Bitcoins newest all time high of 72700 doesnt mean high prices are here to stay – Bitcoin’s newest all-time high of $72,700 doesn’t mean high prices are here to stay. While this milestone marks a significant moment in the cryptocurrency’s history, it’s crucial to understand the factors driving this surge and whether it’s sustainable. This record-breaking price is a testament to Bitcoin’s growing adoption, institutional investment, and increasing demand from retail investors. However, the cryptocurrency market is notoriously volatile, and several factors could influence Bitcoin’s future trajectory.

The recent rally is fueled by a confluence of factors, including the growing acceptance of Bitcoin as a legitimate asset class, the increasing use of Bitcoin as a payment method, and the ongoing development of the Bitcoin ecosystem. However, there are also risks to consider, such as regulatory uncertainty, competition from other cryptocurrencies, and the potential for market manipulation.

Bitcoin’s All-Time High

Bitcoin’s recent surge to an all-time high of $72,700 has sent shockwaves through the cryptocurrency world. While this milestone is a testament to Bitcoin’s growing adoption and mainstream appeal, it’s crucial to remember that past performance is not indicative of future results. Understanding the historical context of Bitcoin’s previous all-time highs and the factors driving them can provide valuable insights into the current market dynamics.

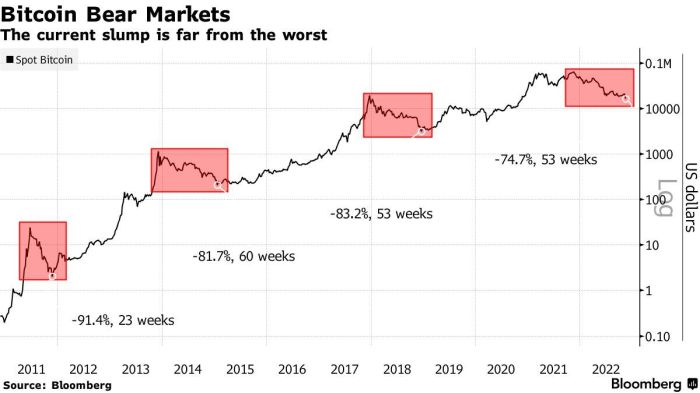

Bitcoin’s price has experienced significant fluctuations throughout its history, marked by periods of explosive growth followed by sharp corrections. Each all-time high has been a reflection of evolving market conditions, investor sentiment, and technological advancements.

Previous All-Time Highs and Contributing Factors

Bitcoin’s price history is characterized by several notable all-time highs, each driven by a unique combination of factors.

- 2013: Bitcoin’s first major surge to $1,100 was fueled by increasing media attention, early adoption by tech enthusiasts, and the emergence of Bitcoin exchanges.

- 2017: The infamous “Bitcoin bubble” saw prices skyrocket to nearly $20,000, driven by a confluence of factors including mainstream media hype, increased institutional interest, and the emergence of new cryptocurrency projects.

- 2020: Following the 2020 halving event, Bitcoin’s price surged to $64,800, driven by a combination of factors including increased institutional adoption, growing macroeconomic uncertainty, and the perception of Bitcoin as a hedge against inflation.

Comparison to the Current All-Time High

The current all-time high of $72,700 is a significant milestone, exceeding the previous high of $64,800 set in April 2021. While the current surge is driven by several factors, including continued institutional adoption, growing demand from retail investors, and the ongoing global economic uncertainty, it’s important to note that the market conditions are different compared to previous highs.

“The current bull run is characterized by a more mature and diversified market, with a greater focus on institutional adoption and regulatory clarity.”

Impact of Major Events

Major events like the 2017 bull run and the 2020 halving have had a profound impact on Bitcoin’s price.

- 2017 Bull Run: The 2017 bull run was characterized by widespread media hype, speculative trading, and a lack of regulatory clarity. While it led to unprecedented price gains, it also resulted in a subsequent market correction.

- 2020 Halving: The 2020 halving event, which reduced the rate of Bitcoin production by half, created a scarcity effect and contributed to the subsequent price surge. The event highlighted the deflationary nature of Bitcoin and its potential as a store of value.

Factors Influencing Bitcoin’s Price Volatility

Bitcoin, the world’s first and largest cryptocurrency, is renowned for its price volatility. This inherent characteristic is a double-edged sword, attracting both investors seeking high returns and those wary of its inherent risks. Understanding the factors driving Bitcoin’s price fluctuations is crucial for navigating this dynamic market.

Market Sentiment and Investor Behavior

The collective emotions and actions of investors significantly influence Bitcoin’s price. When market sentiment is bullish, driven by positive news or anticipation of future growth, investors tend to buy, pushing prices higher. Conversely, bearish sentiment, often fueled by negative news or regulatory concerns, leads to selling pressure and price declines.

“Fear, uncertainty, and doubt (FUD) can drive down prices, while positive news and strong adoption can create a bullish market sentiment.”

This dynamic is often amplified by herd behavior, where investors mimic each other’s actions, leading to price swings.

Regulatory Announcements and Policies

Governments and regulatory bodies around the world are actively shaping the landscape of cryptocurrency regulation. Announcements and policies related to Bitcoin can have a profound impact on its price. Favorable regulations, such as clear guidelines for cryptocurrency exchanges or recognition of Bitcoin as a legitimate asset class, can boost investor confidence and drive prices up. Conversely, restrictive policies, such as bans or excessive taxation, can create uncertainty and lead to price declines.

“The legal status and regulatory environment surrounding Bitcoin significantly influence its price volatility.”

Adoption by Businesses and Institutions

The increasing adoption of Bitcoin by businesses and institutions plays a significant role in its price volatility. When major companies or financial institutions integrate Bitcoin into their operations, it signals a growing acceptance of the cryptocurrency and its potential for mainstream use. This can attract new investors and drive up demand, pushing prices higher.

“The adoption of Bitcoin by large corporations, such as Tesla and MicroStrategy, has significantly impacted its price.”

Macroeconomic Factors and Global Events

Bitcoin’s price is also influenced by broader macroeconomic factors and global events. For instance, during periods of economic uncertainty or global crises, investors often seek safe haven assets, such as gold or Bitcoin. This increased demand can drive Bitcoin’s price up. Conversely, positive economic news or global stability can lead to a shift away from Bitcoin and a decrease in its price.

“The COVID-19 pandemic and the subsequent economic downturn led to a surge in Bitcoin’s price as investors sought safe haven assets.”

Analyzing the Sustainability of Bitcoin’s Current Price

Bitcoin’s recent surge to record highs has sparked intense debate about the sustainability of its current price. While the factors driving this rise are multifaceted, understanding the forces that could sustain or hinder this momentum is crucial for investors and market observers alike.

Continued Institutional Adoption and Investment

Institutional investors, such as hedge funds, pension funds, and corporations, have increasingly recognized Bitcoin’s potential as a store of value and a hedge against inflation. This growing interest has led to substantial capital inflows into the Bitcoin market, driving up demand and contributing to price appreciation.

- For example, MicroStrategy, a business intelligence firm, has invested billions of dollars in Bitcoin, highlighting the growing confidence of institutional investors in its long-term value.

- Furthermore, the launch of Bitcoin futures contracts on major exchanges has facilitated institutional participation, making it easier for institutional investors to access the Bitcoin market.

Growing Demand from Retail Investors

Retail investors, driven by factors like increased awareness, media coverage, and the ease of access to crypto exchanges, have also contributed to Bitcoin’s price surge. The growing popularity of cryptocurrency trading platforms and the availability of user-friendly mobile wallets have made it easier for individuals to participate in the Bitcoin market.

- The widespread adoption of mobile payment apps, such as Cash App and Venmo, has also facilitated Bitcoin adoption among retail investors.

- Furthermore, the increasing number of Bitcoin ATMs around the world provides a convenient way for individuals to buy and sell Bitcoin.

Increased Utility and Use Cases for Bitcoin

Bitcoin’s utility and use cases are expanding beyond simply a digital currency. Its potential applications in various industries, such as payments, decentralized finance (DeFi), and supply chain management, are attracting interest and driving demand.

- For instance, the Lightning Network, a second-layer scaling solution for Bitcoin, is enabling faster and cheaper transactions, expanding its use cases for everyday payments.

- The growth of decentralized finance (DeFi) platforms built on Bitcoin’s blockchain has also contributed to its utility, providing access to financial services without intermediaries.

Technological Advancements and Network Security

Bitcoin’s underlying technology, blockchain, is constantly evolving, leading to advancements that enhance its security, scalability, and efficiency. These advancements can further strengthen Bitcoin’s position as a robust and reliable digital asset.

- For example, the development of new consensus mechanisms, such as Proof-of-Stake, can potentially improve Bitcoin’s energy efficiency and scalability.

- The decentralized nature of Bitcoin’s network, with no single point of failure, enhances its resilience and security.

Regulatory Uncertainty and Potential Bans

Regulatory uncertainty surrounding Bitcoin remains a significant risk. Governments worldwide are still grappling with how to regulate cryptocurrencies, and some countries have implemented bans or restrictions.

- The lack of clear regulatory frameworks can create uncertainty for investors and businesses, potentially impacting Bitcoin’s price trajectory.

- Strict regulations or outright bans in major markets could significantly hinder Bitcoin’s growth and adoption.

Competition from Other Cryptocurrencies

Bitcoin faces competition from a growing number of alternative cryptocurrencies, known as altcoins. These cryptocurrencies often offer features and functionalities that challenge Bitcoin’s dominance.

- The emergence of new cryptocurrencies with faster transaction speeds, lower fees, or more advanced smart contract capabilities could potentially divert investor interest away from Bitcoin.

- The constant innovation and development in the cryptocurrency space pose a competitive threat to Bitcoin’s market share.

Market Manipulation and Volatility

Bitcoin’s price is highly volatile, susceptible to market manipulation and speculative trading. This volatility can lead to sharp price swings, making it difficult to predict the long-term price trajectory.

- Large-scale market manipulation by whales, or individuals with significant holdings, can artificially inflate or deflate Bitcoin’s price.

- News events, regulatory announcements, and social media sentiment can also significantly impact Bitcoin’s price volatility.

Environmental Concerns and Energy Consumption

Bitcoin’s energy consumption has become a growing concern, particularly as it relates to its environmental impact. The proof-of-work consensus mechanism used by Bitcoin requires significant computational power, leading to high energy consumption.

- Critics argue that Bitcoin’s energy consumption is unsustainable and poses a threat to environmental goals.

- The development of more energy-efficient mining techniques and alternative consensus mechanisms could help address these concerns.

The Future of Bitcoin: Bitcoins Newest All Time High Of 72700 Doesnt Mean High Prices Are Here To Stay

Predicting the future of Bitcoin is a complex task, as it is influenced by numerous factors, including technological advancements, regulatory landscapes, and market sentiment. While the recent all-time high has generated excitement, it’s crucial to understand that the future trajectory of Bitcoin’s price is uncertain.

Potential Scenarios for Bitcoin’s Future Price

The future of Bitcoin’s price is a topic of intense debate among investors and analysts. While there is no crystal ball, several potential scenarios can be considered.

- Continued Upward Trend Driven by Adoption and Innovation: One optimistic scenario suggests that Bitcoin’s price will continue its upward trajectory driven by increased adoption and technological innovation. As more businesses and individuals embrace Bitcoin, demand could outpace supply, leading to higher prices. The development of new use cases for Bitcoin, such as decentralized finance (DeFi) and non-fungible tokens (NFTs), could further fuel this growth.

- A Correction or Pullback as the Market Matures: Alternatively, Bitcoin could experience a correction or pullback as the market matures. This scenario suggests that the recent price surge might be unsustainable and that the market needs to adjust to a more realistic valuation. Such a pullback could be driven by factors like increased regulation, market volatility, or a lack of mainstream adoption.

- A Long-Term Bull Market with Periods of Consolidation: A third scenario envisions a long-term bull market for Bitcoin, characterized by periods of consolidation and growth. This scenario suggests that Bitcoin’s price will continue to rise over the long term, but with occasional dips and corrections along the way. This pattern could be driven by a combination of factors, including increasing institutional investment, growing adoption, and technological advancements.

Price Predictions from Reputable Analysts and Industry Experts

| Analyst/Expert | Price Prediction | Timeframe | Reasoning |

|---|---|---|---|

| PlanB (on-chain analyst) | $100,000 by the end of 2021 | Short-term | Based on the stock-to-flow model, which predicts Bitcoin’s price based on its scarcity and issuance rate. |

| Anthony Pompliano (Morgan Creek Digital Assets) | $1 million by 2025 | Long-term | Based on Bitcoin’s potential to become a global reserve currency and its limited supply. |

| Cathie Wood (Ark Invest) | $500,000 by 2026 | Long-term | Based on Bitcoin’s adoption by institutional investors and its potential to disrupt traditional financial systems. |

Investment Strategies for Bitcoin

Navigating the world of Bitcoin investments can be daunting, with various strategies offering unique approaches to potential gains. Each strategy comes with its own set of advantages and disadvantages, making it crucial to understand their nuances before diving in.

Buy and Hold

This strategy involves purchasing Bitcoin and holding it for an extended period, aiming to benefit from long-term price appreciation.

- Advantages:

- Simplicity: This strategy requires minimal effort, as it involves buying and holding without active trading.

- Potential for high returns: Bitcoin’s historical price volatility has resulted in substantial gains for long-term holders.

- Tax efficiency: Holding Bitcoin for a long time can minimize capital gains taxes, especially in jurisdictions with favorable tax laws.

- Disadvantages:

- Market volatility: Bitcoin’s price can fluctuate significantly, potentially leading to losses in the short term.

- Opportunity cost: Holding Bitcoin means missing out on potential gains from other investments.

- Lack of liquidity: Selling Bitcoin for quick cash can be challenging during market downturns.

This strategy is suitable for investors with a long-term horizon and a high risk tolerance.

Dollar-Cost Averaging

This strategy involves investing a fixed amount of money in Bitcoin at regular intervals, regardless of its price.

- Advantages:

- Reduces risk: By buying Bitcoin at different price points, dollar-cost averaging mitigates the impact of market volatility.

- Disciplined approach: It encourages a consistent investment strategy, reducing emotional decisions based on market fluctuations.

- Suitable for beginners: It is a relatively simple strategy that can be implemented with a systematic approach.

- Disadvantages:

- Lower potential returns: This strategy may not yield as high returns as buying Bitcoin at a lower price point.

- Time commitment: It requires consistent investment over a long period, which might not be feasible for all investors.

- Market timing: It does not guarantee profits, especially during prolonged market downturns.

Dollar-cost averaging is suitable for investors seeking to mitigate risk and build a Bitcoin portfolio gradually.

Trading and Day Trading

This strategy involves actively buying and selling Bitcoin to profit from short-term price fluctuations.

- Advantages:

- Potential for high returns: Skilled traders can capitalize on market volatility and generate substantial profits.

- Flexibility: It allows for quick entry and exit points, adapting to changing market conditions.

- Active involvement: It provides a hands-on approach to managing Bitcoin investments.

- Disadvantages:

- High risk: It requires extensive market knowledge, technical analysis, and risk management skills.

- Time commitment: It demands constant monitoring and active trading, requiring significant time and effort.

- Psychological impact: Emotional decisions can lead to impulsive trading and potential losses.

Trading and day trading are suitable for experienced investors with a high risk tolerance and the time and resources to actively manage their investments.

Shorting and Derivatives

This strategy involves betting on Bitcoin’s price decline, typically through derivatives like futures or options.

- Advantages:

- Potential for profit during market downturns: It allows investors to benefit from a declining Bitcoin price.

- Leverage: Derivatives can amplify returns, potentially generating significant profits with a small initial investment.

- Hedging: It can be used to mitigate losses in a long Bitcoin position.

- Disadvantages:

- High risk: Derivatives are complex financial instruments with significant potential for losses.

- Counterparty risk: The value of derivatives depends on the solvency of the counterparty, introducing additional risk.

- Limited understanding: Shorting and derivatives require a deep understanding of financial markets and risk management.

This strategy is suitable for sophisticated investors with a high risk tolerance and a comprehensive understanding of derivatives trading.

Bitcoin’s Impact on the Global Economy

Bitcoin’s increasing popularity and potential for widespread adoption have sparked intense debate about its implications for the global economy. While some view it as a disruptive force that could revolutionize finance, others are concerned about its potential to destabilize traditional systems. This section will explore the potential impact of Bitcoin on the global financial system, examining its implications for decentralized finance, competition with traditional currencies, monetary policy, and the potential for economic disruption and innovation.

Decentralized Finance and Alternative Payment Systems

Bitcoin’s underlying technology, blockchain, has the potential to revolutionize financial systems by enabling decentralized finance (DeFi). DeFi platforms built on blockchain technology allow for peer-to-peer lending, borrowing, and trading without the need for intermediaries like banks. This could empower individuals and businesses to access financial services more easily and affordably, particularly in regions with limited access to traditional banking systems. Furthermore, Bitcoin’s decentralized nature and global reach make it an attractive alternative payment system, potentially reducing reliance on traditional payment networks and facilitating cross-border transactions with lower fees and faster processing times.

Competition with Traditional Currencies

As Bitcoin’s adoption grows, it could potentially compete with traditional currencies, potentially influencing their value and role in the global economy. If Bitcoin gains widespread acceptance as a store of value and medium of exchange, it could reduce demand for traditional currencies, potentially leading to deflationary pressures. Furthermore, the increasing use of Bitcoin for payments could erode the dominance of central banks and governments in controlling monetary policy.

Implications for Monetary Policy and Inflation

Bitcoin’s decentralized nature and limited supply pose challenges for central banks in managing monetary policy. Central banks typically control inflation by adjusting interest rates and managing the money supply. However, Bitcoin’s supply is predetermined and not subject to central bank control, making it difficult for central banks to manage inflation in an environment where Bitcoin is widely adopted.

Potential for Economic Disruption and Innovation

Bitcoin’s emergence has spurred innovation and disruption across various sectors, including finance, technology, and energy. The development of blockchain technology has led to the creation of new financial instruments, improved supply chain management, and enhanced data security. Furthermore, Bitcoin’s energy-intensive mining process has incentivized the development of renewable energy sources and energy efficiency technologies. While Bitcoin’s impact on the global economy is still unfolding, its potential to disrupt traditional systems and drive innovation is undeniable.

Potential Benefits and Risks of Bitcoin Adoption

The widespread adoption of Bitcoin could bring both benefits and risks for various stakeholders. The following table summarizes the potential impacts:

| Stakeholder | Potential Benefits | Potential Risks |

|—|—|—|

| Governments | Increased tax revenue from Bitcoin transactions, potential for economic growth through innovation | Loss of control over monetary policy, difficulty in regulating Bitcoin, potential for illicit activities |

| Central banks | Potential for greater financial inclusion, reduced reliance on traditional financial systems | Loss of control over money supply, potential for financial instability, increased competition from alternative currencies |

| Businesses | Lower transaction fees, faster processing times, increased transparency | Volatility of Bitcoin’s price, regulatory uncertainty, potential for cyberattacks |

| Individuals | Greater financial freedom, access to financial services, potential for investment gains | Volatility of Bitcoin’s price, security risks, potential for scams |

The Future of Cryptocurrencies

Bitcoin’s meteoric rise has sparked a wave of interest in the broader cryptocurrency landscape, ushering in a new era of decentralized finance and digital assets. The success of Bitcoin has fueled the growth of a diverse ecosystem of cryptocurrencies, each with unique functionalities and applications. While Bitcoin remains the dominant player, the future of cryptocurrencies extends beyond its boundaries, encompassing a multitude of innovative technologies and trends that are shaping the financial landscape.

Decentralized Finance (DeFi)

DeFi represents a paradigm shift in the financial system, empowering individuals to take control of their finances through decentralized applications (dApps) built on blockchain technology. DeFi platforms offer a range of financial services, including lending, borrowing, trading, and insurance, without the need for intermediaries like banks or financial institutions. This eliminates traditional gatekeepers and enables peer-to-peer interactions, promoting transparency and accessibility.

Non-Fungible Tokens (NFTs)

NFTs have emerged as a groundbreaking innovation, revolutionizing the way we perceive and interact with digital assets. Unlike traditional cryptocurrencies, NFTs are unique and indivisible, representing ownership of specific digital items, such as artwork, collectibles, and virtual real estate. NFTs have gained immense popularity in recent years, particularly in the art world, where artists can directly sell their creations to collectors without intermediaries, bypassing traditional art markets.

Metaverse and Web3, Bitcoins newest all time high of 72700 doesnt mean high prices are here to stay

The convergence of blockchain technology, virtual reality, and augmented reality is giving rise to the metaverse, a collective virtual space where users can interact, work, and play. Web3, a decentralized version of the internet, leverages blockchain technology to create a more open, secure, and user-centric web experience. Cryptocurrencies play a crucial role in the metaverse, facilitating transactions and powering the underlying infrastructure.

Regulatory Frameworks and Adoption

The future of cryptocurrencies hinges on the development of clear and comprehensive regulatory frameworks. As the cryptocurrency market continues to grow, regulators are grappling with the challenges of balancing innovation with consumer protection and financial stability. The adoption of cryptocurrencies by mainstream institutions and governments will be a key factor in determining their long-term success.

While Bitcoin’s recent all-time high is a significant milestone, it’s important to remember that the cryptocurrency market is highly volatile and unpredictable. Whether this price surge is sustainable or a temporary blip remains to be seen. The future of Bitcoin will depend on a complex interplay of factors, including technological advancements, regulatory changes, and investor sentiment. As with any investment, it’s essential to do your research, understand the risks, and invest wisely.

Just because Bitcoin hit a new all-time high of $72,700 doesn’t mean we’re in for a sustained bull run. Remember, the crypto market is volatile, and recent events like the Worldcoin Spain ban highlight the regulatory uncertainty that can impact prices. So, while the latest surge is exciting, it’s important to stay grounded and invest wisely, keeping in mind the inherent risks associated with cryptocurrencies.

Standi Techno News

Standi Techno News