ARM After the IPO: What’s Next for the Chip Giant? The world of semiconductors is abuzz with excitement as ARM, the British chip design company, recently went public. This IPO marks a pivotal moment for the company, offering both opportunities and challenges as it navigates a new landscape. The IPO raised a staggering amount of capital, giving ARM the financial firepower to fuel its growth ambitions. But with this newfound financial strength comes increased scrutiny from investors, and the pressure to deliver on promises made during the IPO process.

ARM’s business model is unique, relying on licensing its intellectual property to chip manufacturers worldwide. This model has propelled ARM to the forefront of the semiconductor industry, powering everything from smartphones and tablets to servers and the burgeoning Internet of Things (IoT). But with competitors like Intel, Qualcomm, and Nvidia vying for market share, ARM faces a competitive landscape that demands constant innovation and adaptation.

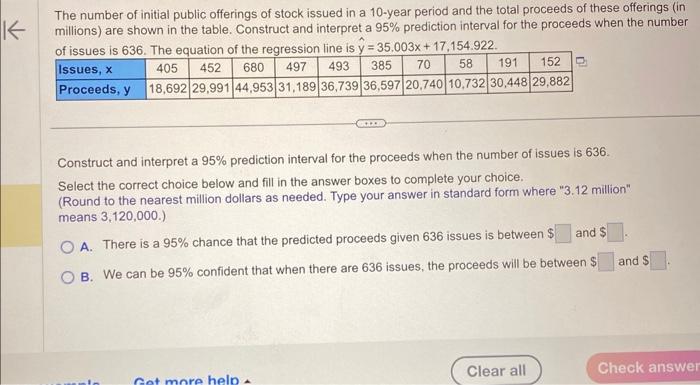

The IPO and its Impact on ARM

ARM’s Initial Public Offering (IPO) marked a significant milestone for the company, ushering in a new era of growth and opportunities. The IPO not only provided ARM with a substantial influx of capital but also positioned it as a publicly traded entity, subject to greater market scrutiny and investor expectations.

ARM’s IPO Financial Details

The IPO, which took place on September 14, 2023, saw ARM offer 95.5 million shares at a price of $51 per share, raising a total of $4.85 billion in capital. This successful IPO positioned ARM as one of the largest tech IPOs in recent history, demonstrating investor confidence in the company’s future prospects.

Benefits of Going Public for ARM

ARM’s decision to go public presented several potential benefits, including:

- Increased Access to Capital: The IPO provided ARM with a significant amount of capital, which can be used to fund research and development, expand into new markets, and make strategic acquisitions. This financial flexibility allows ARM to accelerate its growth and capitalize on emerging opportunities in the semiconductor industry.

- Enhanced Brand Recognition: Going public increases ARM’s visibility and brand recognition, as it becomes a publicly traded company with a stock symbol that is widely tracked by investors and the media. This heightened awareness can attract new customers, partners, and talent to ARM.

- Improved Market Valuation: The IPO allows ARM to access a wider pool of investors, which can lead to a more accurate and liquid market valuation. This improved valuation can benefit ARM in various ways, such as attracting investment, facilitating mergers and acquisitions, and providing a more transparent view of the company’s performance.

Potential Challenges for ARM After the IPO

While going public offers significant advantages, ARM also faces potential challenges, including:

- Increased Regulatory Scrutiny: As a publicly traded company, ARM is subject to increased regulatory scrutiny from agencies such as the Securities and Exchange Commission (SEC). This can involve more stringent reporting requirements, compliance obligations, and potential legal liabilities.

- Pressure to Meet Investor Expectations: Publicly traded companies face constant pressure to meet or exceed investor expectations regarding financial performance, growth, and innovation. This pressure can impact decision-making and resource allocation, as ARM strives to maintain a positive market perception.

- Potential Competition from Other Companies: The semiconductor industry is highly competitive, with numerous companies vying for market share. ARM’s IPO could attract new competitors or intensify existing competition, as other companies seek to capitalize on the growing demand for ARM-based chips.

ARM’s Business Model and Future Prospects

ARM’s business model is based on licensing its intellectual property (IP) to other companies, which then use it to design and manufacture their own processors and chips. This unique approach has enabled ARM to become a dominant force in the semiconductor industry, with its architecture powering billions of devices worldwide.

ARM’s Business Model

ARM’s core business revolves around licensing its processor designs, which include the instruction set architecture (ISA), microarchitecture, and other key components. The company offers a wide range of licenses, tailored to meet the specific needs of its partners. These licenses can be categorized into three main types:

- Architectural License: This license grants the right to use ARM’s ISA and associated technologies, enabling licensees to design their own processors based on ARM’s architecture.

- Processor License: This license provides access to a specific ARM processor design, including the microarchitecture and related documentation. Licensees can use this design to create their own chips, leveraging ARM’s optimized and proven processor architecture.

- System-on-Chip (SoC) License: This license grants access to a complete SoC design, encompassing the processor, memory controller, peripherals, and other essential components. This comprehensive solution simplifies the chip design process for licensees, allowing them to focus on their specific application requirements.

ARM’s licensing model offers several advantages:

- Flexibility: ARM’s licensing approach allows partners to customize processor designs to meet their specific performance, power, and cost requirements.

- Scalability: ARM’s architecture is highly scalable, enabling the development of processors for a wide range of applications, from tiny microcontrollers to high-performance servers.

- Reduced Development Costs: By licensing ARM’s IP, companies can significantly reduce the time and cost associated with developing their own processor designs.

ARM’s Intellectual Property Portfolio

ARM’s success is built upon its extensive and continuously evolving portfolio of intellectual property. This portfolio encompasses:

- Instruction Set Architecture (ISA): The ISA defines the fundamental language that processors understand, enabling software compatibility across different ARM-based devices.

- Microarchitectures: These are the detailed designs of ARM processors, specifying the internal structure, organization, and operation of the processor.

- Cores: ARM offers a wide range of processor cores, optimized for different performance, power, and cost requirements.

- System-on-Chip (SoC) Designs: ARM provides pre-designed SoC solutions, incorporating processor cores, memory controllers, peripherals, and other essential components.

- Software and Tools: ARM offers a comprehensive suite of software tools and libraries to support the development of ARM-based systems.

ARM’s Key Revenue Streams

ARM generates revenue primarily through licensing fees and royalties. The company’s main revenue streams include:

- Licensing Fees: ARM charges upfront fees for its architectural, processor, and SoC licenses. These fees are typically based on the specific features and capabilities of the licensed IP.

- Royalties: ARM receives royalties on each chip that is manufactured using its IP. These royalties are typically calculated as a percentage of the chip’s selling price.

- Software and Services: ARM also generates revenue from the sale of software tools, development services, and other related products and services.

ARM’s Market Landscape and Key Competitors

ARM operates in a highly competitive market, facing competition from several major players, including:

- Intel: Intel is a major player in the x86 processor market, primarily focused on PCs and servers. However, Intel has also expanded into the mobile market with its Atom processors.

- Qualcomm: Qualcomm is a leading provider of mobile processors, known for its Snapdragon chips used in smartphones and other mobile devices.

- Nvidia: Nvidia is a leading provider of graphics processing units (GPUs), which are increasingly being used in high-performance computing, gaming, and artificial intelligence.

ARM’s Growth Opportunities

ARM is well-positioned for continued growth in the coming years, driven by several key trends:

- Expansion of the Internet of Things (IoT) Market: The IoT is rapidly expanding, creating a vast demand for low-power, cost-effective processors, which ARM is well-suited to provide.

- Adoption of 5G Technology: 5G is expected to drive significant growth in mobile data traffic, creating a need for more powerful and efficient processors, which ARM is actively developing.

- Increasing Demand for High-Performance Computing: The increasing demand for high-performance computing in areas such as artificial intelligence, machine learning, and data analytics is creating opportunities for ARM in the server market.

ARM’s Technology and Innovation

ARM’s success is built upon its commitment to technological advancement, consistently pushing the boundaries of what’s possible in the semiconductor industry. From its foundational processor architectures to its latest energy-efficient chip designs, ARM has revolutionized the way we interact with technology.

Advanced Processor Architectures

ARM’s processor architectures are the heart of its success. They are known for their efficiency, power, and versatility, making them ideal for a wide range of devices, from smartphones to servers. Over the years, ARM has continually refined its architectures, introducing new features and capabilities to meet the ever-evolving demands of the computing landscape.

- ARMv8-A: This architecture, introduced in 2011, brought significant performance improvements and introduced support for 64-bit computing. It also included new security features, making it suitable for applications that require high levels of data protection.

- ARMv9: The latest generation of ARM architecture, ARMv9, was released in 2021. It offers further performance enhancements, improved security, and advanced capabilities for artificial intelligence (AI) and machine learning (ML) applications. ARMv9 is designed to meet the demands of next-generation computing, enabling devices to handle complex tasks with greater efficiency.

Energy-Efficient Chip Designs

ARM’s commitment to energy efficiency has been a key driver of its success. The company’s chip designs are optimized to minimize power consumption, extending battery life in mobile devices and reducing energy costs in data centers.

- Big.LITTLE: This innovative architecture combines high-performance “big” cores for demanding tasks with energy-efficient “little” cores for everyday operations. By dynamically switching between these cores, devices can achieve optimal performance while minimizing power consumption.

- ARM Cortex-M Series: This series of microcontrollers is specifically designed for low-power applications, such as wearables, IoT devices, and industrial automation. They offer a balance of performance and energy efficiency, making them ideal for applications where battery life is critical.

Innovative Software Solutions

ARM’s software solutions are designed to enhance the performance and capabilities of its processor architectures. They provide developers with tools and frameworks to create efficient and optimized applications.

- ARM Compiler for Embedded Systems: This compiler is optimized for ARM architectures, enabling developers to create efficient and optimized code for embedded systems. It offers a range of features, including advanced optimization techniques and support for various programming languages.

- ARM Mali Graphics Processors: These graphics processors are designed to deliver high-quality visuals and immersive gaming experiences on mobile devices. They are known for their energy efficiency and performance, making them ideal for demanding graphics applications.

Investor Sentiment and Market Performance

ARM’s initial public offering (IPO) generated significant buzz and excitement in the tech and investment communities. Investors were eager to get a piece of this dominant player in the semiconductor industry, known for its energy-efficient processor designs that power billions of devices worldwide.

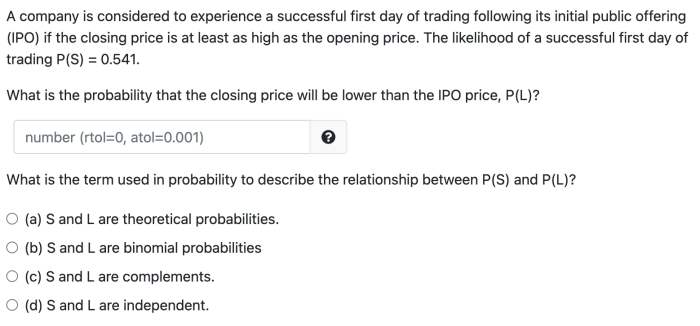

Initial Investor Response and Stock Performance

The IPO’s performance on its first day of trading reflected the positive sentiment surrounding ARM. The stock price opened above its initial offering price, indicating strong demand from investors. This initial surge signaled a positive outlook for ARM’s future growth prospects. The initial investor response was largely positive, driven by several factors, including:

- ARM’s dominant market position in the mobile and embedded computing markets.

- The company’s strong financial performance and track record of innovation.

- The growing demand for ARM’s technology in emerging markets such as the Internet of Things (IoT) and artificial intelligence (AI).

Factors Influencing ARM’s Stock Price, Arm after the ipo

ARM’s stock price is expected to be influenced by a combination of factors, including:

- Financial Performance: Investors will closely monitor ARM’s revenue growth, profitability, and cash flow. Strong financial performance is crucial for sustaining investor confidence and driving stock price appreciation.

- Technological Advancements: ARM’s ability to innovate and develop new processor designs that meet the evolving needs of the market will be a key driver of its stock price. The company’s commitment to research and development in areas like AI and 5G will be closely watched.

- Overall Market Conditions: Broader market trends, such as interest rates, economic growth, and investor sentiment, will also impact ARM’s stock price. A favorable macroeconomic environment generally supports stock market performance.

- Competition: ARM faces competition from other semiconductor companies, such as Intel and Qualcomm. The company’s ability to maintain its market share and differentiate its products will be crucial for its stock price.

Comparison with Other Semiconductor Companies

ARM’s performance will be compared with other companies in the semiconductor industry. The company’s stock price is expected to be influenced by the performance of its peers, as well as the overall health of the semiconductor market.

- Intel: Intel is a major competitor in the semiconductor industry, but its focus is primarily on desktop and server processors. ARM’s strength lies in mobile and embedded computing, where Intel has a smaller presence.

- Qualcomm: Qualcomm is a key competitor in the mobile processor market. ARM’s technology is used in many Qualcomm chips, but the two companies also compete in areas such as 5G technology.

- Nvidia: Nvidia is a leading player in the graphics processing unit (GPU) market. ARM’s technology is used in some Nvidia products, but the two companies also compete in areas such as AI and autonomous driving.

ARM’s Role in the Semiconductor Industry

ARM’s technology has fundamentally reshaped the semiconductor landscape, serving as the bedrock for countless devices across diverse sectors. Its influence extends from the smallest embedded systems to powerful servers, underpinning the modern digital world.

The Importance of ARM Technology

ARM’s dominance stems from its efficient and versatile architecture. Its processors are known for their low power consumption, high performance, and adaptability, making them ideal for a wide range of applications.

- Smartphones and Tablets: ARM’s energy-efficient processors are the driving force behind the mobile revolution. The vast majority of smartphones and tablets rely on ARM-based chips, enabling seamless performance and extended battery life.

- Internet of Things (IoT): The proliferation of connected devices, from smart home appliances to industrial sensors, heavily relies on ARM’s low-power processors. Their compact size and energy efficiency make them perfect for resource-constrained environments.

- Servers and Data Centers: While traditionally dominated by x86 architectures, ARM processors are increasingly gaining traction in server applications. Their energy efficiency and scalability offer compelling advantages for data centers, particularly in cloud computing environments.

Impact of ARM’s IPO on the Semiconductor Industry

ARM’s IPO has significant implications for the semiconductor industry, potentially fostering increased competition and innovation.

- Increased Competition: The IPO has injected fresh capital into ARM, enabling them to invest further in research and development. This could lead to more innovative processor designs and drive competition among chip manufacturers who license ARM’s technology.

- Accelerated Innovation: ARM’s IPO could catalyze a wave of innovation in the semiconductor industry. The influx of capital and the heightened focus on growth may encourage more companies to adopt ARM’s architecture, leading to the development of new and specialized chipsets.

Future Implications of ARM’s Leading Position

ARM’s dominance in the semiconductor industry is likely to continue, shaping the future of computing and technology.

- Expanding Applications: ARM’s technology is poised to expand into new and emerging markets, including artificial intelligence, automotive, and healthcare. The company’s focus on energy efficiency and performance makes it well-suited for these demanding applications.

- Continued Growth: ARM’s market share is expected to grow further as the demand for mobile devices, IoT applications, and cloud computing continues to rise. The company’s position as a leading provider of semiconductor intellectual property gives it a strategic advantage in this rapidly evolving landscape.

Challenges and Opportunities for ARM: Arm After The Ipo

ARM, having recently gone public, faces a complex landscape of both challenges and opportunities. The company’s future success hinges on its ability to navigate these factors effectively.

Competition in the Semiconductor Industry

The semiconductor industry is fiercely competitive, with players like Intel, Qualcomm, and Nvidia vying for market share. ARM’s success depends on its ability to maintain its technological edge and expand its customer base.

- Increased Competition: ARM faces growing competition from established players like Intel and Qualcomm, as well as newer entrants like RISC-V. These companies are developing their own processor architectures and chipsets, putting pressure on ARM’s market share.

- Maintaining Technological Leadership: ARM needs to continue investing in research and development to maintain its technological lead. This includes developing new processor architectures, optimizing performance, and addressing emerging trends like artificial intelligence and edge computing.

- Expanding into New Markets: ARM has a strong presence in mobile devices, but it needs to expand into new markets like automotive, industrial, and IoT. This requires developing specialized chipsets and solutions tailored to the specific needs of these sectors.

Technological Advancements

The rapid pace of technological advancements presents both challenges and opportunities for ARM. The company needs to adapt quickly to stay relevant.

- Emerging Technologies: ARM needs to keep pace with emerging technologies like artificial intelligence, 5G, and quantum computing. These technologies require specialized hardware and software, which ARM must develop to remain competitive.

- Shifting Design Paradigms: The semiconductor industry is moving towards more advanced design paradigms like heterogeneous computing and chiplet technology. ARM needs to adapt its architecture and design tools to support these new approaches.

- Security and Privacy: As devices become more connected and data-intensive, security and privacy become paramount. ARM needs to incorporate robust security features into its processor designs and develop solutions to address emerging threats.

Regulatory Changes

The global regulatory landscape is evolving, impacting the semiconductor industry. ARM needs to navigate these changes effectively.

- Trade Restrictions: Geopolitical tensions and trade restrictions can disrupt supply chains and impact ARM’s operations. The company needs to diversify its manufacturing and supply chain to mitigate these risks.

- Data Privacy Regulations: Data privacy regulations like GDPR and CCPA are becoming increasingly stringent. ARM needs to ensure its products comply with these regulations and provide solutions to help customers meet their compliance obligations.

- Antitrust Scrutiny: ARM’s dominance in the mobile processor market has attracted antitrust scrutiny. The company needs to address these concerns and demonstrate that its business practices are fair and competitive.

Opportunities for Growth

Despite the challenges, ARM has several opportunities to achieve further growth.

- Expanding into New Markets: ARM has a strong presence in mobile devices, but it needs to expand into new markets like automotive, industrial, and IoT. This requires developing specialized chipsets and solutions tailored to the specific needs of these sectors.

- Developing New Technologies: ARM needs to continue investing in research and development to maintain its technological lead. This includes developing new processor architectures, optimizing performance, and addressing emerging trends like artificial intelligence and edge computing.

- Forming Strategic Partnerships: ARM can leverage its strengths by forming strategic partnerships with other companies in the semiconductor industry. This can help it access new markets, technologies, and resources.

Table Summarizing Key Challenges and Opportunities

| Challenge | Opportunity | Impact |

|---|---|---|

| Increased Competition | Expanding into New Markets | Increased market share and revenue |

| Maintaining Technological Leadership | Developing New Technologies | Maintaining competitive edge and attracting customers |

| Emerging Technologies | Forming Strategic Partnerships | Access to new technologies, markets, and resources |

| Trade Restrictions | Diversifying Manufacturing and Supply Chain | Reduced reliance on single suppliers and markets |

| Data Privacy Regulations | Developing Compliance Solutions | Meeting regulatory requirements and attracting customers |

| Antitrust Scrutiny | Demonstrating Fair and Competitive Business Practices | Maintaining market access and avoiding regulatory penalties |

ARM’s IPO marks a new chapter in the company’s history. The future is bright, with opportunities to capitalize on the growth of the IoT, 5G technology, and the demand for high-performance computing. However, challenges lie ahead, including competition, regulatory hurdles, and the need to stay ahead of the curve in technological advancements. As ARM navigates this complex landscape, its ability to innovate and adapt will be crucial to its success. The semiconductor industry is watching closely to see how ARM will leverage its IPO to solidify its position as a leading force in the future of computing.

ARM’s post-IPO journey has been a rollercoaster ride, with investors eagerly watching its every move. While the tech giant navigates this new terrain, another deal in the tech world is facing its own hurdles. The proposed acquisition of Figma by Adobe is currently stuck in regulatory limbo , raising questions about the future of this promising partnership. The outcome of this deal could have implications for the entire design and collaboration landscape, potentially impacting ARM’s own strategies in the future.

Standi Techno News

Standi Techno News