The Deal’s Significance

The acquisition of 21st Century Fox’s entertainment assets by Disney in 2019 marked a pivotal moment in the entertainment industry. This deal, valued at $71.3 billion, transformed the landscape of media, consolidating Disney’s position as a dominant force in film, television, and streaming.

The acquisition of Fox’s film studios, television networks, and cable channels significantly expanded Disney’s reach and influence, solidifying its position as a global entertainment powerhouse.

The deal significantly boosted Disney’s market share in the entertainment industry. Prior to the acquisition, Disney held a substantial market share, primarily driven by its theme parks, cable networks, and film studios. However, the acquisition of Fox’s assets further expanded its reach, encompassing a wider range of entertainment offerings.

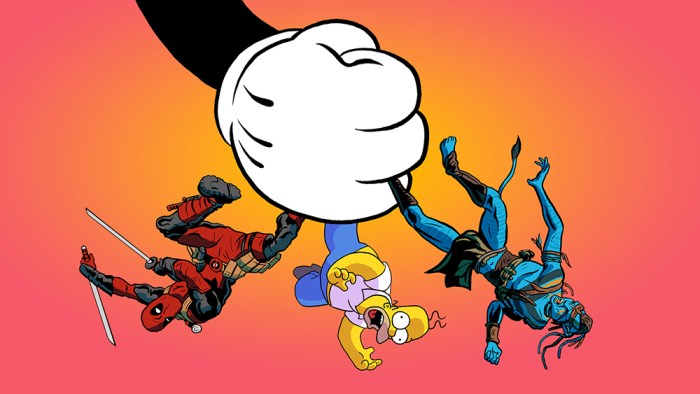

- Film Studios: Disney’s film studios, already a major player, gained access to Fox’s renowned studios, including 20th Century Fox, Searchlight Pictures, and Fox 2000 Pictures. This acquisition brought iconic franchises like “Avatar,” “X-Men,” and “Deadpool” under the Disney umbrella.

- Television Networks: The acquisition added several popular television networks to Disney’s portfolio, including FX, National Geographic, and Fox Broadcasting Company. This expanded Disney’s presence in cable television and broadcasting, allowing it to reach a wider audience.

- Streaming: Disney’s streaming service, Disney+, launched in 2019, gained access to Fox’s extensive library of content, including popular shows like “The Simpsons” and “Modern Family.” This significantly enhanced Disney+’s content library and competitive edge in the streaming market.

The acquisition of Fox’s assets significantly boosted Disney’s market share in film, television, and streaming, making it a dominant force in the entertainment industry.

Impact on the Film Industry

The Disney-Fox deal has far-reaching implications for the film industry, potentially reshaping the landscape of production, distribution, and competition. This acquisition marks a significant consolidation of power within the entertainment industry, with Disney gaining control of a vast library of intellectual property and a formidable distribution network.

The Rise of Mega-Studios, Disney confirms 52 billion deal foxs tv film studios

The Disney-Fox deal signifies a trend toward the consolidation of power in the film industry, with mega-studios acquiring smaller companies and expanding their reach. This consolidation can lead to increased competition among these behemoths, while simultaneously limiting opportunities for smaller independent studios.

The deal further strengthens Disney’s already dominant position in the market, giving them a significant advantage in terms of resources, distribution channels, and intellectual property.

Implications for Consumers: Disney Confirms 52 Billion Deal Foxs Tv Film Studios

The Disney-Fox deal could significantly impact how consumers access and enjoy entertainment content. This merger brings together two of the world’s largest media companies, creating a powerhouse with vast libraries of films, TV shows, and other intellectual property. This integration could lead to changes in how content is distributed, priced, and consumed, potentially influencing consumer choices and viewing habits.

Potential Changes in Content Access

The merger could lead to changes in how consumers access entertainment content. Disney’s streaming service, Disney+, already boasts a vast library of content, including movies, TV shows, and documentaries. With the addition of Fox’s assets, Disney+ could become an even more attractive platform, potentially drawing subscribers away from competing services like Netflix and Amazon Prime Video.

Regulatory and Legal Considerations

The acquisition of 21st Century Fox by Disney was a monumental deal, but it also faced significant regulatory scrutiny due to its size and potential impact on the media landscape. Antitrust concerns were paramount, and the deal was subject to thorough review by multiple regulatory bodies around the world.

Antitrust Concerns

The merger of Disney and Fox raised significant antitrust concerns, particularly in the film and television industries. The deal combined two of the largest entertainment companies in the world, creating a behemoth with a massive portfolio of content, distribution channels, and theme parks.

This raised fears of potential market dominance and reduced competition. The U.S. Department of Justice (DOJ) and other international regulators expressed concerns that the deal could stifle competition and limit consumer choices.

The DOJ’s antitrust division has a long history of scrutinizing media mergers, as they can have a significant impact on the marketplace. The agency is particularly concerned about the potential for mergers to lead to higher prices, reduced innovation, and less consumer choice.

Regulatory Review and Approvals

The Disney-Fox deal underwent rigorous regulatory review by antitrust authorities in the United States, Europe, and other key markets. These agencies examined the potential impact of the merger on competition in various sectors, including film production and distribution, television broadcasting, and cable networks.

To address these concerns, Disney agreed to divest certain assets to ensure the deal would not create a monopoly. For example, Disney agreed to sell off some of Fox’s regional sports networks to appease regulators.

- The U.S. Department of Justice approved the deal after Disney agreed to divest 22 regional sports networks owned by Fox. These networks were sold to a group of investors led by the private equity firm, The Blackstone Group. This divestiture was designed to address concerns that the deal would give Disney too much control over the distribution of sports programming.

- The European Commission, the EU’s antitrust regulator, also approved the deal after Disney agreed to sell off its stake in Sky, a European pay-TV broadcaster. The Commission was concerned that Disney’s ownership of Sky would give it too much control over the distribution of content in Europe.

- In addition to the U.S. and EU, the deal also required approval from regulators in other countries, including Canada, China, and Brazil. Each country had its own specific concerns and conditions for approval, which Disney had to address.

The Future of Disney and Fox

The acquisition of Fox by Disney represents a monumental shift in the entertainment landscape, with implications that extend far beyond the immediate financial transaction. The integration of Fox’s assets into Disney’s vast portfolio presents both challenges and opportunities, shaping the future of both companies and the industry as a whole.

The Integration Timeline

The integration of Fox’s assets into Disney is a complex process that will unfold over several years. The following timeline Artikels key milestones in this journey:

- 2019: Regulatory approvals and completion of the acquisition. Initial steps in integrating Fox’s television and film studios into Disney’s existing structure.

- 2020-2021: Continued integration of Fox’s assets, including the launch of Disney+ with Fox content and the restructuring of Fox’s television networks.

- 2022-2023: Full integration of Fox’s assets, with a unified brand strategy and a streamlined content production process.

Synergy Between Disney and Fox

The acquisition presents significant opportunities for synergy between Disney’s existing brands and Fox’s assets. This synergy can manifest in various ways, including:

- Cross-promotion: Disney can leverage its established brands like Marvel and Star Wars to promote Fox’s content, such as the X-Men and Fantastic Four franchises. Conversely, Fox’s brands like The Simpsons and Family Guy can be promoted through Disney’s channels.

- Content sharing: Disney can distribute Fox content through its streaming services like Disney+ and Hulu, expanding the reach of Fox’s programming. Conversely, Fox’s cable networks can air Disney content, creating a more diverse and engaging lineup.

- Shared resources: Disney can utilize Fox’s production facilities and talent pool, while Fox can benefit from Disney’s expertise in marketing, distribution, and technology.

The Future of Fox’s Studios

The integration of Fox’s television and film studios into Disney will reshape the landscape of content creation and distribution. The following table Artikels the potential future of these studios:

| Studio | Future under Disney |

|---|---|

| 20th Century Fox Film Corporation | Production of major motion pictures, including Marvel and Star Wars franchises, with a focus on theatrical releases and streaming distribution through Disney+ and Hulu. |

| 20th Century Fox Television | Production of television series for broadcast and cable networks, as well as streaming services, with a focus on family-friendly content and targeted programming for specific demographics. |

Disney confirms 52 billion deal foxs tv film studios – The Disney-Fox deal is a game-changer, ushering in a new era of consolidation in the entertainment industry. As Disney integrates Fox’s assets into its already vast empire, we can expect to see significant changes in the way we consume entertainment. From the potential for exclusive streaming content to the emergence of new blockbuster franchises, this acquisition is sure to reshape the landscape of Hollywood for years to come.

Disney’s massive $52 billion deal for Fox’s TV and film studios is a game-changer for the entertainment industry. It’s a move that puts Disney in a dominant position, controlling a huge chunk of the market. And while Disney is busy consolidating its empire, Xiaomi is making waves in the tech world, claiming to have sold $335 million worth of phones in just 12 hours.

It’s clear that both Disney and Xiaomi are aiming for the top spot in their respective industries, and it’ll be fascinating to see how they navigate the competitive landscape in the years to come.

Standi Techno News

Standi Techno News