Bytedance valuation business tiktok – Bytedance Valuation: The Business Behind TikTok, the name that sends shivers down the spines of investors and tech giants alike. This Chinese tech behemoth, with its sprawling portfolio of apps, has become a global phenomenon, fueled by the viral success of TikTok. But what exactly drives Bytedance’s astronomical valuation, and how does TikTok play a central role in this story?

Bytedance’s success lies in its ability to understand and cater to the ever-evolving digital landscape. From its humble beginnings as a news aggregator, Bytedance has diversified its portfolio to include a range of apps that cater to various demographics and interests. This strategy, coupled with its sophisticated algorithms that deliver personalized content, has propelled Bytedance to the forefront of the tech world.

Bytedance’s Business Model

Bytedance, the tech giant behind popular apps like TikTok and Douyin, has established itself as a global force in the digital media landscape. Its success stems from a multifaceted business model that leverages user engagement, data-driven insights, and a diverse portfolio of platforms.

Core Business Model and Diversification Strategy

Bytedance’s core business model revolves around creating engaging content platforms that cater to diverse user interests. The company employs a data-driven approach to personalize content recommendations, fostering user engagement and maximizing time spent on its platforms. This strategy has proven highly effective, attracting billions of users worldwide.

Bytedance’s diversification strategy extends beyond its core content platforms. The company has invested in various sectors, including education, e-commerce, and gaming, expanding its reach and revenue streams. This diversification strategy aims to reduce reliance on any single platform and tap into new growth opportunities.

Key Revenue Streams, Bytedance valuation business tiktok

Bytedance generates revenue primarily through advertising, in-app purchases, and other sources.

Advertising

Advertising is the primary revenue stream for Bytedance. Its platforms, including TikTok and Douyin, offer a vast and engaged audience, making them attractive for advertisers seeking to reach a targeted demographic. Bytedance utilizes advanced algorithms to personalize advertising, ensuring relevant and effective campaigns.

In-App Purchases

In-app purchases, such as virtual gifts, subscriptions, and premium features, generate a significant portion of Bytedance’s revenue. These purchases are particularly prevalent on platforms like TikTok, where users can engage in virtual interactions and express themselves through digital gifts.

Other Revenue Sources

Beyond advertising and in-app purchases, Bytedance generates revenue from various other sources, including licensing fees, content partnerships, and hardware sales. These diverse revenue streams contribute to the company’s overall financial stability and growth.

User Base Breakdown

Bytedance’s platforms boast a massive user base, encompassing a wide range of demographics and geographic locations.

Demographics

Bytedance’s user base is primarily composed of young adults, with a strong presence among teenagers and Gen Z. This demographic is highly active on social media and is receptive to engaging content formats.

Geographic Distribution

Bytedance’s platforms enjoy widespread popularity across the globe. The company has a significant user base in Asia, particularly in China, where Douyin, the Chinese version of TikTok, is immensely popular. Bytedance has also achieved substantial growth in North America, Europe, and other regions, solidifying its global reach.

TikTok’s Role in Bytedance’s Valuation

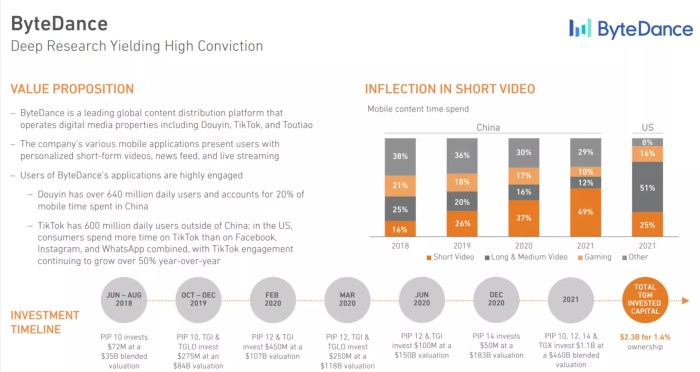

TikTok, the short-form video sharing platform, is a major driver of Bytedance’s valuation. While Bytedance owns other successful apps like Toutiao, a news aggregator app in China, TikTok’s global reach and explosive growth have propelled Bytedance to become one of the world’s most valuable private companies.

Factors Contributing to TikTok’s Valuation

TikTok’s high valuation is a result of several factors:

- Massive User Engagement: TikTok boasts over 1 billion monthly active users globally, with a high level of engagement. Users spend an average of 95 minutes per day on the platform, making it one of the most engaging social media platforms.

- Strong Growth Potential: TikTok continues to grow rapidly, particularly in emerging markets. This growth potential, fueled by its user-friendly interface and engaging content, is a significant factor in its valuation.

- Effective Monetization Strategies: TikTok has implemented various monetization strategies, including in-app advertising, e-commerce partnerships, and virtual gifting. These strategies are generating substantial revenue, further contributing to its valuation.

Comparison with Other Social Media Platforms

TikTok’s valuation can be compared to other social media platforms like Facebook, Instagram, and Snapchat. While TikTok’s valuation is lower than Facebook’s, it is comparable to Instagram and Snapchat, considering its relatively younger age and rapid growth.

- Facebook: Facebook’s valuation is significantly higher than TikTok’s due to its massive user base, diverse revenue streams, and established market dominance. However, Facebook’s growth has slowed down in recent years, while TikTok continues to grow at a rapid pace.

- Instagram: Instagram, owned by Facebook, has a similar valuation to TikTok. Both platforms have a strong focus on visual content and have successfully attracted younger demographics. However, Instagram has a broader range of monetization options, including e-commerce and influencer marketing, which contribute to its valuation.

- Snapchat: Snapchat’s valuation is similar to TikTok’s. Both platforms are known for their focus on short-form content and engaging user experiences. Snapchat’s valuation has been impacted by its slower growth and challenges in expanding its user base.

Factors Influencing Bytedance’s Valuation: Bytedance Valuation Business Tiktok

Bytedance’s valuation is a complex interplay of various factors, each contributing to its overall worth. Understanding these factors is crucial for appreciating the company’s current position and predicting its future trajectory.

Market Trends and Growth Prospects

Market trends play a significant role in shaping Bytedance’s valuation. The company’s success hinges on its ability to capitalize on emerging trends and adapt to evolving user preferences.

- Short-Form Video Trend: Bytedance’s early entry into the short-form video market with TikTok, coinciding with the rise of this trend, propelled its valuation. The platform’s engaging format, coupled with its strong algorithm, attracted a massive user base, further solidifying its position in the market.

- Mobile-First World: Bytedance’s focus on mobile-first platforms aligns with the growing trend of mobile internet usage, particularly in emerging markets. This strategic alignment contributes to its valuation by tapping into a vast user base and potential for future growth.

- E-commerce Integration: Bytedance’s integration of e-commerce features within its platforms, particularly in China, is a key factor influencing its valuation. This allows the company to tap into a lucrative revenue stream by facilitating transactions within its ecosystem.

Competition is a crucial factor affecting Bytedance’s valuation. The company faces stiff competition from established players and emerging startups in various markets.

- Social Media Giants: Bytedance competes with social media giants like Facebook, Instagram, and YouTube for user attention and advertising revenue. The company’s ability to differentiate itself through its unique content formats and algorithm helps it maintain a competitive edge.

- Local Players: In emerging markets, Bytedance faces competition from local players who have a strong understanding of the regional market dynamics. The company’s success in navigating these competitive landscapes influences its valuation.

- New Entrants: The rapid evolution of the digital media landscape attracts new entrants, posing a constant threat to Bytedance’s market share. The company’s ability to innovate and adapt to changing user preferences is crucial for maintaining its competitive advantage.

Regulatory Environment

The regulatory environment significantly impacts Bytedance’s valuation. The company operates in a complex global landscape with varying regulations governing data privacy, content moderation, and competition.

- Data Privacy Concerns: Data privacy concerns surrounding Bytedance’s platforms have led to scrutiny and regulatory investigations in several countries. Addressing these concerns and ensuring compliance with data privacy regulations is crucial for maintaining its valuation.

- Content Moderation Challenges: The company faces challenges in effectively moderating content on its platforms, particularly in the context of misinformation, hate speech, and harmful content. Navigating these challenges and implementing robust content moderation policies is essential for its valuation.

- Antitrust Scrutiny: Bytedance’s global expansion and dominance in certain markets have attracted antitrust scrutiny. The company’s ability to navigate these regulatory challenges and maintain its market position is crucial for its valuation.

Global Expansion and International Growth

Bytedance’s valuation is heavily influenced by its global expansion strategy. The company’s success in expanding into new markets and adapting to diverse cultural contexts is a key factor in its overall valuation.

- Market Penetration: Bytedance’s ability to penetrate new markets and acquire a significant user base in diverse regions is a strong indicator of its valuation potential. The company’s success in attracting users in emerging markets, where mobile internet penetration is high, is particularly significant.

- Localization Efforts: Bytedance’s success in localizing its platforms and content to cater to specific regional preferences is crucial for its global expansion. This involves adapting content formats, language, and cultural nuances to resonate with local audiences, contributing to its valuation.

- International Partnerships: Bytedance’s strategic partnerships with local companies and influencers in different regions contribute to its valuation by facilitating market entry and building brand recognition. These partnerships can provide access to local expertise, resources, and distribution channels, accelerating its global expansion.

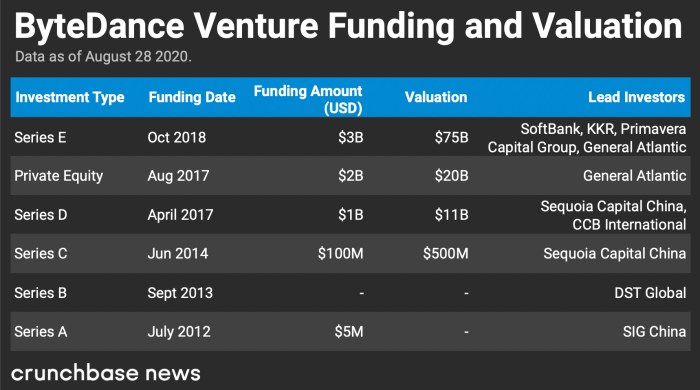

Role of Investors and Venture Capitalists

Investors and venture capitalists play a critical role in shaping Bytedance’s valuation. Their investment decisions, based on their assessment of the company’s potential, influence its market capitalization and overall valuation.

- Funding Rounds: Bytedance has raised significant funding through multiple rounds, attracting investors who believe in its growth potential. These funding rounds, coupled with the company’s performance, directly impact its valuation.

- Investor Confidence: Investor confidence in Bytedance’s long-term prospects is a key factor influencing its valuation. This confidence is built on the company’s track record of growth, innovation, and market leadership.

- Valuation Expectations: Investors’ expectations regarding Bytedance’s future performance and profitability shape its valuation. These expectations are based on factors such as market trends, competition, and regulatory environment, and influence the company’s overall worth.

Bytedance’s valuation is a testament to its innovative business model, its ability to identify and capitalize on emerging trends, and its strategic acquisition of TikTok. As Bytedance continues to expand its global reach, its valuation is likely to soar even higher. The future of Bytedance, and its iconic platform TikTok, is a story worth watching closely.

Bytedance, the company behind TikTok, is a prime example of how a successful social media platform can translate into serious business value. While the company’s valuation has taken a hit recently, it’s still a force to be reckoned with in the tech world. And while sure Microsoft grabbed the headlines recently for its cloud dominance , Bytedance’s global reach and innovative approach to content creation continues to attract investors and users alike.

Standi Techno News

Standi Techno News