Apple Pay’s Expansion into Japan

Apple Pay’s arrival in Japan marks a significant milestone in the global expansion of the mobile payment service. The country, renowned for its technological prowess and high mobile phone penetration, presents a unique and competitive landscape for Apple Pay to navigate. This launch has the potential to reshape consumer behavior and further propel the adoption of mobile payments in a nation already accustomed to cashless transactions.

The Competitive Landscape of Mobile Payments in Japan

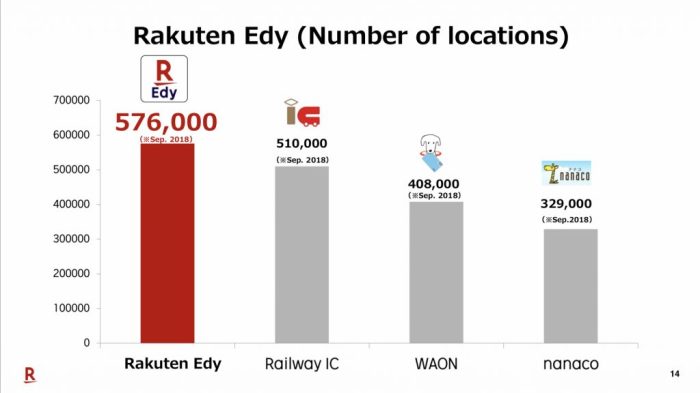

Japan boasts a thriving mobile payment ecosystem, with established players like LINE Pay, PayPay, and Rakuten Pay already dominating the market. These platforms have gained significant traction among consumers, offering a wide range of features and incentives, such as cashback programs and point accumulation systems. Apple Pay’s entry into this dynamic market will inevitably lead to increased competition and potentially alter the existing power dynamics.

Key Features and Benefits of Apple Pay for Japanese Consumers

Apple Pay offers several key features and benefits that could attract Japanese consumers, further accelerating the shift towards cashless transactions.

- Enhanced Security: Apple Pay utilizes advanced security measures, including tokenization and biometric authentication, to protect user data and transactions. This focus on security is crucial for Japanese consumers, who are generally highly security-conscious.

- Seamless User Experience: Apple Pay’s intuitive interface and seamless integration with Apple devices provide a user-friendly experience. Consumers can easily make payments with a simple tap of their iPhone or Apple Watch, streamlining the checkout process.

- Wide Acceptance: Apple Pay is accepted at a growing number of merchants worldwide, including major retailers and restaurants. This wide acceptance is crucial for attracting Japanese consumers, who are accustomed to using mobile payments in various settings.

- Privacy: Apple Pay prioritizes user privacy by not storing or sharing sensitive financial information with merchants. This commitment to privacy aligns with the growing concerns surrounding data security in Japan.

Implications for the Japanese Economy

Apple Pay’s launch in Japan has the potential to significantly impact the Japanese economy. This move could stimulate consumer spending, foster financial inclusion, and drive innovation within the payments sector.

Increased Consumer Spending

The introduction of Apple Pay could lead to an increase in consumer spending in Japan. This is because Apple Pay offers a convenient and secure payment method, making it easier for consumers to make purchases. With the ease of use and security features, consumers are more likely to make spontaneous purchases, potentially leading to higher overall spending.

Financial Inclusion

Apple Pay can contribute to financial inclusion in Japan by providing access to digital payment services for those who may not have had access before. This includes individuals who are unbanked or underbanked, or who are not comfortable with traditional payment methods. Apple Pay’s user-friendly interface and integration with smartphones can make digital payments more accessible to a wider range of consumers.

Innovation in the Payments Sector

Apple Pay’s entry into the Japanese market could stimulate innovation in the payments sector. This could lead to the development of new payment solutions and technologies, further enhancing the digital payment ecosystem in Japan. The competitive landscape could drive existing players to improve their services and offer more competitive pricing and features.

Role of Apple Pay in Promoting Digitalization and Financial Literacy

Apple Pay’s launch in Japan can contribute to the country’s ongoing digitalization efforts. The adoption of Apple Pay can encourage more consumers and businesses to embrace digital payment methods, contributing to a more cashless society. Additionally, the widespread use of Apple Pay can promote financial literacy by familiarizing consumers with digital payment concepts and encouraging them to manage their finances more effectively.

Adoption Rate of Apple Pay in Japan

The adoption rate of Apple Pay in Japan is expected to be significant, given the country’s high smartphone penetration and tech-savvy population. While it’s difficult to predict the exact adoption rate, the widespread use of contactless payments in Japan suggests that Apple Pay has the potential to be widely adopted.

“Japan is a highly digitized society with a strong mobile payments culture, making it a promising market for Apple Pay.”

Consumer Adoption and Usage: Apple Pay Japan Launch Confirmed For October

The successful launch of Apple Pay in Japan hinges on its ability to attract consumers and integrate seamlessly into their existing payment habits. Several factors will play a crucial role in shaping consumer adoption, including cultural preferences, the existing payments landscape, and awareness of the service.

Cultural Preferences and Existing Payment Habits, Apple pay japan launch confirmed for october

Japan boasts a unique payment landscape with a high reliance on cash and a preference for contactless transactions. This presents both opportunities and challenges for Apple Pay.

- Cash Preference: Japan has a long-standing tradition of cash-based transactions, with a significant portion of the population comfortable using cash for everyday purchases. This deeply ingrained habit might pose an initial barrier to Apple Pay adoption, especially among older generations.

- Contactless Payments: While cash remains prevalent, contactless payments are gaining popularity in Japan, particularly through the widespread use of Suica and other IC cards. These existing systems are deeply integrated into daily life, making it a challenge for Apple Pay to gain traction. However, Apple Pay’s contactless functionality could potentially attract users who are already comfortable with this payment method.

- Security and Privacy Concerns: Japanese consumers are known for their high levels of security and privacy awareness. Apple Pay’s focus on security and privacy features could be a major selling point, particularly for consumers who are concerned about the safety of their financial data.

Potential Usage Patterns

Apple Pay’s adoption in Japan is likely to vary across different demographics.

- Younger Generations: Younger generations in Japan are more tech-savvy and open to new technologies, making them a prime target for Apple Pay adoption. They are also more accustomed to using smartphones for various activities, including payments.

- Urban Dwellers: Urban areas in Japan are known for their high concentration of retail stores and restaurants, providing ample opportunities for Apple Pay usage. The convenience of contactless payments in crowded urban environments could further drive adoption.

- Tourists: With Japan being a popular tourist destination, Apple Pay could attract international visitors who are already familiar with the service. The ease of use and global acceptance of Apple Pay could make it a preferred payment option for tourists.

Marketing and Promotional Strategies

To drive consumer adoption, Apple will need to employ effective marketing and promotional strategies that address the unique needs and preferences of Japanese consumers.

- Partnership with Local Businesses: Apple needs to partner with a wide range of local businesses, including convenience stores, restaurants, and retailers, to expand the acceptance network for Apple Pay. This will ensure that consumers can use the service for a variety of everyday purchases.

- Targeted Advertising: Apple should leverage targeted advertising campaigns across various channels, including television, online platforms, and social media, to reach specific demographics. The campaigns should highlight the benefits of Apple Pay, such as convenience, security, and ease of use.

- Incentives and Promotions: Offering incentives and promotions, such as discounts or cashback rewards, could incentivize consumers to try Apple Pay. These incentives should be tailored to specific user segments and their spending habits.

- Public Awareness Campaigns: Apple should conduct public awareness campaigns to educate consumers about the features and benefits of Apple Pay. These campaigns could be delivered through various channels, including online resources, educational videos, and in-store demonstrations.

Future Outlook for Apple Pay in Japan

The launch of Apple Pay in Japan marks a significant milestone for both Apple and the Japanese mobile payments landscape. With a robust smartphone penetration rate and a growing appetite for digital convenience, Apple Pay has the potential to become a dominant force in the Japanese market. The future of Apple Pay in Japan is bright, driven by a confluence of factors including evolving consumer preferences, technological advancements, and regulatory changes.

Growth Opportunities and Market Dynamics

The Japanese market presents a wealth of opportunities for Apple Pay to expand its reach and solidify its position as a leading mobile payment solution. Several factors will contribute to this growth:

- Increasing Smartphone Penetration: Japan boasts a high smartphone penetration rate, exceeding 90%, providing a large and receptive user base for Apple Pay. The widespread adoption of smartphones creates a fertile ground for the growth of mobile payment services.

- Evolving Consumer Preferences: Japanese consumers are increasingly embracing digital solutions, including mobile payments, driven by convenience, speed, and security. Apple Pay aligns perfectly with these preferences, offering a seamless and secure payment experience.

- Growing E-commerce and Digital Transactions: The rise of e-commerce and digital transactions in Japan presents a significant opportunity for Apple Pay. The platform’s integration with online stores and apps allows for effortless and secure online payments.

- Limited Competition: While Japan has a mature mobile payment market, Apple Pay faces limited direct competition from other major international mobile payment platforms. This creates a window of opportunity for Apple Pay to capture a substantial market share.

Technological Advancements and Integration

Technological advancements play a pivotal role in shaping the future of Apple Pay in Japan. Key areas of focus include:

- NFC Expansion: Expanding NFC (Near Field Communication) infrastructure in Japan will further enhance the adoption of Apple Pay. As more merchants and retailers embrace NFC technology, the convenience and accessibility of contactless payments will increase.

- Integration with Local Services: Apple Pay’s integration with local services, such as public transportation, loyalty programs, and delivery apps, will enhance its usability and appeal to Japanese consumers. By seamlessly integrating with everyday services, Apple Pay can become an indispensable part of their daily lives.

- Enhanced Security Features: Apple Pay’s focus on security and privacy aligns with Japanese consumers’ concerns. Continuously enhancing security features, such as biometric authentication and fraud detection, will further bolster consumer trust and confidence in the platform.

Regulatory Landscape and Industry Trends

The regulatory environment and industry trends will significantly impact Apple Pay’s future in Japan. Key factors to watch include:

- Government Support: The Japanese government’s support for cashless initiatives, such as the “Cashless Vision” strategy, creates a favorable environment for Apple Pay’s growth. Government policies encouraging digital payments will drive adoption and acceptance of mobile payment solutions like Apple Pay.

- Open Banking Initiatives: The rise of open banking in Japan will create opportunities for Apple Pay to integrate with financial institutions and offer more personalized and value-added services. By leveraging open banking data, Apple Pay can provide customized payment experiences and financial insights to users.

- Interoperability and Collaboration: Collaboration with other mobile payment platforms and industry stakeholders will enhance interoperability and provide a more seamless payment experience for consumers. Partnerships with local payment providers and financial institutions will expand Apple Pay’s reach and acceptance.

Apple pay japan launch confirmed for october – Apple Pay’s launch in Japan signifies a major step towards a more digitalized and integrated economy. While it faces competition from established players, Apple Pay’s global brand recognition, secure platform, and user-friendly interface could attract a significant user base. As Apple Pay integrates into the Japanese market, it will be fascinating to observe how it shapes consumer behavior, business practices, and the overall landscape of mobile payments.

Get ready, Japan! Apple Pay is finally launching in October, bringing the convenience of contactless payments to the Land of the Rising Sun. While you’re waiting for your digital wallet to be ready, you might want to check out the news that AT&T’s DIRECTV streaming service will now offer HBO atts directv streaming service will offer hbo , which means even more entertainment options for your new Apple Pay-enabled life.

So, grab your favorite snacks, settle in, and get ready for a whole new world of digital convenience.

Standi Techno News

Standi Techno News