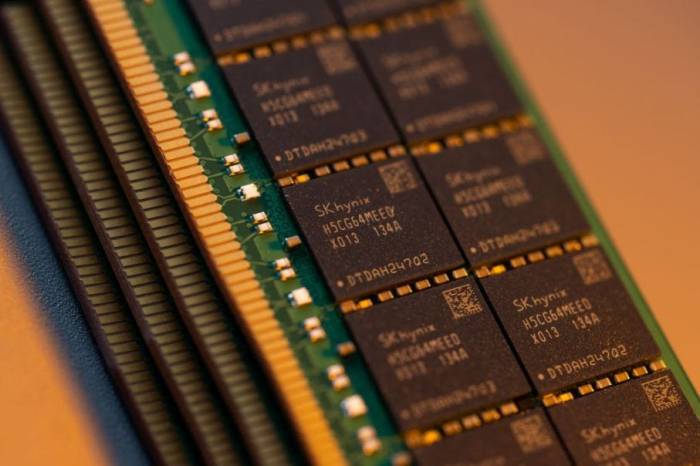

Memory chip maker sk hynix a shareholder of kioxia opposes a merger with western digital – Memory chip maker SK Hynix, a shareholder of Kioxia, has thrown a wrench into the works of a potential merger between Kioxia and Western Digital. This unexpected opposition raises eyebrows in the tech world, especially considering the long-standing partnership between SK Hynix and Kioxia. The proposed merger, which would create a behemoth in the memory chip market, has been met with skepticism from SK Hynix, who sees potential risks to its own interests and the overall market dynamics.

The story begins with the joint venture between SK Hynix and Kioxia, forged in the crucible of the memory chip industry. This partnership has been instrumental in shaping the landscape of the market, and its significance cannot be understated. However, the proposed merger between Kioxia and Western Digital has thrown a curveball into the mix, raising questions about the future of this alliance and the potential impact on the industry as a whole.

SK Hynix and Kioxia

The story of SK Hynix and Kioxia is intertwined with the history of the global memory chip market. Their partnership, born out of a shared vision for innovation, has played a pivotal role in shaping the landscape of this crucial technology sector.

The Genesis of the Partnership

The SK Hynix and Kioxia partnership traces its roots back to 2017 when SK Hynix acquired a 15% stake in Toshiba Memory Corporation (now Kioxia). This move was a strategic response to the growing demand for NAND flash memory, a key component in smartphones, data centers, and other electronic devices. The joint venture aimed to leverage the combined strengths of both companies, with SK Hynix’s expertise in DRAM manufacturing and Kioxia’s prowess in NAND flash technology.

The Proposed Merger with Western Digital

The proposed merger between Kioxia and Western Digital, two leading players in the flash memory market, aimed to create a global powerhouse in the industry. The deal was announced in October 2019, and it involved Western Digital acquiring a controlling stake in Kioxia, which was formerly known as Toshiba Memory.

The merger was driven by the desire to achieve economies of scale, enhance technological innovation, and expand market reach. By combining their strengths, Kioxia and Western Digital aimed to:

- Strengthen their position in the rapidly growing flash memory market: The combined entity would have a significant market share, enabling them to compete more effectively against other industry giants like Samsung and Micron.

- Gain access to a broader customer base: Western Digital’s strong presence in the enterprise storage market would provide Kioxia with access to new customers and markets. Conversely, Kioxia’s expertise in flash memory technology would benefit Western Digital’s product offerings.

- Boost R&D capabilities: Combining their research and development teams would accelerate innovation and allow for the development of cutting-edge flash memory technologies.

- Achieve cost synergies: By streamlining operations and eliminating redundancies, the merged company could achieve significant cost savings, which could be reinvested in growth initiatives.

Potential Challenges and Risks

While the merger promised numerous benefits, it also presented potential challenges and risks:

- Regulatory hurdles: The merger required approval from antitrust regulators in various jurisdictions, which could pose a significant challenge. The potential for regulatory scrutiny and delays was a major concern.

- Integration difficulties: Combining two large and complex organizations can be challenging, and integrating their operations, systems, and cultures could lead to disruptions and delays.

- Competition: The merged entity would face intense competition from other industry players, particularly Samsung and Micron, which are known for their aggressive market strategies.

- Technological advancements: The flash memory market is characterized by rapid technological advancements, and the merged company would need to invest heavily in R&D to stay ahead of the competition.

SK Hynix’s Opposition to the Merger

SK Hynix, a major player in the memory chip market, has voiced its opposition to the proposed merger between Kioxia and Western Digital. This opposition stems from concerns about the potential impact of the merger on the competitive landscape of the memory chip industry.

Reasons for Opposition

SK Hynix’s opposition to the merger is rooted in several key concerns:

* Market Dominance: The merger would create a formidable entity, potentially dominating the NAND flash memory market. This dominance could lead to reduced competition, higher prices, and limited innovation.

* Potential for Antitrust Issues: SK Hynix fears that the merger could raise antitrust concerns, potentially leading to regulatory scrutiny and potential legal challenges.

* Impact on SK Hynix’s Market Position: The merger could significantly impact SK Hynix’s market position. A combined Kioxia and Western Digital would pose a more significant competitor, potentially hindering SK Hynix’s ability to compete effectively.

Impact on SK Hynix’s Interests

The merger could have a substantial impact on SK Hynix’s interests:

* Reduced Market Share: The merger could lead to a decrease in SK Hynix’s market share, making it more challenging to maintain its current position in the NAND flash memory market.

* Increased Competition: The combined entity would pose a more formidable competitor, forcing SK Hynix to invest more resources in research and development to stay competitive.

* Potential for Price Increases: The merger could lead to higher prices for NAND flash memory, potentially impacting SK Hynix’s profitability.

The proposed merger of Kioxia and Western Digital has significant implications for the competitive landscape of the memory chip market. This move would create a formidable entity, potentially impacting market share, pricing dynamics, and the strategies of other key players.

The merger would create a combined entity with a significant market share in the NAND flash memory market, potentially challenging Samsung and SK Hynix’s dominance. This consolidation could lead to increased market concentration and potentially influence pricing dynamics.

A merger of Kioxia and Western Digital would create a formidable competitor with a significant market share in the NAND flash memory market, potentially influencing pricing dynamics and the strategies of other key players.

Implications for Other Key Players

The merger would likely force other memory chip manufacturers to adapt their strategies to maintain their market positions. For example, SK Hynix, a major competitor, has voiced its opposition to the merger, recognizing the potential impact on the competitive landscape.

- Samsung, the current market leader, could see increased pressure from the combined entity, prompting it to further invest in R&D and production to maintain its lead.

- Micron, another key player, might face increased competition for customers and market share, potentially necessitating strategic adjustments to remain competitive.

- Other NAND flash memory manufacturers could face challenges in securing sufficient market share, especially if the merged entity adopts aggressive pricing strategies.

Future Prospects and Potential Outcomes

The merger negotiations between Kioxia and Western Digital remain a complex and evolving situation, with the potential for several outcomes. The fate of the merger hinges on the outcome of negotiations between the two companies and the resolution of SK Hynix’s objections. The future of the memory chip market will be impacted by the outcome of this situation.

Potential Outcomes of the Merger Negotiations

The potential outcomes of the merger negotiations are wide-ranging and can significantly impact the future of the memory chip industry.

- Successful Merger: A successful merger between Kioxia and Western Digital would create a formidable player in the memory chip market, combining their respective strengths in NAND flash memory and storage solutions. This could lead to increased market share, technological advancements, and potential cost synergies. However, regulatory approval and potential antitrust concerns could pose significant challenges.

- Merger Failure: If the merger fails, Kioxia and Western Digital would remain independent entities. This could lead to increased competition in the memory chip market, potentially benefiting consumers with lower prices and more choices. However, it could also hinder innovation and investment in research and development for both companies.

- Alternative Solutions: The negotiations might lead to alternative solutions, such as a joint venture or strategic partnership, where both companies collaborate without a full merger. These options could offer a balance between competition and collaboration, allowing for shared resources and technological advancements while preserving their independent identities.

SK Hynix’s Potential Involvement in Kioxia

SK Hynix’s potential involvement in Kioxia presents several possibilities, each with its own implications for the memory chip market:

- Acquisition of Kioxia: SK Hynix could acquire Kioxia if the merger with Western Digital fails. This would create a global memory chip giant with a dominant market share, potentially leading to higher prices and reduced competition. However, regulatory scrutiny and potential antitrust issues could hinder this scenario.

- Strategic Partnership: SK Hynix might opt for a strategic partnership with Kioxia, collaborating on technology development or joint ventures. This could lead to innovation and market share gains for both companies, while maintaining a degree of competition. This approach could also help address regulatory concerns associated with a full acquisition.

- No Involvement: SK Hynix could choose to remain uninvolved in Kioxia’s future, allowing the company to pursue its own path. This would maintain the status quo in the memory chip market, with SK Hynix continuing to compete with Kioxia and other players. However, it could also limit opportunities for collaboration and innovation.

Future Prospects of the Memory Chip Market

The memory chip market is expected to experience significant growth in the coming years, driven by the increasing demand for data storage and processing power in various applications, such as smartphones, data centers, and artificial intelligence.

- Increased Demand: The global demand for memory chips is projected to rise steadily due to the growing adoption of cloud computing, the Internet of Things (IoT), and 5G technology. This trend will drive investment and innovation in the memory chip industry, leading to new technologies and products.

- Technological Advancements: The memory chip industry is constantly evolving, with new technologies such as 3D NAND and MRAM emerging. These advancements are expected to increase storage capacity, improve performance, and reduce costs, further fueling the growth of the memory chip market.

- Consolidation and Competition: The merger negotiations between Kioxia and Western Digital, along with SK Hynix’s potential involvement, highlight the ongoing consolidation and competition in the memory chip industry. This dynamic will likely continue to shape the market landscape, influencing pricing, innovation, and market share.

The opposition from SK Hynix adds another layer of complexity to the already intricate landscape of the memory chip market. The outcome of this saga remains uncertain, but one thing is clear: the stakes are high, and the potential implications for the industry are far-reaching. The future of Kioxia, Western Digital, and SK Hynix hangs in the balance as the battle for market dominance continues.

SK Hynix, a major memory chip maker and a shareholder of Kioxia, is throwing a wrench into the works of a potential merger between Kioxia and Western Digital. It seems SK Hynix is worried about the impact a merger might have on the flash memory market. Meanwhile, the FTC is taking aim at X, formerly known as Twitter, over unlabeled ads, as seen in this recent report.

The FTC is cracking down on transparency, while SK Hynix is fighting for control in the memory chip arena. Looks like both situations are about keeping things fair and transparent, even in the tech world.

Standi Techno News

Standi Techno News