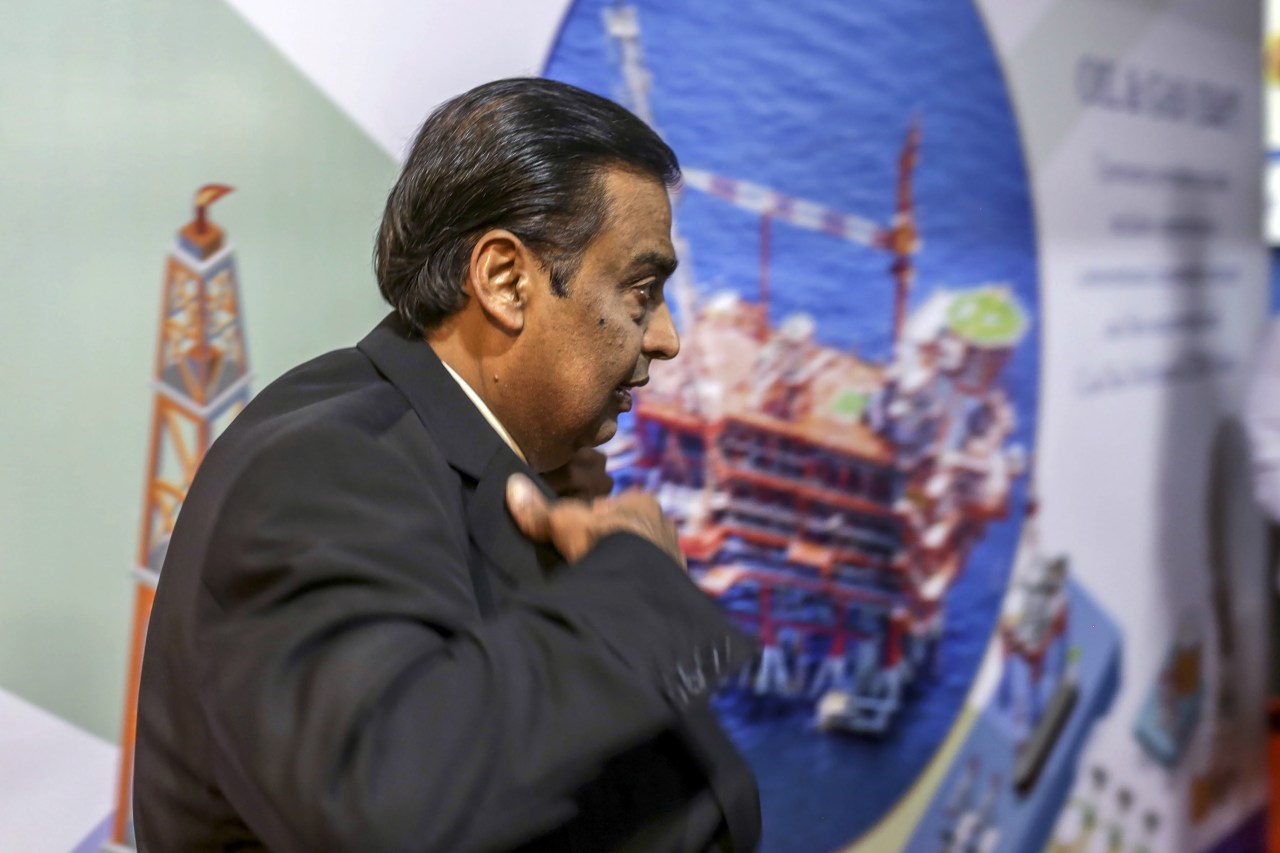

Ambani fires opening salvo in fintech battle launches jiofinance app – Ambani Fires Opening Salvo in Fintech Battle, Launches JioFinance App. The Indian tech giant, Reliance Industries, has taken a significant step into the burgeoning fintech market with the launch of its new app, JioFinance. This move marks a major shift in the Indian financial landscape, potentially shaking up the existing players and introducing a new wave of digital financial services.

JioFinance aims to offer a comprehensive suite of financial products and services, including payments, lending, insurance, and investment options. The app is designed to be user-friendly and accessible to a wide range of users, particularly those who are not currently served by traditional financial institutions.

Ambani’s Move into Fintech: Ambani Fires Opening Salvo In Fintech Battle Launches Jiofinance App

Reliance Industries, under the leadership of Mukesh Ambani, has made a significant move into the Indian fintech market with the launch of Jio Financial Services (JioFS). This move signifies a major shift in the Indian financial landscape and has the potential to reshape the fintech ecosystem.

The Competitive Landscape of the Indian Fintech Sector

The Indian fintech sector is a rapidly growing market with a diverse range of players. From established giants like Paytm and PhonePe to newer entrants like CRED and Razorpay, the sector is characterized by intense competition. The market is also attracting significant investments, with venture capitalists and private equity firms pouring money into promising startups.

- Payment Gateways: Players like Paytm, PhonePe, Google Pay, and Amazon Pay dominate the digital payments space, facilitating seamless transactions through mobile wallets and UPI.

- Lending Platforms: Fintech companies like CRED, ZestMoney, and MoneyTap are offering innovative lending solutions, catering to diverse needs like personal loans, credit lines, and buy-now-pay-later options.

- Investment Platforms: Companies like Groww, Zerodha, and Upstox have disrupted the investment landscape, providing accessible platforms for stock trading, mutual funds, and other investment instruments.

- Insurance Tech: Policybazaar, Acko, and RenewBuy are simplifying the insurance process by offering online platforms for comparing and purchasing policies.

The Potential Impact of JioFinance

JioFS’s entry into the market is expected to have a significant impact on the existing fintech ecosystem. The company leverages Reliance’s vast customer base, robust infrastructure, and strong brand reputation to offer a wide range of financial services.

- Increased Competition: JioFS’s entry will intensify competition in the market, pushing existing players to innovate and offer more competitive products and services.

- Financial Inclusion: JioFS aims to provide financial services to underserved populations, leveraging Reliance’s vast network and infrastructure to reach remote areas.

- Digital Transformation: JioFS’s focus on digital innovation and technology could accelerate the adoption of digital financial services in India.

“Jio Financial Services is poised to be a game-changer in the Indian fintech landscape, offering a comprehensive suite of financial services to millions of users,” said Mukesh Ambani.

Features and Functionality of JioFinance

JioFinance is a comprehensive fintech platform that aims to provide a wide range of financial services to Indian users. It is a one-stop shop for all your financial needs, offering everything from digital payments to investment options. The app leverages the vast user base of Reliance Jio, a leading telecom operator in India, and aims to tap into the growing digital financial services market.

Key Features and Services Offered by JioFinance

JioFinance offers a diverse range of financial services, aiming to cater to the various needs of its users. Here’s a breakdown of some of the key features:

- Digital Payments: JioFinance allows users to make seamless payments through UPI, a widely adopted mobile-based payment system in India. This enables users to send and receive money, pay bills, and make online purchases with ease.

- Financial Products: The platform provides access to a range of financial products, including savings accounts, loans, insurance, and investment options. This allows users to manage their finances effectively and make informed decisions about their financial future.

- Investment Services: JioFinance offers investment services, including mutual funds, stocks, and other financial instruments. Users can invest in these instruments through the app, with the aim of building a portfolio that aligns with their financial goals.

- Credit Facility: JioFinance offers a credit facility, enabling users to access short-term loans and credit lines. This feature aims to provide users with financial flexibility and help them meet their immediate financial needs.

- Financial Management Tools: The app includes financial management tools that help users track their spending, set budgets, and analyze their financial health. These tools provide users with valuable insights into their financial habits and help them make informed financial decisions.

Comparison with Other Popular Fintech Platforms in India

JioFinance competes with several other popular fintech platforms in India, each with its own strengths and weaknesses. Here’s a comparison with some of the leading players:

| Feature | JioFinance | Paytm | PhonePe | Google Pay |

|---|---|---|---|---|

| Digital Payments | Yes | Yes | Yes | Yes |

| Financial Products | Yes | Yes | Yes | No |

| Investment Services | Yes | Yes | Yes | No |

| Credit Facility | Yes | Yes | No | No |

| User Base | Large (Reliance Jio users) | Very large | Very large | Very large |

JioFinance stands out due to its integration with the Reliance Jio ecosystem, which gives it access to a vast user base. It also offers a comprehensive range of financial services, including credit facilities, which are not available on all other platforms. However, other platforms like Paytm and PhonePe have a larger user base and are more established in the market.

User Experience and Interface of the JioFinance App

JioFinance aims to provide a user-friendly and intuitive experience. The app features a clean and straightforward interface, making it easy for users to navigate and access the services they need. It also incorporates features like personalized recommendations and financial insights to enhance the user experience. The app is available on both Android and iOS platforms, ensuring accessibility for a wide range of users.

Ambani’s Strategic Goals

Reliance Jio’s foray into the fintech space with JioFinance is a strategic move aimed at expanding Reliance Industries’ (RIL) digital footprint and diversifying its revenue streams. Ambani’s vision is to create a comprehensive financial ecosystem within the Jio ecosystem, offering a wide range of financial services to cater to the needs of its vast user base.

Potential Benefits for Reliance Industries

JioFinance has the potential to significantly benefit Reliance Industries in several ways:

- Increased Revenue Streams: By offering a wide range of financial services, JioFinance can generate new revenue streams for RIL, contributing to its overall profitability.

- Strengthened Ecosystem: JioFinance can act as a catalyst for strengthening the entire Reliance ecosystem by providing seamless integration with existing Jio services, enhancing user experience and driving user engagement.

- Enhanced Customer Loyalty: By providing convenient and accessible financial services, JioFinance can increase customer loyalty and reduce churn within the Jio ecosystem.

- Data Monetization: The vast amount of data collected through Jio services can be leveraged by JioFinance to offer personalized financial products and services, further driving revenue growth.

Impact on the Reliance Ecosystem

JioFinance is expected to have a profound impact on the overall Reliance ecosystem, transforming it into a more integrated and financially empowered platform:

- Financial Inclusion: JioFinance aims to bring financial services to millions of underserved and unbanked individuals in India, promoting financial inclusion and economic growth.

- Digital Transformation: JioFinance’s digital-first approach is expected to accelerate the digital transformation of the Indian financial services sector, promoting efficiency and innovation.

- Synergies with Existing Businesses: JioFinance can create synergies with other Reliance businesses, such as retail, telecom, and entertainment, by offering integrated financial solutions.

- Competition in Fintech Market: JioFinance’s entry into the fintech market is expected to intensify competition, driving innovation and improving the overall customer experience in the sector.

Impact on the Indian Financial Landscape

JioFinance’s entry into the Indian financial landscape holds the potential to reshape the country’s financial inclusion and digitalization. The app, backed by the vast reach of Reliance Jio, could have a significant impact on both traditional financial institutions and the way individuals access financial services.

Financial Inclusion

The potential of JioFinance to promote financial inclusion in India is immense. With its user-friendly interface, low-cost services, and access to a wide range of financial products, the app can reach millions of unbanked and underbanked individuals across the country.

- Expanding Access to Financial Services: JioFinance can leverage the vast network of Reliance Jio users, particularly in rural areas, to provide access to essential financial services like savings accounts, microloans, and insurance. This can empower individuals to participate in the formal financial system, enabling them to save, invest, and access credit more easily.

- Digital Literacy and Awareness: The app’s user-friendly interface and educational content can play a crucial role in promoting financial literacy among users. This can help individuals make informed financial decisions, understand the benefits of financial products, and build a strong financial foundation.

- Mobile-First Approach: JioFinance’s mobile-first approach aligns perfectly with the increasing adoption of smartphones in India. This accessibility allows individuals to access financial services anytime, anywhere, further enhancing financial inclusion.

Impact on Traditional Financial Institutions

JioFinance’s entry into the market could pose a significant challenge to traditional financial institutions.

- Competition and Innovation: The app’s focus on providing low-cost, digital-first services can drive competition among traditional banks and financial institutions, forcing them to adapt and innovate to remain relevant. This could lead to improved efficiency, reduced costs, and more customer-centric offerings in the financial sector.

- Shifting Customer Preferences: JioFinance’s user-friendly interface and seamless digital experience can attract a significant customer base, particularly younger demographics. This could lead to a shift in customer preferences, demanding more digital and personalized financial solutions from traditional institutions.

- Partnerships and Collaborations: Traditional financial institutions may need to consider strategic partnerships with JioFinance to leverage its reach and technological capabilities. This could involve co-creating products and services, expanding their customer base, and reaching new segments of the market.

Role in Promoting Digital Financial Services

JioFinance has the potential to accelerate the adoption of digital financial services in India.

- Digital Payment Ecosystem: The app’s integration with JioPay can contribute to the growth of a robust digital payment ecosystem in India. This can encourage the adoption of digital payments for everyday transactions, fostering a more cashless and efficient economy.

- Data-Driven Solutions: JioFinance can leverage the vast data available from its parent company, Reliance Jio, to develop personalized and data-driven financial products and services. This can enhance customer experience and improve financial outcomes for users.

- Financial Inclusion and Empowerment: JioFinance’s focus on financial inclusion can empower individuals to participate in the digital economy, enabling them to access financial services and manage their finances more effectively. This can contribute to a more inclusive and equitable financial system in India.

Future Prospects and Challenges

JioFinance, backed by the formidable Reliance Industries, has the potential to disrupt the Indian fintech landscape. However, it faces significant challenges as it strives to establish itself amidst a crowded and competitive market. This section explores the future prospects of JioFinance and the challenges it might encounter in its quest to achieve dominance.

Future Growth and Development

JioFinance is poised for substantial growth, leveraging Reliance’s extensive user base and existing infrastructure. The platform’s user-friendly interface, combined with Reliance’s brand recognition, could attract a large number of users, particularly in rural and semi-urban areas. The integration of JioFinance with other Reliance platforms, such as JioMart and JioPay, could further enhance its reach and utility. The company’s plans to offer a comprehensive suite of financial products and services, including payments, lending, insurance, and wealth management, could further solidify its position as a one-stop shop for financial needs.

Potential Challenges

While JioFinance holds significant promise, it faces several challenges in its pursuit of success.

- Competition: The Indian fintech market is already highly competitive, with established players like Paytm, PhonePe, and Google Pay dominating the space. JioFinance will need to differentiate itself by offering unique value propositions and superior customer service to attract and retain users.

- Regulatory Landscape: The Indian regulatory environment for fintech companies is constantly evolving, with new rules and regulations being introduced regularly. JioFinance will need to navigate this complex regulatory landscape effectively to ensure compliance and avoid legal issues.

- Building Trust and Credibility: As a new entrant, JioFinance needs to build trust and credibility among users. This will require demonstrating a strong track record of security, reliability, and transparency in its operations.

- Data Security and Privacy: Data security and privacy are paramount concerns in the fintech sector. JioFinance will need to invest heavily in robust security measures to protect user data and maintain their confidence in the platform.

Long-Term Implications for the Indian Economy, Ambani fires opening salvo in fintech battle launches jiofinance app

JioFinance’s success could have significant implications for the Indian economy.

- Financial Inclusion: JioFinance’s focus on providing financial services to underserved populations could contribute to financial inclusion in India. By offering affordable and accessible financial products, it can empower individuals and businesses, particularly in rural areas, to participate in the formal financial system.

- Digital Transformation: JioFinance’s digital-first approach could accelerate the digital transformation of the Indian financial sector. By leveraging technology, it can create innovative solutions and streamline processes, leading to greater efficiency and reduced costs.

- Economic Growth: By facilitating access to credit and other financial services, JioFinance could stimulate economic growth in India. Small and medium-sized enterprises (SMEs), in particular, could benefit from access to affordable financing, enabling them to expand their operations and create new jobs.

Ambani’s foray into fintech with JioFinance signals a major shift in the Indian financial landscape. With its massive user base and deep pockets, Reliance Industries is poised to disrupt the existing players and accelerate the adoption of digital financial services. The future of JioFinance remains to be seen, but its potential impact on financial inclusion and the overall Indian economy is undeniable.

Mukesh Ambani’s Jio Financial Services is throwing down the gauntlet in the fintech arena with its new JioFinance app, hoping to capture a slice of the lucrative Indian market. This move comes as Uber and Nvidia-backed Serve Robotics hits public markets with a $40 million splash , highlighting the growing interest in robotics and automation in the financial sector.

With JioFinance, Ambani aims to provide a comprehensive suite of financial services, challenging established players and setting the stage for an intense battle for market dominance.

Standi Techno News

Standi Techno News