Stripe doubling down on embedded finance de couples payments from the rest of its stack – Stripe doubling down on embedded finance by decoupling payments from the rest of its stack sets the stage for a revolution in how businesses integrate financial services. This move, a strategic shift away from the traditional bundled approach, signals a new era of flexibility and customization for developers and businesses alike.

By separating payments from its broader financial infrastructure, Stripe empowers businesses to seamlessly integrate payment functionalities into their existing platforms and applications. This approach not only simplifies payment integration but also accelerates time to market, allowing businesses to focus on core competencies while leveraging Stripe’s robust and secure payment infrastructure.

Decoupling Payments from the Rest of the Stack

Stripe’s decision to decouple payments from its other services marks a significant shift in its strategy. This move, aimed at simplifying and streamlining its offerings, has far-reaching implications for both Stripe and its customers.

Benefits of Decoupling Payments

Decoupling payments from the rest of the Stripe stack offers a range of advantages for both Stripe and its customers.

- Increased Flexibility and Choice for Customers: By separating payments from other services, Stripe empowers customers to choose the specific functionalities they need, without being forced to bundle services they might not use. This flexibility allows businesses to tailor their payment infrastructure to their specific requirements, leading to cost savings and improved efficiency.

- Enhanced Focus and Specialization for Stripe: By focusing solely on payments, Stripe can dedicate its resources to developing and improving its payment processing capabilities. This specialization allows Stripe to become a more robust and reliable payment provider, attracting a wider range of customers and expanding its market reach.

- Simplified Integration and Development: Decoupling payments allows for easier integration with third-party applications and services. This simplifies development efforts and enables businesses to seamlessly connect their payment systems with other essential tools and platforms.

Challenges and Risks of Decoupling Payments, Stripe doubling down on embedded finance de couples payments from the rest of its stack

While decoupling payments presents numerous benefits, it also poses certain challenges and risks that Stripe needs to address.

- Potential for Increased Complexity: Separating payments from other services can lead to a more complex integration process, requiring businesses to manage multiple interfaces and configurations. This complexity can potentially increase development time and costs.

- Maintaining a Unified Customer Experience: Stripe needs to ensure a seamless and consistent customer experience despite decoupling payments. This requires careful coordination and integration between different services to avoid fragmentation and confusion for users.

- Competition from Specialized Payment Providers: Decoupling payments exposes Stripe to increased competition from specialized payment providers that focus solely on payments. To remain competitive, Stripe must continue to innovate and offer competitive pricing and features.

Competitive Landscape: Stripe Doubling Down On Embedded Finance De Couples Payments From The Rest Of Its Stack

Stripe’s decision to decouple payments from its other financial products creates a unique competitive landscape. While Stripe is known for its comprehensive suite of financial tools, this move allows it to compete more directly with specialized players in specific areas.

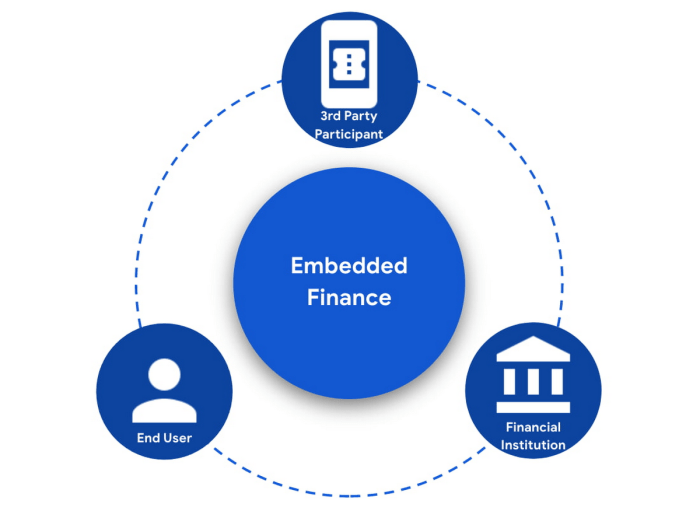

Key Competitors in the Embedded Finance Space

The embedded finance space is becoming increasingly crowded with a variety of players offering specialized solutions. Here are some of Stripe’s key competitors:

- Fintech Platforms: Companies like Plaid, MX, and Yodlee focus on providing data aggregation and financial connectivity services, enabling seamless integration of financial services into other applications. These platforms offer a strong alternative for businesses looking to access and manage customer financial data.

- Payment Processors: Traditional payment processors like PayPal, Adyen, and Square are also expanding into embedded finance, offering services like point-of-sale (POS) systems, lending, and other financial products. They leverage their existing payment infrastructure and customer base to compete with Stripe.

- Neobanks and Challenger Banks: Digital-first banks like Revolut, Monzo, and N26 are disrupting traditional banking by offering embedded financial services directly within their platforms. They focus on providing a streamlined user experience and innovative financial products.

- Specialized Fintech Companies: Companies like Affirm, Klarna, and Afterpay specialize in specific areas of embedded finance, such as buy now, pay later (BNPL) solutions. These companies offer niche services and target specific customer segments.

Comparison of Stripe’s Approach

Stripe’s approach to embedded finance differs from its competitors in several key ways:

- Focus on Developer Experience: Stripe prioritizes a developer-friendly approach, offering a comprehensive set of APIs and documentation to make it easy for businesses to integrate financial services into their applications.

- Global Reach: Stripe operates in a wide range of countries, providing businesses with a global platform for offering financial services.

- Decoupling Strategy: By decoupling payments from its other products, Stripe allows businesses to choose the best solutions for their specific needs, whether it’s payments, lending, or other financial services.

Impact of Decoupling Strategy

Stripe’s decoupling strategy could have a significant impact on the competitive landscape:

- Increased Competition: By focusing on specific areas, Stripe can compete more effectively with specialized players in the embedded finance space.

- Greater Flexibility for Businesses: Businesses have more options and can choose the best solutions for their specific needs, leading to increased adoption of embedded finance.

- Innovation in Embedded Finance: The decoupling strategy could foster innovation as companies focus on developing specialized solutions for specific financial needs.

Stripe’s bold move to decouple payments marks a significant departure from traditional financial institutions and sets a new benchmark for embedded finance. By empowering developers and businesses with the flexibility to choose and integrate payments solutions, Stripe is paving the way for a future where financial services are seamlessly embedded within the very fabric of our digital lives. This move has the potential to reshape the financial landscape, making financial services more accessible, efficient, and tailored to individual needs.

Stripe’s move to decouple payments from its broader platform is a bold one, reflecting a growing trend towards specialized fintech solutions. Think of it like the evolution of the mobile phone, where the original Nokia brick gave way to specialized devices like the samsung blackberry android phone. Stripe’s focus on embedded finance allows businesses to tailor their payment experiences, just as a dedicated messaging app like BlackBerry Messenger revolutionized communication.

Standi Techno News

Standi Techno News