Arc Capital Markets Venture Debt sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Venture debt is a powerful tool for startups seeking to fuel their growth without diluting equity. It allows companies to access capital on favorable terms, providing a bridge to the next round of funding or even a path to profitability.

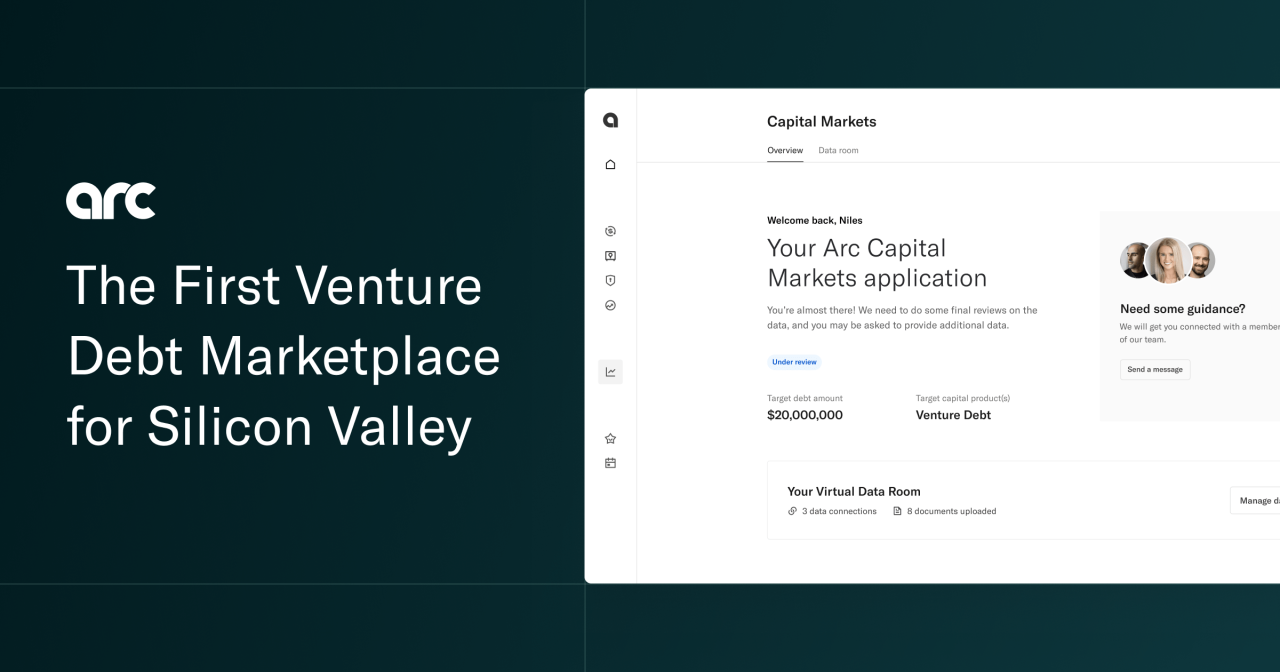

Arc Capital Markets is a leading venture debt provider, specializing in providing flexible and customized financing solutions to high-growth companies. They understand the unique challenges faced by startups and offer a tailored approach that helps them navigate the complex world of capital raising. Arc Capital Markets’ expertise and commitment to building long-term partnerships make them a valuable asset to any startup seeking to scale.

Arc Capital Markets

Arc Capital Markets is a leading provider of venture debt financing, specializing in supporting high-growth technology companies. They offer a unique and flexible approach to financing, providing capital to companies at various stages of their growth journey.

Role in the Venture Capital Ecosystem

Venture debt plays a crucial role in the venture capital ecosystem, providing a valuable alternative to equity financing. Arc Capital Markets acts as a bridge between traditional lenders and venture-backed companies, enabling them to access capital without diluting their equity. They understand the unique challenges and opportunities faced by high-growth businesses and tailor their financing solutions to meet their specific needs.

Key Differentiators, Arc capital markets venture debt

Arc Capital Markets distinguishes itself from other venture debt providers through its:

- Deep Understanding of the Venture Capital Landscape: Their team comprises experienced professionals with a deep understanding of the venture capital ecosystem, enabling them to provide insightful advice and support to their clients.

- Flexible Financing Solutions: Arc Capital Markets offers a range of financing solutions tailored to the specific needs of each company, including term loans, revenue-based financing, and growth equity.

- Strong Relationships with Investors: They have established strong relationships with a network of investors, enabling them to secure competitive financing terms for their clients.

- Data-Driven Approach: Arc Capital Markets leverages data analytics to assess risk and identify growth opportunities, ensuring they provide the right financing solutions to their clients.

Understanding Venture Debt

Venture debt is a type of financing that provides capital to high-growth companies, often in the form of loans or lines of credit. It serves as a valuable tool for companies seeking to bridge the gap between traditional debt and equity financing.

Venture debt plays a crucial role in funding high-growth companies by providing them with flexible and readily accessible capital. It allows companies to accelerate their growth trajectory without diluting equity ownership.

Venture Debt vs. Traditional Debt Financing

Venture debt differs significantly from traditional debt financing in several key aspects. Understanding these differences is essential for companies seeking to leverage venture debt effectively.

- Loan Terms: Venture debt typically offers more flexible terms than traditional debt financing, such as longer repayment periods, lower interest rates, and fewer covenants. This flexibility caters to the specific needs of high-growth companies that may experience fluctuating revenue streams and require greater financial leeway.

- Risk Tolerance: Venture debt providers are typically more risk-tolerant than traditional lenders. They recognize the inherent uncertainty associated with high-growth companies and are willing to accept a higher risk profile in exchange for potentially higher returns.

- Equity Participation: Venture debt providers often include equity participation provisions in their loan agreements. This gives them a stake in the company’s future success and aligns their interests with those of the company’s founders and investors.

Typical Terms and Conditions

Venture debt agreements typically include specific terms and conditions that Artikel the rights and obligations of both the lender and the borrower. These terms are designed to protect the lender’s investment while providing the borrower with the necessary flexibility to achieve its growth objectives.

- Interest Rate: The interest rate on venture debt is typically higher than traditional debt financing, reflecting the higher risk associated with lending to high-growth companies. However, the interest rate may be variable and can be adjusted based on the company’s performance.

- Repayment Schedule: Venture debt typically has a longer repayment period than traditional debt financing, allowing companies to focus on growth and profitability before making significant debt repayments. The repayment schedule may include a grace period, during which no principal payments are required.

- Covenants: Venture debt agreements often include covenants, which are restrictions or obligations that the borrower must adhere to. These covenants are designed to protect the lender’s investment by ensuring that the company maintains a certain level of financial performance and governance standards.

- Equity Participation: Venture debt providers often include equity participation provisions in their loan agreements. This gives them a stake in the company’s future success and aligns their interests with those of the company’s founders and investors.

Venture debt is a valuable financing option for high-growth companies seeking to access capital without diluting equity ownership. By understanding the unique terms and conditions associated with venture debt, companies can leverage this financing tool to accelerate their growth and achieve their strategic objectives.

The Role of Venture Debt in Startup Funding

Venture debt is a powerful tool for startups seeking capital. It offers a unique blend of flexibility and affordability, making it a valuable addition to the startup funding landscape.

Advantages of Venture Debt for Startups

Venture debt provides several advantages for startups seeking capital. Here’s a breakdown of how it can benefit your business:

- Non-Dilutive Funding: Unlike equity financing, venture debt does not dilute ownership in your company. This means you retain control over your business and can maintain a larger stake in its future success.

- Faster Funding: Venture debt typically has a faster approval process compared to traditional bank loans or equity rounds. This speed allows startups to access capital quickly and capitalize on opportunities as they arise.

- Flexible Terms: Venture debt providers offer flexible terms, including variable interest rates, payment schedules, and covenants. This allows startups to tailor financing to their specific needs and growth trajectory.

- Access to Growth Capital: Venture debt can provide startups with access to growth capital that they may not be able to secure through traditional means. This funding can be used for various purposes, such as expanding operations, developing new products, or acquiring competitors.

Scenarios Where Venture Debt is Particularly Beneficial

Venture debt is particularly beneficial for startups in specific scenarios:

- Bridge Financing: Venture debt can serve as a bridge between funding rounds, allowing startups to continue operations and meet their financial obligations while they raise additional equity.

- Expansion and Growth: Venture debt can support startups in expanding their operations, acquiring new customers, or launching new products. It can provide the necessary capital to fuel rapid growth and market penetration.

- Strategic Acquisitions: Venture debt can be used to finance strategic acquisitions, allowing startups to expand their market share, enter new markets, or acquire valuable assets and intellectual property.

- Working Capital: Venture debt can provide startups with working capital to cover day-to-day operating expenses, manage inventory, and meet payroll obligations.

How Venture Debt Complements Equity Financing

Venture debt can complement equity financing by providing startups with a balanced funding approach:

- Reduced Dilution: By utilizing venture debt, startups can reduce the amount of equity they need to raise, minimizing dilution and preserving ownership.

- Enhanced Valuation: Venture debt can improve a startup’s valuation by demonstrating its financial strength and growth potential to potential equity investors.

- Increased Flexibility: Venture debt provides startups with additional flexibility in their financing strategy, allowing them to adjust their capital structure as their business evolves.

- Improved Debt-to-Equity Ratio: A balanced mix of debt and equity can strengthen a startup’s financial position and make it more attractive to investors.

The Arc Capital Markets Approach to Venture Debt

Arc Capital Markets employs a unique approach to venture debt, combining a deep understanding of the startup ecosystem with a rigorous investment methodology. This approach enables us to identify promising venture debt opportunities while providing valuable support to our portfolio companies.

Arc Capital Markets’ Methodology for Evaluating Venture Debt Opportunities

Arc Capital Markets’ approach to evaluating venture debt opportunities is driven by a multi-faceted framework that considers both quantitative and qualitative factors. This framework helps us assess the potential risks and rewards associated with each opportunity, enabling us to make informed investment decisions.

- Financial Analysis: We meticulously review the company’s financial statements, including revenue growth, profitability, and cash flow, to assess its financial health and future prospects.

- Market Analysis: We conduct thorough research into the target market, including market size, growth potential, and competitive landscape, to understand the company’s position within the industry.

- Management Team Assessment: We evaluate the experience, expertise, and track record of the company’s management team to gauge their ability to execute their business plan and navigate potential challenges.

- Technology Assessment: For technology-driven companies, we assess the innovation and potential of the technology to determine its competitive advantage and long-term viability.

- Risk Assessment: We carefully consider the potential risks associated with the investment, including market risks, competitive risks, and operational risks, to ensure we have a clear understanding of the potential downside.

Due Diligence Process

Arc Capital Markets conducts a comprehensive due diligence process to thoroughly evaluate each venture debt opportunity. This process involves a deep dive into the company’s business model, financials, and management team.

- Financial Due Diligence: This involves reviewing the company’s financial statements, including revenue, expenses, and cash flow, to verify the accuracy and completeness of the information provided. We also assess the company’s financial controls and risk management practices.

- Market Due Diligence: We conduct extensive research into the company’s target market, including market size, growth potential, and competitive landscape. This helps us understand the company’s position within the industry and its potential for success.

- Management Due Diligence: We evaluate the experience, expertise, and track record of the company’s management team to gauge their ability to execute their business plan and navigate potential challenges. We also assess the company’s corporate governance and risk management practices.

- Technology Due Diligence: For technology-driven companies, we assess the innovation and potential of the technology to determine its competitive advantage and long-term viability. We also evaluate the company’s intellectual property and its ability to protect its technology.

- Legal Due Diligence: We review the company’s legal documentation, including contracts, agreements, and corporate filings, to ensure that the company is operating in compliance with all applicable laws and regulations.

Commitment to Building Long-Term Partnerships

Arc Capital Markets is committed to building long-term partnerships with our portfolio companies. We believe that by providing our expertise and resources, we can help our portfolio companies achieve their growth objectives and create significant value for all stakeholders.

- Active Engagement: We actively engage with our portfolio companies, providing guidance and support throughout their growth journey. We work closely with management teams to help them develop their business plans, navigate challenges, and achieve their strategic goals.

- Network of Resources: We leverage our extensive network of contacts in the startup ecosystem to connect our portfolio companies with potential investors, customers, and partners. This helps our portfolio companies accelerate their growth and expand their reach.

- Value-Added Services: We offer a range of value-added services to our portfolio companies, including financial modeling, strategic planning, and operational improvement. These services help our portfolio companies improve their efficiency, effectiveness, and overall performance.

Benefits of Partnering with Arc Capital Markets

Partnering with Arc Capital Markets can be a game-changer for startups seeking venture debt. Arc Capital Markets offers a unique value proposition that goes beyond just providing funding. It provides a comprehensive approach to supporting startups on their growth journey.

Arc Capital Markets’ Value Proposition

Arc Capital Markets provides a unique value proposition to startups seeking venture debt. This value proposition encompasses a range of services and expertise designed to help startups navigate the complexities of growth and maximize their potential.

- Access to Capital: Arc Capital Markets provides access to a diverse range of funding options, including venture debt, growth equity, and other alternative financing solutions. This allows startups to choose the best financing solution for their specific needs and growth stage.

- Expert Guidance: Arc Capital Markets offers expert guidance and support throughout the entire funding process. The team has deep experience in the venture capital and debt markets, and they can provide valuable insights and advice to startups.

- Strategic Partnerships: Arc Capital Markets has a strong network of strategic partners, including venture capitalists, angel investors, and other key players in the startup ecosystem. These partnerships provide startups with access to valuable resources and connections.

- Strong Track Record: Arc Capital Markets has a proven track record of success in supporting startups. The firm has helped numerous companies raise capital and achieve their growth objectives. This track record demonstrates the firm’s ability to deliver results.

Successful Arc Capital Markets Investments

Arc Capital Markets has a proven track record of success in supporting startups, with numerous examples of successful investments that have yielded significant returns. Here are some examples:

- [Startup Name]: Arc Capital Markets provided venture debt to [Startup Name], a [briefly describe the startup’s industry and product/service]. This investment enabled [Startup Name] to [explain the impact of the investment on the startup’s growth]. The startup was subsequently acquired by [mention the acquiring company] for [mention the acquisition amount] in [mention the year].

- [Startup Name]: Arc Capital Markets provided venture debt to [Startup Name], a [briefly describe the startup’s industry and product/service]. This investment helped [Startup Name] to [explain the impact of the investment on the startup’s growth]. The startup went on to achieve [mention the startup’s achievement, e.g., significant revenue growth, successful product launch].

- [Startup Name]: Arc Capital Markets provided venture debt to [Startup Name], a [briefly describe the startup’s industry and product/service]. This investment allowed [Startup Name] to [explain the impact of the investment on the startup’s growth]. The startup is currently valued at [mention the startup’s current valuation] and is poised for continued growth.

Contributing to Portfolio Companies’ Growth

Arc Capital Markets plays an active role in the growth and success of its portfolio companies. The firm provides ongoing support and guidance to help startups achieve their strategic goals.

- Financial Planning and Analysis: Arc Capital Markets helps startups develop sound financial plans and strategies. This includes assisting with budgeting, forecasting, and financial modeling.

- Operational Improvement: Arc Capital Markets works with startups to identify and implement operational improvements that can drive efficiency and profitability. This may involve areas such as sales and marketing, product development, and customer service.

- Strategic Advice: Arc Capital Markets provides strategic advice to startups on a wide range of matters, including market positioning, competitive analysis, and fundraising strategies.

- Network Access: Arc Capital Markets leverages its network of strategic partners to connect startups with potential customers, investors, and other key players in the industry.

The Future of Venture Debt: Arc Capital Markets Venture Debt

Venture debt is rapidly evolving as a critical funding source for startups. It’s becoming increasingly sophisticated and accessible, offering innovative solutions to meet the diverse needs of growing businesses.

The Evolving Landscape of Venture Debt Financing

Venture debt financing is undergoing a transformation, driven by several key factors:

- Increased Investor Interest: The venture debt market is attracting more investors, including traditional lenders, hedge funds, and private credit funds. This increased competition is driving down interest rates and making venture debt more accessible to a wider range of startups.

- Greater Product Differentiation: Venture debt providers are developing new and specialized products, catering to specific industries, growth stages, and risk profiles. This allows startups to access tailored financing solutions that meet their unique needs.

- Technological Advancements: The rise of fintech and online lending platforms is simplifying the venture debt application process, making it more efficient and transparent for both borrowers and lenders.

Emerging Trends and Innovations in the Venture Debt Market

The venture debt market is constantly evolving, with new trends and innovations emerging regularly:

- Revenue-Based Financing: This approach allows startups to repay their debt based on a percentage of their revenue, providing flexibility and reducing the pressure on cash flow.

- Equity-Linked Debt: This type of debt includes an equity component, giving lenders the potential for upside participation in the startup’s future success.

- Hybrid Debt Structures: Venture debt providers are increasingly offering hybrid structures that combine elements of traditional debt with equity-like features, providing startups with a broader range of financing options.

Potential Impact of Emerging Trends on the Future of Venture Debt

These trends are likely to have a significant impact on the future of venture debt:

- Increased Access to Capital: The growth of the venture debt market will make it easier for startups to access capital, fostering innovation and entrepreneurship.

- More Competitive Funding Landscape: The emergence of new financing options will create a more competitive funding landscape, giving startups more leverage in negotiating favorable terms.

- Greater Flexibility and Innovation: The development of new and specialized debt products will provide startups with greater flexibility and support for their unique growth strategies.

In the ever-evolving landscape of venture capital, Arc Capital Markets Venture Debt stands out as a game-changer for startups seeking to accelerate their growth. By offering a flexible and strategic approach to financing, Arc Capital Markets empowers entrepreneurs to achieve their goals and build sustainable businesses. Whether it’s bridging the gap between funding rounds, providing working capital, or supporting strategic acquisitions, Arc Capital Markets provides the resources and expertise startups need to succeed.

Arc Capital Markets specializes in venture debt, a crucial funding source for startups navigating the unpredictable landscape of growth. Imagine a world where language barriers melt away, thanks to the Google Pixel Fold’s dual-screen interpreter mode that brings subtitles to real-life conversations. This innovative technology mirrors the agility and adaptability that Arc Capital Markets brings to its venture debt solutions, helping companies bridge the gap between ambition and reality.

Standi Techno News

Standi Techno News