Battery Ventures startup valuations are a hot topic, especially with the booming EV market and the increasing demand for renewable energy. These startups are revolutionizing the energy landscape, but understanding their value can be tricky. From tech innovation to market demand, several factors come into play when assessing these companies.

This article delves into the intricacies of battery ventures startup valuations, exploring the key metrics, valuation methods, and real-world examples. We’ll also discuss the impact of regulatory landscapes, funding stages, and the future trends shaping this dynamic sector.

The Battery Ventures Landscape: Battery Ventures Startup Valuations

The battery ventures market is experiencing explosive growth, driven by the increasing demand for energy storage solutions in various sectors, including electric vehicles, renewable energy, and grid-scale applications. This burgeoning market is characterized by rapid technological advancements, evolving business models, and fierce competition among established players and emerging startups.

Key Trends and Growth Drivers

The battery ventures market is characterized by several key trends and growth drivers:

- Rising Demand for Electric Vehicles (EVs): The global shift towards electric vehicles is a major driver of battery demand. As EV adoption accelerates, the need for high-performance, long-lasting, and affordable batteries is paramount.

- Renewable Energy Integration: The increasing reliance on renewable energy sources like solar and wind power necessitates efficient energy storage solutions. Batteries play a crucial role in stabilizing the grid and ensuring reliable energy supply.

- Grid-Scale Energy Storage: Battery storage is becoming increasingly important for grid-scale applications, enabling utilities to manage peak demand, improve grid reliability, and integrate renewable energy sources.

- Technological Advancements: Continuous innovation in battery technology is driving improvements in energy density, lifespan, charging speed, and cost. New technologies like solid-state batteries and lithium-sulfur batteries hold the potential to revolutionize the industry.

- Government Policies and Incentives: Governments worldwide are implementing policies and incentives to promote the adoption of electric vehicles and renewable energy, further stimulating the battery ventures market.

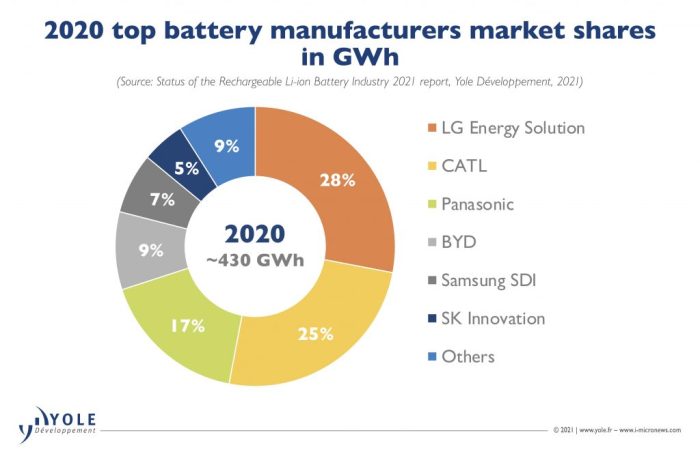

The battery ventures market is dominated by a few major players, including:

- Tesla: The leading electric vehicle manufacturer, Tesla has a significant presence in the battery market, with its Gigafactory producing batteries for its vehicles and energy storage systems.

- LG Energy Solution: A major supplier of lithium-ion batteries for electric vehicles, consumer electronics, and energy storage systems.

- Panasonic: A long-standing partner with Tesla, Panasonic is a key player in the battery market, supplying batteries for EVs and other applications.

- CATL: The world’s largest battery manufacturer, CATL is a major supplier to several automotive manufacturers, including Volkswagen, BMW, and Daimler.

- Samsung SDI: A leading manufacturer of lithium-ion batteries for electric vehicles, consumer electronics, and energy storage systems.

Challenges and Opportunities

Battery ventures startups face several challenges and opportunities:

- Competition: The battery ventures market is highly competitive, with established players possessing significant resources and market share. Startups need to differentiate themselves by offering innovative solutions, cost-effective products, or niche applications.

- Funding: Securing sufficient funding is crucial for startups to develop and scale their technologies. Investors are increasingly interested in the battery space, but securing funding can be challenging, especially for early-stage startups.

- Technological Advancements: The rapid pace of technological innovation in the battery industry requires startups to constantly adapt and innovate to remain competitive.

- Supply Chain Management: Building a reliable and efficient supply chain is essential for battery ventures startups, especially given the complex and global nature of the battery manufacturing process.

- Environmental Sustainability: Battery production and disposal can have significant environmental impacts. Startups need to prioritize sustainable practices and develop solutions that minimize their environmental footprint.

Emerging Technologies

The battery ventures market is constantly evolving, with several emerging technologies promising to revolutionize the industry:

- Solid-State Batteries: Solid-state batteries offer several advantages over traditional lithium-ion batteries, including higher energy density, improved safety, and longer lifespan.

- Lithium-Sulfur Batteries: Lithium-sulfur batteries have the potential for significantly higher energy density than lithium-ion batteries, making them ideal for electric vehicles and grid-scale energy storage.

- Flow Batteries: Flow batteries are large-scale energy storage systems that use electrolytes to store energy. They are particularly well-suited for grid-scale applications, offering long lifespans and high power output.

- Redox Flow Batteries: Redox flow batteries are a type of flow battery that uses redox reactions to store energy. They offer several advantages, including long lifespans, high power output, and scalability.

Factors Influencing Battery Ventures Startup Valuations

Valuing battery ventures is a complex process that involves analyzing various factors, including financial metrics, technological advancements, market demand, and regulatory landscape. Investors, like Battery Ventures, consider these factors to assess the potential of a startup and determine its fair market value.

Financial Metrics

Financial metrics play a crucial role in determining the valuation of a battery ventures startup. Investors analyze key financial indicators to assess the company’s performance, growth potential, and profitability.

- Revenue Growth: A rapidly growing revenue stream is a strong indicator of a company’s potential and market acceptance. Battery Ventures looks for startups with consistent revenue growth and a clear path to achieving profitability.

- Profitability: Profitability is a critical factor for investors, especially in the long term. Startups with a strong profit margin and a proven ability to generate profits are more attractive to investors.

- Customer Acquisition Cost (CAC): This metric reflects the cost of acquiring a new customer. Investors look for startups with a low CAC, indicating efficient marketing and sales strategies.

- Customer Lifetime Value (CLTV): CLTV represents the total revenue a company expects to generate from a single customer over their relationship with the company. A high CLTV indicates a strong customer base and recurring revenue potential.

Valuation Methods for Battery Ventures Startups

Determining the value of a battery ventures startup is a crucial step for investors, founders, and stakeholders. Several valuation methods are commonly used, each with its strengths and weaknesses in the context of battery ventures.

Discounted Cash Flow Analysis (DCF)

DCF analysis is a fundamental valuation method that projects future cash flows and discounts them back to their present value. This method is particularly relevant for battery ventures as it considers the long-term growth potential and profitability of the company.

- Strengths: DCF analysis provides a comprehensive view of the company’s future financial performance, considering factors like revenue growth, operating expenses, and capital expenditures. It is a data-driven approach that allows for a detailed analysis of the company’s underlying economics.

- Weaknesses: DCF analysis relies heavily on assumptions about future cash flows, which can be challenging to predict accurately, especially for startups in rapidly evolving industries like battery technology. It also requires a detailed understanding of the company’s operations and the competitive landscape.

- Real-world Example: A battery startup developing innovative lithium-ion batteries for electric vehicles could use DCF analysis to estimate its future revenue based on projected market growth, battery sales volume, and pricing. By discounting these future cash flows, they could arrive at a present value that reflects the company’s intrinsic worth.

Comparable Company Analysis (CCA)

CCA involves comparing the valuation multiples of publicly traded companies that are similar to the target battery venture. These multiples, such as price-to-earnings ratio (P/E) or enterprise value-to-EBITDA, can be used to derive a valuation range for the startup.

- Strengths: CCA provides a quick and straightforward valuation approach, leveraging market data from publicly traded companies. It is particularly useful for startups with limited historical financial data.

- Weaknesses: CCA relies on finding truly comparable companies, which can be challenging in the dynamic battery technology space. The valuation multiples of public companies may not accurately reflect the risk profile and growth potential of a battery venture startup.

- Real-world Example: A battery startup developing energy storage solutions for residential use could compare its valuation to publicly traded companies in the renewable energy sector, such as solar panel manufacturers or energy storage providers. By analyzing their P/E ratios and other relevant multiples, the startup can gain insights into its potential valuation.

Precedent Transactions

This method involves analyzing the valuation multiples used in recent acquisitions of similar battery ventures. This provides insights into the market’s perception of value for companies in the specific sector.

- Strengths: Precedent transactions provide a real-world indication of the value that investors are willing to pay for battery ventures. It is particularly useful when comparable company data is limited.

- Weaknesses: Precedent transactions are often confidential and may not be readily available. The specific circumstances of each acquisition, such as the buyer’s strategic goals and the market conditions at the time, can influence the valuation multiples, making it challenging to draw direct comparisons.

- Real-world Example: A battery startup developing advanced battery materials could analyze recent acquisitions of similar companies in the materials science sector. By comparing the acquisition prices and the underlying financials of the acquired companies, the startup can gain insights into the market’s valuation expectations for its technology.

Case Studies of Battery Ventures Startup Valuations

The battery venture landscape is dynamic, with startups emerging and evolving rapidly. Understanding the valuation trajectories of notable companies provides valuable insights into the factors influencing their success. This section delves into several case studies, examining their valuations over time and identifying key drivers.

Valuation Trajectories of Notable Battery Ventures Startups

Analyzing the valuation trajectories of several prominent battery ventures startups helps illustrate the dynamics of this sector. These case studies highlight the impact of funding rounds, product launches, and market performance on valuation.

- QuantumScape: This solid-state battery startup garnered significant attention for its innovative technology and impressive funding rounds. Its valuation surged during its initial public offering (IPO) in 2020, reflecting investor optimism about its potential. However, subsequent delays in commercialization and production challenges led to a decline in its valuation. This case study demonstrates the importance of execution and achieving milestones in sustaining a high valuation.

- Solid Power: Another solid-state battery developer, Solid Power, experienced a similar valuation trajectory. It attracted significant investments based on its promising technology and strong partnerships. However, its valuation has fluctuated due to factors such as competition and the timeline for commercialization. This highlights the competitive nature of the battery venture landscape and the need for differentiation to maintain a strong valuation.

- Freyr Battery: This Norwegian battery manufacturer has focused on scaling up production capacity and securing long-term contracts with major automotive players. Its valuation has risen steadily, reflecting its progress in establishing a strong foothold in the rapidly growing electric vehicle (EV) market. This case study demonstrates the importance of strategic partnerships and market positioning in driving valuation growth.

Key Factors Influencing Valuation

The valuation of battery ventures startups is influenced by a complex interplay of factors. These include:

- Technology Innovation: Startups with breakthrough battery technologies, such as solid-state batteries or advanced lithium-ion chemistries, often command higher valuations. Investors seek companies with the potential to disrupt the industry and deliver significant value.

- Funding Rounds: Successful funding rounds, particularly from reputable investors, signal confidence in a startup’s potential and can significantly boost its valuation. Each funding round typically reflects a higher valuation than the previous one, reflecting the investor’s belief in the company’s growth trajectory.

- Product Launches: Successful product launches and early market traction are critical for validating a startup’s technology and business model. These milestones can drive significant valuation increases, demonstrating the company’s ability to deliver on its promises.

- Market Performance: The overall growth and performance of the battery market significantly influence valuations. Factors such as government policies, EV adoption rates, and demand for energy storage solutions all impact investor sentiment and valuations.

Implications for Understanding Battery Ventures Startup Valuations

The case studies presented provide valuable insights into the factors that drive valuations in the battery venture landscape. Key takeaways include:

- Valuation is a dynamic process: Startup valuations are not static but evolve over time, influenced by various factors. Understanding these factors is crucial for investors and entrepreneurs alike.

- Execution is paramount: While promising technology is essential, execution and achieving milestones are critical for sustaining a high valuation. Startups must demonstrate their ability to commercialize their innovations and deliver on their promises.

- Market dynamics play a significant role: The overall battery market landscape, including government policies, competition, and demand, has a direct impact on valuations. Startups must navigate these dynamics strategically to maximize their valuation potential.

Future Trends in Battery Ventures Startup Valuations

Predicting the future of battery ventures startup valuations is a complex task, given the rapid pace of technological advancements and evolving market dynamics. However, by analyzing current trends and considering emerging technologies, market shifts, and regulatory changes, we can gain valuable insights into the factors that will shape valuations in the coming years.

Emerging Technologies and Their Impact, Battery ventures startup valuations

Emerging technologies, such as solid-state batteries, lithium-sulfur batteries, and advanced battery management systems, are poised to revolutionize the battery industry. These innovations promise to enhance battery performance, reduce costs, and improve safety, driving significant growth in the battery ventures space.

- Solid-state batteries offer higher energy density, faster charging times, and improved safety compared to conventional lithium-ion batteries. This technology is expected to significantly impact electric vehicles, consumer electronics, and grid-scale energy storage, creating lucrative opportunities for battery ventures.

- Lithium-sulfur batteries have the potential for even higher energy density than lithium-ion batteries, making them attractive for applications requiring extended range, such as electric aircraft and long-duration energy storage. The development and commercialization of these batteries could lead to substantial valuation increases for battery ventures specializing in this technology.

- Advanced battery management systems (BMS) play a crucial role in optimizing battery performance, extending lifespan, and ensuring safety. As battery technology advances, the demand for sophisticated BMS solutions is expected to grow, presenting opportunities for startups specializing in this field.

Market Dynamics and Their Influence

The global demand for batteries is expected to surge in the coming years, driven by the rapid adoption of electric vehicles, renewable energy, and other applications. This increasing demand will create a favorable market environment for battery ventures, potentially leading to higher valuations.

- Electric vehicle (EV) adoption is accelerating worldwide, with governments and consumers increasingly embracing electric mobility. The growing EV market will drive demand for high-performance, cost-effective batteries, creating significant opportunities for battery ventures.

- Renewable energy sources, such as solar and wind power, are becoming more prevalent, requiring efficient energy storage solutions. Battery ventures developing advanced energy storage technologies will benefit from this growing market.

- Grid-scale energy storage is crucial for stabilizing power grids and integrating renewable energy sources. Battery ventures specializing in large-scale energy storage solutions will be well-positioned to capitalize on this growing market.

Regulatory Changes and Their Impact

Government policies and regulations play a significant role in shaping the battery industry. As governments worldwide prioritize sustainability and energy security, regulatory changes are likely to influence battery ventures startup valuations.

- Incentives for electric vehicles, such as tax credits and subsidies, can stimulate demand and create a more favorable environment for battery ventures.

- Regulations on battery recycling and responsible disposal are becoming increasingly stringent, requiring battery ventures to implement sustainable practices and invest in recycling technologies. Companies demonstrating a commitment to responsible battery management are likely to receive higher valuations.

- Safety standards and regulations for battery production and use are evolving to ensure the safety and reliability of battery technologies. Battery ventures complying with these regulations and demonstrating robust safety protocols will gain a competitive advantage.

Opportunities and Challenges for Battery Ventures

The future of battery ventures holds both exciting opportunities and significant challenges. Startups need to be prepared to navigate a rapidly evolving landscape and adapt to changing market conditions.

- Opportunities:

- Emerging technologies: Battery ventures focusing on innovative technologies, such as solid-state batteries and lithium-sulfur batteries, have the potential to disrupt the market and achieve high valuations.

- Vertical integration: Battery ventures that integrate their technologies into specific applications, such as electric vehicles or energy storage systems, can gain a competitive advantage and command higher valuations.

- Partnerships and collaborations: Collaborating with established players in the automotive, energy, or electronics industries can provide access to resources, markets, and expertise, leading to faster growth and higher valuations.

- Challenges:

- Competition: The battery industry is becoming increasingly competitive, with established players and new entrants vying for market share. Battery ventures need to differentiate themselves with innovative technologies and strong value propositions.

- Funding: Securing sufficient funding for research and development, scaling up production, and expanding into new markets is crucial for battery ventures. Access to capital will be a key determinant of success and valuation.

- Supply chain: Battery ventures need to establish reliable and sustainable supply chains for raw materials, components, and manufacturing. Disruptions in the supply chain can significantly impact production and valuations.

Navigating the world of battery ventures startup valuations requires a keen eye for detail and a solid understanding of the factors that influence value. From financial metrics to market trends, a comprehensive approach is essential. By analyzing case studies, exploring valuation methods, and keeping an eye on future trends, investors can gain a competitive edge in this rapidly evolving industry.

Battery venture startup valuations are booming, driven by the growing demand for electric vehicles and renewable energy. But even in this hot sector, investors are starting to get picky, looking for companies with a clear path to profitability. This trend mirrors the recent shift in the dating app market, where Match Group is betting on Hinge as Tinder struggles.

Match looks to hinge as tinder fails q1 2024 – just like in the dating world, success in the battery venture space requires a clear value proposition and a sustainable business model.

Standi Techno News

Standi Techno News