Carta growth without secondaries, a strategy that prioritizes organic growth over secondary market transactions, is gaining traction in the startup world. This approach offers a refreshing alternative to traditional growth strategies, where startups rely heavily on secondary sales to boost valuations. By focusing on intrinsic value and long-term growth, startups can build a sustainable foundation for success, attracting investors who are aligned with their vision for the future.

Carta growth without secondaries is not just about avoiding secondary market transactions; it’s about creating a strong company culture, fostering innovation, and building a loyal investor base. This approach requires a commitment to transparency, clear communication, and a long-term perspective. It’s a strategy that demands discipline, focus, and a belief in the power of organic growth.

Understanding Carta Growth Without Secondaries

Carta, a popular equity management platform, is known for facilitating secondary market transactions where investors can buy and sell shares of private companies. However, Carta also supports a strategy known as “Carta growth without secondaries,” which emphasizes organic growth within the company itself. This approach focuses on building value through internal operations and strategic initiatives rather than relying on external liquidity from secondary sales.

Comparing Carta Growth Without Secondaries to Traditional Growth Strategies

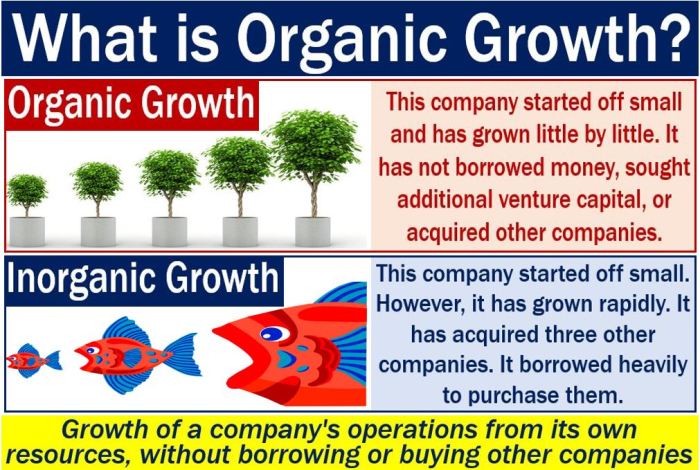

This approach stands in contrast to traditional growth strategies that often rely heavily on secondary market transactions. Secondary markets provide a mechanism for investors to exit their positions and realize returns, even if the company isn’t yet ready for an IPO. However, this liquidity can come at a cost, potentially diluting existing shareholders and hindering long-term growth.

- Carta growth without secondaries focuses on building value organically through internal operations, product development, and strategic partnerships. This approach emphasizes long-term value creation and avoids the potential dilution and short-term focus that can accompany secondary market transactions.

- Traditional growth strategies often rely on secondary market transactions to provide liquidity for investors. While this can be beneficial for early investors, it can also lead to dilution and a focus on short-term gains rather than long-term value creation.

Advantages of Carta Growth Without Secondaries for Startups and Investors

This strategy offers several benefits for startups and investors:

- Reduced Dilution: By avoiding secondary sales, startups can retain a larger portion of their equity, allowing for greater control and ownership for founders and early investors.

- Focus on Long-Term Value Creation: Without the pressure to exit through secondary sales, startups can focus on building a sustainable and profitable business, fostering long-term growth and value creation.

- Improved Alignment: By minimizing the focus on short-term liquidity, this approach promotes alignment between founders, employees, and investors, fostering a shared vision for the company’s future.

- Stronger Company Culture: A focus on organic growth can contribute to a more cohesive and motivated company culture, as employees are invested in the long-term success of the business.

Disadvantages of Carta Growth Without Secondaries for Startups and Investors

While Carta growth without secondaries offers significant advantages, it also presents some potential drawbacks:

- Limited Liquidity: Investors may find it difficult to exit their positions without secondary markets, especially if the company isn’t ready for an IPO.

- Potential for Stagnation: Without the pressure to perform for potential secondary buyers, startups may face a greater risk of stagnation or slow growth.

- Increased Risk for Investors: Investors in startups that pursue this strategy may face higher risk and a longer time horizon for returns.

Key Drivers of Carta Growth

Carta’s growth without relying on secondary markets is fueled by a combination of factors, including company performance, favorable market conditions, and investor sentiment. This dynamic interplay creates an environment where valuations are driven by real business performance and the broader economic landscape.

Company Performance

The performance of companies listed on Carta is a primary driver of growth. When companies perform well, their valuations increase, which in turn attracts more investors and drives Carta’s growth. This growth is further fueled by the fact that Carta offers a platform for companies to raise capital directly from investors, eliminating the need for secondary markets.

- Strong Revenue Growth: Companies exhibiting strong revenue growth, consistent profitability, and expanding market share are more likely to attract investors, leading to higher valuations and driving Carta’s growth.

- Innovation and Differentiation: Companies with innovative products or services that differentiate them from competitors are often favored by investors, contributing to higher valuations and Carta growth.

- Strong Management Team: Investors place a premium on companies with experienced and capable management teams, as they are seen as crucial for long-term success and value creation. This translates to higher valuations and drives Carta’s growth.

Market Conditions

Market conditions play a significant role in driving Carta’s growth. A strong economy and favorable investment climate can lead to increased investor appetite for private companies, boosting valuations and driving Carta’s growth.

- Low Interest Rates: Low interest rates can make it more attractive for investors to invest in private companies, as the cost of borrowing is lower, leading to higher valuations and driving Carta’s growth.

- Increased Venture Capital Funding: Increased venture capital funding can create a more favorable environment for private companies to raise capital and grow, leading to higher valuations and driving Carta’s growth.

- Strong IPO Market: A strong IPO market can create a positive sentiment for private companies, as it suggests that investors are willing to pay a premium for growth and potential, leading to higher valuations and driving Carta’s growth.

Investor Sentiment

Investor sentiment towards private companies can significantly influence their valuations and drive Carta’s growth.

- Confidence in the Future: Investors who are optimistic about the future of the economy and specific industries are more likely to invest in private companies, leading to higher valuations and driving Carta’s growth.

- Search for Growth: In a low-interest-rate environment, investors often seek out companies with high growth potential, which can lead to higher valuations and drive Carta’s growth.

- Technology Sector Interest: Investors are increasingly interested in technology companies, particularly those with disruptive technologies, leading to higher valuations and driving Carta’s growth.

Regulatory Changes and Industry Trends

Regulatory changes and industry trends can also impact Carta’s growth by influencing the valuations of private companies.

- Increased Regulation: Increased regulation of the private capital markets can create uncertainty and potentially dampen investor enthusiasm, leading to lower valuations and potentially slowing Carta’s growth.

- Emerging Technologies: The emergence of new technologies, such as artificial intelligence and blockchain, can create opportunities for new companies and industries, leading to higher valuations and driving Carta’s growth.

- Shifting Investor Preferences: As investor preferences evolve, for example, towards companies with a strong focus on environmental, social, and governance (ESG) factors, valuations can be affected, potentially driving Carta’s growth if it caters to these preferences.

Strategies for Achieving Carta Growth

Achieving Carta growth without relying on secondary market transactions requires a multifaceted approach that prioritizes long-term value creation and sustainable growth. By focusing on key areas such as optimizing company performance, nurturing investor relations, and fostering a strong company culture, businesses can achieve significant Carta growth without relying on external liquidity events.

Strategies for Optimizing Company Performance

Optimizing company performance is paramount for achieving Carta growth. By focusing on core business operations and driving revenue growth, companies can increase their intrinsic value and attract investors.

- Focus on Revenue Growth: Prioritize revenue growth by identifying and capitalizing on market opportunities. This could involve expanding into new markets, developing innovative products or services, or increasing sales and marketing efforts.

- Improve Operational Efficiency: Streamline business processes, reduce costs, and optimize resource allocation to enhance profitability. This could involve implementing lean methodologies, automating tasks, and improving supply chain management.

- Enhance Product Development: Continuously invest in research and development to improve existing products and services or create new offerings that meet evolving customer needs. This fosters innovation and competitive advantage.

Strategies for Nurturing Investor Relations, Carta growth without secondaries

Building strong investor relations is crucial for attracting and retaining investors, thereby increasing Carta growth. Effective communication and transparency are key to fostering trust and confidence among stakeholders.

- Maintain Open Communication: Regularly update investors on company performance, key milestones, and future plans through clear and concise communication channels such as investor presentations, newsletters, and investor relations websites.

- Engage with Investors: Organize investor calls, conferences, and roadshows to provide opportunities for direct interaction and Q&A sessions. This fosters a sense of community and transparency.

- Demonstrate Strong Governance: Maintain high standards of corporate governance, including transparent financial reporting, ethical business practices, and a robust board of directors. This builds trust and credibility among investors.

Strategies for Building a Strong Company Culture

A strong company culture attracts and retains top talent, fostering a positive and productive work environment that contributes to Carta growth.

- Define Core Values: Clearly articulate company values that guide decision-making, employee behavior, and overall company culture. This provides a framework for attracting and retaining individuals who align with the company’s mission and vision.

- Foster a Positive Work Environment: Promote collaboration, open communication, and employee well-being. This could involve offering competitive compensation and benefits, providing opportunities for professional development, and creating a culture of respect and inclusion.

- Attract Top Talent: Invest in recruiting and retaining high-performing individuals who possess the skills and expertise needed to drive company growth. This could involve building a strong employer brand, leveraging social media platforms, and offering competitive compensation and benefits packages.

Measuring Carta Growth

Measuring Carta growth without secondaries is crucial for understanding the company’s overall progress and attracting investors. It requires a focus on metrics that reflect the core value proposition of Carta, which is to provide equity management solutions for private companies.

Key Metrics for Measuring Carta Growth

Several key metrics can be used to measure Carta growth without secondaries. These metrics offer a comprehensive view of the company’s performance, including its user base, revenue, and market penetration.

Carta’s growth without relying on secondary market sales is a testament to their commitment to building a sustainable ecosystem. This approach mirrors the innovative spirit behind Instagram’s development of a customizable AI friend , which focuses on personal interaction and unique experiences. Both Carta and Instagram are pushing boundaries in their respective fields, showing us the power of building long-term value through genuine connection and innovation.

| Metric | Interpretation |

|---|---|

| Number of Companies on Platform | This metric reflects the overall reach of Carta and its ability to attract new clients. A higher number indicates a larger market share and a stronger position in the private equity market. |

| Total Equity Managed | This metric showcases the total value of equity managed by Carta. A higher value signifies a larger pool of assets under management and a greater influence on the private equity landscape. |

| Number of Users | This metric measures the number of individuals using Carta’s platform. A larger user base indicates a wider adoption of Carta’s services and a stronger brand presence. |

| Average Revenue Per User (ARPU) | This metric measures the average revenue generated per user. A higher ARPU indicates a strong pricing strategy and efficient monetization of the user base. |

| Customer Acquisition Cost (CAC) | This metric measures the cost of acquiring a new customer. A lower CAC indicates efficient marketing and sales efforts and a sustainable growth model. |

| Customer Lifetime Value (CLTV) | This metric measures the total revenue generated from a single customer over their lifetime. A higher CLTV indicates strong customer loyalty and a successful business model. |

| Net Promoter Score (NPS) | This metric measures customer satisfaction and loyalty. A higher NPS indicates a positive customer experience and a strong brand reputation. |

| Employee Growth | This metric reflects the company’s ability to attract and retain talent. A higher growth rate indicates a strong organizational culture and a commitment to innovation. |

| Product Innovation | This metric measures the frequency and impact of new product launches and features. A higher rate of innovation indicates a commitment to staying ahead of the competition and providing value to users. |

Case Studies of Carta Growth Without Secondaries

Carta growth without secondary sales is a testament to the power of organic growth strategies. Companies that achieve this feat demonstrate a strong commitment to building a sustainable and valuable business.

Examples of Companies Achieving Carta Growth Without Secondaries

Here are some notable examples of companies that have successfully grown their Carta valuations without relying on secondary sales:

- Stripe: This payment processing company has consistently grown its Carta valuation organically, reaching a valuation of over $95 billion in 2021. Stripe’s focus on innovation, customer satisfaction, and strong financial performance has been key to its success.

- Zoom: The video conferencing platform experienced a significant surge in demand during the COVID-19 pandemic, leading to substantial Carta growth. Zoom’s strategic acquisitions and expansion into new markets contributed to its valuation exceeding $100 billion in 2021.

- Databricks: This data and AI platform has achieved a Carta valuation of over $38 billion, driven by its strong product offerings and growing customer base. Databricks’ commitment to research and development, coupled with its strategic partnerships, has played a significant role in its success.

Strategies Employed by These Companies

The strategies employed by these companies highlight the key drivers of Carta growth without secondaries:

- Strong Product-Market Fit: These companies have identified and catered to a specific market need with innovative and highly valued products. This strong product-market fit has driven customer acquisition and revenue growth, contributing to their Carta valuations.

- Focus on Customer Satisfaction: These companies prioritize customer satisfaction by providing exceptional service, addressing customer needs, and building long-term relationships. This focus on customer experience has fostered brand loyalty and positive word-of-mouth marketing, leading to sustained growth.

- Strategic Acquisitions and Partnerships: Strategic acquisitions and partnerships have enabled these companies to expand their reach, enter new markets, and access valuable resources. These strategic moves have contributed to their Carta valuations by enhancing their competitive advantage and market position.

- Strong Financial Performance: Consistent revenue growth, profitability, and strong cash flow have been crucial to these companies’ success. Their financial performance has demonstrated their ability to generate value and attract investors, leading to increased Carta valuations.

- Commitment to Innovation: These companies prioritize research and development, constantly innovating and improving their products and services. This commitment to innovation has kept them at the forefront of their respective industries, attracting investors and driving Carta growth.

Key Takeaways from These Case Studies

- Organic growth is achievable: These case studies demonstrate that Carta growth can be achieved without relying on secondary sales. By focusing on key drivers such as product-market fit, customer satisfaction, and financial performance, companies can build sustainable and valuable businesses.

- Long-term vision is crucial: These companies have a clear vision for the future and are committed to long-term growth. They have invested in research and development, strategic partnerships, and customer satisfaction, laying the foundation for sustainable success.

- Data-driven decision-making: These companies use data to track their progress, identify areas for improvement, and make informed decisions. This data-driven approach has enabled them to optimize their strategies and achieve their growth objectives.

Challenges and Opportunities

Achieving Carta growth without relying on secondary market transactions presents a unique set of challenges and opportunities. While avoiding secondaries can offer strategic advantages, it also necessitates careful planning and execution to ensure sustainable growth. This section delves into the potential roadblocks and the opportunities that arise from this approach.

Potential Challenges

Navigating the complexities of Carta growth without secondaries requires understanding the potential challenges. These challenges can arise from various factors, including market dynamics, regulatory landscapes, and internal organizational factors.

- Limited Liquidity: The absence of a secondary market can limit liquidity for investors seeking to exit their positions, potentially impacting the attractiveness of Carta investments.

- Valuation Challenges: Determining accurate valuations without secondary market data can be difficult, especially for privately held companies with limited financial information.

- Investor Appetite: Investors may be hesitant to invest in companies without a clear path to liquidity, potentially impacting fundraising efforts.

- Regulatory Compliance: Navigating evolving regulations surrounding private markets and capital formation can be complex and require specialized expertise.

Opportunities and Strategies

Despite the challenges, Carta growth without secondaries presents significant opportunities. By focusing on long-term value creation and fostering a strong company culture, companies can overcome challenges and achieve sustainable growth.

- Building a Strong Company Culture: Cultivating a positive and supportive company culture can attract and retain top talent, ultimately driving growth and innovation.

- Focusing on Long-Term Value Creation: Prioritizing long-term value creation over short-term gains can attract investors seeking sustainable growth and long-term returns.

- Developing Clear Exit Strategies: Companies should develop clear exit strategies, such as IPOs or acquisitions, to provide investors with potential liquidity events.

- Leveraging Alternative Liquidity Solutions: Exploring alternative liquidity solutions, such as private market transactions or employee stock ownership plans (ESOPs), can provide investors with some liquidity options.

Evolving Landscape and Future Trends

The landscape of Carta growth is constantly evolving, driven by technological advancements, changing investor preferences, and evolving regulations. Understanding these trends is crucial for companies seeking to navigate the complexities of Carta growth without secondaries.

- Rise of Alternative Investment Strategies: The increasing popularity of alternative investments, such as venture capital and private equity, is driving demand for Carta investments.

- Growth of Private Market Data and Analytics: Advancements in data analytics and technology are providing more robust data and insights into private markets, enabling better valuations and investment decisions.

- Increased Regulatory Scrutiny: Regulatory bodies are increasingly scrutinizing private markets, requiring companies to adhere to stricter compliance standards.

In a world where short-term gains often overshadow long-term value, Carta growth without secondaries presents a compelling alternative. By focusing on intrinsic growth, building a strong foundation, and cultivating a loyal investor base, startups can achieve sustainable success. This approach not only benefits the company but also empowers investors to participate in the journey, sharing in the long-term rewards of a thriving business. As the startup landscape evolves, Carta growth without secondaries offers a promising path forward, one that prioritizes value creation over speculative trading, and ultimately contributes to a more sustainable and equitable ecosystem for startups and investors alike.

Standi Techno News

Standi Techno News