Camshaft says byjus unit beneficial owner of 533 million funds – Camshaft says Byju’s unit is the beneficial owner of 533 million funds, throwing the spotlight on a complex financial landscape. This revelation has sparked intense scrutiny, raising questions about transparency, ownership, and the potential impact on Byju’s operations and its stakeholders.

The statement by Camshaft, a company with a history of involvement with Byju’s, has sent ripples through the educational technology sector. The revelation of these funds and their management structure has triggered a wave of inquiries, prompting a deeper dive into the financial dealings of Byju’s and its intricate network of entities.

The Camshaft Connection

The Camshaft Group, a leading private equity firm, has played a significant role in the story of Byju’s, India’s largest edtech company. While Byju’s is a publicly recognized brand, the intricate connections between the two entities remain a topic of interest, especially in the wake of the company’s financial challenges.

Camshaft’s Role in Byju’s

Camshaft’s involvement with Byju’s extends beyond mere financial investment. The firm has actively participated in shaping the company’s strategic direction and growth trajectory. Camshaft’s expertise in navigating complex financial landscapes and driving value creation has been instrumental in Byju’s expansion. Camshaft’s role has been particularly significant in:

- Strategic Guidance: Camshaft has provided strategic counsel to Byju’s leadership team, helping them navigate the complexities of the edtech landscape, particularly in terms of market expansion, product development, and international growth.

- Financial Expertise: Camshaft has leveraged its deep financial expertise to guide Byju’s financial strategies, including capital allocation, debt management, and fundraising efforts.

- Board Representation: Camshaft has representatives on Byju’s board of directors, ensuring alignment between the company’s operational strategies and its long-term financial objectives.

Camshaft’s History with Byju’s

Camshaft’s relationship with Byju’s dates back to 2015, when the firm made its initial investment in the company. This investment marked a pivotal moment for Byju’s, providing the company with the financial resources and strategic support needed to scale its operations and solidify its position as a leading player in the Indian edtech market. Since then, Camshaft has consistently supported Byju’s growth trajectory, participating in subsequent funding rounds and actively contributing to the company’s strategic direction.

Financial Transactions between Camshaft and Byju’s

While the exact details of financial transactions between Camshaft and Byju’s remain confidential, it is known that Camshaft has invested significant capital in the company. This investment has been crucial in fueling Byju’s expansion, acquisitions, and product development initiatives.

Note: The exact amounts invested by Camshaft and the specific terms of the financial agreements are not publicly available due to confidentiality clauses.

Beneficial Ownership and Fund Management: Camshaft Says Byjus Unit Beneficial Owner Of 533 Million Funds

The revelation that Camshaft Says Byjus unit possesses 533 million funds raises significant questions about the structure of these funds, their beneficial ownership, and the potential implications of Camshaft’s involvement. Understanding these aspects is crucial to evaluating the transparency and accountability of the entity managing these funds.

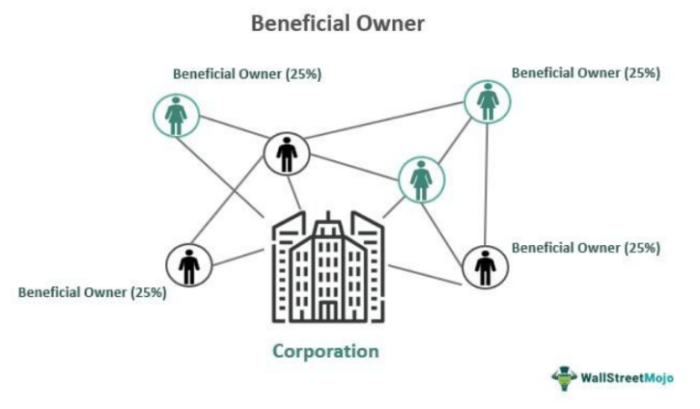

Beneficial Ownership

Identifying the individuals or entities holding beneficial ownership of the 533 million funds is essential for determining who ultimately controls and benefits from these assets. This information is crucial for transparency and accountability, allowing stakeholders to understand the potential conflicts of interest and assess the potential impact of the funds’ management on various parties.

Fund Structure and Purpose, Camshaft says byjus unit beneficial owner of 533 million funds

The structure and purpose of the 533 million funds are critical factors in understanding their potential impact. A detailed analysis of the fund structure, including its legal framework, investment strategies, and intended beneficiaries, will provide valuable insights into the intended use of these funds and their potential implications for stakeholders.

Camshaft’s Involvement and Implications

Camshaft’s involvement in the management and distribution of the 533 million funds raises several implications. Analyzing the potential impact of Camshaft’s involvement on the fund’s management, investment strategies, and distribution processes is crucial for assessing the potential risks and benefits associated with this relationship. This analysis should consider the potential conflicts of interest, ethical considerations, and regulatory compliance aspects related to Camshaft’s role.

Financial Transparency and Regulatory Compliance

The controversy surrounding Byju’s 533 million funds and their connection to Camshaft raises significant questions about the company’s financial transparency and adherence to regulatory requirements. Understanding the intricacies of these transactions is crucial for investors, stakeholders, and the broader educational technology sector.

Transparency of Byju’s Financial Dealings

Byju’s financial dealings related to the 533 million funds have come under scrutiny, with concerns raised about the lack of transparency and potential conflicts of interest. The opaque nature of these transactions has led to calls for greater accountability and disclosure from the company.

- Limited Public Information: Despite the significant amount involved, Byju’s has provided limited public information regarding the source, purpose, and management of the 533 million funds. This lack of transparency has fueled speculation and concerns about potential misuse or mismanagement of these funds.

- Conflicting Statements: There have been inconsistencies in statements made by Byju’s executives regarding the 533 million funds, further contributing to the perception of a lack of transparency. This ambiguity has created confusion and raised questions about the company’s commitment to open communication with stakeholders.

- Allegations of Misuse: There have been allegations that a portion of the 533 million funds may have been used for purposes other than those initially stated, including potential investments in unrelated businesses. These allegations, if true, would raise serious concerns about the integrity of Byju’s financial practices.

Impact on Byju’s Operations and Stakeholders

The revelation of the 533 million funds managed by Camshaft and the intricate web of beneficial ownership raises significant questions about the potential impact on Byju’s operations and its stakeholders. This complex situation demands careful analysis to understand the implications for the edtech giant, its investors, and the broader educational landscape.

Potential Impact on Byju’s Operations

The presence of these funds and Camshaft’s involvement could have a multifaceted impact on Byju’s operations. Firstly, it could affect the company’s financial stability and its ability to secure future investments. Investors may be hesitant to commit further capital if they perceive a lack of transparency or potential financial irregularities. Secondly, the scrutiny surrounding these funds could lead to regulatory investigations and potential legal challenges, impacting Byju’s resources and focus. Thirdly, the reputational damage stemming from these revelations could affect user trust and confidence in Byju’s services, potentially leading to decreased enrollment and revenue.

Key Stakeholders Affected and Their Concerns

The stakeholders affected by this situation include:

- Investors: Investors in Byju’s may be concerned about the transparency of the company’s financial dealings and the potential impact on their investments. They may seek clarification on the nature and purpose of the 533 million funds and Camshaft’s role in managing them.

- Students and Parents: Students and parents relying on Byju’s educational services may be concerned about the company’s financial stability and its ability to deliver on its promises. They may question the long-term viability of the platform and the potential impact on the quality of education provided.

- Employees: Byju’s employees may be concerned about job security and the company’s future prospects in light of the current situation. They may seek reassurance about the company’s commitment to their well-being and its long-term stability.

- Regulators: Regulators may be concerned about the potential for financial irregularities and lack of transparency in Byju’s operations. They may investigate the nature and purpose of the 533 million funds and Camshaft’s role in managing them, ensuring compliance with financial regulations.

Potential Risks and Opportunities

The 533 million funds and Camshaft’s involvement present both risks and opportunities for Byju’s:

| Risks | Opportunities |

|---|---|

| Reduced investor confidence and difficulty securing future funding | Increased transparency and accountability could enhance investor trust |

| Regulatory scrutiny and potential legal challenges | Improved governance and compliance practices could strengthen the company’s position |

| Reputational damage and loss of user trust | Addressing concerns and rebuilding trust could lead to greater user loyalty |

| Potential impact on educational quality and service delivery | Enhanced financial stability could support investments in technology and educational resources |

The Camshaft claim about Byju’s unit owning 533 million funds unveils a web of financial intricacies. The scrutiny surrounding this revelation underscores the need for greater transparency in the educational technology sector. The impact of this situation on Byju’s operations and stakeholders remains a crucial point of discussion, highlighting the importance of ethical and responsible financial practices within the industry.

Camshaft’s recent revelation that Byju’s unit is the beneficial owner of 533 million funds has sparked a wave of speculation and scrutiny. While the financial world grapples with this news, it’s hard not to be distracted by the launch of the new iPad lineup, heres the new ipad lineup , which promises to revolutionize how we learn and work.

But back to the Byju’s saga, it’s a story that will likely continue to unfold, leaving us all wondering what’s next.

Standi Techno News

Standi Techno News