Tesla profits drop 55 company says ev sales under pressure from hybrids – Tesla Profits Drop 55%, Company Says EV Sales Under Pressure from Hybrids. This news sent shockwaves through the electric vehicle industry, raising questions about Tesla’s dominance and the future of EVs. The company, once seen as the undisputed leader in the electric vehicle market, is facing a new challenge: the rising popularity of hybrid vehicles. Hybrids, with their blend of fuel efficiency and affordability, are increasingly appealing to consumers, putting pressure on Tesla’s pure-electric offerings.

Tesla’s recent profit decline is a clear indication that the company is feeling the heat from hybrid competitors. While Tesla has long been lauded for its innovative technology and stylish designs, the growing appeal of hybrids, which offer a more practical and budget-friendly alternative, is starting to chip away at Tesla’s market share. The company has acknowledged this pressure, stating that EV sales are under pressure from hybrids, a sign that Tesla is taking the threat seriously.

Tesla’s Profit Decline: Tesla Profits Drop 55 Company Says Ev Sales Under Pressure From Hybrids

Tesla’s recent financial performance has been marked by a significant drop in profits, with a 55% decline reported in the latest quarter. This dramatic shift in the company’s financial landscape has sent ripples through the industry, raising questions about Tesla’s future trajectory.

The company attributes this profit decline to a combination of factors, with a primary emphasis on the increasing pressure from hybrid vehicles on EV sales. Tesla claims that the rise in hybrid car adoption has impacted the demand for its fully electric vehicles, leading to a reduction in sales volume and ultimately impacting the company’s profitability.

Impact on Tesla’s Future

The decline in profits has significant implications for Tesla’s future investments and growth strategies. The company’s ability to sustain its ambitious expansion plans, including the development of new models, the expansion of its charging infrastructure, and the establishment of new manufacturing facilities, hinges on its financial health.

With reduced profits, Tesla may need to re-evaluate its investment priorities and potentially adjust its growth trajectory. The company might need to consider scaling back on certain projects or seeking alternative funding sources to maintain its ambitious goals.

Tesla’s commitment to reducing its reliance on subsidies and increasing profitability is crucial in the face of these challenges. The company needs to find ways to optimize its production processes, enhance its marketing strategies, and further develop its product offerings to maintain its market leadership position and drive future growth.

Competition from Hybrid Vehicles

The recent decline in Tesla’s profits, attributed to a 55% drop, has raised concerns about the company’s future prospects. While Tesla cites challenges in the electric vehicle (EV) market, the rise of hybrid vehicles has emerged as a significant factor contributing to this decline.

Hybrid vehicles offer a compelling alternative to both traditional gasoline-powered cars and pure EVs, presenting a formidable challenge to Tesla’s dominance in the electric vehicle market.

Hybrid Vehicles’ Growing Popularity

The popularity of hybrid vehicles has been steadily increasing, driven by several factors.

- Fuel Efficiency: Hybrid vehicles combine a gasoline engine with an electric motor, allowing them to achieve better fuel economy than traditional gasoline-powered cars. This is particularly attractive to consumers concerned about rising fuel costs.

- Reduced Emissions: Hybrid vehicles produce fewer emissions than gasoline-powered cars, making them more environmentally friendly. This aligns with growing consumer awareness of climate change and the need for sustainable transportation solutions.

- Affordability: Hybrid vehicles are often priced competitively with gasoline-powered cars, making them accessible to a wider range of consumers. This price point has been a major factor in their increasing popularity.

Hybrid vs. Electric Vehicles

While hybrid vehicles offer advantages over gasoline-powered cars, they also present a competitive challenge to pure EVs like those produced by Tesla.

- Range Anxiety: Hybrid vehicles do not suffer from the same range anxiety as EVs. Their gasoline engine provides a backup power source, allowing drivers to travel longer distances without needing to recharge. This is a significant advantage for consumers who are hesitant to switch to EVs due to concerns about limited range.

- Charging Infrastructure: Hybrid vehicles do not require dedicated charging infrastructure. They can be refueled at any gas station, making them more convenient for long-distance travel. This is a major advantage over EVs, which are dependent on charging stations that are not yet as widespread as gas stations.

- Cost: Hybrid vehicles are often less expensive than EVs. This is due to the lower cost of battery technology and the absence of the need for a dedicated charging infrastructure.

Hybrid Vehicles’ Impact on Tesla

The increasing popularity of hybrid vehicles has already had a noticeable impact on Tesla’s sales.

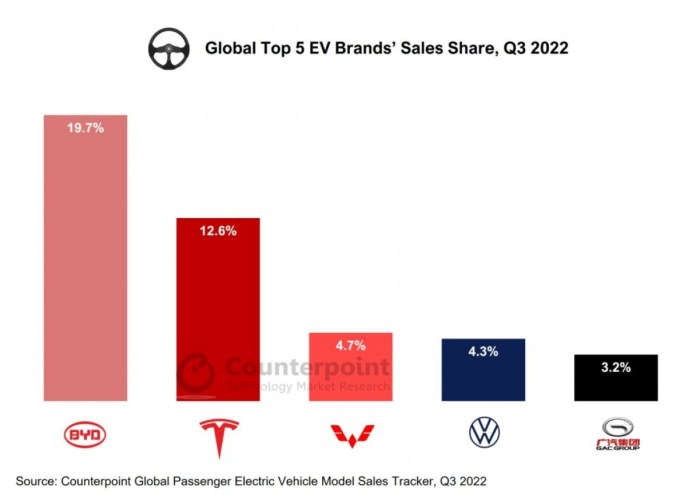

- Market Share Erosion: As more consumers opt for hybrid vehicles, Tesla’s market share in the EV market has been steadily declining. This is a significant challenge for the company, as it relies heavily on its dominance in the EV market.

- Price Pressure: The growing popularity of hybrid vehicles has also put pressure on Tesla to lower its prices to remain competitive. This has eroded Tesla’s profit margins, contributing to the recent decline in the company’s profitability.

Tesla’s Response to Market Pressure

Tesla, the electric vehicle (EV) giant, is facing a new wave of competition from hybrid vehicles, which are becoming increasingly popular due to their lower price points and the growing perception that they offer a more practical solution for many drivers. This has led to a decline in Tesla’s profits, prompting the company to take strategic action to defend its market share and ensure long-term sustainability.

Strategies to Address Competition

Tesla is employing a multifaceted approach to address the growing competition from hybrid vehicles. These strategies aim to strengthen Tesla’s position in the market by addressing consumer concerns and enhancing its product offerings.

- Price Reductions: Tesla has recently announced significant price reductions for its vehicles, making them more accessible to a wider range of customers. This strategy is designed to attract price-sensitive buyers who might be considering hybrid alternatives.

- Enhanced Features and Technology: Tesla continues to invest heavily in research and development, introducing new features and technological advancements that enhance the driving experience and provide a competitive edge. Examples include improved Autopilot capabilities, enhanced safety features, and software updates that provide new functionalities.

- Expanded Model Lineup: Tesla is expanding its product lineup to cater to a wider range of customer needs and preferences. The introduction of new models, such as the Model Y and Cybertruck, aims to capture different market segments and attract buyers who might be interested in vehicles with specific functionalities or price points.

- Focus on Sustainability and Environmental Benefits: Tesla emphasizes the environmental benefits of its electric vehicles, highlighting their zero-emission nature and contribution to a cleaner future. This strategy resonates with environmentally conscious consumers who might be hesitant to purchase traditional gasoline-powered vehicles.

Future Product Development and Innovation, Tesla profits drop 55 company says ev sales under pressure from hybrids

Tesla is committed to continuous innovation and product development to maintain its market leadership. The company is exploring various avenues to enhance its existing offerings and develop new technologies that will shape the future of electric mobility.

- Next-Generation Battery Technology: Tesla is investing heavily in battery research and development, aiming to create more efficient and cost-effective batteries with longer ranges. This will be crucial for maintaining Tesla’s competitive edge in terms of driving range and performance.

- Autonomous Driving Capabilities: Tesla’s Autopilot and Full Self-Driving (FSD) technologies are constantly being refined and improved. The company aims to achieve true autonomous driving capabilities, which could revolutionize the automotive industry and provide a significant competitive advantage.

- Expansion into New Market Segments: Tesla is exploring opportunities to expand into new market segments, such as commercial vehicles and energy storage systems. This diversification strategy aims to reduce reliance on the passenger vehicle market and create new revenue streams.

- Enhanced Charging Infrastructure: Tesla is expanding its Supercharger network and partnering with other companies to provide convenient and reliable charging infrastructure for its customers. This will address one of the key concerns of potential EV buyers, namely range anxiety.

Impact on Financial Performance and Long-Term Sustainability

Tesla’s strategic initiatives, including price reductions, product development, and expansion into new markets, are expected to have a significant impact on the company’s financial performance and long-term sustainability.

- Short-Term Challenges: Price reductions may initially impact profit margins, but they are expected to boost sales volume and market share in the long run. Tesla’s focus on cost optimization and operational efficiency will be crucial to mitigating the impact on profitability.

- Long-Term Growth Potential: Investments in innovation and new technologies, such as autonomous driving and next-generation battery technology, are likely to drive long-term growth and solidify Tesla’s position as a leader in the EV industry. These advancements will attract new customers and create new revenue streams.

- Increased Competition: The growing competition from established automakers and emerging EV startups will continue to put pressure on Tesla’s market share and profitability. The company’s ability to adapt to changing market dynamics and maintain its innovative edge will be crucial for long-term success.

- Sustainability and Environmental Impact: Tesla’s commitment to sustainability and its focus on reducing carbon emissions are likely to attract environmentally conscious consumers and contribute to the company’s long-term brand value. This aligns with the growing global trend towards sustainable transportation and renewable energy.

The Future of the Electric Vehicle Market

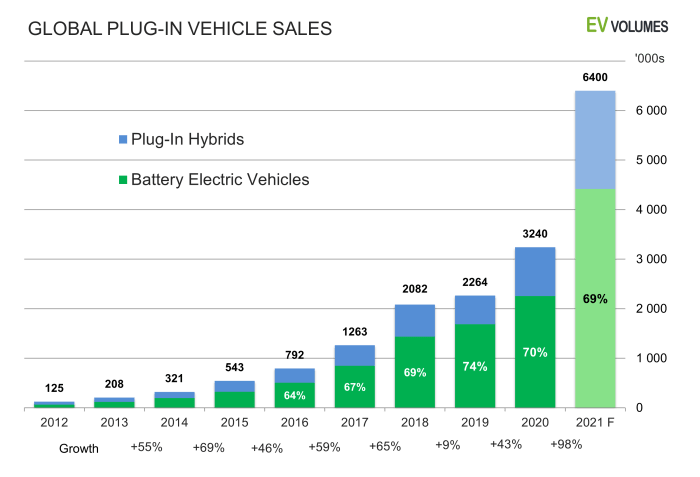

The electric vehicle (EV) market is in a state of rapid evolution, with both challenges and opportunities on the horizon. While Tesla’s recent profit decline highlights the competitive pressures in the market, the long-term outlook for EVs remains positive. Several factors will shape the future of this industry, including the increasing competition from hybrid vehicles, the impact of government policies, and evolving consumer preferences.

The Role of Hybrid Vehicles

The rise of hybrid vehicles presents both a challenge and an opportunity for the EV market. Hybrids offer a more gradual transition to electrification, appealing to consumers who are hesitant to fully embrace EVs. This competition could slow down the adoption of pure EVs in the short term. However, hybrids also act as a stepping stone towards greater EV adoption, as consumers become more familiar with and comfortable with electric technology. This could ultimately benefit the EV market in the long run.

Government Policies and Incentives

Government policies play a crucial role in shaping the EV landscape. Many countries are implementing incentives such as tax breaks, subsidies, and charging infrastructure development to encourage EV adoption. These policies can significantly impact the affordability and accessibility of EVs, accelerating their market penetration. However, the effectiveness of these policies can vary depending on their scope and implementation. For instance, some policies might favor certain EV manufacturers or types, potentially leading to market distortions.

Consumer Preferences and Market Trends

Consumer preferences are a key driver of EV adoption. Factors such as range anxiety, charging infrastructure availability, and vehicle cost all influence consumer decisions. However, consumer preferences are constantly evolving. Growing awareness of environmental concerns and increasing availability of affordable EVs are contributing to a shift in consumer sentiment towards electric vehicles. As technology advances and charging infrastructure expands, range anxiety is expected to decrease, further driving EV adoption.

Tesla’s Future in the EV Market

Tesla remains a major player in the EV market, known for its innovative technology and strong brand recognition. However, the company faces increasing competition from established automakers who are aggressively entering the EV space. Tesla’s future success will depend on its ability to maintain its technological edge, expand its product portfolio, and adapt to evolving consumer preferences. The company is focusing on expanding its production capacity, developing new models, and improving its battery technology to stay ahead of the competition.

The future of the electric vehicle market is becoming increasingly uncertain. While Tesla remains a major player, the rise of hybrid vehicles presents a significant challenge. Tesla’s response to this competition will be crucial in determining its future success. The company’s ability to innovate, adapt, and offer compelling solutions to address consumer concerns will be key to maintaining its position in the market. Only time will tell if Tesla can overcome this challenge and continue its dominance in the EV world.

While Tesla grapples with a 55% profit drop, citing pressure from hybrid car sales, a different kind of nostalgia is hitting the market. Final Fantasy XX-2 HD Remaster makes its PS4 debut , offering a blast from the past for gamers. It seems like even the automotive industry is facing competition from a different kind of horsepower – the kind that comes from classic gaming experiences.

Standi Techno News

Standi Techno News