Forward 16m payments fintech is disrupting the financial landscape, changing how businesses operate and consumers spend. Imagine a world where payments are instant, seamless, and borderless. That’s the promise of forward 16m payments, a revolutionary approach that’s gaining momentum in the fintech world.

This innovative technology allows businesses to receive payments before they actually deliver goods or services, unlocking a world of possibilities. From improved cash flow to reduced risk, the benefits are far-reaching. Forward 16m payments are poised to become the new standard, transforming the way we think about money and finance.

The Rise of Forward 16m Payments in Fintech: Forward 16m Payments Fintech

The fintech landscape is constantly evolving, with new technologies and payment solutions emerging at a rapid pace. Among these innovations, forward 16m payments have gained significant traction, revolutionizing the way businesses and individuals manage their finances. This article delves into the rise of forward 16m payments in fintech, exploring its evolution, key drivers, and successful implementations.

Evolution of Forward 16m Payments, Forward 16m payments fintech

Forward 16m payments represent a significant shift in the traditional payment paradigm. Unlike traditional methods that involve immediate transfers, forward 16m payments allow for scheduled payments to be made at a future date. This approach offers several advantages, including enhanced financial planning, improved cash flow management, and greater flexibility.

Key Drivers of Adoption

Several factors have contributed to the increasing adoption of forward 16m payments in the fintech space.

Growing Demand for Financial Flexibility

The need for greater financial flexibility has become increasingly important in today’s dynamic economic environment. Forward 16m payments empower individuals and businesses to manage their finances effectively, allowing them to allocate funds strategically and meet future obligations without disrupting their current cash flow.

Advancements in Technology

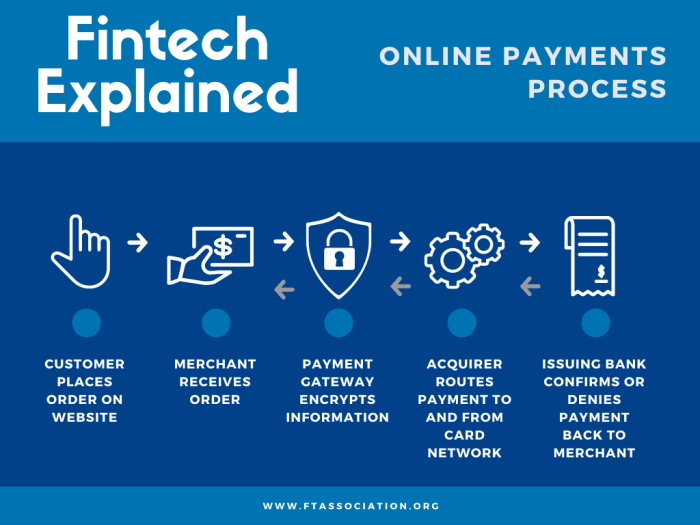

The rise of forward 16m payments is closely tied to advancements in technology. The development of robust payment processing platforms and secure digital infrastructure has made it possible to facilitate seamless and efficient forward payments.

Changing Consumer Preferences

Consumers are increasingly embracing digital solutions, including mobile payments and online banking. Forward 16m payments seamlessly integrate with these digital channels, offering a convenient and user-friendly experience.

Successful Implementations

Several fintech companies have successfully implemented forward 16m payment solutions, showcasing their effectiveness and potential.

Example 1: [Fintech Company Name]

[Fintech Company Name] has integrated forward 16m payments into its platform, allowing users to schedule payments for bills, subscriptions, and other recurring expenses. This feature has been well-received by users, who appreciate the ability to manage their finances proactively and avoid late payment penalties.Example 2: [Fintech Company Name]

[Fintech Company Name] has leveraged forward 16m payments to provide businesses with a more efficient and flexible way to manage their payroll. By scheduling payroll payments in advance, businesses can ensure timely payments while optimizing their cash flow.Benefits of Forward 16m Payments for Businesses

Forward 16m payments offer businesses a unique and powerful way to manage their cash flow, reduce risk, and optimize their operations. This innovative payment method allows businesses to receive funds upfront for future receivables, providing them with immediate access to liquidity. By leveraging this forward-looking approach, businesses can gain a competitive edge, enhance customer satisfaction, and drive growth.

Improved Cash Flow and Reduced Risk

Forward 16m payments provide businesses with a reliable and predictable source of funding, significantly improving their cash flow. By receiving funds upfront, businesses can cover immediate expenses, invest in growth initiatives, and manage their working capital more effectively. This enhanced liquidity reduces the risk of cash flow shortages, enabling businesses to operate with greater stability and confidence.

“Forward 16m payments can be particularly beneficial for businesses with seasonal sales cycles or long payment terms. By receiving funds upfront, they can ensure a steady cash flow throughout the year, mitigating the impact of fluctuating revenue.”

Streamlined Business Operations

Forward 16m payments can streamline business operations by simplifying the payment process and reducing administrative burden. Businesses can automate their receivables management, eliminating the need for manual tracking and reconciliation. This automation frees up valuable time and resources, allowing businesses to focus on core operations and strategic initiatives.

Enhanced Customer Satisfaction

Forward 16m payments can enhance customer satisfaction by providing them with faster and more convenient payment options. Businesses can offer flexible payment terms, allowing customers to pay for goods and services in installments or over an extended period. This flexibility can improve customer loyalty and retention, as customers appreciate the convenience and control over their payments.

Case Study: Impact on a Retail Business

Consider a retail business that sells high-value furniture and appliances. This business typically faces long payment terms from customers, leading to cash flow challenges and difficulty in managing inventory. By implementing forward 16m payments, the business can receive upfront funds for future sales, ensuring a steady cash flow and allowing them to purchase more inventory to meet customer demand. This improved cash flow enables the business to expand its product offerings, attract new customers, and increase sales.

Technological Advancements Enabling Forward 16m Payments

The adoption of forward 16m payments is being driven by technological advancements that are transforming the financial landscape. These innovations streamline processes, enhance security, and provide greater transparency for businesses.

The Role of Blockchain Technology

Blockchain technology, known for its decentralized and transparent nature, is playing a pivotal role in facilitating forward 16m payments.

- Enhanced Security: Blockchain’s decentralized ledger system eliminates the need for a central authority, making it highly secure and resistant to fraud. Transactions are encrypted and recorded immutably, reducing the risk of unauthorized access or manipulation.

- Faster Settlement: Blockchain technology enables near-instantaneous settlement of payments, eliminating the delays associated with traditional banking systems. This speed can significantly improve cash flow for businesses.

- Reduced Costs: By eliminating intermediaries, blockchain can lower transaction fees associated with traditional payment methods. This cost-effectiveness can be particularly beneficial for businesses making large forward payments.

The Use of Artificial Intelligence (AI)

AI is revolutionizing forward 16m payments by automating processes, optimizing workflows, and providing valuable insights.

- Automated Payment Processing: AI algorithms can automate the processing of forward payments, reducing manual effort and minimizing errors. This automation can streamline operations and free up resources for other tasks.

- Fraud Detection and Prevention: AI-powered systems can analyze transaction patterns and identify potential fraudulent activities in real-time. This proactive approach helps businesses mitigate risks and protect their finances.

- Predictive Analytics: AI can analyze historical data and market trends to predict future payment needs. This foresight allows businesses to optimize their cash flow management and ensure timely payments.

Innovative Fintech Solutions

Emerging fintech solutions are leveraging advanced technologies to create innovative forward 16m payment systems.

- Digital Payment Platforms: Platforms like PayPal, Stripe, and Square offer seamless online payment processing for businesses of all sizes. These platforms integrate with existing accounting systems, simplifying forward payment management.

- Open Banking APIs: Open banking APIs allow businesses to connect their financial accounts with third-party applications. This connectivity facilitates automated payments and data sharing, improving efficiency and transparency.

- Decentralized Finance (DeFi): DeFi platforms are built on blockchain technology and offer decentralized financial services, including lending, borrowing, and payments. These platforms can facilitate forward 16m payments with greater flexibility and lower fees.

Regulatory Landscape and Challenges for Forward 16m Payments

The regulatory landscape surrounding forward 16m payments is still evolving, with different jurisdictions adopting varying approaches. This dynamic environment presents both opportunities and challenges for businesses and regulators alike.

Regulatory Framework

The regulatory framework for forward 16m payments is often intertwined with regulations governing traditional financial services, such as payment processing, lending, and foreign exchange. This is because forward 16m payments often involve elements of these traditional financial services.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations: Forward 16m payment platforms are subject to AML and KYC regulations to prevent money laundering and terrorist financing. These regulations require platforms to verify the identities of their users and monitor transactions for suspicious activity.

- Data Protection Regulations: Forward 16m payments often involve the collection and processing of sensitive personal data. Platforms must comply with data protection regulations, such as the General Data Protection Regulation (GDPR) in the European Union, to ensure the privacy and security of user data.

- Licensing and Registration Requirements: In some jurisdictions, forward 16m payment platforms may need to obtain licenses or register with financial regulators to operate legally. These requirements can vary depending on the specific activities of the platform and the applicable regulatory framework.

Challenges and Risks

Forward 16m payments present a unique set of challenges and risks, which can be categorized as follows:

- Fraud and Security Concerns: Forward 16m payments involve transactions that occur in the future, which makes them susceptible to fraud and manipulation. For example, businesses could potentially engage in fraudulent activities by artificially inflating future payments or using the platform to launder money.

- Market Volatility and Currency Fluctuations: The value of forward 16m payments can be affected by market volatility and currency fluctuations, which can create uncertainty for both businesses and consumers. This risk is particularly pronounced for businesses that operate in multiple currencies or are exposed to volatile markets.

- Regulatory Uncertainty: As the regulatory landscape for forward 16m payments continues to evolve, businesses may face uncertainty about compliance requirements and potential changes to the rules. This can make it challenging for businesses to plan for the long term and to ensure that their operations are compliant.

Mitigating Challenges and Ensuring Responsible Implementation

To mitigate these challenges and ensure the responsible implementation of forward 16m payment systems, several recommendations can be followed:

- Strong Risk Management Frameworks: Platforms should establish robust risk management frameworks to identify, assess, and mitigate potential risks, including fraud, security breaches, and market volatility. This could involve implementing measures such as KYC/AML checks, fraud detection systems, and data encryption.

- Transparency and Disclosure: Platforms should provide clear and transparent information to users about the terms and conditions of forward 16m payments, including potential risks and fees. This will help users make informed decisions and avoid misunderstandings.

- Collaboration with Regulators: Platforms should engage with regulators and industry stakeholders to develop best practices and address regulatory concerns. This will help ensure that forward 16m payments are implemented responsibly and that the regulatory framework is appropriate for the evolving landscape.

- Continuous Monitoring and Adaptation: Platforms should continuously monitor their operations and adapt their practices to address emerging risks and changes in the regulatory environment. This includes staying informed about regulatory developments, implementing new technologies, and conducting regular security audits.

Future Trends in Forward 16m Payments

The landscape of financial technology is rapidly evolving, and forward 16m payments are poised to play a pivotal role in this transformation. Emerging trends like open banking and the rise of digital currencies are poised to significantly impact how forward 16m payments operate and interact with other financial services.

Impact of Open Banking and Digital Currencies

Open banking, with its emphasis on data sharing and API-driven connectivity, is set to revolutionize the way forward 16m payments are initiated, processed, and settled. This increased data transparency will enable more efficient risk assessment, personalized pricing, and seamless integration with other financial services. For instance, businesses can leverage open banking APIs to directly access customer account data for faster and more accurate payment processing.

The rise of digital currencies like Bitcoin and stablecoins presents exciting opportunities for forward 16m payments. These currencies offer faster transaction speeds, lower fees, and increased transparency, potentially making them a more attractive option for businesses and individuals. Forward 16m payment platforms can integrate with digital currency wallets and exchanges, facilitating cross-border payments and facilitating access to global markets.

Forward 16m Payments in a Rapidly Evolving Fintech Landscape

The fintech landscape is characterized by rapid innovation and disruption, and forward 16m payments are at the forefront of this change. Forward 16m payment platforms are increasingly incorporating artificial intelligence (AI), machine learning (ML), and blockchain technology to enhance their services. AI and ML can be used to optimize pricing, detect fraud, and personalize customer experiences. Blockchain technology can provide a secure and transparent platform for recording and tracking payments, fostering trust and accountability.

Future Vision of Forward 16m Payments

Forward 16m payments are set to become a fundamental component of the future financial ecosystem. Their ability to streamline payment processes, reduce costs, and enhance security will make them increasingly attractive to businesses and individuals alike. The integration of open banking, digital currencies, and advanced technologies like AI and blockchain will enable forward 16m payments to play a crucial role in transforming the financial industry.

Forward 16m payments will likely become a cornerstone of a more efficient, transparent, and inclusive financial system. By facilitating seamless cross-border transactions, reducing friction in payments, and empowering businesses with innovative financial tools, forward 16m payments will continue to shape the future of finance.

The future of finance is looking bright with forward 16m payments at the forefront. As technology continues to evolve, we can expect even more innovative solutions to emerge, further revolutionizing the financial landscape. With its potential to streamline operations, reduce risk, and enhance customer experiences, forward 16m payments are a game-changer, ushering in a new era of financial empowerment for businesses and individuals alike.

Forward 16m payments fintech is disrupting the traditional financial landscape, just like the way technology has transformed the way rappers battle. The Kendrick Lamar and Drake feud, as documented online , showcases how social media and streaming platforms have become the new battlegrounds for lyrical supremacy. Forward 16m payments fintech is similarly leveraging technology to create a more accessible and transparent financial ecosystem.

Standi Techno News

Standi Techno News