Australian Banks Boycott Apple Pay: A Digital Payment Showdown. This isn’t just another tech battle; it’s a clash of titans in the world of digital payments, with Australian banks taking a stand against Apple’s foray into their territory. The story begins with Apple Pay’s arrival in Australia, promising a seamless and convenient way to pay, but it didn’t take long for the established banking giants to push back, sparking a controversy that has implications for the future of digital payments.

The heart of the issue lies in the control and fees associated with Apple Pay. Australian banks, accustomed to their dominance in the payments landscape, saw Apple Pay as a threat to their existing systems and revenue streams. The boycott, a bold move by the banks, aimed to protect their interests and maintain control over the digital payment ecosystem. This led to a heated debate, with Apple arguing for the benefits of its platform and the banks emphasizing the importance of their role in safeguarding consumer data and financial security.

The Australian Banking Landscape

Australia has witnessed a significant shift towards digital payment adoption in recent years, driven by the increasing use of smartphones and the convenience offered by digital payment platforms. This has led to a dynamic and competitive landscape within the Australian banking sector, with major players vying for dominance in the digital payment space.

The Major Players and Their Payment Solutions

The Australian banking sector is dominated by the “Big Four” banks: Commonwealth Bank of Australia (CBA), Westpac Banking Corporation, National Australia Bank (NAB), and Australia and New Zealand Banking Group (ANZ). These institutions have established a strong presence in the market and have invested heavily in developing their own digital payment solutions.

- Commonwealth Bank of Australia (CBA): CBA offers a comprehensive range of digital payment solutions, including its popular “CommBank app,” which allows users to make payments, transfer funds, and manage their accounts. The bank also supports various contactless payment methods, including Apple Pay and Google Pay.

- Westpac Banking Corporation: Westpac has also embraced digital payments, offering its “Westpac One” app, which provides similar functionality to CBA’s app. Westpac has also partnered with other financial institutions to offer a wider range of payment options, including PayID and BPAY.

- National Australia Bank (NAB): NAB has focused on developing its “NAB Pay” platform, which allows customers to make payments using their mobile phones. The bank also supports various contactless payment methods, including Apple Pay and Google Pay.

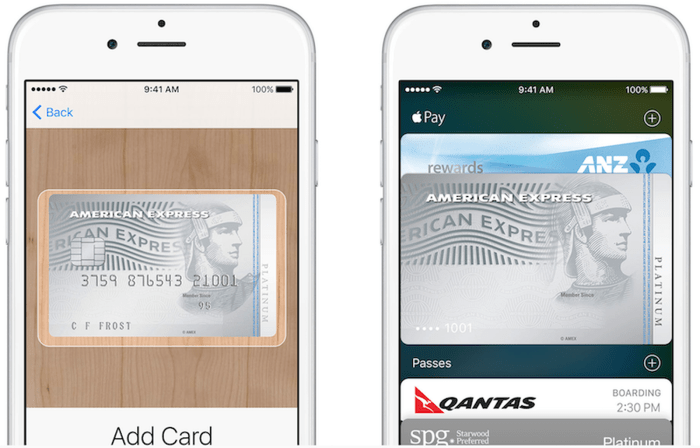

- Australia and New Zealand Banking Group (ANZ): ANZ has also developed its own digital payment platform, known as “ANZ goMoney.” The app allows customers to make payments, transfer funds, and manage their accounts. ANZ also supports various contactless payment methods, including Apple Pay and Google Pay.

The Competitive Landscape

The Australian banking sector is highly competitive, with each bank striving to differentiate itself by offering innovative payment solutions. The introduction of Apple Pay and Google Pay has further intensified competition, as these platforms offer users a convenient and secure way to make payments.

- Potential Conflicts of Interest: The introduction of Apple Pay and Google Pay has raised concerns about potential conflicts of interest. These platforms operate independently of the Australian banking sector, and some banks have expressed concerns about the control that these companies have over their customers’ payment data. The “Big Four” banks have expressed concerns that Apple and Google are becoming “gatekeepers” to the digital payment ecosystem, potentially limiting their ability to compete effectively. This is because Apple Pay and Google Pay can act as a “middleman” between banks and customers, potentially limiting the banks’ ability to directly interact with their customers and collect valuable data.

- The Future of Digital Payments in Australia: The future of digital payments in Australia is likely to be shaped by the ongoing competition between banks and technology companies. As technology continues to evolve, we can expect to see even more innovative payment solutions emerge, such as biometric authentication, blockchain-based payments, and the integration of artificial intelligence (AI) into payment systems. This will create new opportunities for banks to enhance their customer experience and remain competitive in the digital payment space.

Apple Pay’s Entry into the Australian Market

Apple Pay, the mobile payment service from Apple, made its debut in Australia in 2016, marking a significant moment in the country’s mobile payments landscape. This launch sparked widespread interest and excitement, particularly among Apple enthusiasts and early adopters of mobile payment technologies.

Initial Reception and Timeline

Apple Pay launched in Australia on February 18, 2016. The initial reception was largely positive, with many Australians eager to try out the new payment method. Apple Pay quickly gained traction, with a number of major banks and retailers signing up to support the service.

Key Features and Benefits

Apple Pay offered a range of features and benefits that appealed to Australian consumers:

- Convenience: Apple Pay enabled users to make contactless payments quickly and easily using their iPhone or Apple Watch, eliminating the need to carry physical cards.

- Security: Apple Pay employed advanced security measures, such as tokenization, to protect user data and prevent fraudulent transactions.

- Wide Acceptance: Apple Pay was accepted at a growing number of retailers and businesses in Australia, including major chains like Woolworths, Coles, and 7-Eleven.

- Integration with Apple Devices: Apple Pay seamlessly integrated with Apple’s ecosystem, allowing users to make payments directly from their Apple devices.

Potential Impact on the Australian Banking Industry

Apple Pay’s arrival in Australia presented both opportunities and challenges for the country’s banking industry:

- Increased Competition: Apple Pay provided a new avenue for consumers to make payments, potentially increasing competition for traditional payment methods like credit cards and debit cards.

- Potential for Innovation: Apple Pay’s success could encourage banks to invest in developing their own mobile payment solutions or to partner with other technology providers to enhance their offerings.

- Shifting Consumer Preferences: The rise of mobile payments, as exemplified by Apple Pay, could lead to a shift in consumer preferences towards digital payment methods, prompting banks to adapt their services and strategies.

The Boycott of Apple Pay by Australian Banks

The Australian banking landscape witnessed a unique event when major banks collectively boycotted Apple Pay, a move that sparked debate and scrutiny. This decision was not a knee-jerk reaction but a carefully considered strategy driven by a complex interplay of factors.

The Circumstances Surrounding the Boycott

The Australian banks’ boycott of Apple Pay was a direct response to Apple’s terms and conditions for using its mobile payment platform. The banks perceived these terms as unfavorable, potentially undermining their control over customer data and transactions.

Concerns and Challenges Raised by the Banks

The banks articulated several key concerns regarding Apple Pay:

- Control Over Customer Data: The banks expressed apprehension about Apple’s access to sensitive customer data, including transaction details and payment information. They feared that Apple’s control over this data could compromise customer privacy and potentially expose them to security risks.

- Transaction Fees: The banks argued that Apple’s transaction fees were exorbitant, eating into their profits and ultimately affecting the affordability of mobile payments for customers. They believed that these fees were disproportionate to the value Apple provided, especially considering the banks already had their own mobile payment systems in place.

- Limited Interoperability: The banks pointed out that Apple Pay was not fully compatible with their existing infrastructure, leading to potential integration challenges and limitations in functionality. They emphasized the importance of a seamless and integrated payment experience for customers, which Apple Pay did not fully guarantee.

- Competitive Concerns: The banks expressed concern about Apple’s dominance in the mobile payment market, fearing that Apple Pay’s widespread adoption could stifle competition and reduce consumer choice. They argued that a diverse ecosystem of mobile payment providers was essential for innovation and healthy market dynamics.

Arguments Presented by Apple and its Proponents

Apple and its supporters countered the banks’ concerns, emphasizing the benefits of Apple Pay:

- Enhanced Security: Apple argued that its payment platform provided a higher level of security than traditional payment methods, thanks to its robust encryption and tokenization technologies. They highlighted the importance of protecting customer data and reducing fraud risk.

- Convenience and Accessibility: Apple proponents emphasized the convenience and accessibility of Apple Pay, allowing users to make payments quickly and easily using their iPhones or Apple Watches. They highlighted the growing demand for contactless payments and the benefits of a user-friendly platform.

- Market Innovation: Apple argued that its entry into the Australian market would drive innovation and competition, ultimately benefiting consumers. They claimed that their technology would push other players to improve their offerings and create a more dynamic and competitive mobile payment landscape.

Consequences of the Boycott

The Australian banks’ boycott of Apple Pay had far-reaching consequences, impacting both the banks and consumers. The immediate and long-term ramifications of this decision were felt across the Australian digital payments ecosystem.

Impact on Banks, Australian banks boycott apple pay

The boycott’s impact on banks was multifaceted.

- Loss of Potential Revenue: By refusing to adopt Apple Pay, banks missed out on potential revenue streams associated with transaction fees. Apple Pay typically charges a small fee per transaction, which banks would have received.

- Missed Opportunity for Innovation: The boycott hampered banks’ ability to embrace innovative payment technologies. Apple Pay’s integration with NFC (Near Field Communication) technology provided a secure and convenient way for consumers to make payments. This missed opportunity could have positioned banks as leaders in the digital payments space.

- Negative Public Perception: The boycott drew negative attention from consumers, who perceived the banks’ actions as being anti-consumer and resistant to technological advancements. This damaged the banks’ public image and reputation.

- Competitive Disadvantage: The boycott put Australian banks at a competitive disadvantage compared to international institutions that had embraced Apple Pay. This could have hindered their ability to attract and retain customers in a competitive market.

Impact on Consumers

The boycott’s consequences for consumers were equally significant.

- Limited Payment Options: Consumers were limited in their payment options, particularly when using Apple devices. The lack of Apple Pay support made it inconvenient and cumbersome for consumers to make payments.

- Reduced Convenience: Apple Pay offered a convenient and seamless payment experience. The boycott forced consumers to rely on alternative payment methods, which were often less convenient and user-friendly.

- Potential Security Concerns: While Apple Pay is generally considered secure, the boycott may have led consumers to rely on less secure payment methods, potentially increasing their risk of fraud.

Impact on the Australian Digital Payments Ecosystem

The boycott had a detrimental impact on the Australian digital payments ecosystem.

- Slowed Adoption of Digital Payments: The boycott slowed the adoption of digital payments in Australia. The absence of Apple Pay hindered the development of a more robust and competitive digital payments landscape.

- Limited Innovation: The boycott discouraged innovation in the Australian digital payments market. It created an environment where banks were reluctant to embrace new technologies and ideas, hindering the growth of the sector.

- Missed Opportunity for Interoperability: The boycott missed an opportunity for interoperability between different payment systems. Apple Pay could have facilitated seamless transactions between various banks and payment providers, creating a more integrated and efficient ecosystem.

Financial and Reputational Risks

The boycott posed significant financial and reputational risks to all parties involved.

- Financial Losses: Banks could have suffered financial losses due to missed revenue opportunities and increased costs associated with maintaining legacy payment systems.

- Reputational Damage: The boycott damaged the reputation of both banks and the Australian digital payments ecosystem. It created a perception of resistance to innovation and a lack of consumer focus.

- Loss of Customer Trust: The boycott could have eroded consumer trust in banks and the Australian financial sector. Consumers may have become more inclined to seek alternative banking services that embraced innovative technologies.

Alternative Payment Solutions: Australian Banks Boycott Apple Pay

The Australian banks’ boycott of Apple Pay left a significant gap in the mobile payment landscape. However, it also opened the door for other payment solutions to step up and offer Australians alternative ways to pay.

Existing Mobile Payment Solutions

The boycott spurred the adoption of existing mobile payment solutions that were already present in the Australian market. These solutions, often offered by banks or financial institutions, provided an immediate alternative for consumers who were used to the convenience of contactless payments.

- Google Pay: A widely recognized mobile payment platform that works with various Android devices and supports contactless payments at many merchants. It also allows for online purchases and peer-to-peer transactions.

- Samsung Pay: Samsung’s mobile payment solution is available on select Samsung smartphones and supports contactless payments, online purchases, and even magnetic stripe readers found in older payment terminals.

- Bank-Specific Mobile Wallets: Many Australian banks have their own mobile wallets that allow users to make contactless payments, often integrated with their banking apps. These wallets often offer features like transaction history, budgeting tools, and loyalty program integration.

Emerging Payment Technologies

The boycott also accelerated the adoption of newer payment technologies, offering a more diverse range of payment options for Australian consumers. These emerging technologies presented a chance for innovation and disruption in the payment industry.

- QR Code Payments: QR code payments, popular in China and other Asian markets, gained traction in Australia. These payments involve scanning a QR code displayed by a merchant to complete a transaction. Several platforms, including Alipay and WeChat Pay, have entered the Australian market, offering this service.

- Biometric Authentication: Biometric authentication, such as facial recognition and fingerprint scanning, became more prevalent in mobile payments. These technologies offer a secure and convenient way to authenticate payments, eliminating the need for passwords or PINs.

- Near-Field Communication (NFC) Tags: NFC tags, small chips that can be attached to objects, can be used for contactless payments. This technology allows consumers to pay for goods and services simply by tapping their phone against an NFC-enabled tag, potentially streamlining the checkout process.

Future Outlook and Implications

The Australian banks’ boycott of Apple Pay, while initially a major setback for Apple’s ambitions in the Australian market, presents a complex scenario with various potential outcomes. Analyzing the situation provides insights into the future of digital payments in Australia and globally.

The Likelihood of a Resolution to the Boycott

The boycott’s resolution hinges on several factors, including the bargaining power of both parties, the evolving competitive landscape, and consumer preferences. While the banks initially sought to maintain control over the payment ecosystem, the growing popularity of mobile wallets and consumer demand for convenient payment options might force a compromise. Apple, on the other hand, might be willing to make concessions to secure a foothold in the lucrative Australian market.

Potential for Similar Boycotts in Other Countries

The Australian banks’ boycott serves as a cautionary tale for other countries considering the adoption of Apple Pay. The case highlights the potential for conflict between established financial institutions and technology giants vying for control over the digital payment space. Similar boycotts could arise in countries where banks hold significant market power and perceive Apple Pay as a threat to their existing business models. For instance, in countries like India, where mobile payments have surged, but banks still maintain a dominant position, a similar scenario might unfold.

The Broader Implications for the Evolution of Digital Payments Globally

The Australian case underscores the evolving dynamics of the digital payments landscape. The rise of mobile wallets and alternative payment methods, coupled with the growing influence of technology giants, challenges traditional banking systems. The conflict between Apple and Australian banks highlights the need for collaboration and innovation to create a seamless and secure digital payment experience for consumers. The Australian experience could prompt other countries to reconsider their approach to digital payments, fostering a more inclusive and competitive ecosystem.

The Australian banks’ boycott of Apple Pay stands as a stark reminder of the ongoing power struggle in the digital payment space. While the boycott ultimately failed to derail Apple Pay’s momentum, it highlighted the complex dynamics at play between technology giants and established financial institutions. The future of digital payments in Australia, and indeed globally, will likely be shaped by these ongoing negotiations, as new technologies and players continue to challenge the status quo.

The Australian banks’ boycott of Apple Pay might seem like a petty power struggle, but it’s a reminder that even the biggest tech giants can’t always force their way into new markets. Meanwhile, with 16m in fresh funds whistleblower software rebrands and expands into compliance , proving that innovation can thrive even in the face of resistance.

The banks’ stubbornness may just be a temporary setback for Apple Pay, but it’s a testament to the power of local players in a global market.

Standi Techno News

Standi Techno News