Amazon adds paypal as a payment option to buy with prime – Amazon Adds PayPal: Prime Shopping Gets Easier. This move is a game-changer for both Amazon Prime members and PayPal users. It opens up a whole new world of convenience and flexibility, potentially altering the way we shop online. Imagine this: you’re browsing Amazon, eyeing that new gadget you’ve been wanting, but you’re short on credit card funds. Now, you can simply click, pay with your trusted PayPal account, and get your purchase delivered with Prime speed. But what does this mean for the future of online shopping, and how will it impact the competition?

This partnership could be a major boost for Amazon’s already dominant position in the e-commerce market. By offering PayPal as a payment option, Amazon is catering to a wider range of consumers who may prefer to use alternative payment methods. This could lead to increased sales and customer satisfaction, potentially even attracting new users who were previously hesitant to shop on Amazon. On the other hand, PayPal could see a surge in its user base and transaction volume, as it gains access to Amazon’s massive customer pool.

Impact on Amazon Prime Members: Amazon Adds Paypal As A Payment Option To Buy With Prime

The addition of PayPal as a payment option for Amazon Prime members could significantly impact their shopping experience and potentially reshape their purchasing patterns. This change allows Prime members greater flexibility and convenience, which could lead to increased engagement with the platform.

Potential Benefits for Prime Members

The integration of PayPal offers Prime members several advantages, including:

- Enhanced Payment Flexibility: Prime members can now choose from a wider range of payment options, including PayPal, which can be particularly appealing to those who prefer not to use credit cards or who have existing PayPal balances. This added flexibility could encourage more Prime members to make purchases on Amazon.

- Increased Security: PayPal offers an extra layer of security for online transactions, as users don’t need to share their credit card details directly with Amazon. This could attract security-conscious shoppers and increase their confidence in making purchases on the platform.

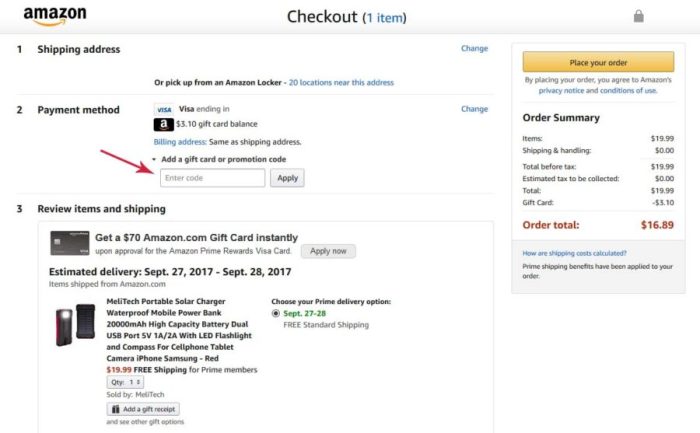

- Simplified Checkout Process: For Prime members who already have a PayPal account, the checkout process becomes more streamlined, as they can complete their purchases with just a few clicks. This convenience could lead to faster and more efficient shopping experiences, potentially encouraging impulsive purchases.

Influence on Shopping Behavior and Purchasing Patterns

The introduction of PayPal could potentially influence Prime members’ shopping behavior and purchasing patterns in several ways:

- Increased Purchase Frequency: The added convenience and security offered by PayPal could lead to an increase in purchase frequency among Prime members. With a streamlined checkout process and the option to use existing PayPal funds, they might be more inclined to make spontaneous purchases or smaller purchases that they might have previously hesitated to make.

- Shift in Spending Habits: The availability of PayPal as a payment option could also influence Prime members’ spending habits. Some members who previously avoided certain purchases due to payment preferences might now be more likely to make those purchases, leading to an overall increase in spending on the platform.

- Enhanced Loyalty: By providing a wider range of payment options and a more convenient checkout experience, Amazon could potentially increase customer satisfaction and loyalty among Prime members. This could translate into a higher retention rate for Prime memberships and a stronger brand affinity.

Potential Impact on Customer Satisfaction and Loyalty

The integration of PayPal could significantly impact customer satisfaction and loyalty among Prime members:

- Increased Convenience and Satisfaction: Offering PayPal as a payment option can significantly improve the overall shopping experience for Prime members. The convenience and security offered by PayPal could lead to increased customer satisfaction and a more positive perception of the Amazon Prime membership.

- Enhanced Brand Perception: By providing a wider range of payment options, Amazon demonstrates its commitment to customer satisfaction and its willingness to adapt to evolving customer preferences. This could enhance the brand’s perception among Prime members, making them more likely to recommend Amazon to others.

- Strengthened Customer Loyalty: By addressing the payment preferences of a wider customer base, Amazon can strengthen its relationship with Prime members and increase their loyalty to the platform. This could translate into increased customer retention and a more robust Prime membership base.

Competition and Market Dynamics

Amazon’s integration of PayPal as a payment option within its Prime ecosystem signifies a strategic move to enhance its competitive edge in the e-commerce landscape. This decision directly impacts the dynamics of the online retail market, particularly in relation to major players like eBay and Walmart.

Impact on Competitive Landscape

Amazon’s move to incorporate PayPal as a payment option for Prime members represents a significant shift in the e-commerce landscape. This integration allows Amazon to tap into a broader customer base that prefers PayPal as their preferred payment method, potentially attracting new users and increasing customer loyalty. This move also puts pressure on other e-commerce giants like eBay and Walmart to adapt their payment strategies.

eBay, known for its wide range of payment options, including PayPal, has long relied on its diverse payment ecosystem to attract a diverse customer base. However, Amazon’s move could potentially shift consumer preferences towards platforms that offer a more streamlined and integrated shopping experience. Walmart, on the other hand, has been actively investing in its online presence and payment options, including its own Walmart Pay service. However, Walmart’s focus on its own payment system might limit its appeal to customers who prefer the convenience and familiarity of PayPal.

The integration of PayPal into Amazon Prime could potentially lead to a shift in consumer preferences towards platforms that offer a more seamless and integrated shopping experience, putting pressure on other e-commerce giants to adapt their payment strategies.

Impact on Consumer Choices and Preferences

The availability of PayPal as a payment option within Amazon Prime could significantly influence consumer choices and preferences in the online retail market. This move addresses a key pain point for many consumers who prefer the security and convenience of PayPal over traditional credit card payments.

- Increased Convenience: PayPal’s user-friendly interface and secure payment processing system simplify the checkout process, reducing friction and enhancing the overall shopping experience.

- Enhanced Security: PayPal offers a robust security system that protects consumers’ financial information, minimizing the risk of fraud and unauthorized transactions.

- Wider Reach: PayPal’s global reach allows Amazon to tap into a broader customer base, particularly in regions where credit card penetration is lower.

These benefits could potentially lead to increased adoption of Amazon Prime, as consumers are drawn to the platform’s expanded payment options and streamlined shopping experience.

PayPal’s Perspective

For PayPal, the integration with Amazon Prime is a strategic move that promises significant benefits. By becoming a preferred payment method for Prime members, PayPal gains access to a massive and loyal customer base, potentially boosting its user base and revenue streams.

Market Reach and User Base Expansion

This partnership presents a golden opportunity for PayPal to significantly expand its market reach and user base. Amazon Prime boasts over 200 million subscribers globally, providing PayPal with a vast pool of potential new customers. By integrating with Prime, PayPal becomes a convenient and familiar option for millions of Amazon shoppers, enhancing its brand visibility and increasing its adoption rate. This increased user base can lead to higher transaction volume, ultimately driving revenue growth.

Impact on Revenue Streams

The integration is expected to positively impact PayPal’s revenue streams in several ways:

- Increased Transaction Volume: With a larger user base and increased convenience, PayPal can expect a surge in transaction volume. Prime members, known for their frequent purchases, are likely to use PayPal more often, leading to higher revenue from transaction fees.

- Enhanced Merchant Partnerships: The integration with Amazon could encourage other major online retailers to adopt PayPal as a preferred payment method. This would expand PayPal’s merchant network, further boosting transaction volume and revenue.

- New Revenue Streams: The partnership could open doors to new revenue streams for PayPal. For example, Amazon might offer exclusive deals or promotions to Prime members who use PayPal, generating additional revenue for the company.

Security and User Experience

The integration of PayPal into Amazon’s platform presents both opportunities and challenges regarding security and user experience. This move could potentially strengthen Amazon’s security posture while offering a more seamless payment experience for customers. However, it also raises concerns about potential vulnerabilities and the need to ensure a smooth transition for existing users.

Security Implications of Integration

The integration of PayPal into Amazon’s platform presents a complex security landscape, requiring a thorough analysis of potential vulnerabilities and mitigation strategies.

- Data Security: Integrating two vast systems like Amazon and PayPal necessitates careful consideration of data security. Both platforms hold sensitive customer information, including financial details and personal data. Ensuring the secure transfer and storage of this data is paramount to prevent breaches and maintain user trust.

- Authentication and Authorization: The integration should seamlessly integrate existing authentication and authorization mechanisms from both platforms. This includes ensuring that user accounts are properly linked and that access controls are robust to prevent unauthorized transactions.

- Fraud Prevention: Integrating PayPal’s sophisticated fraud detection mechanisms with Amazon’s existing security measures can significantly enhance the platform’s overall fraud prevention capabilities.

User Experience Enhancement, Amazon adds paypal as a payment option to buy with prime

The integration of PayPal into Amazon’s platform has the potential to enhance the user experience for both Amazon and PayPal customers.

- Faster Checkout: PayPal’s existing user base and streamlined checkout process can potentially accelerate the checkout experience for Amazon customers. This is particularly beneficial for users who already have a PayPal account and prefer to avoid entering their credit card details repeatedly.

- Increased Payment Options: Integrating PayPal expands the range of payment options available to Amazon customers. This could be especially attractive to customers who prefer using PayPal for its security features, buyer protection, and convenience.

- Improved Customer Service: The integration could streamline customer service for both Amazon and PayPal users. Customers can potentially contact either platform for support related to payments, returns, or other issues, potentially simplifying the process and improving overall customer satisfaction.

Challenges and Risks

While the integration of PayPal into Amazon’s platform offers potential benefits, it also presents several challenges and risks that require careful consideration.

- Compatibility Issues: Integrating two complex systems can lead to compatibility issues, particularly if there are differences in data formats, APIs, or security protocols. Thorough testing and coordination between the two platforms are essential to ensure seamless integration and avoid disruptions to user experience.

- Data Privacy Concerns: Integrating PayPal into Amazon’s platform raises data privacy concerns. Customers might be hesitant to share their data with both platforms, especially if they are not fully aware of how their information will be used or shared. Transparency and clear communication about data handling practices are crucial to maintain user trust.

- Security Vulnerabilities: Integrating two systems can potentially introduce new security vulnerabilities. Attackers could exploit potential weaknesses in the integration process to gain access to sensitive data or disrupt services.

Future Implications

The integration of PayPal as a payment option on Amazon Prime marks a significant shift in the e-commerce landscape. This partnership has the potential to reshape the future of online shopping for both Amazon and PayPal, creating new opportunities and challenges.

Potential Long-Term Impact

This partnership is likely to have a profound impact on both companies in the long term. Amazon can leverage PayPal’s vast user base, particularly in regions where Amazon’s own payment methods are less popular. This could lead to increased customer acquisition and market share for Amazon. Conversely, PayPal gains access to Amazon’s massive customer base and Prime membership network, expanding its reach and driving transaction volume.

Potential Future Developments

This partnership could pave the way for further collaborations between Amazon and PayPal. For example, they might explore joint marketing initiatives to target specific customer segments or develop new features that integrate seamlessly with both platforms. The integration could also lead to the development of innovative payment solutions that leverage the strengths of both companies, such as a combined loyalty program or personalized payment options.

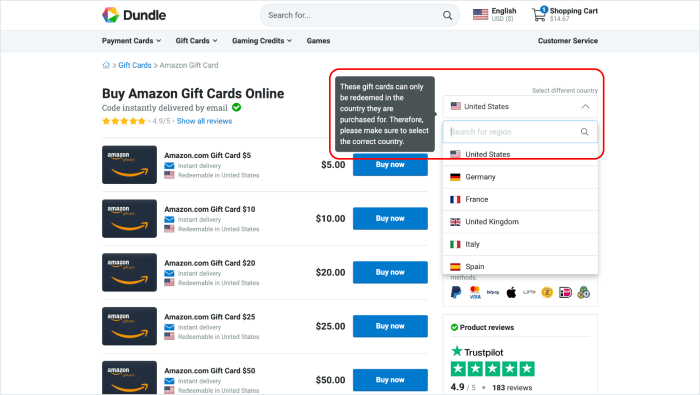

Other Payment Options

The addition of PayPal to Amazon’s platform suggests a potential trend towards greater payment flexibility for online shoppers. This could lead to Amazon incorporating other popular payment methods, such as cryptocurrencies or alternative digital wallets, to cater to evolving consumer preferences. This strategy would enhance Amazon’s competitive edge by offering a wider range of payment options to its customers.

Amazon’s integration of PayPal is a strategic move that signals a shift towards a more inclusive and customer-centric approach to online shopping. This partnership not only benefits both companies but also empowers consumers with greater flexibility and convenience. As the e-commerce landscape continues to evolve, this move could set a precedent for future collaborations between major players in the industry, potentially leading to a more diverse and competitive market for online retail.

Amazon’s decision to add PayPal as a payment option for Prime purchases is a game-changer for online shopping, giving customers more flexibility. This move comes on the heels of Home Depot’s plan to support Apple Pay in over 2,000 stores , showcasing a trend toward embracing diverse payment methods. Whether you’re browsing for tools or ordering online, it seems like more options are becoming available to make shopping a breeze.

Standi Techno News

Standi Techno News