History of Apple Pay in Australia

Apple Pay, the mobile payment service developed by Apple, made its debut in Australia in 2016, marking a significant milestone in the country’s digital payment landscape. The introduction of Apple Pay was eagerly anticipated, and its journey in Australia has been marked by both positive developments and some initial challenges.

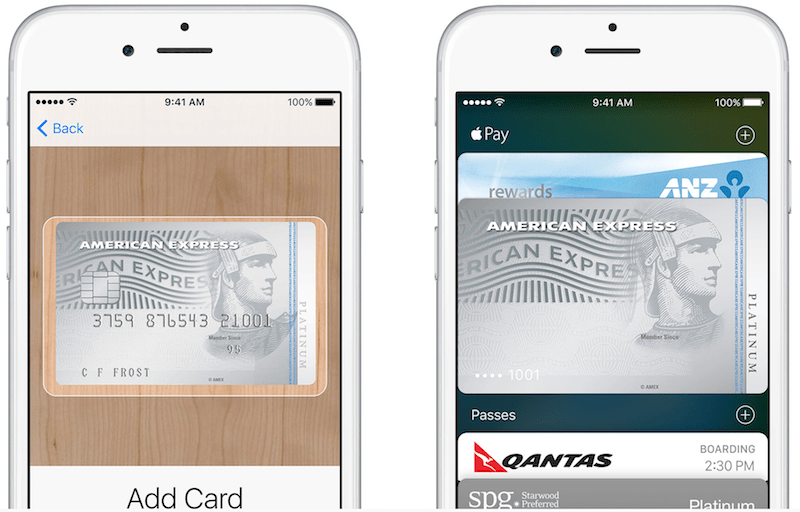

Early Adoption and Key Partnerships

The initial launch of Apple Pay in Australia was met with considerable excitement, with a number of major banks and financial institutions quickly signing on as partners. The service was initially available to customers of Commonwealth Bank, Westpac, National Australia Bank (NAB), and American Express. This early adoption helped establish Apple Pay as a viable and accessible option for Australian consumers.

Subsequent Expansion and Growth

Following its initial launch, Apple Pay continued to expand its reach in the Australian market. More banks and financial institutions joined the platform, including ANZ Bank, Bank of Melbourne, and Bendigo Bank. The increasing number of participating institutions broadened the appeal of Apple Pay, making it a more attractive option for a wider range of consumers.

Initial Challenges and Delays

Despite the initial enthusiasm, Apple Pay’s introduction in Australia was not without its challenges. Some banks initially faced delays in integrating their systems with Apple Pay, resulting in a slower-than-expected rollout for certain institutions. This delay was attributed to various factors, including technical complexities and regulatory considerations.

Reasons for Bank Resistance: Australian Banks Denied Apple Pay

The adoption of Apple Pay in Australia has been slower than in other countries, primarily due to the reluctance of major banks to embrace the technology. Several factors contribute to this resistance, ranging from security concerns to the potential impact on their existing business models.

While Apple Pay offers a convenient and secure payment method, Australian banks have been hesitant to fully integrate it into their systems.

Security Concerns

One of the primary reasons for bank resistance is concern about security. While Apple Pay boasts robust security features, including tokenization and biometric authentication, banks may worry about potential vulnerabilities and the risk of fraud.

“The security of customer data is paramount, and we are committed to ensuring that any new payment technology meets our rigorous security standards.” – A spokesperson for a major Australian bank

Banks may also be concerned about the potential for data breaches and the reputational damage that could result. The Australian banking sector has a strong focus on security, and any perceived weakness in Apple Pay could undermine customer trust.

Cost and Control

Integrating Apple Pay into existing banking systems can be costly, requiring significant investment in infrastructure and software updates. Banks may also be concerned about losing control over customer data and the customer experience. Apple Pay operates on a closed ecosystem, and banks may be hesitant to cede control of their customer relationships to a third party.

“We need to ensure that any new payment technology is aligned with our existing systems and processes, and that it does not compromise our ability to provide a seamless and secure banking experience.” – Another bank spokesperson

This concern is particularly relevant in Australia, where banks have historically maintained a strong grip on customer data and interactions.

The emergence of Apple Pay and other mobile payment solutions has introduced a new level of competition to the Australian banking market. Banks may be concerned about losing market share to alternative payment providers, particularly as younger generations increasingly embrace digital payment methods.

“We are constantly evaluating new technologies and services to ensure that we remain competitive and meet the evolving needs of our customers.” – A statement from a major Australian bank

Banks may also be wary of the potential for Apple Pay to disrupt their existing revenue streams, such as fees for card transactions.

Comparison with Other Countries

In contrast to Australia, Apple Pay has gained widespread acceptance in other countries, including the United States, Canada, and the United Kingdom. This difference can be attributed to a combination of factors, including a more competitive banking landscape, a higher adoption rate of smartphones, and a greater willingness by banks to embrace new technologies.

“The Australian banking sector has historically been more risk-averse than its counterparts in other developed countries, which has contributed to a slower pace of innovation.” – A financial analyst

The Australian banking landscape is characterized by a high level of concentration, with a small number of large banks dominating the market. This lack of competition may have contributed to a more cautious approach to new technologies.

Impact on Consumers and Businesses

Apple Pay’s potential arrival in Australia has sparked excitement among consumers and businesses alike, promising a smoother and more secure payment experience. While the benefits are undeniable, certain drawbacks also exist, requiring careful consideration.

Impact on Consumers, Australian banks denied apple pay

The introduction of Apple Pay in Australia holds significant implications for consumers, offering both advantages and potential drawbacks.

- Convenience and Speed: Apple Pay streamlines the payment process, eliminating the need for physical cards or cash. Consumers can make purchases quickly and easily with just a tap of their iPhone or Apple Watch. This convenience is particularly appealing for everyday transactions, such as buying coffee or groceries.

- Security and Privacy: Apple Pay prioritizes security and privacy. Transactions are encrypted and authenticated through Touch ID or Face ID, reducing the risk of fraud and unauthorized access to payment information.

- Increased Spending: The ease and speed of Apple Pay could potentially lead to increased spending as consumers are more likely to make impulse purchases.

- Limited Acceptance: The widespread adoption of Apple Pay depends on merchant acceptance. While many major retailers have embraced contactless payments, smaller businesses may not have the necessary infrastructure, limiting the practicality of Apple Pay for some consumers.

- Data Privacy Concerns: While Apple emphasizes privacy, concerns remain regarding the collection and use of transaction data by Apple and participating banks.

Impact on Businesses

Apple Pay’s potential arrival in Australia offers numerous benefits for businesses, enhancing customer experience and potentially reducing costs.

- Increased Convenience and Speed: Apple Pay offers a faster and more convenient checkout experience for customers, leading to shorter queues and reduced wait times. This improved efficiency can boost customer satisfaction and encourage repeat business.

- Reduced Transaction Costs: Businesses can potentially save on transaction fees associated with traditional card payments. Apple Pay’s lower processing fees can contribute to increased profitability.

- Enhanced Security: Apple Pay’s security features can help businesses reduce the risk of fraudulent transactions and protect sensitive customer data.

- Improved Customer Loyalty: Offering a seamless and secure payment experience through Apple Pay can enhance customer loyalty and attract new customers who value convenience and technology.

- Increased Sales: The ease of use and speed of Apple Pay can encourage impulse purchases and potentially lead to increased sales for businesses.

Influence on the Australian Mobile Payments Market

Apple Pay’s potential entry into the Australian market has already influenced the mobile payments landscape.

- Increased Competition: The arrival of Apple Pay would intensify competition among existing mobile payment providers, such as Google Pay and Samsung Pay, potentially leading to lower fees and improved features for consumers.

- Accelerated Adoption of Contactless Payments: Apple Pay’s popularity in other markets has accelerated the adoption of contactless payments globally. This trend is likely to continue in Australia, driving greater acceptance of mobile payment technologies among businesses and consumers.

- Innovation and Development: The introduction of Apple Pay could stimulate innovation and development within the Australian mobile payments industry, leading to the emergence of new payment solutions and technologies.

Australian banks denied apple pay – The saga of Australian banks denying Apple Pay offers a compelling case study in the evolving world of digital payments. It highlights the clash between established financial practices and the relentless march of technology. While the future of Apple Pay in Australia remains uncertain, one thing is clear: the demand for seamless and secure mobile payments is only growing, pushing banks to adapt and embrace the digital revolution.

While Aussie bank users are still stuck with the old-school tap-and-go, the VR world is getting a major upgrade. HTC Vive gets new content bundle , giving users access to a whole new world of virtual experiences. Meanwhile, Australian banks are stuck in the past, denying us the convenience of Apple Pay. Maybe they should take a cue from the VR world and embrace some innovation?

Standi Techno News

Standi Techno News