LeEco Acquires Vizio, a move that shook up the television and smart TV market. This acquisition wasn’t just a business deal; it was a strategic play, a bold move by LeEco to make its mark in the US market. The deal, announced in 2016, saw LeEco acquiring Vizio, a well-established American TV manufacturer, for a reported $2 billion. This merger brought together two companies with distinct strengths, and the implications were far-reaching.

Vizio, known for its affordable and feature-packed TVs, had already gained a strong foothold in the American market. LeEco, on the other hand, was a rising Chinese tech giant with ambitions to expand globally. This acquisition was LeEco’s way of fast-tracking its entry into the US market, gaining access to Vizio’s established distribution network and loyal customer base.

The Acquisition: Leeco Acquires Vizio

In 2016, LeEco, a Chinese technology conglomerate, acquired Vizio, a leading American manufacturer of televisions and sound systems. This deal marked a significant step for both companies, with LeEco aiming to expand its global footprint and Vizio seeking to leverage LeEco’s technology and resources.

Details of the Acquisition

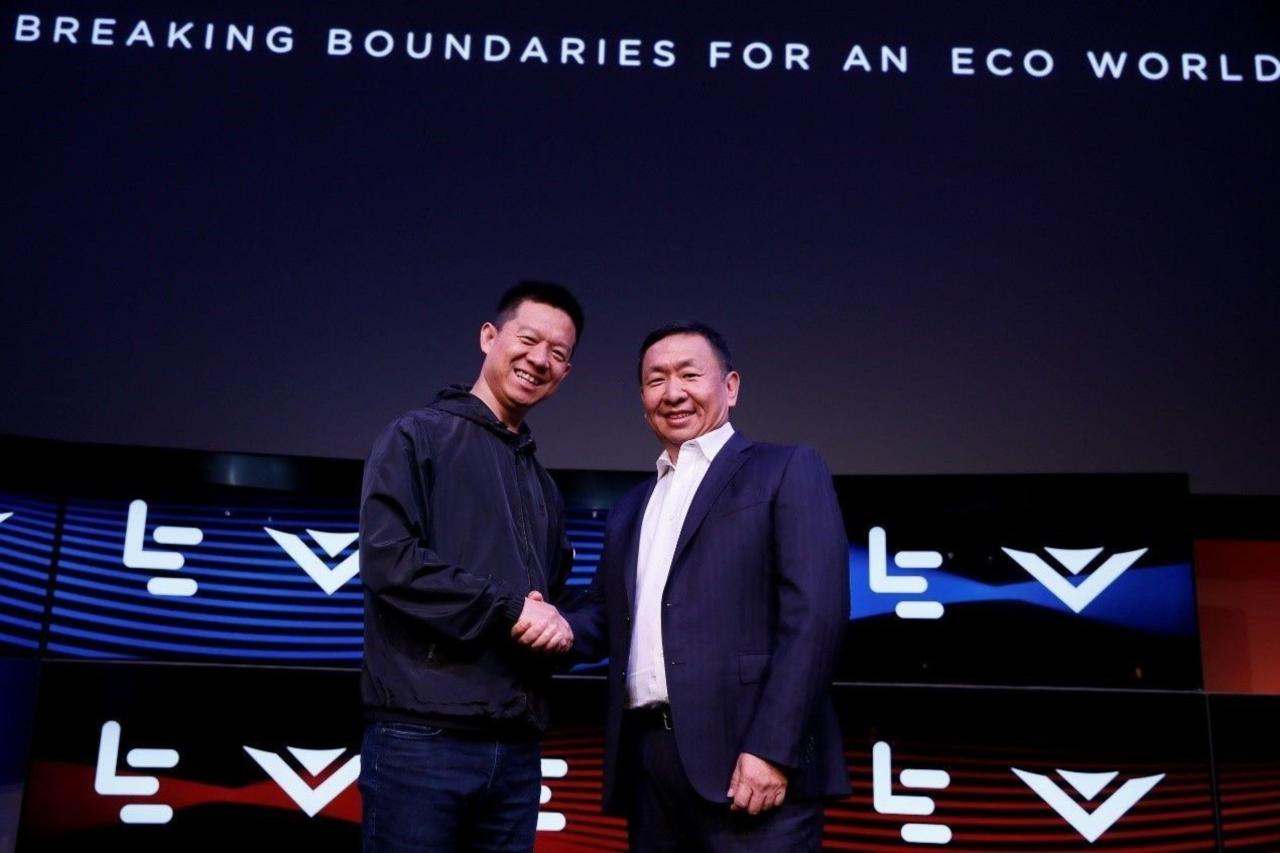

LeEco’s acquisition of Vizio was finalized on July 29, 2016, for a reported purchase price of $2 billion. The deal involved LeEco acquiring a controlling stake in Vizio, while Vizio’s founder and CEO, William Wang, remained in his position. The terms of the acquisition included LeEco integrating Vizio’s technology and manufacturing capabilities into its own ecosystem, while Vizio would gain access to LeEco’s content and services.

Motivations for the Acquisition

LeEco’s Motivations

LeEco’s acquisition of Vizio was driven by its ambition to expand its global presence and penetrate the American market. LeEco, known for its innovative technology and content offerings, saw Vizio’s established brand and distribution network as a valuable asset to achieve its expansion goals. The acquisition allowed LeEco to leverage Vizio’s expertise in manufacturing and distribution, while also providing a platform to introduce its own content and services to American consumers.

Vizio’s Motivations

Vizio, on the other hand, was seeking to enhance its technology and content offerings to remain competitive in the increasingly crowded TV market. By partnering with LeEco, Vizio gained access to LeEco’s advanced technology, content library, and global resources. This partnership allowed Vizio to offer a more comprehensive and compelling product and service portfolio, enhancing its competitiveness in the market.

History of LeEco and Vizio

LeEco

LeEco, formerly known as LeTV, was founded in 2004 as an online video streaming service. Over the years, the company expanded its operations to include various sectors, including smartphones, smart TVs, electric vehicles, and content production. LeEco’s rapid growth and aggressive expansion strategy made it a major player in the Chinese technology landscape.

Vizio

Vizio was founded in 2002 as a manufacturer of flat-panel televisions. The company quickly gained popularity for its affordable and high-quality products, challenging established players like Samsung and LG. Vizio’s focus on innovation and value-driven products helped it become a leading brand in the American TV market.

Market Impact

The acquisition of Vizio by LeEco, a Chinese technology company, significantly impacted the television and smart TV market, shaking up the competitive landscape and influencing the trajectory of both companies. This move brought together a leading smart TV manufacturer with a fast-growing tech conglomerate, creating a powerful force in the industry.

The Competitive Landscape Before and After the Acquisition

Before the acquisition, Vizio was a major player in the American television market, known for its affordable and feature-rich TVs. LeEco, on the other hand, was a rising star in China, expanding its reach globally with its diverse portfolio of products, including smartphones, televisions, and electric vehicles.

The acquisition created a new competitor with a broader reach and a more comprehensive product offering. LeEco’s strong presence in China and its growing global footprint provided Vizio with access to new markets and resources. This combination gave the merged entity a competitive edge in the global television market.

- Pre-acquisition: The television market was dominated by established players like Samsung, LG, and Sony. Vizio carved out a niche by focusing on affordability and innovative features, appealing to price-conscious consumers. LeEco was a relatively new player, but its rapid growth and aggressive expansion strategy posed a potential threat to established players.

- Post-acquisition: The acquisition of Vizio by LeEco significantly altered the competitive landscape. The merged entity became a more formidable competitor, capable of challenging established players in both the US and global markets. The combined resources and expertise of both companies allowed them to develop and launch new products more quickly and efficiently.

Potential Benefits and Challenges for Vizio

The acquisition brought both benefits and challenges for Vizio.

- Benefits: LeEco’s resources and global reach allowed Vizio to expand its market share and reach new customers. The acquisition also provided Vizio with access to LeEco’s innovative technologies, such as its content platform and cloud services. This allowed Vizio to enhance its smart TV offerings and provide a more comprehensive entertainment experience to consumers.

- Challenges: One of the biggest challenges for Vizio was integrating LeEco’s technology and operations into its existing business. This required significant adjustments and a new approach to product development and marketing. Additionally, LeEco’s financial difficulties and subsequent restructuring posed a risk to Vizio’s future.

LeEco’s Strategy

LeEco’s acquisition of Vizio was a strategic move designed to expand its global reach and solidify its position as a leading player in the connected entertainment ecosystem. The acquisition was part of LeEco’s larger ambition to become a global leader in the consumer electronics market, challenging established players like Samsung and LG.

LeEco’s Overall Business Strategy

LeEco’s overall business strategy revolves around creating a vertically integrated ecosystem of products and services. This ecosystem includes hardware, software, content, and services, all designed to work seamlessly together. The company aims to provide a comprehensive and immersive experience for its users, from content creation and distribution to device usage and consumption. LeEco’s ecosystem encompasses a wide range of products and services, including smartphones, televisions, electric vehicles, cloud computing, and content streaming. The acquisition of Vizio, a major player in the smart TV market, was a key step in expanding this ecosystem and strengthening LeEco’s presence in the US market.

LeEco’s Ambitions in the US Market

LeEco’s acquisition of Vizio was a strategic move to gain a foothold in the lucrative US market. The US is a major market for consumer electronics, and Vizio was already a well-established brand with a strong presence in the smart TV segment. By acquiring Vizio, LeEco gained access to Vizio’s existing customer base, distribution channels, and manufacturing capabilities. LeEco aimed to leverage Vizio’s brand recognition and market share to introduce its own products and services to US consumers.

LeEco’s Plans for Integrating Vizio into its Ecosystem

LeEco planned to integrate Vizio into its existing ecosystem of products and services, creating a unified platform for users. This integration would involve several key aspects:

- Content Integration: LeEco planned to make its content streaming service, LeEco Live, available on Vizio TVs. This would allow Vizio users to access LeEco’s vast library of movies, TV shows, and live sports events. LeEco aimed to leverage Vizio’s large user base to expand its content distribution reach and attract new subscribers to its streaming service.

- Software Integration: LeEco planned to integrate its proprietary software platform, EUI, into Vizio TVs. EUI provides a user-friendly interface and access to a range of LeEco’s apps and services. By integrating EUI into Vizio TVs, LeEco aimed to provide a consistent user experience across its entire ecosystem.

- Hardware Integration: LeEco planned to leverage Vizio’s manufacturing capabilities to produce its own hardware products, such as smartphones and smart home devices. This would allow LeEco to expand its product portfolio and offer a wider range of devices to its US customers. LeEco aimed to utilize Vizio’s expertise in manufacturing and supply chain management to streamline its production processes and reduce costs.

Vizio’s Future

The acquisition of Vizio by LeEco presents a significant opportunity for the TV manufacturer to enhance its product development, expand its market reach, and solidify its position in the competitive consumer electronics landscape. LeEco’s expertise in content streaming, smart devices, and technological innovation could empower Vizio to create a more compelling and integrated user experience.

Impact on Product Development and Innovation

LeEco’s acquisition of Vizio is likely to have a substantial impact on the latter’s product development and innovation. LeEco’s extensive experience in content streaming and smart devices, coupled with its commitment to technological advancement, could lead to the development of more sophisticated and feature-rich Vizio products. This could involve:

* Integration of LeEco’s content streaming platform: Vizio TVs could become integrated with LeEco’s vast library of content, providing users with a seamless and comprehensive entertainment experience.

* Development of advanced smart TV features: LeEco’s expertise in smart devices could drive the development of more intuitive and personalized smart TV features, enhancing the user experience.

* Improved hardware capabilities: LeEco’s focus on technological innovation could lead to Vizio TVs with enhanced hardware capabilities, such as improved display technology, faster processors, and more robust operating systems.

* Expansion of product categories: LeEco’s acquisition could also lead to Vizio expanding into new product categories, such as smart home devices, wearables, and other connected devices, leveraging LeEco’s expertise in these areas.

Impact on Brand Image and Consumer Perception

The acquisition could impact Vizio’s brand image and consumer perception in several ways. On the one hand, LeEco’s association with innovative technologies and content streaming could enhance Vizio’s reputation for being a cutting-edge and technologically advanced brand. This could appeal to tech-savvy consumers who value advanced features and seamless integration.

On the other hand, LeEco’s recent financial struggles and controversies might raise concerns among consumers about Vizio’s long-term stability and the potential for product support issues. Vizio will need to carefully manage its brand image and communication to address these concerns and maintain consumer trust.

Expansion into New Markets and Product Categories

LeEco’s acquisition could provide Vizio with opportunities to expand into new markets and product categories. LeEco’s global presence and established distribution channels could enable Vizio to reach new consumers in international markets. Additionally, LeEco’s expertise in areas such as smart home devices and wearables could open up new product categories for Vizio to explore.

For example, Vizio could leverage LeEco’s smart home technology to develop a range of smart home devices, such as smart speakers, security cameras, and smart lighting systems, expanding its product portfolio and catering to the growing demand for connected home solutions.

Overall, the acquisition of Vizio by LeEco presents a complex landscape with both potential benefits and challenges. Vizio’s future hinges on its ability to effectively leverage LeEco’s strengths, address concerns about LeEco’s financial stability, and navigate the evolving consumer electronics market.

Financial Implications

The acquisition of Vizio by LeEco has significant financial implications for both companies. The deal, valued at $2 billion, presents both opportunities and challenges for the two companies.

Financial Implications for LeEco

The acquisition of Vizio allows LeEco to expand its reach in the US market. Vizio is a well-established brand in the US, with a strong presence in the television and home theater market. This acquisition provides LeEco with access to Vizio’s existing customer base and distribution channels. LeEco can leverage Vizio’s brand recognition and market share to gain a foothold in the US market and expand its product offerings.

Financial Implications for Vizio

The acquisition of Vizio by LeEco provides the company with access to LeEco’s resources and technology. LeEco is a technology-focused company with a strong presence in the Chinese market. This acquisition gives Vizio access to LeEco’s advanced technology and innovative products. The deal also provides Vizio with access to LeEco’s global distribution channels and a larger market. This can help Vizio to expand its business and reach new customers.

Impact on Financial Performance

The acquisition of Vizio by LeEco is expected to have a positive impact on the financial performance of both companies. LeEco expects to see an increase in revenue and market share as it leverages Vizio’s brand recognition and distribution channels. Vizio is also expected to benefit from the deal, as it gains access to LeEco’s technology and resources. However, the acquisition may also pose some challenges. LeEco may need to invest heavily in integrating Vizio’s operations and technology into its own systems. Vizio may also need to adapt to LeEco’s corporate culture and business practices.

Financing the Acquisition

LeEco financed the acquisition of Vizio through a combination of debt and equity. The company took on a significant amount of debt to fund the deal. This debt will need to be repaid over time, which could put a strain on LeEco’s finances. LeEco also raised equity financing to support the acquisition. This equity financing can dilute the ownership of existing shareholders. LeEco’s ability to manage its debt and equity financing will be crucial to the success of the acquisition.

Challenges and Opportunities

The acquisition of Vizio by LeEco presents both challenges and opportunities for the two companies. One challenge is the integration of the two companies’ operations and technology. LeEco will need to ensure that the integration process is seamless and does not disrupt Vizio’s business. Another challenge is the potential for cultural clashes between the two companies. LeEco will need to be sensitive to Vizio’s corporate culture and ensure that the integration process is respectful of Vizio’s employees and customers. However, the acquisition also presents significant opportunities. LeEco can leverage Vizio’s brand recognition and market share to expand its reach in the US market. Vizio can benefit from access to LeEco’s technology and resources. The acquisition has the potential to create a global leader in the consumer electronics market.

Consumer Perspective

The acquisition of Vizio by LeEco has the potential to impact consumers in both positive and negative ways. While some consumers might be excited about the prospect of new technologies and features, others might be concerned about privacy, data security, and the overall reliability of LeEco’s products and services.

Potential Benefits for Consumers, Leeco acquires vizio

The acquisition of Vizio by LeEco could bring several benefits for consumers, including:

- Integration of LeEco’s technology and services into Vizio products: LeEco is known for its innovative technology, including its streaming services and smart home devices. Integrating these technologies into Vizio products could enhance the user experience, providing consumers with access to a wider range of features and content. For example, consumers might see the integration of LeEco’s streaming services directly into Vizio TVs, offering a seamless and unified entertainment experience.

- Lower prices for Vizio products: LeEco is a large and ambitious company, and its acquisition of Vizio could potentially lead to economies of scale, resulting in lower prices for consumers. This could make Vizio products more accessible to a wider audience, especially those on a budget.

- Increased innovation in Vizio products: LeEco’s focus on innovation could lead to new and exciting features being added to Vizio products. This could benefit consumers by providing them with more advanced and user-friendly devices.

Potential Drawbacks for Consumers

However, there are also potential drawbacks for consumers as a result of the acquisition:

- Concerns about data privacy and security: LeEco is a Chinese company, and some consumers might be concerned about their data privacy and security in the hands of a foreign entity. LeEco’s commitment to data security and its practices in this regard will be crucial in gaining consumer trust.

- Potential for reduced product quality: Some consumers might be concerned that LeEco’s focus on innovation could lead to a decrease in the quality of Vizio products. They might worry that new features could be added at the expense of reliability and durability.

- Integration challenges: Integrating LeEco’s technology and services into Vizio products could present challenges. Consumers might experience compatibility issues or bugs, which could lead to frustration and a less enjoyable user experience.

Hypothetical Consumer Scenario

Imagine a consumer named Sarah, who recently purchased a Vizio TV. After the acquisition by LeEco, she starts noticing changes in the TV’s user interface. She finds that the TV now has a new streaming service called “LeEco TV,” which offers a wide range of content, including movies, shows, and live TV channels. Sarah is initially excited about the new service, but she also notices that her personal data, such as her viewing history and preferences, is now being collected by LeEco. Sarah is unsure about the implications of this data collection and starts to question LeEco’s commitment to data privacy. She also encounters some technical issues with the new streaming service, such as buffering and lag, which make her question the overall reliability of LeEco’s technology. Sarah’s experience highlights the potential benefits and drawbacks of the acquisition for consumers. While she appreciates the new features and content offered by LeEco, she also remains cautious about the potential implications for her data privacy and the overall quality of the product.

The acquisition of Vizio by LeEco was a defining moment in the TV industry, a move that signaled the growing influence of Chinese tech companies in the global market. It remains to be seen how this acquisition will ultimately play out, but one thing is clear: the landscape of the TV market has been forever altered.

LeEco’s acquisition of Vizio might seem like a move into the TV market, but it could be a strategic play for the future of entertainment. With the news that Instagram is developing a customizable AI friend , LeEco could be positioning itself to integrate AI into its smart TV platform, creating a more personalized and interactive viewing experience.

This move could give LeEco a major advantage in the increasingly competitive smart home market.

Standi Techno News

Standi Techno News