Apple’s Market Capitalization: Apple Market Cap 900 Billion

Apple’s market capitalization reaching $900 billion is a significant milestone, reflecting the company’s enduring success and its position as a global tech leader. This achievement underscores Apple’s ability to consistently innovate, maintain strong brand loyalty, and deliver exceptional financial performance.

Factors Contributing to Apple’s Market Cap Growth

Apple’s market cap growth is attributed to a confluence of factors, including:

- Product Innovation: Apple has a long history of introducing groundbreaking products like the iPhone, iPad, and Apple Watch, which have revolutionized their respective markets. These innovations have consistently driven demand and boosted the company’s revenue and profitability.

- Strong Brand Loyalty: Apple has cultivated a loyal customer base through its user-friendly products, seamless ecosystem, and premium brand image. This loyalty translates into high customer retention rates and repeat purchases, supporting Apple’s long-term growth.

- Financial Performance: Apple consistently generates robust revenue and profits, driven by its strong product sales and efficient operations. This financial strength provides investors with confidence in the company’s long-term prospects and contributes to its high market valuation.

- Global Expansion: Apple has expanded its operations and market reach across the globe, tapping into new markets and customer segments. This global presence has broadened the company’s revenue streams and contributed to its market cap growth.

Comparison with Other Tech Giants

Apple’s $900 billion market cap places it among the world’s most valuable companies. It surpasses other tech giants like Microsoft and Amazon, showcasing Apple’s dominant position in the industry.

| Company | Market Cap (USD Billion) |

|---|---|

| Apple | 900+ |

| Microsoft | 2.00+ |

| Amazon | 1.20+ |

Key Drivers of Apple’s Market Cap

Apple’s market cap is driven by a combination of factors, including:

- Product Innovation: Apple’s continuous introduction of new products and features, such as the iPhone’s advanced camera capabilities and the Apple Watch’s health tracking features, keeps customers engaged and drives demand.

- Brand Loyalty: Apple’s brand loyalty is a significant driver of its market cap. Customers are willing to pay a premium for Apple products due to their perceived quality, design, and user experience.

- Financial Performance: Apple’s strong financial performance, characterized by consistent revenue growth and high profitability, instills confidence in investors and contributes to its high valuation.

Apple’s Financial Performance

Apple’s financial performance has been consistently strong, reflecting the company’s dominance in the technology sector and its ability to innovate and adapt to changing market trends.

Revenue Growth and Key Business Segments

Apple’s revenue has grown steadily over the past several years, driven by strong demand for its products and services. The company’s key business segments include iPhone, Mac, iPad, Wearables, Home and Accessories, Services, and Others. The iPhone remains Apple’s largest revenue generator, accounting for a significant portion of its overall sales. However, the Services segment, which includes Apple Music, Apple Pay, and iCloud, has been experiencing rapid growth and is becoming an increasingly important contributor to Apple’s revenue.

Investment Strategies and Impact on Financial Performance

Apple has consistently invested heavily in research and development, as well as in expanding its product and service offerings. These investments have been crucial to Apple’s success, enabling the company to maintain its competitive edge and introduce innovative products that resonate with consumers. For instance, Apple’s investment in augmented reality (AR) and artificial intelligence (AI) technologies has led to the development of new features and products that enhance user experience.

Profitability Metrics and Industry Benchmarks

Apple’s profitability metrics, such as gross margin and operating margin, have been consistently high, reflecting the company’s strong pricing power and efficient operations. Apple’s gross margin, which measures the profitability of its products and services, has remained above 40% for several years. The company’s operating margin, which measures the profitability of its core business operations, has also been consistently high, exceeding 25%. These metrics are significantly higher than industry benchmarks, highlighting Apple’s strong financial performance and its ability to generate substantial profits.

Apple’s Product Portfolio

Apple’s product portfolio is a diverse ecosystem of hardware, software, and services, meticulously designed to seamlessly integrate and cater to a wide range of user needs. This strategy has been instrumental in Apple’s success, driving its market share and solidifying its position as a technology leader.

iPhone

The iPhone is Apple’s flagship product and a major revenue driver. It holds a significant market share in the smartphone market, consistently ranking among the top-selling smartphones globally. Apple’s iPhone is renowned for its sleek design, powerful performance, and intuitive user experience.

The iPhone’s success is attributed to several key features and innovations, including:

* Powerful processors: Apple’s A-series chips offer exceptional performance, enabling smooth multitasking, advanced gaming, and high-quality video recording.

* High-resolution displays: iPhones boast vibrant and sharp displays, providing an immersive viewing experience for content consumption and gaming.

* Advanced camera systems: Apple’s iPhones feature cutting-edge camera technology, including multiple lenses, computational photography, and advanced video recording capabilities.

* iOS operating system: The iOS operating system provides a user-friendly interface, seamless integration with other Apple devices, and a robust app ecosystem.

* Security and privacy: Apple prioritizes user security and privacy, implementing robust security features and data encryption.

Mac

Apple’s Mac computers are known for their premium design, powerful performance, and user-friendly operating system. They target a diverse audience, from creative professionals to students and casual users.

Apple’s Mac computers are powered by its proprietary M-series chips, which offer significant performance gains over previous generations. They feature a range of models, including the MacBook Air, MacBook Pro, iMac, and Mac Pro, catering to different needs and budgets.

The Mac’s success can be attributed to:

* Powerful processors: Apple’s M-series chips offer exceptional performance, enabling smooth multitasking, advanced creative workflows, and demanding applications.

* macOS operating system: macOS is known for its intuitive user interface, seamless integration with other Apple devices, and a robust app ecosystem.

* High-quality displays: Macs feature high-resolution displays, providing a vibrant and immersive viewing experience for creative work, content consumption, and gaming.

* Focus on security and privacy: Apple prioritizes user security and privacy, implementing robust security features and data encryption.

iPad

The iPad is a versatile tablet device that bridges the gap between smartphones and laptops. It offers a large display, portability, and a wide range of productivity and entertainment features.

The iPad has gained significant popularity due to its:

* Large and responsive display: The iPad’s large display provides a comfortable and immersive experience for content consumption, browsing, and creative work.

* Powerful performance: The iPad is equipped with powerful processors that enable smooth multitasking, gaming, and demanding applications.

* iPadOS operating system: iPadOS is a customized version of iOS, offering a more desktop-like experience with features like split-screen multitasking and support for external peripherals.

* Apple Pencil support: The iPad supports Apple Pencil, a stylus that provides a natural and precise drawing and writing experience.

* Versatility and portability: The iPad’s lightweight design and portability make it an ideal device for both work and leisure.

Services

Apple’s services segment has become a significant revenue driver, offering a diverse range of digital services that complement its hardware products.

Apple’s services include:

* App Store: The App Store is a thriving marketplace for apps, games, and digital content, generating significant revenue for Apple.

* Apple Music: Apple Music is a subscription-based music streaming service that offers a vast library of songs, curated playlists, and exclusive content.

* Apple TV+: Apple TV+ is a streaming service that offers original movies, TV shows, and documentaries.

* Apple Pay: Apple Pay is a mobile payment service that allows users to make secure and contactless payments.

* AppleCare: AppleCare is an extended warranty program that provides technical support and repair services for Apple products.

* iCloud: iCloud is a cloud storage and syncing service that allows users to store and access their data across multiple devices.

Apple’s services have become increasingly important for the company’s revenue and growth. They offer a recurring revenue stream and provide a valuable ecosystem for users.

Apple’s Competitive Landscape

Apple operates in a highly competitive market, facing rivals in various segments like smartphones, computers, and wearables. These competitors offer compelling products and services, challenging Apple’s dominance in certain areas. Understanding the competitive landscape is crucial for assessing Apple’s future prospects and potential threats.

Smartphone Market

The smartphone market is arguably Apple’s most fiercely contested battleground. Key competitors include Samsung, Google (Android), and Chinese brands like Xiaomi, Oppo, and Vivo.

- Samsung: Samsung’s flagship Galaxy S series directly challenges Apple’s iPhone lineup. Samsung boasts a wider range of devices, including foldable phones like the Galaxy Z Fold and Z Flip, offering innovative form factors. Their strengths lie in their display technology, camera capabilities, and wider price range, catering to diverse budgets. However, Samsung’s software experience is often criticized for being less polished than iOS.

- Google (Android): Google’s Android operating system powers a vast majority of smartphones globally. While Google doesn’t manufacture phones directly, its open-source platform enables numerous manufacturers to build devices. Android’s flexibility and customization options attract users seeking more control over their devices. However, Android’s fragmented ecosystem and security concerns can be drawbacks.

- Chinese Brands: Chinese smartphone manufacturers like Xiaomi, Oppo, and Vivo have rapidly gained market share globally. Their aggressive pricing strategies, innovative features, and focus on emerging markets have proven successful. Xiaomi, for instance, is known for its value-for-money devices and its ecosystem of connected products. However, these brands often face scrutiny regarding software updates and long-term support.

Apple’s iPhone remains a premium product with a loyal following, known for its user-friendly interface, strong security features, and a robust app ecosystem. However, the high price point can be a barrier for budget-conscious consumers.

Computer Market

Apple’s Mac computers face competition from established players like Microsoft (Windows) and Lenovo, as well as emerging players like Chromebooks.

- Microsoft (Windows): Microsoft’s Windows operating system dominates the personal computer market, offering a wide range of devices from various manufacturers. Windows PCs offer greater hardware flexibility and affordability compared to Macs. However, Macs are generally perceived as more user-friendly and secure.

- Lenovo: Lenovo is the world’s largest PC manufacturer, offering a wide range of devices at various price points. Lenovo’s strengths lie in its cost-effectiveness and extensive distribution network. However, Lenovo’s PCs are often criticized for their generic design and lack of innovation.

- Chromebooks: Chromebooks, powered by Google’s Chrome OS, are gaining popularity for their simplicity and affordability. Chromebooks are designed for web-based tasks and cloud storage, making them suitable for students and casual users. However, Chromebooks lack the versatility and offline capabilities of traditional PCs.

Apple’s Mac computers are known for their sleek design, seamless integration with Apple’s ecosystem, and high-quality hardware. However, the high price point and limited hardware options can be drawbacks for some users.

Wearable Device Market

The wearable device market is rapidly growing, with Apple facing competition from companies like Samsung, Fitbit, and Garmin.

- Samsung: Samsung’s Galaxy Watch series competes directly with Apple Watch, offering similar features like fitness tracking, health monitoring, and smartwatch functionality. Samsung’s watches are known for their long battery life and support for both Android and iOS devices. However, Samsung’s smartwatch ecosystem is not as extensive as Apple’s.

- Fitbit: Fitbit is a leading fitness tracker manufacturer, focusing on health and wellness features. Fitbit devices are known for their affordability and accurate fitness tracking capabilities. However, Fitbit lacks the smartwatch functionality and app ecosystem of Apple Watch.

- Garmin: Garmin specializes in GPS devices and wearable technology for athletes and outdoor enthusiasts. Garmin’s watches offer advanced fitness tracking, navigation features, and long battery life. However, Garmin’s devices are often more expensive than Apple Watch and have a less user-friendly interface.

Apple Watch remains the market leader in smartwatches, known for its sleek design, robust health features, and extensive app ecosystem. However, Apple Watch’s high price point and limited compatibility with non-Apple devices can be drawbacks.

Threats and Opportunities

Apple faces various threats and opportunities in the future.

- Rising Competition: The smartphone market is increasingly competitive, with Chinese brands gaining ground. Apple needs to continue innovating and offering compelling products to maintain its market share.

- Economic Slowdown: A global economic slowdown could impact consumer spending on premium products like Apple devices. Apple needs to offer more affordable options to reach a wider audience.

- Regulatory Scrutiny: Apple is facing increasing regulatory scrutiny over its business practices, particularly in areas like antitrust and data privacy. Apple needs to navigate these challenges effectively.

- Emerging Technologies: Emerging technologies like augmented reality (AR) and virtual reality (VR) present opportunities for Apple to expand its product portfolio. Apple needs to invest in these technologies to remain competitive.

Apple’s Growth Strategies

Apple’s future growth hinges on its ability to continuously innovate, expand into new markets, and enhance its service offerings. The company’s commitment to research and development, coupled with its strategic investments in emerging technologies, positions it for sustained success.

Apple’s Product Innovation

Apple’s product innovation strategy is focused on delivering cutting-edge products that seamlessly integrate hardware, software, and services. This approach has consistently led to the creation of iconic devices, such as the iPhone, iPad, and Mac, which have revolutionized their respective industries. Apple’s product innovation process is characterized by a relentless pursuit of design excellence, user-friendliness, and performance optimization.

Market Expansion

Apple is actively expanding its global presence to tap into new markets and customer segments. The company has made significant strides in emerging economies, particularly in Asia, where it has established a strong foothold. Apple’s market expansion strategy is underpinned by localization efforts, tailored product offerings, and strategic partnerships with local distributors and retailers.

Service Offerings

Apple’s service offerings are a crucial component of its growth strategy. The company has expanded its portfolio of services, including Apple Music, Apple TV+, Apple Pay, and iCloud, which generate recurring revenue streams and enhance the overall user experience. Apple’s service offerings are designed to provide value to customers throughout their product lifecycle, fostering brand loyalty and increasing customer engagement.

Investments in Research and Development

Apple invests heavily in research and development to drive innovation and maintain its competitive edge. The company’s R&D efforts are focused on areas such as artificial intelligence, augmented reality, and 5G technology. Apple’s investments in R&D are expected to fuel the development of future products and services, further solidifying its position as a technology leader.

Emerging Technologies

Apple is actively exploring and integrating emerging technologies into its product portfolio. The company is investing in areas such as artificial intelligence, augmented reality, and 5G technology, which have the potential to revolutionize the way people interact with technology. Apple’s focus on emerging technologies is expected to drive future product innovation and create new growth opportunities.

Apple’s Investor Sentiment

Apple’s investor sentiment reflects a mix of optimism and cautiousness, driven by the company’s strong track record, robust financial performance, and a vast product portfolio. However, concerns regarding slowing growth, competition, and economic uncertainties also influence investor confidence.

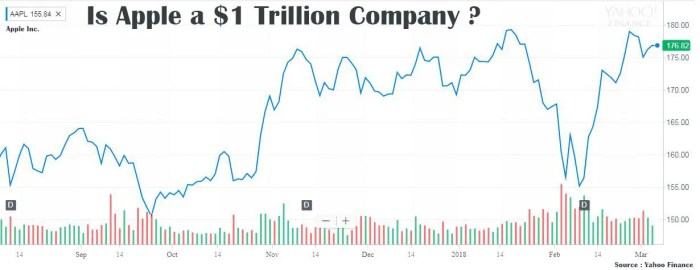

Stock Price Performance

Apple’s stock price has consistently risen over the past decade, reflecting strong investor confidence. The stock has outperformed the broader market, driven by factors such as consistent revenue and profit growth, innovative product launches, and a loyal customer base. For example, Apple’s stock price has increased by over 1,000% in the past ten years, significantly exceeding the S&P 500’s performance.

Analyst Ratings

Analysts generally maintain a positive outlook on Apple, with a majority rating the stock as a “buy” or “outperform.” They cite Apple’s strong brand recognition, robust cash flow, and growth opportunities in emerging markets as key drivers for future growth. However, some analysts express concerns regarding the company’s dependence on the iPhone, slowing smartphone market growth, and intensifying competition from rivals like Samsung and Huawei.

Investor Reports

Investor reports provide insights into investor sentiment towards Apple. While some reports highlight the company’s long-term growth potential, others emphasize risks such as the potential for economic slowdown, rising competition, and supply chain disruptions. Investor reports often analyze Apple’s financial performance, product launches, and market share to gauge the company’s future prospects.

Factors Influencing Investor Confidence

Several factors influence investor confidence in Apple, including:

- Strong Brand Recognition: Apple enjoys a strong brand reputation, known for its premium products and innovative designs. This brand loyalty translates into consistent demand for its products, contributing to revenue stability and investor confidence.

- Robust Financial Performance: Apple consistently delivers strong financial results, with high revenue growth, profitability, and cash flow. This consistent performance provides investors with confidence in the company’s ability to generate returns.

- Innovation and Product Launches: Apple continues to introduce new products and services, such as the iPhone, Apple Watch, and Apple TV+, which attract new customers and drive revenue growth. This ongoing innovation is a key factor driving investor confidence.

- Loyal Customer Base: Apple has a large and loyal customer base, known for its brand loyalty and willingness to upgrade to newer products. This customer loyalty ensures consistent demand for Apple’s products, contributing to revenue stability and investor confidence.

Potential Risks and Challenges

Despite its strengths, Apple faces several risks and challenges that could impact its stock price:

- Slowing Smartphone Market Growth: The global smartphone market is experiencing slower growth, which could impact Apple’s iPhone sales and overall revenue growth. This slowdown could lead to reduced investor confidence and pressure on Apple’s stock price.

- Intensifying Competition: Apple faces intense competition from rivals like Samsung, Huawei, and other smartphone manufacturers. These competitors are aggressively introducing new features and technologies, potentially eroding Apple’s market share and impacting its financial performance.

- Economic Uncertainty: Global economic uncertainty, such as trade tensions, geopolitical risks, and inflation, could impact consumer spending and demand for Apple’s products. This economic uncertainty could lead to reduced investor confidence and pressure on Apple’s stock price.

- Supply Chain Disruptions: Apple’s global supply chain is vulnerable to disruptions, such as natural disasters, political instability, and labor shortages. These disruptions could impact production, lead to delays, and negatively affect Apple’s financial performance and investor sentiment.

Long-Term Growth Prospects

Apple’s long-term growth prospects remain promising, driven by factors such as:

- Emerging Markets: Apple has significant growth opportunities in emerging markets, where smartphone penetration is increasing rapidly. This growth potential could drive future revenue growth and enhance investor confidence.

- Services Business: Apple’s services business, including Apple Music, Apple TV+, and iCloud, is growing rapidly and becoming a significant revenue source. This growth in services could offset potential slowing in hardware sales and provide a stable revenue stream for Apple.

- Innovation: Apple continues to invest heavily in research and development, driving innovation and introducing new products and services. This ongoing innovation is crucial for maintaining Apple’s competitive edge and driving future growth.

Apple’s Impact on the Technology Industry

Apple’s influence on the technology industry is undeniable, shaping consumer preferences, driving innovation, and setting trends that continue to reverberate across the sector. From its iconic design and user-friendly interfaces to its emphasis on a seamless ecosystem, Apple has redefined what it means to use technology in our daily lives.

Apple’s Innovation and Market Dominance

Apple’s innovation has been a driving force behind its success. The company has consistently pushed the boundaries of what’s possible with technology, introducing groundbreaking products like the Macintosh, iPod, iPhone, and iPad. These devices have not only revolutionized their respective categories but have also had a profound impact on the broader technology landscape. Apple’s market dominance, fueled by its innovative products and strong brand loyalty, has encouraged other companies to raise their game, leading to a more competitive and dynamic technology industry.

Apple’s Role in Shaping Consumer Preferences, Apple market cap 900 billion

Apple has played a pivotal role in shaping consumer preferences, particularly in the realm of mobile technology. The iPhone’s sleek design, intuitive interface, and powerful app ecosystem have set a new standard for smartphones, influencing the design and functionality of devices from other manufacturers. Apple’s emphasis on user experience, coupled with its focus on aesthetics and simplicity, has instilled a desire for similar features in other tech products, driving a trend towards user-centric design and seamless integration.

Apple’s Key Contributions to the Advancement of Technology

Apple’s contributions to the advancement of technology are far-reaching. The company’s focus on user experience has led to significant improvements in software design, user interface, and overall usability. Apple’s commitment to hardware and software integration has created a more seamless and efficient computing experience. Furthermore, Apple’s investments in research and development have led to breakthroughs in areas such as mobile operating systems, mobile payments, and wearable technology.

The Future of the Technology Industry and Apple’s Place Within It

The technology industry is constantly evolving, and Apple is well-positioned to continue playing a leading role in its future. The company’s focus on innovation, coupled with its strong brand loyalty and vast ecosystem, gives it a competitive advantage. Apple’s continued investment in artificial intelligence, augmented reality, and other emerging technologies will likely shape the future of computing and consumer experiences. While the technology landscape is becoming increasingly competitive, Apple’s commitment to user experience, design, and innovation ensures that it will remain a major force in the industry for years to come.

Apple market cap 900 billion – Apple’s journey to a $900 billion market cap is a testament to its ability to innovate, adapt, and engage its customers. With a strong foundation of product innovation, brand loyalty, and financial performance, Apple continues to dominate the tech landscape. As the company looks towards the future, it is poised to capitalize on emerging technologies and expand its global reach, cementing its position as a leader in the ever-evolving tech industry. This remarkable journey is a reminder that success is built on a foundation of consistent innovation, strategic decision-making, and a deep understanding of consumer needs. Apple’s story is a blueprint for other tech companies, showcasing the power of visionary leadership, product excellence, and unwavering commitment to customer satisfaction.

Apple’s $900 billion market cap is a testament to its enduring success, but sometimes you just need a good ol’ fashioned distraction. If you’re looking for a blast from the past, check out the new Guitar Hero Lives controller demonstrated in this video , a reminder that even the most powerful tech companies can’t compete with the pure joy of shredding on a plastic guitar.

Maybe Apple should invest in a little nostalgia to keep things interesting.

Standi Techno News

Standi Techno News