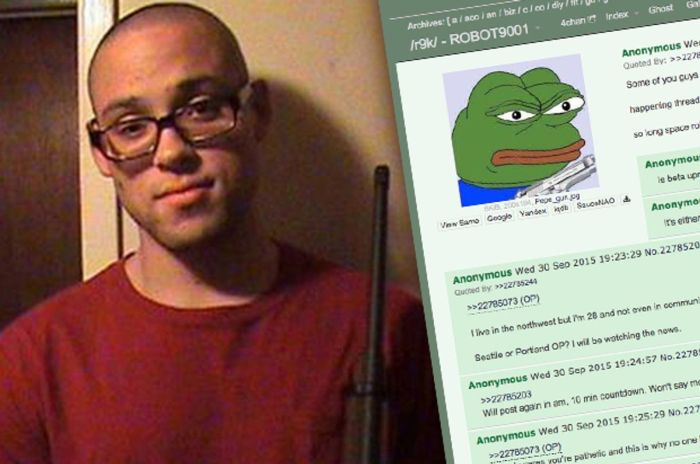

The Rise of the “4chan User”: 4chan User Allegedly Turns Gamestop Into Their Own Private Bank

The “4chan user” is a complex and multifaceted persona that has emerged from the depths of the internet, a digital phantom embodying a unique blend of anonymity, humor, and often, a rebellious spirit. This persona has become a significant force in online culture, influencing everything from meme culture to political discourse.

Origins and Evolution of the “4chan User” Persona

The “4chan user” persona has its roots in the imageboard website 4chan, founded in 2003. Initially, the site was primarily a place for sharing anime and manga images, but it quickly evolved into a breeding ground for a diverse range of online subcultures. Early users, often young and tech-savvy, embraced the anonymity afforded by the platform and used it to experiment with online identities, often creating humorous or provocative content. The “4chan user” persona, as it is known today, emerged from this early community.

Anonymity and Online Communities

Anonymity played a crucial role in shaping the “4chan user” persona. The ability to post anonymously gave users a sense of freedom and detachment, allowing them to express themselves without fear of real-world repercussions. This fostered a culture of irreverence and experimentation, where users could push boundaries and engage in behaviors that they might not otherwise consider. Online communities like 4chan, with their focus on shared interests and anonymity, provided a fertile ground for the development and proliferation of this persona.

The “4chan User” in Online Culture

The “4chan user” persona has had a profound impact on online culture. The site’s influence can be seen in the widespread adoption of memes, the rise of internet slang, and the emergence of online communities focused on niche interests. For example, the “4chan user” persona is often associated with the creation and spread of popular memes, such as “lolcats” and “rage comics.” The persona’s irreverence and willingness to challenge norms have also contributed to the growth of online communities dedicated to topics like gaming, technology, and political activism.

The Gamestop Phenomenon

The Gamestop stock surge in 2021 was a defining moment in the world of finance and social media, showcasing the power of collective action and the potential for retail investors to influence the market. This event, dubbed the “Gamestop saga,” had far-reaching implications, sparking debates about market manipulation, short squeezes, and the democratization of investing.

The Context of the Gamestop Stock Surge

The Gamestop story unfolded against the backdrop of a heavily shorted stock. Short-selling is a trading strategy where investors borrow shares and immediately sell them in the market, hoping to buy them back later at a lower price to profit from the difference. However, if the stock price rises instead of falls, short-sellers face significant losses. In the case of Gamestop, several hedge funds had heavily shorted the stock, believing it was overvalued and destined to decline.

The Role of Retail Investors and Social Media

Retail investors, fueled by online communities on platforms like Reddit’s WallStreetBets forum, noticed the high short interest in Gamestop and saw an opportunity. They began buying the stock en masse, driving up its price and forcing short-sellers to cover their positions, further increasing the price. Social media played a crucial role in coordinating these actions, enabling investors to share information, strategies, and memes, fostering a sense of community and collective action.

Comparing and Contrasting the “4chan User” and “Retail Investor” Archetypes, 4chan user allegedly turns gamestop into their own private bank

The “4chan user” and the “retail investor” represent distinct archetypes, each with their own motivations and characteristics. The “4chan user,” often associated with anonymity and trolling, is known for their irreverent humor, meme culture, and tendency to disrupt established norms. While they might be drawn to the Gamestop saga for its disruptive potential, their motivations are often less focused on financial gain and more about challenging authority and disrupting the status quo.

On the other hand, the “retail investor” archetype represents individuals who are actively engaged in the financial markets, seeking to grow their wealth through investing. While their motivations are primarily financial, the Gamestop saga demonstrated that they can also be influenced by social trends, community sentiment, and the desire to challenge institutional power structures.

While the “4chan user” and the “retail investor” might seem like contrasting figures, the Gamestop saga highlighted the potential for their motivations to converge, creating a powerful force capable of influencing market dynamics.

“Private Bank” and the Meme Economy

The Gamestop saga was more than just a stock market frenzy; it was a cultural phenomenon fueled by online communities, particularly 4chan and Reddit. The narrative of a “private bank” emerged from the collective actions of these communities, who saw themselves as defying Wall Street and reclaiming control of the financial system. This narrative was woven into the fabric of online discourse, fueled by a potent mix of memes, online trends, and collective action.

The Meme Economy and the Rise of the “Private Bank”

Memes and online trends played a crucial role in shaping the narrative of Gamestop as a “private bank.” These memes weren’t just humorous distractions; they served as rallying cries, fostering a sense of community and shared purpose. The memes also helped to simplify complex financial concepts, making them accessible to a wider audience and promoting a sense of collective action.

- Diamond Hands: This meme, depicting a hand clutching a diamond, symbolized the unwavering commitment of retail investors to hold their Gamestop shares, regardless of market fluctuations. This meme emphasized the collective strength of retail investors and their ability to outlast institutional investors.

- “We Like the Stock”: This meme, often accompanied by a picture of a smiling individual, became a rallying cry for Gamestop investors. It celebrated the collective passion for the stock and the belief in its future potential. This meme was particularly effective in galvanizing the community and fostering a sense of shared purpose.

- “The Short Squeeze”: This meme, often depicted as a giant hand squeezing a lemon, symbolized the pressure exerted on short-sellers, who had bet against Gamestop’s stock price. This meme resonated with retail investors, who saw it as a way to reclaim control of the market and punish institutional investors who had profited from their losses.

The Impact of Meme Culture on Financial Markets

The Gamestop saga highlighted the potential impact of meme culture on financial markets. The meme economy can amplify market trends, creating a feedback loop where online hype fuels further price increases. While this can lead to rapid price appreciation, it can also create a volatile and unpredictable market environment.

“The meme economy has created a new paradigm in which online communities can exert significant influence on market trends. This can lead to both positive and negative outcomes, depending on the nature of the meme and the collective action it inspires.”

- Increased Volatility: The Gamestop saga demonstrated how meme-driven market movements can create significant price fluctuations. The rapid rise and fall of the stock price illustrated the potential for meme culture to create unpredictable and volatile market conditions.

- Retail Investor Empowerment: The Gamestop saga also showed how meme culture can empower retail investors. By leveraging online platforms and social media, retail investors were able to coordinate their actions and challenge the dominance of institutional investors. This highlights the potential for meme culture to democratize access to financial markets and challenge traditional power structures.

- Regulatory Challenges: The Gamestop saga also raised regulatory challenges. The rapid rise of meme-driven market movements highlighted the need for regulators to adapt to the evolving landscape of online finance and consider the potential for market manipulation through meme culture.

Ethical and Legal Implications

The Gamestop saga raised significant ethical and legal questions, prompting a critical examination of the interplay between online communities, financial markets, and regulatory frameworks. This case highlighted the potential for coordinated action within online communities to manipulate stock prices, leading to both financial gains for some and substantial losses for others.

Ethical Implications of Stock Price Manipulation

The ethical implications of manipulating stock prices through online communities are complex and multifaceted. While some argue that the “4chan user” actions were simply a case of free market forces at play, others contend that the coordinated effort to inflate Gamestop’s stock price constituted unethical behavior.

- Unfair Advantage: The coordinated effort to inflate Gamestop’s stock price gave a small group of individuals an unfair advantage over other investors. This advantage allowed them to profit at the expense of those who were unaware of the manipulation or who were unable to participate in it.

- Market Instability: The volatile swings in Gamestop’s stock price created market instability and uncertainty. This instability could have a ripple effect on other companies and industries, potentially leading to broader economic consequences.

- Erosion of Trust: The Gamestop saga could erode public trust in financial markets and institutions. If investors believe that markets are susceptible to manipulation, they may be less likely to participate in them, leading to a decrease in liquidity and efficiency.

Legal Challenges Associated with the Gamestop Case

The legal challenges associated with the “4chan user” actions in the Gamestop case centered around the question of whether their actions constituted market manipulation. While the “4chan user” actions were ultimately deemed legal, the case raised important questions about the application of existing laws to online communities and the potential need for new regulations.

- Market Manipulation: The Securities and Exchange Commission (SEC) defines market manipulation as “any act or course of conduct that creates an artificial price for a security or that results in a price that does not reflect the true value of the security.” While the “4chan user” actions did not explicitly involve false or misleading information, some argue that the coordinated effort to inflate Gamestop’s stock price was inherently manipulative.

- Insider Trading: Insider trading occurs when someone uses non-public information to buy or sell securities. While the “4chan user” actions were not based on insider information, the coordinated effort to inflate Gamestop’s stock price could be viewed as a form of “insider trading” by proxy, as the group effectively had access to information that was not publicly available.

- Fraud: Fraudulent activity involves intentionally deceiving others for personal gain. While the “4chan user” actions were not necessarily fraudulent, the coordinated effort to inflate Gamestop’s stock price could be viewed as a form of “fraud” if the group intentionally misled others about the true value of Gamestop’s stock.

Potential Impact on Future Regulations and Online Behavior

The Gamestop saga has prompted discussions about the need for new regulations to address the potential for online communities to manipulate financial markets. Some argue that existing laws are sufficient to address these concerns, while others contend that new regulations are necessary to ensure fair and orderly markets.

- Regulation of Online Communities: One potential area of regulation is the oversight of online communities that engage in financial activities. This could involve requiring online platforms to monitor for and prevent coordinated efforts to manipulate stock prices.

- Increased Transparency: Another potential area of regulation is increased transparency in financial markets. This could involve requiring investors to disclose their positions and intentions, making it more difficult for online communities to coordinate their actions without detection.

- Enhanced Enforcement: Increased enforcement of existing laws is another potential solution. This could involve the SEC taking a more proactive approach to investigating and prosecuting cases of market manipulation.

The Impact on Online Culture

The Gamestop saga had a profound impact on online culture, demonstrating the power of collective action and meme-driven movements. The event showcased how online communities can mobilize quickly, influence financial markets, and challenge traditional power structures.

Online Communities Involved in the Gamestop Saga

The Gamestop saga involved a diverse range of online communities, each contributing to the phenomenon in unique ways.

| Community Name | Size (Estimated) | Primary Purpose |

|---|---|---|

| Reddit (r/WallStreetBets) | Over 10 million subscribers | Financial discussion and meme culture, particularly focused on investing in meme stocks |

| 4chan | Millions of users | Anonymous online forum known for its meme culture and often controversial discussions |

| Over 330 million monthly active users | Social media platform where users share news, opinions, and memes, often engaging in real-time discussions | |

| Discord | Over 350 million monthly active users | Communication platform used by online communities for group chats, voice calls, and file sharing |

The Gamestop saga highlighted the interconnectedness of these online communities and their ability to amplify each other’s messages. The rapid spread of information, memes, and strategies across these platforms fueled the movement, demonstrating the power of collective action in the digital age.

The Future of Online Finance

The Gamestop saga, while seemingly a quirky internet phenomenon, has fundamentally altered the landscape of online finance. The event has accelerated the adoption of online investing platforms, fueled the rise of social media-driven financial communities, and challenged the traditional power dynamics between retail investors and Wall Street. This confluence of factors paints a compelling picture of a future where online finance will be profoundly shaped by the forces unleashed by the Gamestop saga.

The Evolution of Online Finance and Social Media

The evolution of online finance is inextricably linked to the rise of social media. This evolution can be depicted as a timeline that showcases the growing influence of social media in shaping financial decisions:

- Early Days (1990s-Early 2000s): The internet ushered in online brokerage platforms, offering convenience and accessibility. However, financial information remained largely confined to traditional media outlets.

- The Rise of Social Media (Mid-2000s-2010s): The emergence of social media platforms like Twitter and Facebook facilitated the sharing of financial news and opinions. Financial blogs and forums started gaining traction, creating online communities for investors.

- The Era of Social Trading (2010s-Present): Social trading platforms emerged, enabling investors to follow and copy the trades of experienced traders. The rise of social media influencers in the financial sphere further amplified the impact of social media on investment decisions.

- The Gamestop Era (2021-Present): The Gamestop saga marked a watershed moment. Social media played a pivotal role in mobilizing retail investors, demonstrating the power of online communities in influencing market movements.

The Role of Online Communities in Shaping Financial Trends

Online communities are playing an increasingly significant role in shaping financial trends. These communities serve as platforms for:

- Information Sharing and Dissemination: Online communities facilitate the rapid dissemination of financial information, enabling investors to access a diverse range of perspectives and insights.

- Collective Action and Mobilization: The Gamestop saga demonstrated the power of online communities to coordinate collective action, influencing market movements and challenging established financial institutions.

- Peer-to-Peer Learning and Mentorship: Online communities provide platforms for investors to learn from each other, share strategies, and receive mentorship from experienced traders.

- Investment Research and Due Diligence: Online communities often engage in collaborative research, analyzing companies and identifying investment opportunities.

The Gamestop Saga’s Influence on Future Interactions

The Gamestop saga has fundamentally altered the relationship between retail investors and financial institutions. This event has:

- Empowered Retail Investors: The saga demonstrated the collective power of retail investors to influence market movements, challenging the traditional narrative of Wall Street dominance.

- Increased Scrutiny of Financial Institutions: The saga has prompted increased scrutiny of the practices of financial institutions, highlighting potential conflicts of interest and market manipulation.

- Fueled the Adoption of Decentralized Finance (DeFi): The saga has accelerated the adoption of decentralized finance (DeFi) platforms, which aim to create a more transparent and accessible financial system.

4chan user allegedly turns gamestop into their own private bank – The Gamestop saga serves as a stark reminder of the evolving relationship between online communities, financial markets, and the potential for disruption in the digital age. The “4chan user” and their online brethren have demonstrated the power of collective action and the ability to leverage internet culture to influence the stock market. This event has forced regulators, financial institutions, and investors alike to grapple with the implications of online finance and the challenges of managing the meme economy. The future of finance will likely be shaped by the interplay of these forces, as online communities continue to evolve and influence the markets in unexpected ways.

Remember that time a 4chan user allegedly turned GameStop into their own private bank? Talk about a power move! But honestly, even the most ambitious internet troll wouldn’t be able to pull that off without some serious tech skills. Maybe they’re running a custom SiriKit setup on iOS 11.2 beta to control their stock trades? Whatever their method, that 4chan user’s GameStop scheme is definitely a story for the ages.

Standi Techno News

Standi Techno News