Apple Pay

Apple Pay has emerged as a leading force in the mobile payment landscape, transforming how people make purchases and businesses accept payments. The popularity of Apple Pay stems from its seamless integration with Apple devices, coupled with its robust security features and user-friendly interface. This has led to a surge in adoption among consumers and merchants alike, making it a key player in the evolving world of digital transactions.

Benefits of Apple Pay for Consumers

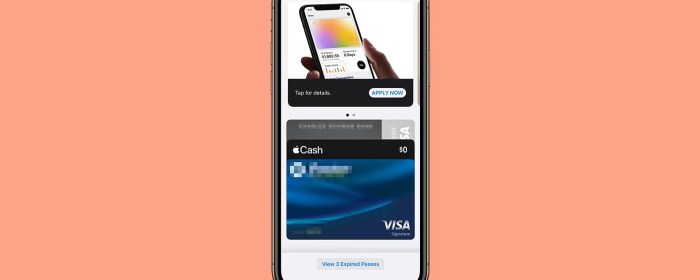

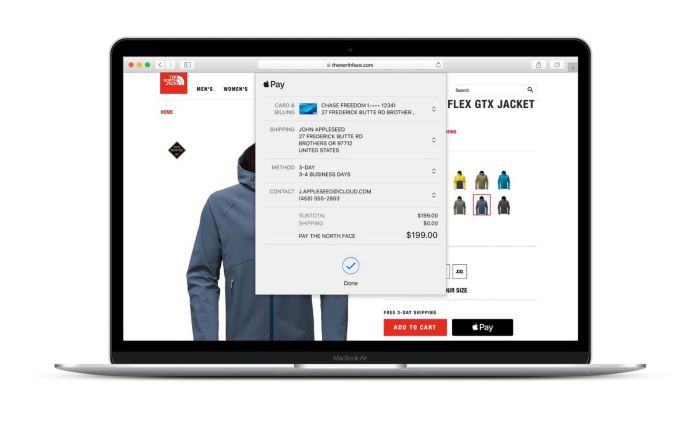

Apple Pay offers a range of benefits for consumers, making it a compelling alternative to traditional payment methods. The convenience of Apple Pay lies in its ability to simplify the checkout process, eliminating the need for physical cards or cash. Users can easily make purchases with just a tap of their iPhone or Apple Watch, streamlining the payment process and reducing waiting times.

- Speed and Convenience: Apple Pay allows users to make purchases quickly and effortlessly. Simply hold your iPhone or Apple Watch near a contactless payment terminal and authenticate the transaction with Face ID or Touch ID. This eliminates the need for fumbling with cards or cash, making payments more convenient and efficient.

- Enhanced Security: Apple Pay prioritizes security by employing tokenization technology. When you add a card to Apple Pay, your actual card number is not stored on your device or Apple’s servers. Instead, a unique token is generated and used for transactions, safeguarding your sensitive information. This makes Apple Pay highly secure, reducing the risk of fraud and unauthorized access to your card details.

- Wide Acceptance: Apple Pay is widely accepted at a growing number of merchants worldwide. Look for the contactless payment symbol (usually a wave icon) at checkout to see if Apple Pay is supported. As more businesses adopt contactless payment technologies, the reach of Apple Pay continues to expand, making it a versatile payment option for a wide range of transactions.

Advantages of Apple Pay for Merchants

Apple Pay offers numerous benefits for merchants, enhancing their operational efficiency and customer experience. By adopting Apple Pay, merchants can streamline their checkout process, reduce fraud risks, and improve customer satisfaction.

- Faster Transactions: Apple Pay significantly speeds up the checkout process for both merchants and customers. The contactless payment method eliminates the need for card swiping or manual entry of card details, resulting in faster transactions and reduced wait times for customers. This improved efficiency can lead to increased customer satisfaction and higher transaction volume.

- Reduced Fraud Risk: Apple Pay’s tokenization technology minimizes fraud risks for merchants. Since the actual card number is not shared during transactions, merchants are protected from fraudulent activities like card cloning or data breaches. This enhanced security can help reduce chargebacks and improve overall financial stability.

- Enhanced Customer Experience: Apple Pay provides a seamless and convenient payment experience for customers, leading to increased customer satisfaction. The ability to make purchases quickly and securely can enhance the overall shopping experience, encouraging repeat business and customer loyalty.

Recent Apple Pay Issues at Checkout Counters

Apple Pay, a convenient and widely adopted mobile payment system, has recently faced some hiccups at checkout counters, causing frustration for users. While Apple Pay generally provides a seamless experience, reports of issues have emerged, highlighting the need for continued improvement and reliability.

Examples of Recent Issues

These issues have manifested in various forms, impacting user experience and causing inconvenience.

- Transaction Failures: Users have reported instances where their Apple Pay transactions failed, leaving them stranded at the checkout counter. This can be particularly frustrating when time is of the essence, such as during a busy shopping trip or a rush hour commute. For example, a customer at a busy grocery store might find their Apple Pay transaction failing repeatedly, causing delays and potential embarrassment.

- Slow Processing: In some cases, Apple Pay transactions have been reported to process slowly, leading to extended waiting times at the checkout. This can be particularly problematic in situations where there are long queues or limited time. Imagine a customer at a fast-food restaurant who is in a hurry to get back to work. Slow processing times can lead to delays and frustration.

- Communication Errors: Some users have encountered communication errors, where their devices fail to connect to the payment terminal or the network. This can result in the inability to complete transactions, leaving users stranded at the checkout. For instance, a customer trying to use Apple Pay at a vending machine might encounter a communication error, preventing them from purchasing their desired item.

Potential Causes of Apple Pay Issues: Apple Pay Reportedly Running Into Issues At The Checkout Counter

While Apple Pay is generally a smooth and convenient way to make purchases, there are times when it might encounter hiccups at the checkout counter. These issues can be frustrating, especially when you’re in a hurry. Understanding the potential causes behind these glitches can help you troubleshoot them and get back to using Apple Pay seamlessly.

Network Connectivity Issues

Network connectivity plays a crucial role in Apple Pay’s functionality. A weak or unstable internet connection can disrupt the communication between your device, the payment terminal, and Apple’s servers, leading to transaction failures.

- Cause: A weak Wi-Fi signal, poor cellular data reception, or a temporary network outage can disrupt the communication process, leading to delays or errors in processing payments.

- Solution: Ensure you have a strong and stable internet connection. Try connecting to a different Wi-Fi network or switching to cellular data if available. If you suspect a network outage, wait for the service to be restored.

Software Glitches

Software bugs or glitches in the Apple Pay app, your device’s operating system, or the payment terminal’s software can also cause issues. These glitches can interfere with the communication between different components involved in the payment process.

- Cause: Outdated versions of the Apple Pay app, iOS, or the payment terminal’s software can contain bugs that might cause unexpected behavior. In some cases, even the latest versions might have unforeseen glitches.

- Solution: Ensure your Apple Pay app, iOS, and the payment terminal’s software are updated to the latest versions. If the issue persists, try restarting your device or the payment terminal. In rare cases, you might need to contact Apple support or the merchant for assistance.

System Overloads

During peak shopping hours or major events, Apple Pay’s servers might experience heavy traffic. This overload can cause delays in processing transactions, resulting in errors or timeouts.

- Cause: High demand on Apple Pay’s servers can lead to processing delays. This is especially common during peak shopping seasons, major holidays, or events like Black Friday.

- Solution: If you encounter an error during peak hours, try again later when the traffic might be less congested. Consider using a different payment method if the issue persists.

Other Potential Causes

Similar to other mobile payment systems, Apple Pay can encounter issues due to various factors:

| Cause | Description | Possible Solutions |

|---|---|---|

| Card Reader Issues | Malfunctioning or outdated card readers at the checkout counter can fail to recognize Apple Pay signals. | Try using a different card reader, if available. Contact the merchant for assistance if the issue persists. |

| Incorrect Card Information | Errors in the card information associated with your Apple Pay account can prevent successful transactions. | Verify the card information in your Apple Pay settings. Contact your bank or card issuer for assistance if needed. |

| Insufficient Funds | You might encounter issues if there are insufficient funds in your linked bank account. | Check your bank account balance and ensure you have sufficient funds available. |

Impact of Apple Pay Issues on Users and Merchants

Apple Pay issues at checkout counters can have significant consequences for both users and merchants. When Apple Pay transactions fail, it can lead to frustration, inconvenience, and even financial losses. This section delves into the specific impacts of these issues on users and merchants.

Impact on Users

When Apple Pay experiences issues at checkout, users face various inconveniences and potential financial losses. These issues can lead to delays in purchases, frustration, and even the inability to complete transactions.

- Delayed Purchases: When Apple Pay fails, users may need to resort to alternative payment methods, such as credit cards or cash, which can add time to the checkout process. This delay can be particularly frustrating during busy shopping periods or when time is limited.

- Inconvenience: The inability to use a preferred payment method, such as Apple Pay, can be inconvenient and disruptive to the shopping experience. Users may have to search for their credit cards or withdraw cash, adding extra steps to the transaction.

- Potential Financial Losses: In some cases, Apple Pay issues can lead to financial losses. For example, if a user’s transaction is declined due to a technical glitch, they may not receive the goods or services they purchased, resulting in a loss of money.

Impact on Merchants, Apple pay reportedly running into issues at the checkout counter

Apple Pay issues can also have a significant impact on merchants, leading to lost sales, customer dissatisfaction, and operational disruptions.

- Lost Sales: When Apple Pay transactions fail, merchants lose sales, as customers may choose to go elsewhere or use a different payment method. This can be particularly problematic for businesses that rely heavily on mobile payments.

- Customer Dissatisfaction: Apple Pay issues can lead to customer dissatisfaction, as shoppers may become frustrated with the inconvenience and delays. This can damage a merchant’s reputation and result in negative reviews.

- Operational Disruptions: Apple Pay issues can disrupt a merchant’s operations, as staff may need to handle more transactions manually, leading to longer wait times and increased workload.

Impact Summary

The following table summarizes the specific impacts of Apple Pay issues on users and merchants:

| Impact | Users | Merchants |

|---|---|---|

| Delayed Purchases | Customers may experience delays in completing their purchases, especially during busy periods. | Merchants may experience longer checkout lines and reduced throughput, leading to lost sales. |

| Inconvenience | Users may experience frustration and inconvenience due to the inability to use their preferred payment method. | Merchants may experience increased customer complaints and negative reviews, damaging their reputation. |

| Financial Losses | Customers may lose money if their transactions are declined due to technical glitches. | Merchants may experience lost sales and revenue due to declined transactions. |

| Operational Disruptions | Users may experience delays in receiving their goods or services. | Merchants may experience increased workload and operational inefficiencies due to manual transaction processing. |

Apple’s Response to the Issues

Apple, being a tech giant known for its commitment to user experience, has acknowledged the reported Apple Pay issues at checkout counters. The company has been actively working to identify and address the root causes of these problems, aiming to ensure a seamless and reliable payment experience for its users.

Apple’s Official Statements and Actions

Apple has publicly acknowledged the issues, expressing its commitment to resolving them. The company has stated that it is investigating the reported problems and working to improve the reliability and performance of Apple Pay. In addition to official statements, Apple has also taken concrete steps to address the issues.

- Technical Updates: Apple has released software updates for both iOS and its payment processing systems to address specific bugs and improve overall performance. These updates aim to resolve issues related to network connectivity, transaction processing, and device compatibility.

- Customer Support: Apple has increased its customer support resources to assist users experiencing problems with Apple Pay. They provide troubleshooting guidance and technical support to resolve issues encountered at checkout counters.

- Collaboration with Merchants: Apple has been actively collaborating with merchants to ensure compatibility and smooth integration of Apple Pay with their point-of-sale systems. This involves technical support, training, and guidance to help merchants address any issues related to Apple Pay acceptance.

Impact of Apple’s Response on User Confidence and Merchant Acceptance

Apple’s prompt response and efforts to address the issues have had a positive impact on user confidence and merchant acceptance of Apple Pay.

- Increased User Confidence: Apple’s transparent communication and proactive actions have reassured users that the company is committed to resolving the issues and improving the Apple Pay experience. This has helped maintain user confidence in the service.

- Enhanced Merchant Acceptance: Apple’s collaboration with merchants has helped to address technical concerns and improve the integration of Apple Pay into their systems. This has led to increased merchant acceptance of Apple Pay, making it a more widely available payment option.

Future Implications of Apple Pay Issues

The recent hiccups with Apple Pay at checkout counters raise crucial questions about its long-term viability and impact on the mobile payment landscape. These issues, if not addressed effectively, could potentially erode Apple Pay’s market share and hinder its future development.

These recurring issues could impact Apple Pay’s market share in several ways. Firstly, frustrated users might turn to alternative payment methods, like Google Pay or Samsung Pay, which offer a more reliable experience. Secondly, merchants might become hesitant to embrace Apple Pay, potentially leading to its limited adoption at various retail outlets. This could further hinder its growth and limit its reach.

Addressing the Issues to Ensure Smooth and Reliable User Experience

Apple needs to prioritize addressing these issues to ensure a smooth and reliable user experience. This involves:

- Identifying and resolving the root causes of the issues: This could involve collaborating with payment processors, network providers, and device manufacturers to pinpoint and fix the underlying technical glitches.

- Improving communication and transparency: Apple should proactively inform users about potential issues and provide timely updates on their resolution. This fosters trust and helps manage user expectations.

- Investing in robust infrastructure and testing: Apple needs to ensure that its payment infrastructure is scalable and resilient to handle increasing transaction volumes and potential technical challenges.

Maintaining Competitive Edge in the Mobile Payment Market

To maintain its competitive edge in the mobile payment market, Apple needs to:

- Continuously innovate and introduce new features: This could involve integrating Apple Pay with new payment methods, such as cryptocurrencies, or expanding its functionality to include features like loyalty programs and rewards.

- Strengthen partnerships with merchants and financial institutions: Apple needs to foster stronger relationships with merchants and financial institutions to ensure widespread adoption and seamless integration.

- Improve security and privacy: Apple needs to maintain its reputation for security and privacy by implementing robust measures to protect user data and prevent fraud.

Apple pay reportedly running into issues at the checkout counter – The recent Apple Pay issues highlight the delicate balance between convenience and reliability in the world of mobile payments. While Apple Pay offers a user-friendly and secure way to pay, it’s clear that the technology is still evolving. As more users adopt mobile payment systems, it’s crucial for companies like Apple to prioritize a seamless and reliable experience. Otherwise, the allure of a tap-and-go future might fade, leaving users yearning for the days of swiping their cards.

Imagine trying to pay for your groceries with Apple Pay, only to have it glitch out at the checkout counter. It’s like a scene straight out of a dystopian movie, except instead of a malfunctioning robot, it’s your phone. Maybe you’re experiencing the same frustration as those who are discovering that Netflix God Mode removes horizontal scrolling but instead of a smooth browsing experience, you’re left staring at a frozen screen.

Either way, it’s a reminder that technology isn’t always as reliable as we hope, and sometimes we just have to accept the glitches and move on.

Standi Techno News

Standi Techno News