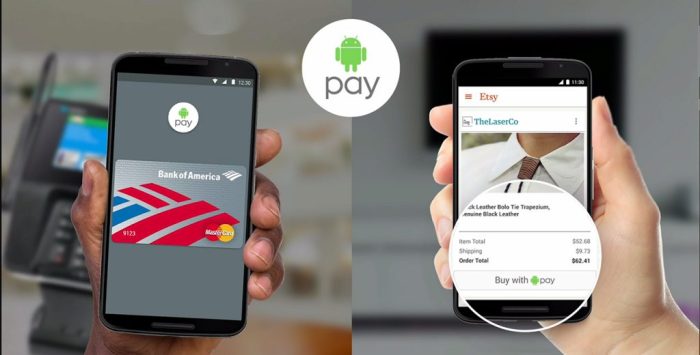

Android Pay’s Expansion to Mobile Web: Android Pay Lands On Mobile Web Soon

Get ready to wave goodbye to your physical wallet, because Android Pay is making its way to the mobile web! This move signifies a significant shift in the mobile payments landscape, making it easier and more convenient than ever to pay for goods and services online.

Benefits for Users

Android Pay’s expansion to the mobile web brings a plethora of benefits for users.

- Seamless Payment Experience: Users can now make purchases directly from their browser without having to switch apps. This streamlined experience eliminates friction and makes online shopping faster and more enjoyable.

- Enhanced Security: Android Pay’s robust security features, including tokenization and multi-factor authentication, extend to the mobile web. This ensures that user financial data remains protected throughout the transaction process.

- Wide Acceptance: Android Pay is accepted at millions of merchants worldwide, both online and in-store. This broad acceptance makes it a truly universal payment solution.

Benefits for Businesses

Businesses stand to gain significantly from Android Pay’s mobile web integration.

- Increased Conversion Rates: By offering a convenient and secure payment option, businesses can reduce cart abandonment rates and increase overall conversion rates. This leads to higher sales and improved revenue.

- Reduced Fraud Risk: Android Pay’s robust security measures minimize the risk of fraudulent transactions, giving businesses peace of mind and reducing their exposure to financial losses.

- Improved Customer Experience: Providing a seamless and secure checkout experience enhances customer satisfaction and loyalty, leading to repeat business and positive word-of-mouth referrals.

Impact on the Mobile Payments Landscape

Android Pay’s expansion to the mobile web is poised to have a significant impact on the mobile payments landscape.

- Increased Competition: This move intensifies competition in the mobile payments market, pushing other players to innovate and offer more compelling features and services. This ultimately benefits consumers by providing them with a wider range of options and greater choice.

- Accelerated Adoption: By making mobile payments more accessible and convenient, Android Pay’s expansion is likely to accelerate the adoption of mobile payments globally. This shift towards a cashless society is already underway, and Android Pay’s move will likely further fuel this trend.

- Enhanced User Experience: The focus on user experience and convenience will drive further innovation in the mobile payments space. We can expect to see more seamless integrations, faster processing times, and personalized features that cater to the evolving needs of users.

User Experience and Functionality

Android Pay’s expansion to the mobile web brings a familiar and convenient payment experience to a wider audience. The user interface and navigation are designed to be intuitive and seamless, allowing users to make purchases quickly and securely without needing to download a separate app.

The user interface of Android Pay on the mobile web is designed to be simple and straightforward. It follows a similar design language to the Android Pay app, making it easy for users to navigate and understand. The main features are prominently displayed, and the overall layout is clean and uncluttered.

Key Features and Functionalities

The mobile web version of Android Pay offers a comprehensive set of features, including:

- Secure Payment Processing: Android Pay on the web utilizes the same secure payment processing technology as the Android Pay app, ensuring that your transactions are protected from fraud.

- Multiple Payment Methods: You can link multiple payment methods to your Android Pay account, including credit cards, debit cards, and bank accounts.

- One-Click Checkout: With Android Pay, you can complete purchases with a single click, eliminating the need to enter your payment information repeatedly.

- Mobile Wallet Integration: Android Pay on the web seamlessly integrates with your mobile wallet, allowing you to access your payment information quickly and easily.

- Loyalty Programs: You can store your loyalty cards in Android Pay and redeem them at participating merchants.

Comparison with Android Pay App

The mobile web version of Android Pay provides a user experience that is very similar to the Android Pay app. Both platforms offer the same core functionalities, such as secure payment processing, multiple payment methods, and one-click checkout.

However, there are a few key differences between the two:

- App Availability: The Android Pay app is available for download on Android devices, while the mobile web version is accessible from any web browser on any device.

- Offline Payments: The Android Pay app allows for offline payments, while the mobile web version requires an internet connection to process transactions.

- Push Notifications: The Android Pay app sends push notifications for transaction confirmations and other important updates, while the mobile web version does not currently offer this feature.

Security and Privacy Considerations

Android Pay’s expansion to the mobile web brings convenience, but it also raises questions about security and privacy. While Android Pay has a solid reputation for security on mobile devices, the web environment introduces new challenges. This section explores the security measures implemented for Android Pay on the mobile web and discusses the privacy implications for users and their data.

Security Measures

Android Pay utilizes robust security measures to safeguard user data and transactions on the mobile web. These measures include:

- Tokenization: Instead of storing your actual credit card information, Android Pay uses a unique token for each transaction. This token is a random string of characters that represents your card, protecting your actual card details from being compromised.

- Secure Communication: All communication between your device and Android Pay’s servers is encrypted using HTTPS, preventing unauthorized access to your sensitive information.

- Two-Factor Authentication: For added security, Android Pay supports two-factor authentication, requiring you to enter a one-time code sent to your phone or email, in addition to your password.

- Device Verification: Android Pay verifies your device’s security before allowing transactions. This ensures that only authorized devices can access your payment information.

- Fraud Detection: Android Pay uses sophisticated fraud detection algorithms to identify and prevent suspicious transactions. This includes analyzing transaction patterns, geolocation data, and other factors to detect potential fraud.

Privacy Implications, Android pay lands on mobile web soon

Android Pay collects and uses user data to provide its services and enhance user experience. However, the company is committed to protecting user privacy.

- Data Collection: Android Pay collects data like transaction history, payment methods, device information, and geolocation data. This information is used to personalize services, detect fraud, and improve the overall user experience.

- Data Sharing: Android Pay does not share your personal information with third-party advertisers or other companies without your explicit consent.

- Data Security: Android Pay implements industry-standard security measures to protect your data from unauthorized access, use, or disclosure.

- User Control: You have control over your data. You can review your transaction history, manage your payment methods, and adjust your privacy settings.

Impact on the Mobile Payments Industry

Android Pay’s expansion to the mobile web is a significant move that will undoubtedly reshape the mobile payments landscape. This move will not only expand Android Pay’s reach but also introduce new challenges for existing players in the industry.

Competitive Landscape and Potential Challenges

Android Pay’s expansion to the web will undoubtedly intensify competition within the mobile payments industry. The introduction of a seamless payment experience across platforms will challenge other providers to adapt and innovate. The key challenges for other payment providers include:

- Increased User Adoption: Android Pay’s widespread adoption on mobile devices, coupled with its expansion to the web, will likely lead to increased user adoption. This could make it difficult for other payment providers to attract and retain users.

- Enhanced User Experience: Android Pay’s web expansion offers a more streamlined and integrated payment experience. Other payment providers will need to invest in similar features and functionality to remain competitive.

- Security and Privacy Concerns: The expansion of Android Pay to the web raises concerns about security and privacy. Other payment providers will need to demonstrate robust security measures and transparent data handling practices to maintain user trust.

Predictions on the Future of Mobile Payments

Android Pay’s web expansion signifies a broader trend towards the convergence of online and offline payments. This will likely accelerate the adoption of mobile payments, leading to several significant changes in the industry:

- Increased Adoption of Mobile Payments: The seamless integration of Android Pay across platforms will encourage more users to adopt mobile payments for everyday transactions.

- Emergence of New Payment Technologies: The competitive landscape will likely drive innovation in payment technologies. Expect the emergence of new technologies like biometrics, blockchain, and artificial intelligence to enhance security, convenience, and personalization.

- Growth of the Mobile Commerce Ecosystem: The expansion of mobile payments will fuel the growth of the mobile commerce ecosystem. This will lead to increased online shopping, digital subscriptions, and mobile-based services.

Integration with Existing Services and Platforms

Android Pay’s integration with other Google services and platforms is a key aspect of its functionality and user experience. By leveraging the existing ecosystem, Android Pay aims to provide a seamless and convenient payment experience for users.

Android Pay’s integration with Google services and platforms offers numerous benefits for users and businesses. For users, it simplifies the payment process by eliminating the need to manually enter payment information. For businesses, it opens up new opportunities for reaching customers and increasing sales.

Integration with Google Services

The integration of Android Pay with Google services provides a seamless and secure payment experience. Here are some examples:

- Google Account: Users can link their Android Pay accounts to their Google accounts, enabling them to manage their payment information and make purchases across various Google services.

- Google Pay: Android Pay is seamlessly integrated with Google Pay, allowing users to make online and in-app purchases using their saved payment methods.

- Google Maps: Android Pay is integrated with Google Maps, allowing users to make payments directly within the app for services like parking and ride-sharing.

Integration with Third-Party Apps and Services

Android Pay’s open platform allows for integration with third-party apps and services, expanding its reach and functionality. Here are some examples:

- E-commerce Platforms: Android Pay can be integrated with popular e-commerce platforms like Shopify and WooCommerce, enabling merchants to accept Android Pay payments directly on their websites.

- Ride-Sharing Services: Android Pay is integrated with ride-sharing services like Uber and Lyft, allowing users to pay for rides directly within the app.

- Food Delivery Services: Android Pay can be integrated with food delivery services like Grubhub and DoorDash, enabling users to pay for their orders directly within the app.

Benefits of Seamless Integration

Seamless integration between Android Pay and other services offers several benefits for users and businesses:

- Convenience: Users can make payments quickly and easily without having to manually enter their payment information.

- Security: Android Pay leverages the security features of Google services to protect users’ payment information.

- Increased Reach: Businesses can reach a wider audience by accepting Android Pay payments.

- Enhanced User Experience: Seamless integration provides a more intuitive and enjoyable payment experience.

User Adoption and Market Penetration

The expansion of Android Pay to the mobile web presents a significant opportunity for Google to broaden its reach and increase user adoption. The convenience of making payments directly from a web browser, coupled with the existing familiarity and trust associated with Android Pay, can drive widespread adoption across diverse user demographics.

Factors Influencing User Adoption

The adoption of Android Pay on the mobile web will be influenced by several key factors:

- Ease of Use and Integration: A seamless integration with existing web browsing experiences is crucial. Users should be able to make payments without navigating away from their preferred websites or apps, ensuring a smooth and intuitive user journey.

- Security and Privacy: User trust is paramount. Android Pay’s established security features and adherence to privacy regulations will be critical in building confidence among web users.

- Merchant Acceptance: The wider adoption of Android Pay by online merchants will be a key driver. A robust network of participating merchants will encourage users to utilize the service for their online purchases.

- Incentives and Promotions: Google can leverage targeted incentives and promotional campaigns to attract new users and encourage existing users to explore the mobile web functionality of Android Pay.

Potential for Market Penetration

Android Pay on the mobile web has the potential to reach a wide range of users across various demographics.

- Younger Generations: Gen Z and Millennials, accustomed to mobile-first experiences, are likely to embrace the convenience and speed of mobile web payments.

- Tech-Savvy Users: Early adopters of technology and those comfortable with online transactions will be quick to adopt Android Pay on the mobile web.

- Mobile Commerce Enthusiasts: Users who regularly make purchases through their mobile devices will see the value in a unified payment solution for both apps and the web.

Strategies for Encouraging User Adoption

Google can implement a variety of strategies to encourage user adoption of Android Pay on the mobile web:

- Partnerships with Online Retailers: Collaborating with major e-commerce platforms and online retailers can expand Android Pay’s reach and visibility.

- Targeted Marketing Campaigns: Personalized marketing campaigns can highlight the benefits of using Android Pay on the mobile web, catering to specific user segments.

- Integration with Existing Services: Seamless integration with Google services like Gmail, Chrome, and Search can expose users to Android Pay’s mobile web capabilities.

- User Education and Onboarding: Clear and concise instructions, tutorials, and FAQs can help users understand the features and benefits of Android Pay on the mobile web.

Android pay lands on mobile web soon – Android Pay’s foray into the mobile web marks a significant milestone in the evolution of mobile payments. By offering a user-friendly and secure platform, Google is poised to further solidify its position in the digital payments industry. As more users and businesses embrace this convenient and secure payment method, the future of mobile payments looks bright, with Android Pay leading the charge towards a more streamlined and integrated digital economy.

Get ready to ditch your wallet, because Android Pay is making its way to the mobile web! This news comes hot on the heels of Apple’s latest spat with Australian banks, apple fires back australian banks , which is forcing them to rethink their mobile payment strategies. It seems like the mobile payment game is heating up, and we’re all about to be the beneficiaries!

Standi Techno News

Standi Techno News