Softbank backed firstcry seeks to raise nearly 220 million in india ipo – SoftBank-backed FirstCry seeks to raise nearly ₹220 million in an India IPO, setting the stage for a fascinating narrative of growth and ambition. FirstCry, a leading online retailer for baby and children’s products in India, has emerged as a powerhouse in the market, attracting the attention of investors and industry experts alike. The company’s journey from its inception to its current position as a market leader is a testament to its innovative approach and strategic vision.

FirstCry’s success can be attributed to a combination of factors, including its ability to cater to the growing demand for baby and children’s products in India, its strong brand recognition, and its strategic partnerships. SoftBank’s investment has played a pivotal role in FirstCry’s growth, providing the company with access to capital, expertise, and a vast network of resources. The IPO is expected to further fuel FirstCry’s expansion plans and solidify its position as a dominant player in the Indian online retail market.

FirstCry’s IPO: A Look at the Company’s Growth Trajectory

FirstCry, a leading online retailer for baby and children’s products in India, is gearing up for its Initial Public Offering (IPO), aiming to raise nearly ₹220 million. This move marks a significant milestone for the company, reflecting its remarkable growth and strong market position.

FirstCry’s Journey: From Inception to Market Leader

FirstCry’s journey began in 2010 with the vision of providing parents with a comprehensive online platform for all their baby and children’s needs. The company started as a small online store offering a limited range of products. However, with its focus on quality, competitive pricing, and exceptional customer service, FirstCry quickly gained popularity among Indian parents.

Key Milestones and Achievements

FirstCry’s success can be attributed to a series of strategic initiatives and milestones achieved over the years:

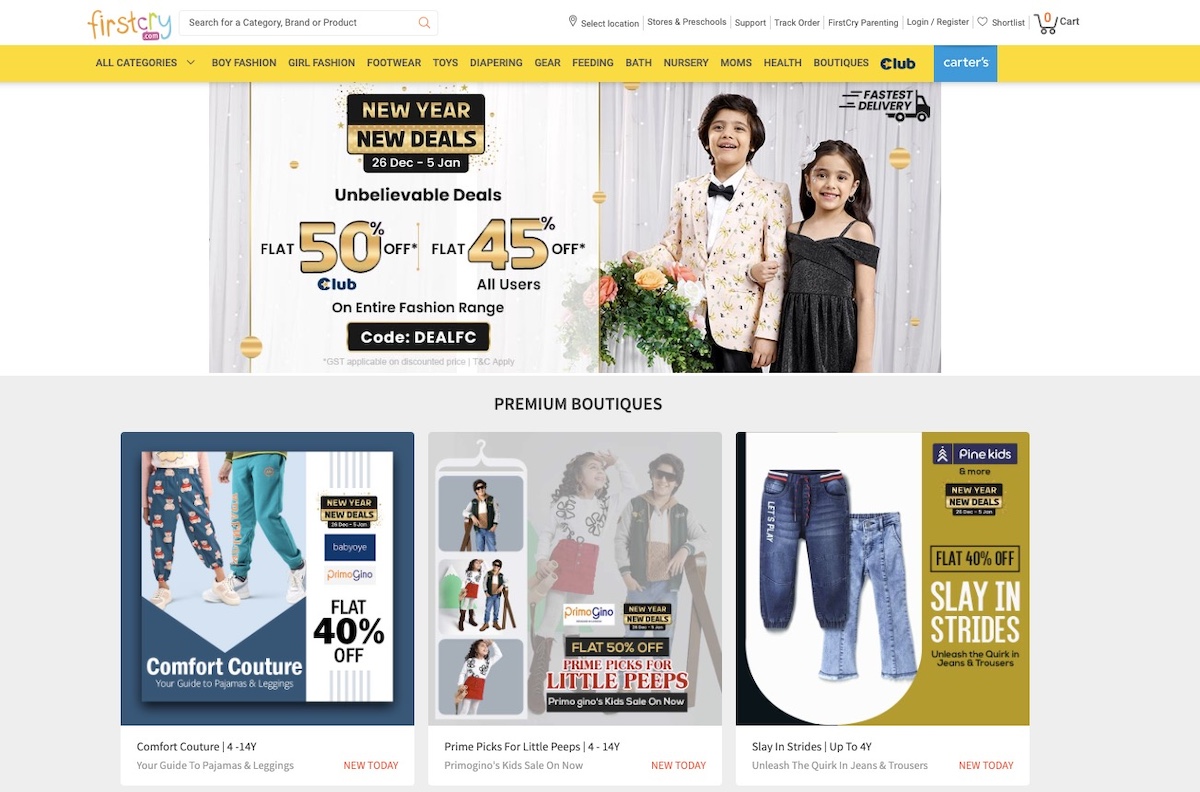

- Acquisitions: FirstCry has made strategic acquisitions to expand its product portfolio and reach new customer segments. In 2016, it acquired Babyoye, another prominent online retailer for baby products, strengthening its market share. This move broadened its product range and customer base, establishing FirstCry as a dominant player in the Indian baby and children’s products market.

- Expansion Strategies: FirstCry has adopted a multi-pronged approach to expansion, including opening physical stores across India, launching its own private label brands, and expanding into new product categories such as toys, apparel, and furniture. This strategic expansion has enabled FirstCry to cater to a wider customer base and offer a more comprehensive shopping experience.

- Partnerships: FirstCry has forged strategic partnerships with leading brands and retailers to enhance its product offerings and reach new customers. These collaborations have enabled FirstCry to provide exclusive deals and discounts to its customers, further strengthening its competitive advantage.

Factors Contributing to FirstCry’s Success

FirstCry’s success can be attributed to several factors:

- Growing Market Demand: The Indian baby and children’s products market is experiencing robust growth, driven by factors such as rising disposable incomes, increasing urbanization, and a growing middle class. This favorable market environment has provided FirstCry with a fertile ground for expansion and growth.

- Brand Recognition and Trust: FirstCry has built a strong brand reputation for quality, reliability, and customer satisfaction. Its commitment to offering a wide range of products, competitive pricing, and excellent customer service has earned it the trust of Indian parents. This brand recognition has been instrumental in attracting new customers and retaining existing ones.

- Strategic Initiatives: FirstCry’s strategic initiatives, including acquisitions, expansion strategies, and partnerships, have played a pivotal role in its growth. These initiatives have enabled the company to stay ahead of the competition and capitalize on market opportunities.

The IPO Landscape in India

India’s IPO market has been on a roll in recent years, fueled by a robust economic growth story, increasing investor appetite for new listings, and a supportive regulatory environment. This has resulted in a surge in IPO activity, with companies across various sectors seeking to tap the capital markets for expansion and growth.

The Current State of the IPO Market in India

The Indian IPO market is currently characterized by a mix of positive and cautious sentiment. On the one hand, the market has witnessed a significant surge in IPO activity in recent years, driven by factors such as a strong economic growth story, increasing investor appetite for new listings, and a supportive regulatory environment. This has led to a record number of IPOs in 2021 and 2022.

On the other hand, the market is also facing some headwinds, such as rising inflation, geopolitical uncertainties, and a potential slowdown in global economic growth. These factors have led to some volatility in the market, and investors are becoming more selective in their investment decisions.

The Competitive Landscape in the Online Retail Sector in India

The online retail sector in India is highly competitive, with a large number of players vying for market share. Some of the key players in this sector include:

- Amazon India: A global e-commerce giant with a strong presence in India. It offers a wide range of products and services, and has invested heavily in its logistics and technology infrastructure.

- Flipkart: One of the largest e-commerce companies in India, known for its wide selection of products and competitive pricing. It has a strong focus on building its own logistics and payment infrastructure.

- Myntra: A leading online fashion retailer in India, offering a wide range of clothing, footwear, and accessories. It has a strong focus on providing a personalized shopping experience.

- Snapdeal: A popular online marketplace in India, offering a wide range of products across categories. It has a strong focus on providing value-for-money products and services.

These companies are constantly innovating and expanding their offerings to stay ahead of the competition. They are also investing heavily in technology and logistics to improve customer experience and efficiency.

Challenges and Opportunities for FirstCry in the Indian IPO Market

FirstCry faces a number of challenges and opportunities in the Indian IPO market.

Challenges

- Competition: The online retail sector in India is highly competitive, with a large number of players vying for market share. FirstCry will need to differentiate itself from its competitors and offer a compelling value proposition to investors.

- Market Volatility: The Indian IPO market is subject to volatility, and investor sentiment can change quickly. FirstCry will need to be prepared to navigate these market conditions and ensure that its IPO is priced appropriately.

- Regulatory Environment: The regulatory environment in India can be complex and challenging for companies seeking to go public. FirstCry will need to ensure that it complies with all applicable regulations and requirements.

Opportunities

- Growing Market: The Indian online retail market is expected to continue to grow in the coming years, driven by factors such as increasing internet penetration and rising disposable incomes. FirstCry is well-positioned to capitalize on this growth.

- Strong Brand: FirstCry has established a strong brand in the Indian market, known for its wide selection of products and reliable service. This brand equity could help it attract investors.

- Technology Advantage: FirstCry has invested heavily in technology and has developed a strong platform that can be scaled to meet the growing demand in the Indian market. This could be a key differentiator for the company.

FirstCry’s Future Outlook: Softbank Backed Firstcry Seeks To Raise Nearly 220 Million In India Ipo

FirstCry, a SoftBank-backed company, is poised for continued growth in the Indian market. With a strong brand presence, a diverse product portfolio, and a commitment to technological innovation, FirstCry is well-positioned to capitalize on the growing demand for children’s products in India. However, the company also faces several challenges, including intense competition, regulatory changes, and economic fluctuations. This section delves into the key growth drivers and potential challenges that FirstCry may encounter in the coming years.

Growth Drivers for FirstCry

FirstCry’s future success hinges on several key growth drivers, including market expansion, product diversification, and technological advancements.

- Market Expansion: The Indian market for children’s products is vast and growing, presenting significant opportunities for FirstCry. The company can expand its reach by opening new stores in tier-II and tier-III cities, tapping into a larger customer base. This strategy leverages the rising disposable income and increasing awareness of quality products among middle-class families in these regions.

- Product Diversification: FirstCry can enhance its product portfolio by expanding into new categories such as toys, educational products, and personalized items. This approach caters to a wider customer base and increases revenue streams. For example, the company can introduce premium toy brands and educational games, catering to the growing demand for high-quality products among discerning parents.

- Technological Advancements: FirstCry can leverage technology to enhance its customer experience and drive sales. This includes implementing personalized recommendations, improving its online platform, and exploring new channels like social media and influencer marketing. By adopting cutting-edge technology, FirstCry can streamline its operations, optimize inventory management, and offer a more personalized shopping experience.

Challenges for FirstCry

While FirstCry enjoys a strong position in the market, it faces several challenges, including competition, regulatory changes, and economic fluctuations.

- Competition: The children’s products market is highly competitive, with both online and offline players vying for market share. FirstCry needs to differentiate itself from competitors by offering unique products, superior customer service, and a strong brand image. The company can achieve this by focusing on niche segments, developing innovative products, and building a loyal customer base through effective marketing strategies.

- Regulatory Changes: The Indian government frequently introduces new regulations, which can impact businesses in the retail sector. FirstCry needs to stay informed about these changes and ensure compliance with all relevant regulations. For example, changes in e-commerce policies or regulations governing online advertising can significantly impact the company’s operations. FirstCry needs to proactively adapt to these changes and remain compliant to avoid penalties and maintain a positive brand image.

- Economic Fluctuations: Economic downturns can affect consumer spending, particularly on discretionary items like children’s products. FirstCry needs to be prepared for such fluctuations by diversifying its revenue streams, offering value-for-money products, and implementing cost-cutting measures. During economic downturns, the company can focus on offering discounts and promotions to attract budget-conscious customers. It can also explore partnerships with financial institutions to offer financing options, making its products more accessible to a wider audience.

Impact of FirstCry’s IPO on its Future Growth, Softbank backed firstcry seeks to raise nearly 220 million in india ipo

FirstCry’s IPO can significantly impact its future growth and strategic direction. The IPO can provide the company with access to significant capital, enabling it to pursue growth initiatives such as market expansion, product diversification, and technological advancements. The IPO can also enhance FirstCry’s brand visibility and attract new investors, further strengthening its financial position. However, the company needs to carefully manage its post-IPO growth, focusing on sustainable and profitable growth strategies. It must also maintain transparency and accountability to its investors and stakeholders.

FirstCry’s IPO represents a significant milestone in the company’s journey, marking its entry into a new phase of growth and expansion. The IPO is expected to attract significant investor interest, given FirstCry’s strong track record, its presence in a rapidly growing market, and its strategic alliance with SoftBank. The company’s future outlook is promising, with opportunities for market expansion, product diversification, and technological advancements. FirstCry’s IPO is a testament to the burgeoning Indian startup ecosystem and the potential for growth in the online retail sector.

While SoftBank-backed FirstCry is gearing up for its IPO, aiming to raise nearly $220 million in India, the space industry is also buzzing with excitement. Inversion Space, a company focusing on reusable space technologies, is set to test its cargo reentry capabilities for the first time in October. This test could be a game-changer for the future of space logistics, potentially impacting how companies like FirstCry might transport goods in the years to come.

Standi Techno News

Standi Techno News