Adani Ecommerce Payments India is making waves in the digital landscape. This ambitious venture by the Adani Group, a conglomerate known for its infrastructure prowess, aims to revolutionize the way Indians shop and pay online. But is this a game-changer, or just another player in a crowded market?

The Adani Group, with its vast infrastructure network and deep pockets, is uniquely positioned to challenge the existing giants in the Indian ecommerce market. They’re not just focusing on delivery, but also on creating a seamless payment ecosystem, offering a compelling alternative to established players like Paytm and Google Pay.

Adani Group’s Ecommerce Ambitions: Adani Ecommerce Payments India

The Adani Group, a conglomerate known for its infrastructure and energy ventures, is setting its sights on the dynamic Indian ecommerce market. With a strategic vision and a commitment to digital transformation, the group is poised to disrupt the existing landscape.

Adani Group’s Existing and Potential Ecommerce Ventures in India

Adani Group’s foray into the ecommerce space is driven by a clear strategy to leverage its existing infrastructure and expertise to cater to the growing demand for online shopping in India. The group has already made significant strides in this domain, and its future plans are ambitious.

- Adani Wilmar: This subsidiary, a leading player in the FMCG sector, has established an online presence through its own website and marketplaces. It offers a wide range of edible oils, food products, and other household items.

- Adani Airport Holdings: With a portfolio of airports across India, Adani is exploring opportunities to integrate ecommerce services into its airport operations. This could involve partnerships with retailers and logistics providers to offer duty-free shopping and other online services to passengers.

- Adani Logistics: The group’s logistics arm is well-positioned to support the growth of its ecommerce ventures. Its vast network of warehouses, transportation infrastructure, and logistics expertise can provide efficient and cost-effective delivery solutions.

- Potential Ventures: Adani Group has expressed interest in exploring new ecommerce ventures, including grocery delivery, fashion retail, and online marketplaces. The group’s focus on strategic acquisitions and partnerships will likely play a key role in its expansion into these areas.

Adani’s Ecommerce Payment Solutions

Adani Group, a conglomerate with significant presence in India’s infrastructure and energy sectors, is venturing into the lucrative world of ecommerce. A crucial aspect of their strategy involves building a robust payment ecosystem, which will be vital for facilitating seamless transactions within their digital marketplace.

Adani’s Payment Solutions: An Overview

Adani Group is developing a comprehensive suite of payment solutions to cater to the diverse needs of its ecommerce platform. These solutions aim to provide secure, convenient, and affordable options for both merchants and consumers.

Key Payment Solutions

- Adani Pay: This is expected to be the core digital wallet solution, enabling users to make online and offline payments. Adani Pay is likely to leverage QR code technology for swift and secure transactions, much like existing players like Paytm and PhonePe.

- Adani Pay Later: This offering will allow consumers to purchase goods and services online and pay for them later, similar to popular Buy Now Pay Later (BNPL) services like ZestMoney and LazyPay.

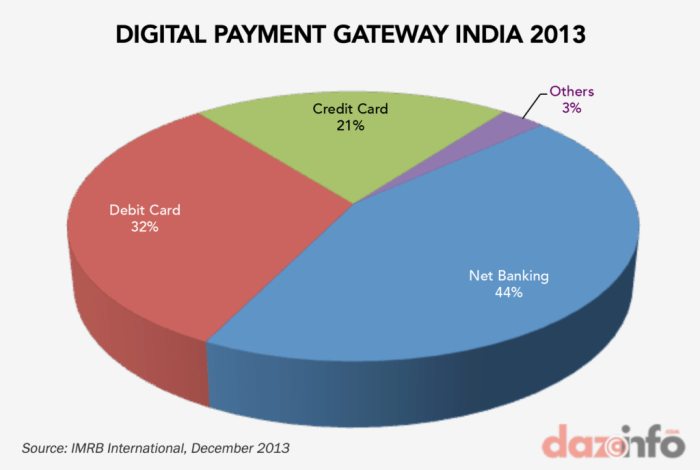

- Adani Merchant Solutions: These solutions are designed to cater to the specific needs of merchants on the Adani platform, enabling them to accept payments through various channels, including UPI, debit/credit cards, and net banking.

Comparison with Existing Players

Adani’s foray into the payments space will face stiff competition from established players like Paytm, PhonePe, Google Pay, and Amazon Pay. These players have already amassed a vast user base and enjoy significant brand recognition.

Key Differentiators

- Leveraging Existing Infrastructure: Adani has the potential advantage of leveraging its existing infrastructure, such as its extensive logistics network and physical retail presence, to reach a wider audience. This could give them a competitive edge in attracting merchants and consumers.

- Focus on Specific Niches: Adani could differentiate itself by focusing on specific niches within the ecommerce market, such as agricultural products, logistics services, or energy-related goods. This targeted approach could help them build strong brand loyalty within specific sectors.

- Integration with Adani Ecosystem: Adani’s payment solutions will be seamlessly integrated with its ecommerce platform, offering a unified experience for users. This could attract consumers seeking a streamlined and convenient shopping experience.

Potential Advantages and Challenges

Adani’s entry into the payments market presents both opportunities and challenges.

Advantages

- Strong Brand Recognition: Adani Group enjoys significant brand recognition in India, which could translate into a strong starting point for its payment solutions.

- Financial Resources: Adani has access to significant financial resources, enabling them to invest heavily in marketing and technology development.

- Potential for Synergies: Adani can leverage synergies with its other businesses, such as its logistics and energy ventures, to create a comprehensive ecosystem for consumers.

Challenges

- Competitive Landscape: The Indian payments market is fiercely competitive, with established players holding a significant market share. Adani will need to offer compelling value propositions to attract users.

- Regulatory Environment: The Indian government has introduced regulations for digital payments, which Adani will need to navigate carefully to ensure compliance.

- Trust and Security: Building trust and ensuring security are paramount in the payments industry. Adani will need to demonstrate a strong commitment to both to gain consumer confidence.

Regulatory Landscape and Challenges

India’s ecommerce and payments landscape is a complex and dynamic environment, governed by a multifaceted regulatory framework. Adani, with its ambitious ecommerce and payment ventures, will need to navigate this intricate web of regulations to ensure its operations are compliant and successful.

The regulatory environment in India for ecommerce and payments is characterized by multiple agencies and overlapping regulations. The Reserve Bank of India (RBI) oversees payment systems, while the Department of Consumer Affairs (DCA) and the Ministry of Electronics and Information Technology (MeitY) regulate ecommerce. Adani needs to understand the specific requirements of each agency and comply with all applicable regulations.

Potential Regulatory Hurdles

- Payment Gateway Licensing: Adani will require a payment gateway license from the RBI to process online payments. The RBI’s licensing requirements are stringent, including financial stability, robust risk management systems, and strong cybersecurity measures. Adani will need to demonstrate its ability to meet these requirements to obtain a license.

- Data Localization: India’s data localization rules require certain sensitive data to be stored within the country. Adani will need to ensure its ecommerce platform complies with these rules, which could involve significant infrastructure investments and data management complexities.

- Consumer Protection: India has robust consumer protection laws that aim to safeguard consumers from unfair trade practices. Adani will need to ensure its ecommerce platform adheres to these laws, including transparent pricing, clear return policies, and effective dispute resolution mechanisms.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations: Adani will need to comply with stringent AML and KYC regulations to prevent money laundering and terrorist financing. This could involve robust customer verification processes and transaction monitoring systems.

- Competition Law: Adani’s ecommerce ventures will need to comply with India’s competition law, which prohibits anti-competitive practices such as price fixing and market manipulation. Adani will need to ensure its pricing strategies and market practices are compliant with these regulations.

- Proactive Engagement: Adani should engage proactively with regulatory agencies, including the RBI, DCA, and MeitY, to understand the latest regulations and seek clarifications where needed. Regular communication with these agencies can help avoid misunderstandings and ensure compliance.

- Robust Compliance Framework: Adani should establish a robust compliance framework that incorporates all applicable regulations. This framework should include policies, procedures, and training programs to ensure all employees are aware of their compliance obligations.

- Investment in Technology: Adani should invest in technology solutions that can help automate compliance processes, such as data localization tools and fraud detection systems. These investments can help streamline compliance efforts and reduce the risk of non-compliance.

- Building Partnerships: Adani can leverage partnerships with technology providers and legal experts who have experience navigating India’s regulatory landscape. These partnerships can provide valuable insights and support in ensuring compliance.

Impact on the Indian Economy

Adani’s foray into the Indian e-commerce market has the potential to significantly impact the country’s economy. The group’s massive infrastructure investments, combined with its existing logistics and supply chain expertise, could revolutionize online shopping in India. This section explores the potential economic implications of Adani’s e-commerce ambitions, analyzing the impact on job creation, consumer spending, and overall economic growth.

Impact on Job Creation

Adani’s e-commerce ventures are expected to create numerous jobs across various sectors, including logistics, warehousing, technology, and customer service. The group’s ambitious plans involve building a robust network of fulfillment centers and delivery infrastructure, which will require a substantial workforce. This surge in employment will contribute to reducing unemployment and boosting the Indian economy.

Impact on Consumer Spending, Adani ecommerce payments india

Adani’s e-commerce platform is expected to enhance consumer spending by offering competitive prices, a wide range of products, and convenient delivery options. The group’s focus on logistics efficiency and its vast infrastructure network will likely lead to faster and more affordable delivery services. This will encourage more people to shop online, leading to increased consumer spending and boosting the overall economy.

Impact on Overall Economic Growth

Adani’s e-commerce ventures are expected to contribute significantly to India’s economic growth by stimulating domestic demand, promoting innovation, and fostering entrepreneurship. The group’s investments in technology and infrastructure will create new opportunities for businesses, leading to increased productivity and economic growth.

Benefits and Risks

Benefits

- Increased competition and innovation: Adani’s entry into the e-commerce market will increase competition, leading to innovation and improved services for consumers.

- Enhanced logistics and infrastructure: Adani’s vast infrastructure network will improve logistics efficiency and reduce delivery costs, benefiting businesses and consumers.

- Boost to rural economy: Adani’s focus on rural markets will create opportunities for farmers and small businesses, contributing to the growth of the rural economy.

- Job creation and employment opportunities: Adani’s e-commerce ventures are expected to create numerous jobs across various sectors, contributing to employment growth in India.

Risks

- Potential for market dominance: Adani’s vast resources and infrastructure could give it a significant advantage in the e-commerce market, potentially leading to market dominance and reduced competition.

- Data privacy concerns: The collection and use of consumer data by e-commerce platforms raise concerns about data privacy and security.

- Impact on small businesses: The entry of a large player like Adani could pose challenges for smaller e-commerce businesses, potentially leading to consolidation and reduced competition.

- Regulatory challenges: Adani’s e-commerce ventures will need to navigate a complex regulatory landscape, which could pose challenges for its growth and expansion.

Adani Ecommerce Payments India is a bold move that could reshape the Indian digital landscape. With its focus on infrastructure, technology, and strategic partnerships, the Adani Group is poised to disrupt the market. However, the success of this venture hinges on navigating regulatory hurdles, fostering customer trust, and building a robust payment infrastructure. The journey is just beginning, and the outcome remains to be seen.

Adani’s foray into e-commerce payments in India could be a game-changer, offering a much-needed alternative in a market dominated by established players. This move echoes the ambition of Orbex’s new funding, which aims to accelerate its Prime microlauncher into orbit and disrupt the space launch industry. Adani’s entry into this space could spark a similar revolution, offering customers more choice and potentially driving innovation in the Indian payments landscape.

Standi Techno News

Standi Techno News