Lenovo’s PC Business Strategy

Lenovo is a global technology powerhouse, and its PC business is a key driver of its success. The company has consistently ranked as the world’s largest PC manufacturer, capturing a significant market share. This dominance is a result of a well-defined strategy that leverages diverse product lines, targeted market segmentation, and strategic acquisitions and partnerships.

Lenovo’s Market Position

Lenovo holds a dominant position in the global PC market, consistently ranking as the top vendor. In 2022, the company captured approximately 24% of the worldwide PC market share, according to Gartner. This leadership is attributed to its diverse product portfolio, competitive pricing, and strong distribution network.

Lenovo’s Key Product Lines and Target Markets

Lenovo’s PC business is characterized by a diverse range of products targeting various market segments.

- ThinkPad: This line of laptops is known for its durability, reliability, and focus on business users. ThinkPads are designed for professionals, enterprises, and government agencies, offering features like enhanced security, long battery life, and robust build quality.

- IdeaPad: Targeting consumers, the IdeaPad series encompasses a wide range of laptops, from budget-friendly options to high-performance gaming models. The IdeaPad line prioritizes features like portability, multimedia capabilities, and stylish designs.

- Yoga: This line combines the features of both ThinkPad and IdeaPad, offering versatile laptops with 2-in-1 functionality. Yoga laptops are designed for professionals and consumers who need a device that can seamlessly transition between laptop and tablet modes.

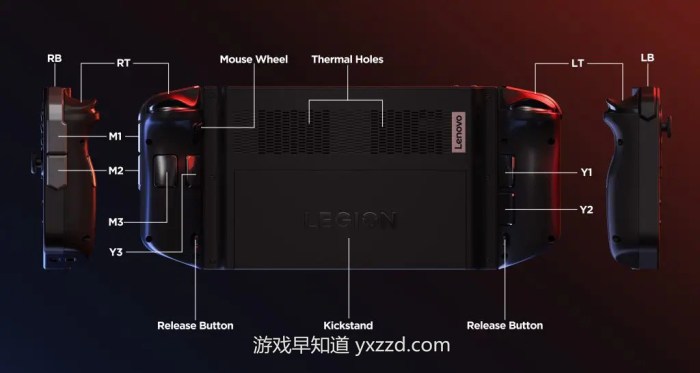

- Legion: Lenovo’s Legion line is dedicated to gaming enthusiasts. These high-performance laptops feature powerful processors, dedicated graphics cards, and immersive displays, providing an exceptional gaming experience.

- Desktops: Lenovo offers a comprehensive range of desktops, targeting both home and business users. These desktops cater to diverse needs, from budget-friendly options for everyday tasks to high-end workstations for demanding applications.

Lenovo’s Acquisitions and Partnerships, Lenovo control fujitsus pc business

Lenovo has strategically pursued acquisitions and partnerships to strengthen its PC business and expand its reach.

- IBM’s PC Business: In 2005, Lenovo acquired IBM’s PC business, gaining access to the renowned ThinkPad brand and a strong foothold in the enterprise market.

- Motorola Mobility: In 2014, Lenovo acquired Motorola Mobility, expanding its portfolio to include smartphones and other mobile devices.

- Fujitsu’s PC Business: In 2016, Lenovo acquired Fujitsu’s PC business in Europe, further solidifying its position in the European market.

- Partnerships: Lenovo collaborates with various technology companies, including Microsoft, Intel, and AMD, to ensure its products integrate seamlessly with the latest software and hardware.

Lenovo’s Business Model

Lenovo’s business model is characterized by a focus on cost-efficiency, vertical integration, and strong distribution channels.

- Cost-Efficiency: Lenovo has a vertically integrated supply chain, allowing it to control costs and maintain competitive pricing. The company also leverages its manufacturing facilities in China to reduce production expenses.

- Vertical Integration: Lenovo’s vertically integrated business model enables it to manage every stage of the product lifecycle, from design and manufacturing to distribution and customer support. This vertical integration allows the company to optimize its operations and maintain control over its supply chain.

- Strong Distribution Channels: Lenovo has a robust distribution network, including direct sales, online retailers, and partnerships with major retailers. This extensive network ensures its products reach a wide range of customers.

Fujitsu’s PC Business Strategy

Fujitsu, a Japanese multinational technology giant, has a long and storied history in the PC market. While not as dominant as some of its global counterparts, Fujitsu has carved out a niche for itself, particularly in specific segments and geographic regions. Understanding Fujitsu’s PC business strategy requires delving into its historical presence, core competencies, recent strategic shifts, and target markets.

Fujitsu’s Historical Presence in the PC Market

Fujitsu’s journey in the PC market began in the early 1980s, with the launch of its FM-8 personal computer. This early entry positioned Fujitsu as a pioneer in the Japanese PC market. The company later expanded its presence globally, becoming a major player in the enterprise and government sectors. Fujitsu’s early success was driven by its strong reputation for quality, reliability, and security, particularly in the enterprise segment.

Fujitsu’s Core Competencies and Strengths in the PC Sector

Fujitsu’s core competencies in the PC sector stem from its deep expertise in hardware design, manufacturing, and software integration. The company has a long history of developing innovative and reliable PCs, with a particular focus on security and enterprise-grade features. Fujitsu’s strengths lie in:

- Enterprise-Grade Security: Fujitsu has consistently prioritized security in its PC offerings, developing robust security features and solutions tailored for enterprise environments.

- Hardware Expertise: Fujitsu’s expertise in hardware design and manufacturing allows it to create high-quality, durable PCs that meet the specific needs of its target customers.

- Software Integration: Fujitsu excels in integrating hardware and software solutions, offering tailored PC configurations that meet the unique requirements of various businesses and industries.

Fujitsu’s Recent Strategic Shifts and Focus Areas

In recent years, Fujitsu has undergone strategic shifts to adapt to the evolving PC market landscape. These shifts have been driven by factors such as the rise of mobile computing, the increasing demand for cloud-based solutions, and the growing importance of cybersecurity. Fujitsu has focused on:

- Mobile Computing: Fujitsu has expanded its portfolio of mobile devices, including tablets and convertibles, to cater to the growing demand for mobile computing solutions.

- Cloud Integration: The company has incorporated cloud-based features and services into its PC offerings, enabling seamless integration with cloud platforms.

- Cybersecurity Enhancement: Fujitsu has intensified its focus on cybersecurity, incorporating advanced security measures into its PCs to combat evolving threats.

Fujitsu’s Target Markets Compared to Lenovo

Fujitsu’s target markets differ from Lenovo’s in several key aspects. While Lenovo has a broader focus across various segments, Fujitsu has historically concentrated on:

- Enterprise and Government: Fujitsu’s primary target market is the enterprise and government sectors, where its focus on security, reliability, and tailored solutions resonates strongly.

- Specific Industries: Fujitsu has developed specialized PC solutions for specific industries, such as healthcare, finance, and education, where its deep understanding of industry-specific requirements provides a competitive advantage.

- Japan and Europe: Fujitsu maintains a strong presence in Japan and Europe, where its brand recognition and reputation for quality have contributed to its success.

Competition and Market Dynamics: Lenovo Control Fujitsus Pc Business

The PC market is a highly competitive landscape with numerous players vying for market share. Lenovo and Fujitsu, while both prominent players, face challenges from established competitors and emerging players alike. This section delves into the competitive landscape, examining key market dynamics and their implications for Lenovo and Fujitsu.

This section presents a comparative analysis of Lenovo and Fujitsu based on key metrics such as market share, product portfolio, and pricing strategies.

| Metric | Lenovo | Fujitsu |

|---|---|---|

| Market Share (Global) | ~24% (Q1 2023, Gartner) | ~1% (Q1 2023, Gartner) |

| Product Portfolio | Wide range, including desktops, laptops, workstations, servers, and tablets | Focus on enterprise and commercial segments, offering desktops, laptops, and servers |

| Pricing Strategy | Offers products across various price points, catering to both consumer and enterprise segments | Primarily targets the enterprise segment with premium pricing |

Major Competitors and Their Strategies

The PC market is dominated by a few key players, each with distinct strategies and target markets.

- HP: Focuses on both consumer and enterprise segments, offering a wide range of products. HP has a strong brand recognition and distribution network.

- Dell: Similar to HP, Dell targets both consumer and enterprise markets. Dell emphasizes its customization options and direct sales channels.

- Acer: Acer primarily targets the consumer market, offering affordable and feature-rich devices. Acer leverages its strong presence in emerging markets.

- Apple: Apple focuses on the premium segment with its Mac computers. Apple differentiates itself through its ecosystem and user experience.

Impact of Technological Trends

Technological advancements have a profound impact on the PC industry, driving innovation and shaping market dynamics.

- Mobile Computing: The rise of smartphones and tablets has challenged the traditional PC market. This trend has led to a shift towards smaller, more portable devices and the integration of mobile functionalities into PCs.

- Cloud Computing: Cloud computing has enabled access to computing resources and applications remotely, reducing the need for traditional desktop PCs. This trend has led to a rise in thin clients and hybrid computing models.

- Artificial Intelligence (AI): AI is being integrated into PCs to enhance user experience and improve productivity. This includes features such as voice assistants, intelligent search, and personalized recommendations.

- 5G Connectivity: The rollout of 5G networks is expected to enhance PC performance and connectivity, enabling faster data transfer and improved user experience.

Future Outlook for the PC Market

The PC market is expected to experience growth in the coming years, driven by factors such as increasing demand for remote work, digital transformation, and the adoption of new technologies.

“The global PC market is expected to grow at a CAGR of 5.2% from 2023 to 2028.” – Source: Statista

- Growth in Emerging Markets: Emerging markets are expected to drive significant growth in the PC market, fueled by rising disposable incomes and increased internet penetration.

- Demand for High-Performance Devices: The increasing adoption of gaming, content creation, and demanding software applications is driving demand for high-performance PCs, including gaming laptops and workstations.

- Focus on Security and Privacy: As cyber threats become more sophisticated, the demand for secure and privacy-focused PCs is expected to increase.

Potential Synergies and Challenges

A merger between Lenovo and Fujitsu’s PC businesses could create a formidable force in the global PC market. The combined entity would leverage the strengths of both companies, potentially unlocking new avenues for growth and market share expansion. However, navigating the integration process and overcoming potential challenges would be crucial for the success of such a partnership.

Potential Synergies

Lenovo could significantly benefit from Fujitsu’s expertise in specific areas, enhancing its overall capabilities.

- Strong Presence in Japan: Fujitsu enjoys a strong brand presence and market share in Japan, a key market for Lenovo’s expansion. Leveraging Fujitsu’s existing network and customer relationships would provide Lenovo with a solid foundation for growth in this strategically important region.

- Enterprise Solutions: Fujitsu is renowned for its expertise in enterprise-grade solutions, particularly in areas like security, data management, and cloud computing. Integrating these capabilities into Lenovo’s portfolio would enhance its offerings to corporate clients, expanding its reach and competitiveness in the enterprise market.

- Research and Development: Fujitsu’s research and development capabilities, particularly in areas like artificial intelligence (AI) and edge computing, could complement Lenovo’s existing technology portfolio. Collaborating on research and development initiatives could lead to innovative products and solutions, giving the combined entity a competitive edge.

Challenges in Integration

Integrating two large organizations with distinct cultures, operating models, and technologies presents significant challenges.

- Cultural Differences: Integrating the two company cultures, particularly in areas like decision-making, communication styles, and employee expectations, could pose significant hurdles. Effective communication, cultural sensitivity, and a clear integration strategy would be essential to minimize cultural clashes and ensure a smooth transition.

- Overlapping Operations: Both companies have established supply chains, distribution networks, and manufacturing facilities. Eliminating redundancies, streamlining operations, and optimizing resource allocation would be crucial to avoid inefficiencies and maximize cost savings. A well-defined integration plan, including clear roles and responsibilities, would be essential to ensure a smooth transition and avoid conflicts.

- Brand Management: Balancing the two brands and their respective reputations would be crucial. Maintaining brand equity and customer trust would require careful consideration of branding strategies, product positioning, and marketing campaigns. A clear strategy for integrating the brands, while respecting their individual identities, would be crucial for success.

Impact on the PC Market

A Lenovo-Fujitsu merger could have a significant impact on the PC market, potentially leading to:

- Increased Market Share: The combined entity would become a dominant force in the global PC market, potentially increasing its market share and creating a more competitive landscape. This could lead to greater innovation and product development, benefiting consumers.

- Consolidation and Restructuring: The merger could trigger further consolidation in the PC market, as other players seek to maintain their competitiveness. This could lead to restructuring within the industry, with smaller players merging or being acquired by larger entities.

- Pricing Pressure: The increased market power of the combined entity could potentially lead to pricing pressure on competitors. This could benefit consumers in the short term, but could also stifle innovation and reduce product diversity in the long term.

Potential Benefits and Risks

| Benefits | Risks |

|---|---|

| Increased market share and revenue | Integration challenges and cultural clashes |

| Enhanced product portfolio and innovation | Overlapping operations and redundancies |

| Stronger presence in key markets like Japan | Potential brand dilution and customer confusion |

| Access to new technologies and expertise | Antitrust scrutiny and regulatory hurdles |

Lenovo control fujitsus pc business – The potential union of Lenovo and Fujitsu’s PC business is a game-changer, one that could reshape the landscape of the PC market. This move promises exciting possibilities, but also poses challenges. The success of this partnership will hinge on Lenovo’s ability to leverage Fujitsu’s strengths while navigating the complexities of integration. This is a story worth watching, as it could redefine the way we think about and interact with technology in the years to come.

Lenovo’s acquisition of Fujitsu’s PC business was a big deal, shaking up the tech world. It’s a move that’s got people talking, and it’s definitely not as simple as Tim Cook assuring us our AirPods won’t fall out. This merger could mean big changes for the PC market, with Lenovo potentially gaining a stronger foothold in the Japanese market and Fujitsu focusing on other areas.

Only time will tell what the long-term effects will be.

Standi Techno News

Standi Techno News