The Dispute’s Context: Apple Fires Back Australian Banks

The Apple Pay dispute with Australian banks is a complex saga that revolves around fees, control, and the future of mobile payments in the country. It’s not just about Apple wanting a bigger slice of the pie; it’s about how the entire financial ecosystem will evolve in the digital age.

The core issue stems from Apple’s desire to charge banks a transaction fee for every Apple Pay transaction processed through their systems. Australian banks, however, are reluctant to accept these fees, arguing that they are unfair and unnecessary. They see it as Apple trying to leverage its dominant position in the mobile payments market to extract profits from their existing infrastructure.

Timeline of Key Events

The Apple Pay dispute with Australian banks has been a simmering conflict for several years. The key events leading up to the current standoff include:

- 2014: Apple Pay launches in the United States. The service is met with enthusiasm, but questions arise about its potential impact on traditional payment systems.

- 2016: Apple Pay launches in Australia. Initially, it enjoys a relatively smooth rollout, with major banks signing on. However, tensions begin to emerge over the fees Apple charges for transactions.

- 2017: The Australian Competition and Consumer Commission (ACCC) begins investigating Apple Pay’s business practices, raising concerns about potential anti-competitive behavior.

- 2019: The Australian Bankers’ Association (ABA) publicly opposes Apple’s fee structure, arguing that it is unsustainable and unfair to consumers.

- 2020: The dispute escalates, with Apple threatening to withdraw Apple Pay from Australia if banks do not agree to its terms. This move sparks public debate and raises concerns about the potential impact on consumers.

- 2021: Apple and Australian banks remain at an impasse, with both sides refusing to budge. The situation remains unresolved, with the potential for a protracted legal battle.

Apple’s Perspective

Apple argues that Australian banks are hindering innovation and competition in the digital payments ecosystem by refusing to adopt a more open and interoperable approach. Apple believes that consumers should have the freedom to choose their preferred payment method, including Apple Pay, without facing unnecessary restrictions.

Apple’s Stance on the Role of Banks in the Digital Payments Ecosystem

Apple emphasizes that banks play a crucial role in facilitating digital payments, but they should not be allowed to stifle competition or dictate the terms of the digital payments landscape. Apple believes that the banking industry should embrace open standards and interoperability to enable a more inclusive and competitive payments environment.

“We believe that the banking industry has a responsibility to support innovation and competition in the digital payments ecosystem. Consumers should have the freedom to choose their preferred payment method, and banks should not be allowed to hinder this choice.” – Apple spokesperson

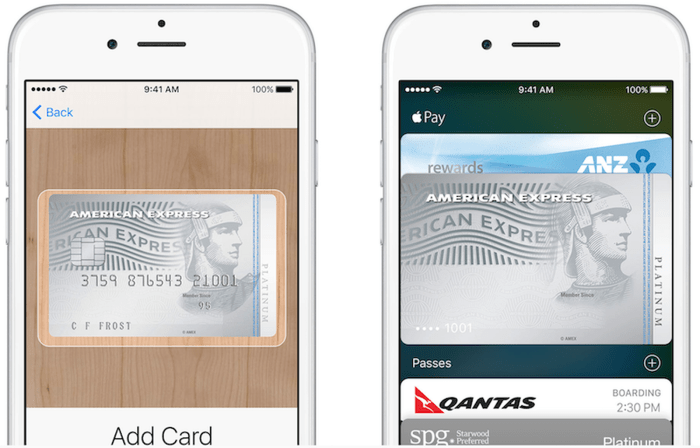

Apple’s Efforts to Promote Apple Pay in Australia

Apple has made significant efforts to promote Apple Pay in Australia, including partnering with major retailers and merchants. However, the lack of support from Australian banks has hampered the widespread adoption of Apple Pay in the country. Apple has also engaged in discussions with Australian regulators to address the issues surrounding the adoption of digital payment solutions.

- Apple has partnered with major retailers such as Woolworths, Coles, and Kmart to enable Apple Pay at their stores.

- Apple has also worked with transit authorities in major cities to integrate Apple Pay into public transportation systems.

- Apple has actively engaged with the Australian Competition and Consumer Commission (ACCC) to advocate for a more open and competitive payments environment.

Australian Banks’ Perspective

The Australian banks, naturally, have a different view on the Apple Pay dispute. They see Apple’s demands as a threat to their business model and a move that could significantly impact their bottom line. They argue that Apple is trying to gain control over the payment ecosystem, and their actions could stifle competition and innovation.

Concerns Regarding Apple Pay’s Impact, Apple fires back australian banks

The Australian banks are concerned about the potential impact of Apple Pay on their business. They fear that Apple’s platform could attract customers away from their existing services, leading to a loss of revenue and market share. They are also worried about the potential for Apple to collect valuable data about their customers, which could be used to gain an unfair advantage in the market.

“We believe that Apple’s demands are unreasonable and will ultimately harm competition and innovation in the Australian payments market,” said a spokesperson for the Australian Bankers’ Association.

Arguments Against Apple’s Demands

The banks argue that Apple’s demands are unreasonable and unfair. They point out that Apple is already charging them a hefty commission for every transaction processed through Apple Pay. They also argue that Apple is attempting to dictate the terms of their relationship, which could lead to a situation where the banks are forced to comply with Apple’s demands or risk losing access to the platform.

- Excessive Transaction Fees: The banks argue that Apple’s transaction fees are exorbitant and that they are not justified by the value Apple provides. They believe that Apple is using its dominant market position to extract excessive profits from the Australian banking industry.

- Control Over Data: The banks are also concerned about Apple’s control over customer data. They argue that Apple could use this data to gain an unfair advantage in the market, potentially offering targeted services or products that could undermine the banks’ own offerings.

- Stifling Innovation: The banks believe that Apple’s demands could stifle innovation in the Australian payments market. They argue that Apple’s control over the payment ecosystem could discourage other players from entering the market, leading to a less competitive and less dynamic environment.

Regulatory Landscape

The Australian government plays a crucial role in shaping the outcome of the dispute between Apple and the Australian banks. The government’s regulatory policies and actions will directly influence the way both parties conduct their business and potentially determine the direction of the dispute.

The Australian Competition and Consumer Commission (ACCC) is the primary regulator responsible for overseeing competition and consumer protection in Australia. The ACCC has the power to investigate potential breaches of competition law, including those related to anti-competitive practices, and can impose penalties on companies found to be in violation.

Role of the ACCC

The ACCC’s role in the Apple-banks dispute is multifaceted. It’s tasked with ensuring that consumers are not being disadvantaged by the actions of either party. The ACCC will likely be monitoring the situation closely, particularly regarding any potential anti-competitive practices or unfair treatment of consumers.

“The ACCC will be closely monitoring the situation to ensure that consumers are not being disadvantaged by the actions of either party.”

Relevant Regulations

Several Australian regulations could potentially influence the outcome of the dispute. These include:

- The Competition and Consumer Act 2010 (Cth), which prohibits anti-competitive conduct, including price fixing, market sharing, and exclusive dealing. This act could be relevant if Apple is found to be engaging in practices that limit competition within the Australian market.

- The Australian Consumer Law, which protects consumers from unfair business practices, including misleading or deceptive conduct. This law could be relevant if Apple’s actions are deemed to be misleading consumers about the availability or functionality of its products.

- The Payment Systems (Regulation) Act 1998, which regulates the payment systems industry in Australia. This act could be relevant if the dispute involves issues related to the processing of payments or the use of payment systems.

Potential for Government Intervention

The Australian government could intervene in the dispute in various ways, depending on the specific circumstances. This could include:

- Launching an investigation into potential breaches of competition law.

- Imposing sanctions or penalties on companies found to be in violation of regulations.

- Introducing new legislation or policies to address the issues raised by the dispute.

International Comparisons

The Australian Apple Pay dispute provides a valuable lens through which to examine how similar situations have unfolded in other countries. By comparing the regulatory environments and bank responses in different markets, we can gain a deeper understanding of the factors that have influenced the outcome of Apple Pay’s global expansion.

Regulatory Environments and Bank Responses

The regulatory environment for mobile payments varies significantly across countries. Some countries, like the United States, have a more open and competitive market, while others, like Australia, have a more concentrated banking sector with stricter regulations. These differences have a direct impact on how banks respond to the introduction of new payment technologies.

- United States: In the United States, Apple Pay faced relatively little resistance from banks. The US market is characterized by a large number of banks and credit card companies, leading to greater competition and a more open approach to new technologies. Banks quickly adopted Apple Pay, recognizing its potential to attract customers and enhance their mobile offerings.

- Europe: The European Union (EU) has adopted a more standardized approach to mobile payments, with regulations designed to ensure interoperability and consumer protection. This has facilitated the adoption of Apple Pay and other mobile payment systems across the EU, though there have been some challenges related to data privacy and security.

- China: China’s mobile payment market is dominated by domestic players like Alipay and WeChat Pay. These platforms have established a strong presence and are deeply integrated into the country’s digital economy. While Apple Pay has made some inroads in China, it faces stiff competition from these established players.

International Precedents

The Australian Apple Pay dispute has parallels with similar situations in other countries. In the United Kingdom, for example, banks initially resisted the introduction of Apple Pay, citing concerns about security and cost. However, after negotiations with Apple and the UK government, banks eventually adopted Apple Pay. This experience provides a precedent that could influence the outcome of the Australian dispute.

Future Implications

The Apple Pay-Australian banks dispute, while seemingly focused on fees, has far-reaching implications for the future of digital payments in Australia and the relationship between tech giants and financial institutions. This dispute is a microcosm of the broader tension between established players and innovative tech companies in the financial landscape.

Impact on Digital Payments

The dispute highlights the growing influence of technology companies in the financial sector. Apple’s push for a greater share of the transaction fees emphasizes the potential for technology giants to disrupt traditional payment systems. The dispute could accelerate the adoption of alternative payment methods, potentially leading to:

- Increased competition in the digital payments space, driving innovation and potentially lowering fees for consumers.

- A shift towards open banking, allowing consumers to control their financial data and choose from a wider range of payment options.

- Greater transparency and accountability in the payment processing system, as consumers become more aware of the fees associated with different payment methods.

Evolution of Apple-Banks Relationship

The dispute could reshape the relationship between Apple and Australian banks, leading to:

- A more adversarial relationship, with both parties vying for control over the payment ecosystem.

- Increased collaboration, with Apple and banks finding ways to work together to create a more seamless and secure payment experience for consumers.

- A shift in power dynamics, with Apple potentially gaining more leverage in negotiations with banks.

Apple fires back australian banks – The Apple Pay versus Australian banks showdown is far from over. The battle lines are drawn, and the outcome will likely shape the digital payments landscape in Australia for years to come. Will Apple Pay succeed in conquering the Aussie market, or will the banks manage to hold their ground? Only time will tell, but one thing’s for sure: the future of money in Australia is about to get a whole lot more interesting.

Apple’s fight with Australian banks is heating up, but while they’re busy battling over fees, Sony is keeping the gaming world buzzing with news. Sony confirms playstation 4 neo event will be live streamed , so gamers can catch all the action live, just like Apple wants their customers to catch every detail of their latest banking feature.

Looks like both companies are playing their own game, and we’re all just spectators waiting to see who wins.

Standi Techno News

Standi Techno News