid only for a single transaction, thereby reducing the risk of unauthorized access. However, the effectiveness of OTPs can be significantly compromised by SIM swap attacks, which exploit vulnerabilities in the mobile phone network.

Vulnerability of One-Time Passcodes to SIM Swap Attacks

In a SIM swap attack, cybercriminals manipulate telecommunication providers into transferring a user’s phone number to a new SIM card under their control. This allows them to intercept OTPs sent to the user’s phone, effectively bypassing the two-factor authentication process.

Consequences of a Successful One-Time Passcode Theft, Cyber criminals stealing one time passcodes sim swap raiding bank accounts

The consequences of a successful SIM swap attack can be severe, leading to significant financial losses and identity theft. Here’s how a stolen OTP can be exploited:

- Account Takeover: Criminals can gain access to online banking accounts, cryptocurrency wallets, email accounts, and other sensitive services, enabling them to transfer funds, make unauthorized purchases, or compromise personal data.

- Financial Fraud: Stolen OTPs can be used to authorize fraudulent transactions, including online purchases, money transfers, and loan applications.

- Identity Theft: By accessing email accounts, criminals can reset passwords, gain access to personal information, and potentially commit identity theft.

Protecting Against SIM Swap Attacks

SIM swap attacks are a serious threat to individuals and businesses alike. These attacks can lead to significant financial losses and identity theft. Fortunately, there are steps that individuals and financial institutions can take to mitigate the risk of these attacks.

Individual Measures

Individuals can take several steps to protect themselves from SIM swap attacks.

- Enable Two-Factor Authentication (2FA): 2FA adds an extra layer of security by requiring a code sent to your phone in addition to your password. This makes it more difficult for attackers to access your accounts even if they have your password.

- Use Strong Passwords: Create strong passwords that are unique for each account. Avoid using common words or personal information in your passwords.

- Be Cautious of Phishing Attempts: Attackers often use phishing emails or text messages to trick people into giving up their personal information. Be wary of suspicious links or requests for personal information.

- Report Suspicious Activity: If you suspect your SIM card has been swapped, contact your mobile carrier immediately. You should also report any suspicious activity to the relevant authorities.

Financial Institution Measures

Financial institutions play a critical role in protecting their customers from SIM swap attacks.

- Implement Robust Security Measures: Financial institutions should implement strong security measures, including multi-factor authentication and fraud detection systems, to prevent unauthorized access to accounts.

- Educate Customers: Financial institutions should educate their customers about the risks of SIM swap attacks and provide guidance on how to protect themselves.

- Partner with Mobile Carriers: Financial institutions should work with mobile carriers to develop and implement measures to prevent SIM swap attacks. This includes sharing information and collaborating on fraud detection systems.

- Respond Quickly to Suspicious Activity: Financial institutions should respond quickly to any reports of suspicious activity related to SIM swap attacks. They should have procedures in place to investigate and resolve these issues promptly.

Regulatory Role

Regulatory bodies play a crucial role in combating SIM swap fraud.

- Develop and Enforce Regulations: Regulatory bodies should develop and enforce regulations to prevent SIM swap attacks. These regulations should address issues such as identity verification, account security, and fraud reporting.

- Promote Collaboration: Regulatory bodies should promote collaboration between financial institutions, mobile carriers, and law enforcement agencies to combat SIM swap fraud.

- Increase Public Awareness: Regulatory bodies should raise public awareness about SIM swap attacks and provide guidance on how to protect themselves.

Impact on Victims: Cyber Criminals Stealing One Time Passcodes Sim Swap Raiding Bank Accounts

The consequences of a successful SIM swap attack can be devastating, reaching far beyond just financial losses. Victims often face a whirlwind of emotional distress, bureaucratic hurdles, and long-lasting impacts on their trust in online security.

Financial Losses

The most immediate and tangible impact of a SIM swap attack is the financial loss. Criminals can quickly drain bank accounts, empty cryptocurrency wallets, and even access credit lines. The financial impact can be crippling, particularly for individuals who rely on their accounts for essential needs like rent, utilities, and food. The average financial loss from a SIM swap attack can range from a few hundred dollars to tens of thousands of dollars, depending on the victim’s financial resources and the sophistication of the attack.

Emotional Distress

Beyond the financial strain, victims of SIM swap attacks often experience significant emotional distress. The feeling of violation and helplessness can be overwhelming, especially as they grapple with the realization that their personal information has been compromised and their privacy breached. The emotional toll can manifest as anxiety, stress, depression, and even PTSD. The experience can erode trust in online services and institutions, leaving victims feeling vulnerable and insecure.

Challenges in Recovering Stolen Funds

Recovering stolen funds after a SIM swap attack can be a complex and frustrating process. Banks and financial institutions may be reluctant to reimburse victims, often citing the victim’s responsibility to protect their account information. The process of filing claims, providing documentation, and navigating bureaucratic procedures can be lengthy and emotionally draining. Victims may face challenges in proving their innocence and demonstrating that they were not negligent in protecting their account information.

Long-Term Impact on Trust in Online Security

The experience of a SIM swap attack can have a profound and lasting impact on victims’ trust in online security. Victims may become increasingly wary of online transactions, hesitant to share personal information, and reluctant to use mobile devices for sensitive operations. The attack can erode their confidence in the security of online platforms and institutions, leading to a heightened sense of vulnerability and distrust.

SIM swap attacks highlight the fragility of online security and the need for constant vigilance. Individuals, financial institutions, and regulatory bodies must work together to combat this evolving threat. By understanding the tactics used by cybercriminals and implementing robust security measures, we can protect ourselves and our finances from falling victim to these devastating attacks. It’s a race against time, and the stakes are higher than ever before.

Cybercriminals are getting increasingly sophisticated, stealing one-time passcodes through SIM swapping and raiding bank accounts with ease. To protect yourself, consider using a secure payment platform like aplazo , which offers robust security measures and two-factor authentication. By staying vigilant and utilizing advanced security tools, you can fight back against these cyber threats and safeguard your hard-earned money.

Standi Techno News

Standi Techno News