Baron values swiggy at 12 16b above prior private market valuation – Baron Values Swiggy at $12-16 Billion, Above Prior Market Valuation sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The news of Baron Capital Group valuing the Indian food delivery giant, Swiggy, at a whopping $12-16 billion has sent shockwaves through the industry, especially considering it’s a significant leap from previous private market valuations. This valuation reflects a surge in confidence in Swiggy’s potential, driven by its impressive growth trajectory and strategic position in the rapidly expanding Indian food delivery market.

This valuation is a testament to Swiggy’s dominance in the Indian food delivery space, showcasing its ability to navigate a competitive landscape and capture a significant market share. The valuation also underscores the burgeoning potential of the Indian food delivery market, which is experiencing rapid growth fueled by increasing urbanization, rising disposable incomes, and a growing preference for convenience. This analysis will delve into the factors driving this valuation, exploring the key metrics that make Swiggy a lucrative investment opportunity and examining the company’s future prospects.

Valuation Dynamics

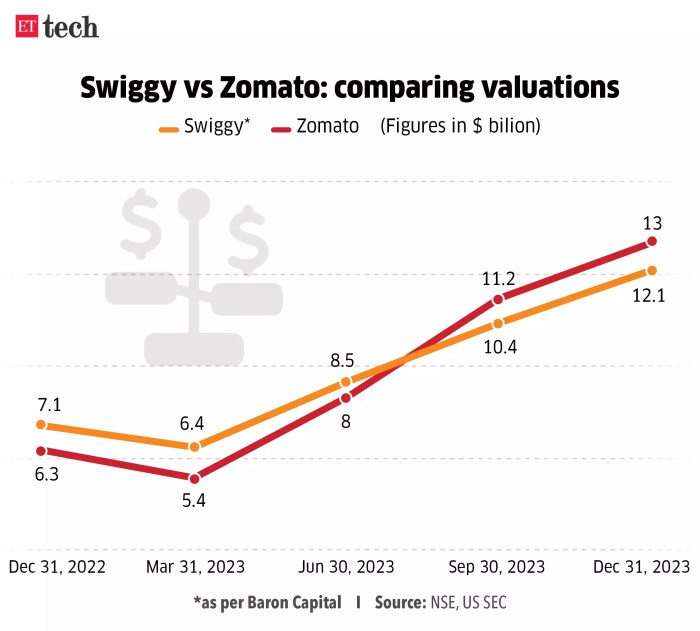

Baron’s valuation of Swiggy at $12-16 billion signifies a significant jump from its previous private market valuations. This valuation highlights the increasing investor confidence in the company’s growth trajectory and its potential to become a dominant player in the Indian online food delivery market.

Comparison with Previous Valuations

The valuation assigned by Baron represents a substantial increase compared to Swiggy’s previous private market valuations. In 2020, Swiggy was valued at around $5 billion, which reflects the significant growth the company has experienced in recent years. The factors driving this valuation difference include:

- Increased Market Share: Swiggy has consistently grown its market share in the Indian food delivery market, solidifying its position as a leader. This growth is attributed to its robust delivery network, extensive restaurant partnerships, and innovative features.

- Expansion into New Verticals: Swiggy has expanded beyond food delivery into grocery delivery and quick commerce, broadening its revenue streams and attracting new customer segments. This diversification strategy has contributed to its enhanced valuation.

- Improved Profitability: Swiggy has demonstrated significant improvements in its financial performance, with a focus on profitability and cost optimization. This improved profitability has made the company more attractive to investors, driving up its valuation.

- Favorable Market Conditions: The Indian online food delivery market is experiencing rapid growth, driven by increasing smartphone penetration, rising disposable incomes, and changing consumer preferences. This favorable market environment has boosted investor confidence in the sector, leading to higher valuations for companies like Swiggy.

Methodology Used by Baron

Baron likely employed a combination of methodologies to arrive at its valuation, including:

- Comparable Company Analysis: Baron may have compared Swiggy to other publicly listed food delivery companies globally, considering their financial performance, market share, and growth prospects. This comparison would have provided a benchmark for Swiggy’s valuation.

- Discounted Cash Flow (DCF) Analysis: Baron may have projected Swiggy’s future cash flows and discounted them back to the present value using a discount rate that reflects the company’s risk profile. This analysis would have provided an intrinsic valuation based on Swiggy’s expected future earnings.

- Precedent Transactions: Baron may have considered recent transactions involving food delivery companies to understand the market dynamics and the valuations assigned to similar businesses. This analysis would have provided insights into the current market appetite for investments in this sector.

Key Metrics and Financial Performance

Swiggy’s valuation is supported by its strong financial performance and key metrics, including:

- Revenue Growth: Swiggy has consistently demonstrated robust revenue growth, driven by its expanding customer base and increasing order volumes. This growth has made the company more attractive to investors, leading to a higher valuation.

- Market Share: Swiggy holds a significant market share in the Indian online food delivery market, solidifying its position as a dominant player. This market leadership has contributed to its enhanced valuation.

- Profitability: Swiggy has made significant progress in improving its profitability, demonstrating its ability to manage costs and generate sustainable profits. This improved financial performance has increased investor confidence and contributed to the valuation.

- User Base: Swiggy boasts a large and growing user base, reflecting the popularity of its services and its strong brand recognition. This user base is a key driver of revenue growth and contributes to the company’s valuation.

Market Context

The Indian food delivery market is experiencing rapid growth, fueled by increasing urbanization, rising disposable incomes, and the growing popularity of online ordering. This has led to a surge in investments and a competitive landscape characterized by established players and emerging startups.

The Indian Food Delivery Market: A Flourishing Landscape

The Indian food delivery market is booming, driven by several factors. The increasing urbanization and rising disposable incomes in India have created a large and growing customer base for food delivery services. The convenience and ease of ordering food online have also contributed to the market’s rapid growth. Additionally, the proliferation of smartphones and internet access has made it easier for consumers to access food delivery platforms.

The Indian food delivery market is highly competitive, with several key players vying for market share.

- Swiggy, founded in 2014, is one of the leading players in the market, known for its extensive network of restaurants and its focus on customer experience.

- Zomato, another prominent player, offers a wide range of services, including food delivery, restaurant discovery, and table reservations.

- Uber Eats, the food delivery arm of ride-hailing giant Uber, has also established a significant presence in the Indian market.

- Other players include Dunzo, a hyperlocal delivery platform, and Blinkit, a quick-commerce platform.

External Factors Shaping the Market

The food delivery market is influenced by various external factors, including:

- Economic Conditions: Economic downturns can impact consumer spending, potentially affecting the demand for food delivery services. However, the Indian economy is expected to continue its growth trajectory, which will likely support the food delivery market.

- Regulatory Changes: Government regulations and policies can impact the food delivery industry, such as those related to food safety, pricing, and platform fees.

- Technological Advancements: Technological advancements, such as the development of AI-powered delivery systems and contactless delivery options, can significantly impact the food delivery market.

Future Growth Potential: A Promising Outlook

The Indian food delivery market is projected to continue its rapid growth in the coming years. The increasing penetration of smartphones and internet access, coupled with the growing adoption of online ordering, will drive further market expansion. The emergence of new business models, such as cloud kitchens and ghost kitchens, will also contribute to the market’s growth.

Swiggy’s Business Model: Baron Values Swiggy At 12 16b Above Prior Private Market Valuation

Swiggy is a leading online food delivery platform in India, operating a multi-sided marketplace that connects customers with restaurants. The company’s success is rooted in its robust business model, which leverages technology to streamline the food ordering and delivery process, while also catering to the needs of both customers and restaurant partners.

Swiggy’s business model revolves around facilitating transactions between customers and restaurants, earning revenue through commissions on orders and additional services. The company’s operational structure involves a network of delivery partners, a robust technology platform, and a customer support team that ensures a seamless experience for all stakeholders.

Revenue Streams

Swiggy’s revenue streams are primarily derived from:

- Commission on Orders: The primary revenue source for Swiggy is a commission charged on each order placed through its platform. This commission is typically a percentage of the order value, varying depending on the restaurant and the type of order.

- Delivery Fees: Swiggy charges customers a delivery fee for orders, which contributes to its revenue. However, the company often offers free delivery promotions to attract customers and incentivize orders.

- Subscription Services: Swiggy offers subscription services like Swiggy One, which provides users with benefits such as free deliveries, discounts, and priority service. These subscriptions generate recurring revenue for the company.

- Advertising: Swiggy also generates revenue through advertising on its platform, allowing restaurants to promote their offerings to a wider audience. This revenue stream is expected to grow as the company expands its user base.

Customer Base

Swiggy caters to a large and diverse customer base across India, targeting both urban and semi-urban populations. The company’s customer base comprises:

- Office Workers: A significant portion of Swiggy’s customer base consists of office workers who rely on the platform for convenient and quick lunch and dinner options.

- Students: Students also represent a significant customer segment, particularly in cities with large student populations. Swiggy offers affordable and diverse food options, making it a popular choice for students.

- Families: Swiggy caters to families by offering a wide range of cuisines and options, including vegetarian, vegan, and healthy meals. The company’s delivery services are also convenient for families who prefer to stay home and enjoy meals together.

- Individuals: Swiggy serves individuals who prefer to order food online for various reasons, such as lack of time to cook, convenience, and the desire to explore different cuisines.

Operational Structure

Swiggy’s operational structure is built around a network of delivery partners, a technology platform, and a customer support team:

- Delivery Partners: Swiggy relies on a network of delivery partners who are responsible for picking up orders from restaurants and delivering them to customers. These partners are typically independent contractors who use their own vehicles for deliveries.

- Technology Platform: Swiggy’s technology platform is the backbone of its operations, enabling seamless order placement, restaurant management, and delivery tracking. The platform leverages advanced algorithms to optimize delivery routes, manage inventory, and provide real-time updates to customers.

- Customer Support Team: Swiggy has a dedicated customer support team that handles inquiries, complaints, and feedback from customers and restaurant partners. This team plays a crucial role in ensuring customer satisfaction and resolving any issues that may arise.

Key Features and Benefits

Swiggy’s platform offers a range of features and benefits for both customers and restaurant partners:

Customers

- Wide Selection: Swiggy offers a wide selection of restaurants and cuisines, catering to diverse tastes and preferences. Customers can choose from thousands of restaurants across various categories, including Indian, Chinese, Italian, and more.

- Convenient Ordering: Swiggy’s user-friendly app and website make it easy for customers to place orders, track their deliveries, and manage their accounts. The platform offers multiple payment options, including cash on delivery, credit cards, and digital wallets.

- Fast Delivery: Swiggy prioritizes fast delivery times, with most orders being delivered within 30-45 minutes. The company uses advanced technology to optimize delivery routes and ensure timely deliveries.

- Order Tracking: Swiggy provides real-time order tracking, allowing customers to monitor the status of their deliveries and receive updates on the estimated arrival time. This feature enhances transparency and keeps customers informed throughout the process.

- Special Offers and Discounts: Swiggy offers various special offers and discounts to customers, including promotions, loyalty programs, and coupon codes. These incentives encourage repeat orders and drive customer engagement.

Restaurant Partners

- Increased Visibility: Swiggy’s platform provides restaurants with increased visibility to a wider audience, reaching customers who may not have known about their establishment previously. This exposure can drive new customers and boost sales.

- Order Management System: Swiggy’s platform offers a robust order management system that simplifies order processing, inventory management, and order fulfillment for restaurants. This system streamlines operations and reduces the risk of errors.

- Marketing and Promotion Tools: Swiggy provides restaurants with various marketing and promotion tools to reach their target customers. These tools include targeted advertising campaigns, special offers, and promotions, helping restaurants increase brand awareness and attract new customers.

- Data Analytics: Swiggy’s platform provides restaurants with valuable data analytics insights, enabling them to understand customer preferences, order trends, and popular dishes. This data can help restaurants optimize their menus, improve customer service, and drive sales.

Expansion Strategy, Baron values swiggy at 12 16b above prior private market valuation

Swiggy has adopted a multi-pronged strategy to expand its services and market share:

- Geographical Expansion: Swiggy has been actively expanding its geographical reach, adding new cities and towns to its network. The company aims to cover a wider range of locations to cater to a larger customer base and tap into new markets.

- Expanding Service Offerings: Swiggy has expanded its service offerings beyond food delivery, including grocery delivery, quick commerce, and restaurant reservations. This diversification allows the company to cater to a wider range of customer needs and capture a larger market share.

- Partnerships and Acquisitions: Swiggy has engaged in strategic partnerships and acquisitions to strengthen its market position. These collaborations have helped the company expand its service offerings, reach new customers, and gain access to new technologies.

- Investing in Technology: Swiggy continues to invest heavily in technology to enhance its platform, improve efficiency, and enhance customer experience. The company is exploring advanced technologies such as artificial intelligence (AI) and machine learning (ML) to optimize its operations and personalize customer interactions.

Customer Experience and Brand Loyalty

Swiggy prioritizes customer experience and brand loyalty through various initiatives:

- Customer Support: Swiggy provides 24/7 customer support through various channels, including phone, email, and live chat. The company aims to resolve customer issues promptly and efficiently, ensuring a positive experience.

- Personalized Recommendations: Swiggy leverages data analytics to provide personalized recommendations to customers, suggesting restaurants and dishes based on their past orders and preferences. This personalization enhances customer satisfaction and encourages repeat orders.

- Loyalty Programs: Swiggy offers loyalty programs, such as Swiggy One, that reward customers for their patronage. These programs provide exclusive benefits, discounts, and perks, incentivizing customers to order frequently and remain loyal to the platform.

- Community Initiatives: Swiggy engages in various community initiatives, such as supporting local restaurants and food banks. These initiatives enhance the company’s image and foster positive relationships with customers and the community.

Investment Implications

Swiggy’s recent valuation at $12.16 billion, exceeding its prior private market valuation, presents a compelling investment opportunity, but it also comes with inherent risks. Understanding these risks and opportunities is crucial for investors to make informed decisions.

Potential Risks and Opportunities

The potential risks and opportunities associated with investing in Swiggy are multifaceted, stemming from its business model, competitive landscape, and broader economic conditions.

- Competition: The food delivery market is highly competitive, with players like Zomato, Uber Eats, and local competitors vying for market share. Swiggy’s ability to maintain its market leadership and profitability in this environment is crucial.

- Profitability: Swiggy has been focusing on profitability, but achieving sustained profitability in a competitive market with high operating costs is challenging. Investors should carefully evaluate Swiggy’s profitability metrics and growth trajectory.

- Regulatory Environment: The food delivery sector is subject to various regulations, including those related to food safety, labor laws, and platform fees. Changes in regulations could impact Swiggy’s operating costs and revenue.

- Technological Disruption: The food delivery industry is constantly evolving, with new technologies and business models emerging. Swiggy’s ability to adapt to these changes will be critical to its long-term success.

- Economic Conditions: Macroeconomic factors like inflation, consumer spending, and unemployment can significantly impact Swiggy’s performance. During economic downturns, consumers may reduce discretionary spending on food delivery, impacting Swiggy’s revenue.

Factors Influencing Swiggy’s Future Valuation and Performance

Several factors will influence Swiggy’s future valuation and performance, including its ability to:

- Expand Market Share: Swiggy can continue to expand its market share by entering new markets, targeting new customer segments, and offering innovative services.

- Enhance Profitability: Swiggy needs to improve its profitability by optimizing its operations, negotiating better terms with restaurants, and exploring new revenue streams.

- Strengthen Brand: Building a strong brand reputation is essential for attracting and retaining customers in a competitive market. Swiggy can achieve this through superior customer service, consistent quality, and targeted marketing campaigns.

- Embrace Technology: Leveraging technology for operational efficiency, personalized recommendations, and innovative delivery solutions can give Swiggy a competitive edge.

- Adapt to Changing Consumer Preferences: Swiggy needs to adapt to changing consumer preferences, such as a growing demand for healthy and sustainable food options and contactless delivery.

Key Metrics for Investors

Investors should closely monitor key metrics to assess Swiggy’s progress and performance. These include:

- Revenue Growth: Investors should track Swiggy’s revenue growth to understand its market share and overall performance.

- Gross Merchandise Value (GMV): GMV reflects the total value of transactions on Swiggy’s platform, providing insights into the platform’s activity and growth potential.

- Profitability: Investors should assess Swiggy’s profitability metrics, such as EBITDA and net income, to understand its financial health and sustainability.

- Customer Acquisition Cost (CAC): CAC reflects the cost of acquiring new customers, which is crucial for Swiggy’s growth strategy.

- Customer Retention Rate: Customer retention rate is a key indicator of Swiggy’s ability to retain existing customers and build customer loyalty.

Impact of Baron’s Valuation

Baron’s valuation of Swiggy at $12.16 billion is a significant endorsement of the company’s potential. This valuation can:

- Boost Confidence: The high valuation can boost investor confidence in Swiggy’s future prospects and attract further investment.

- Enhance Bargaining Power: A strong valuation can give Swiggy more bargaining power in negotiations with restaurants and other stakeholders.

- Increase Competition: The valuation may attract more competition in the food delivery market, potentially leading to price wars and increased investment in innovation.

The valuation of Swiggy at $12-16 billion by Baron Capital Group signifies a significant vote of confidence in the company’s future. This valuation reflects Swiggy’s strong position in the rapidly growing Indian food delivery market, its robust business model, and its potential for continued expansion. The future looks bright for Swiggy, with its focus on innovation, customer satisfaction, and strategic partnerships. As the Indian food delivery market continues to evolve, Swiggy is well-positioned to capitalize on its growth and solidify its dominance in the space. The company’s commitment to expanding its services, enhancing customer experience, and building a strong brand loyalty will be key drivers of its future success. This valuation serves as a testament to the potential of the Indian food delivery market and the transformative power of technology in shaping consumer behavior. The future of Swiggy and the Indian food delivery market is ripe with possibilities, and this valuation is just the beginning of an exciting journey.

Baron’s valuation of Swiggy at $12.16 billion, a significant jump from previous private market valuations, underscores the growing confidence in the Indian food delivery market. This surge in investment comes at a time when the tech industry is seeing a wave of funding, as seen in the recent OpenAI Startup Fund raising an additional $5 million. This influx of capital signals a strong belief in the potential of both artificial intelligence and the future of food delivery, highlighting the exciting possibilities for innovation and growth in these sectors.

Standi Techno News

Standi Techno News