How low can Bitcoin ETF fees drop before it hurts a business? This question is increasingly relevant as the Bitcoin ETF market becomes more competitive. With a growing number of providers vying for investor dollars, fees are becoming a key battleground. While lower fees may attract more investors, they can also erode profitability for ETF providers. This delicate balance between attracting investors and maintaining profitability is a key challenge for Bitcoin ETF providers today.

This article delves into the complexities of Bitcoin ETF fees, exploring the competitive landscape, the impact of low fees on both providers and investors, and the role of regulatory oversight. We’ll also consider future trends in fee levels and the potential impact of technological advancements on the industry.

The Competitive Landscape of Bitcoin ETF Fees

The Bitcoin ETF market is rapidly evolving, with numerous providers vying for investors’ attention. This competitive landscape has led to a decline in fees, as providers seek to attract investors with lower costs. The fees charged by Bitcoin ETFs vary significantly, and understanding the factors driving this competition is crucial for investors seeking to minimize their expenses.

Fees Charged by Bitcoin ETF Providers

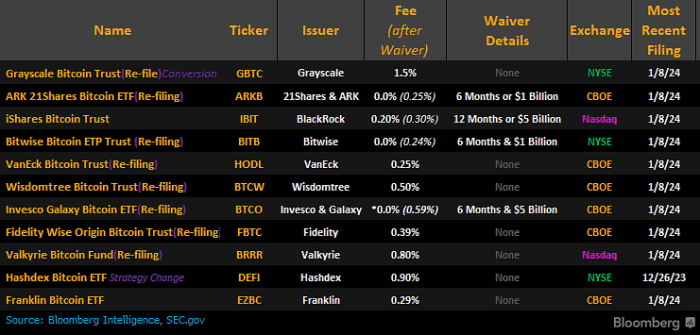

The fees charged by Bitcoin ETF providers are typically expressed as an expense ratio, which represents the percentage of assets under management (AUM) that is deducted annually to cover operating costs. The current range of fees charged by different Bitcoin ETF providers is relatively narrow, with most ETFs charging between 0.50% and 1.00% annually.

- For example, the ProShares Bitcoin Strategy ETF (BITO), the first Bitcoin ETF to launch in the United States, charges an expense ratio of 0.95%.

- In contrast, the VanEck Bitcoin Strategy ETF (XBTF), launched shortly after BITO, charges a lower expense ratio of 0.65%.

Factors Driving Fee Competition

Several key factors are driving fee competition in the Bitcoin ETF market:

- The emergence of new ETF providers seeking to gain market share.

- The increasing popularity of Bitcoin as an investment asset, leading to a larger pool of potential investors.

- The desire of investors to minimize their investment costs, especially in a volatile market like Bitcoin.

Comparison of Fee Structures

While most Bitcoin ETFs charge a simple expense ratio, some providers offer unique fee structures or advantages:

- Some ETFs may offer tiered fee structures, where the expense ratio decreases as the AUM increases.

- Others may offer fee waivers or discounts for certain investor types, such as institutional investors.

- Some ETFs may also offer a “tracking difference” fee, which is charged only if the ETF’s performance deviates significantly from the underlying Bitcoin price.

The Impact of Low Fees on Investors

Lowering fees for Bitcoin ETFs presents a compelling proposition for investors, promising to enhance returns and potentially attract new participants. However, the impact of such fee reductions extends beyond simple cost savings, influencing investor behavior and market dynamics in multifaceted ways.

The Benefits of Low Fees for Investors

Low fees translate directly into greater returns for investors, as a larger proportion of investment gains remains in their hands. This is particularly significant in the volatile world of cryptocurrencies, where price fluctuations can have a substantial impact on profitability.

- Increased Profitability: Lower fees mean a larger share of investment gains goes to the investor, potentially leading to higher overall returns. For example, a 1% fee on a $10,000 investment translates to a $100 fee, whereas a 0.5% fee would cost only $50, leaving $50 more for the investor.

- Enhanced Accessibility: Lower fees can make Bitcoin ETFs more attractive to a wider range of investors, particularly those with smaller investment amounts. This can contribute to increased market participation and liquidity.

- Reduced Investment Costs: Lower fees reduce the overall cost of investing in Bitcoin, making it more accessible to budget-conscious investors. This can be particularly beneficial for long-term investors who seek to accumulate Bitcoin over time.

The Drawbacks of Low Fees for Investors

While lower fees offer enticing advantages, it’s essential to consider potential drawbacks that could impact investor outcomes.

- Potential Impact on ETF Quality: Extremely low fees might incentivize ETF providers to cut corners in areas like portfolio management or research, potentially compromising the quality of the product. This could lead to suboptimal investment performance, negating the benefits of lower fees.

- Limited Investment Options: In the pursuit of ultra-low fees, investors might face a limited selection of Bitcoin ETFs, potentially restricting their ability to choose an ETF that aligns with their investment strategy or risk tolerance.

- Potential for Hidden Fees: Investors should be cautious of “hidden fees” or complex fee structures that might not be immediately apparent. These fees can erode returns, making it difficult to assess the true cost of investing.

The Impact of Low Fees on Return on Investment

The relationship between fees and return on investment is straightforward: lower fees lead to higher returns. However, the magnitude of this impact depends on factors such as the ETF’s performance and the investor’s investment horizon.

Lower fees directly impact the return on investment, as investors retain a larger portion of their gains.

For instance, a 1% fee on a 10% annual return translates to a 1% reduction in profits, while a 0.5% fee would result in a 0.5% reduction. Over time, these seemingly small differences can accumulate, significantly impacting the overall return.

The Relationship Between Fees and Investor Confidence

Lower fees can enhance investor confidence by signaling a commitment to cost-effectiveness and transparency. This can encourage greater participation and market liquidity.

- Increased Trust and Transparency: Lower fees can signal a commitment to investor interests, fostering trust and transparency in the ETF provider. This can attract investors who prioritize cost-effectiveness and value.

- Enhanced Market Participation: Lower fees can encourage greater participation in the Bitcoin ETF market, leading to increased trading volume and liquidity. This can benefit all investors by making it easier to buy and sell shares.

- Potential for Price Volatility: While lower fees can increase participation, it’s crucial to acknowledge that high volatility in the Bitcoin market can lead to rapid price fluctuations, potentially impacting returns despite lower fees.

The Role of Regulatory Oversight in Fee Levels

Regulatory frameworks play a crucial role in shaping the landscape of Bitcoin ETF fees. These frameworks, often set by securities regulators, establish guidelines and requirements that directly influence the costs associated with Bitcoin ETFs.

Impact of Regulatory Frameworks on Fees, How low can bitcoin etf fees drop before it hurts a business

Regulatory oversight significantly impacts Bitcoin ETF fees by dictating the operational requirements and risk management protocols that issuers must adhere to. This can influence fees in the following ways:

- Custodial Requirements: Regulations might mandate the use of specific custodians for Bitcoin holdings, potentially impacting the cost of secure storage and insurance.

- Trading and Liquidity Requirements: Regulatory guidelines can influence the frequency and volume of trading activities, impacting market-making costs and overall liquidity.

- Reporting and Transparency Obligations: Regulations might require frequent and detailed reporting, increasing operational costs for ETF providers.

- Risk Management and Compliance: Stricter regulatory oversight often translates to higher compliance costs, which can be reflected in ETF fees.

Regulatory Changes and the Competitive Landscape

Regulatory changes can significantly reshape the competitive landscape of Bitcoin ETF fees. For example:

- Relaxation of Custodial Requirements: If regulations become more flexible regarding custodial requirements, it might enable ETF providers to explore lower-cost storage options, potentially leading to reduced fees.

- Increased Transparency and Standardization: Regulations promoting greater transparency and standardization in reporting and disclosure can lead to more efficient and cost-effective operations, potentially benefiting investors through lower fees.

- Competition Among Regulators: As more jurisdictions develop their own regulatory frameworks for Bitcoin ETFs, the competitive landscape can influence fee structures as providers seek to attract investors in different markets.

Role of Regulators in Ensuring Transparency and Fairness

Regulators play a vital role in ensuring transparency and fairness in Bitcoin ETF fee structures. They can achieve this by:

- Mandating Clear and Comprehensive Fee Disclosure: Regulators can require ETF providers to disclose all fees and expenses in a clear and concise manner, enabling investors to compare different options.

- Monitoring and Auditing Fee Structures: Regulators can conduct regular monitoring and audits to ensure that ETF fees are reasonable and aligned with the services provided.

- Promoting Competition: Regulators can foster a competitive environment by encouraging new entrants and facilitating innovation in the ETF market, potentially leading to lower fees for investors.

Future Trends in Bitcoin ETF Fees: How Low Can Bitcoin Etf Fees Drop Before It Hurts A Business

The Bitcoin ETF market is still relatively young, and fee levels are likely to continue evolving in the coming years. Several factors will influence the trajectory of these fees, including technological advancements, market competition, and regulatory oversight.

Impact of Technological Advancements on Fee Structures

Technological advancements are likely to play a significant role in shaping the future of Bitcoin ETF fees. For example, the emergence of blockchain-based solutions could streamline the trading and settlement process, potentially reducing operational costs and leading to lower fees for investors.

“The adoption of blockchain technology could potentially lead to lower transaction fees for Bitcoin ETFs, as it eliminates the need for intermediaries and streamlines the settlement process.”

Additionally, advancements in artificial intelligence (AI) and machine learning (ML) could enhance portfolio management strategies, potentially leading to more efficient trading and lower management fees.

Potential for Further Consolidation or Fragmentation in the Bitcoin ETF Market

The Bitcoin ETF market is currently characterized by a relatively small number of providers. However, the landscape could evolve significantly in the coming years, with potential for both consolidation and fragmentation.

Consolidation

Consolidation could occur as larger players acquire smaller competitors, potentially leading to increased economies of scale and lower fees for investors.

“The consolidation of the Bitcoin ETF market could lead to lower fees for investors, as larger players benefit from economies of scale and increased bargaining power with service providers.”

Fragmentation

Conversely, the market could also fragment, with the emergence of new players offering specialized products or targeting specific niches. This could lead to increased competition and potentially lower fees, as providers strive to attract investors with competitive offerings.

“Fragmentation in the Bitcoin ETF market could lead to increased competition and potentially lower fees, as providers seek to differentiate themselves and attract investors.”

The race to the bottom in Bitcoin ETF fees is a fascinating story of competition, innovation, and regulation. While lower fees can benefit investors, they can also create challenges for ETF providers. Ultimately, the future of Bitcoin ETF fees will be shaped by a complex interplay of market forces, technological advancements, and regulatory oversight. As the market matures, we can expect to see further consolidation, increased transparency, and perhaps even a shift towards more innovative fee structures.

The question of how low Bitcoin ETF fees can go before hurting a business is a tricky one. It’s like asking how low can a tutor’s rates go before they can’t afford to pay their bills? Well, in the education world, AI tutors are quietly changing how kids in the US study, and the leading apps are from China, ai tutors are quietly changing how kids in the US study and the leading apps are from china.

So, it’s clear that a low-cost model can be successful, but it depends on the value proposition and the overall business strategy. The same applies to Bitcoin ETF fees – finding that sweet spot where fees are low enough to attract investors, but high enough to sustain the business is key.

Standi Techno News

Standi Techno News