Carta the cap table management outfit is accused of unethical tactics by a customer after it tries broker a deal for a startups shares without consent – Carta, the cap table management outfit, has found itself in hot water after a customer accused them of unethical tactics. The customer alleges that Carta attempted to broker a deal for the startup’s shares without their consent, raising serious concerns about the company’s practices and the impact on the startup ecosystem.

Carta, a popular platform for managing equity in startups, provides a range of services, including equity tracking, shareholder management, and fundraising assistance. However, this recent allegation has cast a shadow on the company’s reputation, prompting questions about the ethical standards within the industry.

Carta’s Role in Startup Equity Management

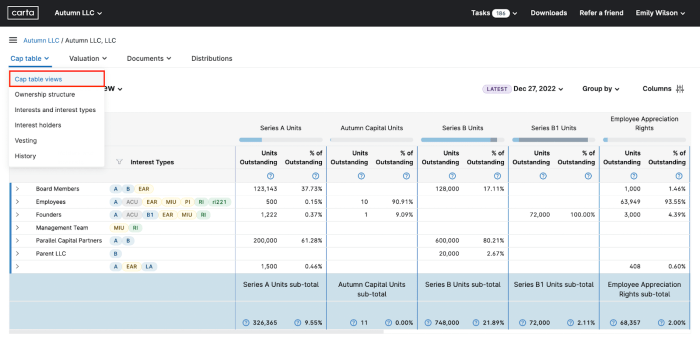

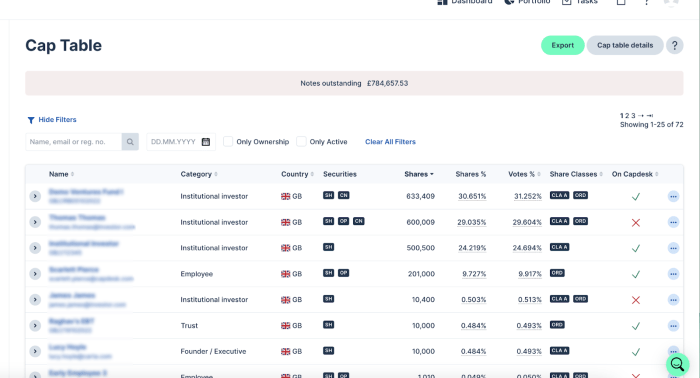

Carta is a leading platform for managing the equity of private companies, particularly startups. It provides a comprehensive suite of tools designed to streamline and simplify the complex world of equity ownership and management.

Carta’s primary function is to create and maintain a centralized cap table, which is a detailed record of all the equity holders in a company, their ownership percentages, and any associated rights or restrictions. This cap table serves as a crucial reference point for various stakeholders, including founders, investors, employees, and advisors.

Services Offered by Carta

Carta offers a range of services to help startups effectively manage their equity, including:

- Equity Tracking: Carta’s platform automatically tracks equity ownership, vesting schedules, and other relevant data, ensuring accurate and up-to-date information for all stakeholders.

- Shareholder Management: Carta facilitates communication and interaction between shareholders, providing tools for issuing and transferring shares, managing dividends, and handling other shareholder-related matters.

- Fundraising Assistance: Carta assists startups in raising capital by providing tools for creating investor decks, managing investor relations, and closing financing rounds.

- Compliance and Reporting: Carta helps startups comply with relevant regulations and reporting requirements, including those related to securities laws and tax compliance.

- Valuation and Liquidation: Carta provides valuation services and tools to help startups understand the value of their equity and manage potential liquidation events.

Benefits of Using Carta

Using Carta can provide numerous benefits for startups, including:

- Improved Efficiency: Carta’s automated tools streamline equity management processes, saving time and resources for startups.

- Increased Transparency: Carta’s centralized platform ensures that all stakeholders have access to the same, accurate information about equity ownership and related matters.

- Enhanced Security: Carta’s platform is designed to be secure and compliant with industry best practices, protecting sensitive equity data from unauthorized access.

- Simplified Fundraising: Carta’s fundraising tools can help startups attract investors and close financing rounds more efficiently.

- Improved Investor Relations: Carta provides tools for managing investor communications and providing updates on company performance.

Drawbacks of Using Carta

While Carta offers many advantages, there are also potential drawbacks to consider:

- Cost: Carta’s services can be expensive, especially for startups with limited resources.

- Complexity: Carta’s platform can be complex to navigate, particularly for startups with limited experience in equity management.

- Data Security Concerns: While Carta takes data security seriously, there is always a risk of data breaches or unauthorized access to sensitive information.

- Limited Customization: Carta’s platform may not be fully customizable to meet the specific needs of all startups.

- Dependence on Third-Party Provider: Using Carta means relying on a third-party provider for critical equity management functions, which can create potential vulnerabilities or limitations.

Ethical Considerations in Cap Table Management

Cap table management, the process of tracking and managing the ownership structure of a company, is crucial for startups and growing businesses. It involves sensitive financial and legal information, making ethical considerations paramount. While transparency, confidentiality, and conflict of interest are essential in any business, they are particularly crucial in the context of cap table management.

Transparency and Confidentiality

Transparency and confidentiality are two sides of the same coin in cap table management. While transparency ensures fairness and accountability, confidentiality protects sensitive information from unauthorized access.

- Transparency: Cap table management companies should be transparent about their processes, fees, and any potential conflicts of interest. This includes providing clear and understandable information to stakeholders about the company’s ownership structure, share distribution, and any changes to the cap table.

- Confidentiality: At the same time, they must protect the confidentiality of sensitive information, such as shareholder details, financial records, and strategic plans. This includes implementing robust security measures to prevent unauthorized access and data breaches.

The challenge lies in striking a balance between these two principles, ensuring that transparency does not compromise confidentiality and vice versa.

Conflict of Interest

Cap table management companies often have access to sensitive information about startups, including their financial performance, growth prospects, and future plans. This can create opportunities for conflicts of interest, particularly if the company is involved in activities that could benefit from this knowledge.

- Brokering Deals: One common example is when a cap table management company brokers deals for startups, such as facilitating investment rounds or secondary share sales. In such cases, the company must ensure that it acts in the best interests of the startup and its shareholders, rather than pursuing its own financial gain.

- Investment Decisions: Similarly, if a cap table management company has a financial stake in a startup, it must disclose this information to all stakeholders and avoid making decisions that could benefit its own investments at the expense of the startup or its other shareholders.

It is essential for cap table management companies to have clear policies and procedures to manage potential conflicts of interest and to ensure that their actions are aligned with the best interests of their clients.

Ethical Implications of Carta’s Allegations

The allegations against Carta involve the company attempting to broker a deal for a startup’s shares without the startup’s consent. This raises several ethical concerns, including:

- Breach of Trust: Carta’s alleged actions represent a breach of trust, as the company was entrusted with sensitive information about the startup and its shareholders. By attempting to broker a deal without consent, Carta violated this trust and potentially jeopardized the startup’s interests.

- Manipulation: The allegations also suggest that Carta may have engaged in manipulative tactics to try and push through the deal. This could include misrepresenting the startup’s situation or pressuring shareholders to agree to the deal.

These allegations raise serious questions about Carta’s ethical standards and its commitment to acting in the best interests of its clients.

Ethical Standards in Cap Table Management

Cap table management companies are expected to adhere to high ethical standards, including:

- Transparency and Disclosure: Companies should be transparent about their processes, fees, and any potential conflicts of interest.

- Confidentiality and Data Security: They should protect sensitive information and implement robust security measures to prevent unauthorized access.

- Objectivity and Fairness: They should act objectively and fairly in their dealings with startups and shareholders, avoiding conflicts of interest and prioritizing the best interests of their clients.

- Professionalism and Integrity: They should maintain high standards of professionalism and integrity in all their interactions.

The allegations against Carta highlight the importance of these ethical standards and the potential consequences of failing to adhere to them.

Impact on Startup Ecosystem

The allegations against Carta have the potential to significantly impact the trust and confidence in the startup ecosystem. If such unethical practices become prevalent, it could create a climate of distrust and uncertainty, hindering future fundraising and investment activities.

Potential Impact on Trust and Confidence

The allegations against Carta raise serious concerns about the integrity of cap table management practices within the startup ecosystem. If investors and founders lose trust in the ability of these platforms to manage equity fairly and transparently, it could have a chilling effect on future investments.

Consequences for Future Fundraising and Investment Activities

The potential consequences for future fundraising and investment activities are significant. If investors are hesitant to invest in startups due to concerns about unethical practices, it could lead to a decrease in funding available to startups. This could stifle innovation and hinder the growth of the startup ecosystem.

Impact on Carta’s Reputation and Future Business Prospects

The allegations against Carta have already damaged its reputation and could significantly impact its future business prospects. Investors and founders may be reluctant to use Carta’s services in the future, leading to a decline in its user base and revenue. Carta will need to address these allegations transparently and take concrete steps to restore trust in its platform.

Regulatory and Legal Implications

Carta’s alleged actions raise significant regulatory and legal concerns, potentially impacting both the company and the startup involved. The company’s actions, if proven, could violate various legal frameworks and expose Carta to legal liability, including lawsuits and regulatory investigations.

The regulatory landscape for cap table management is evolving, but several frameworks and legal precedents are relevant to Carta’s alleged actions.

- Securities Laws: The sale of securities, including company shares, is subject to federal and state securities laws. The Securities Act of 1933 and the Securities Exchange Act of 1934 require registration of securities offerings, unless an exemption applies. Carta’s alleged attempt to broker a deal for the startup’s shares without consent could raise concerns about potential violations of these laws.

- State Corporate Laws: State corporate laws govern the internal affairs of corporations, including shareholder rights and the issuance of stock. These laws often require shareholder approval for significant transactions, such as the sale of a substantial portion of the company’s shares. Carta’s actions could violate these laws if the startup’s governing documents or state law require shareholder consent for the transaction.

- Fiduciary Duty: Directors and officers of companies have a fiduciary duty to act in the best interests of the company and its shareholders. This duty could extend to cap table management practices. If Carta acted without the startup’s consent, it could be argued that it violated its fiduciary duty to the startup’s shareholders.

- Contract Law: Carta likely has contracts with its clients, including the startup in question. These contracts may contain provisions related to cap table management practices and the sale of shares. Carta’s alleged actions could violate these contractual provisions, exposing the company to legal liability.

Potential Legal Implications

Carta’s alleged actions could lead to several legal implications, including:

- Lawsuits: The startup, its shareholders, or other parties could sue Carta for breach of contract, fraud, or other legal claims.

- Regulatory Investigations: The Securities and Exchange Commission (SEC) or state securities regulators could investigate Carta’s activities to determine if it violated securities laws.

- Criminal Charges: In some cases, depending on the nature of the alleged misconduct, criminal charges could be brought against Carta or its employees.

Potential Consequences for Carta and the Startup

The legal implications of Carta’s alleged actions could have significant consequences for both the company and the startup:

- Financial Penalties: Carta could face substantial fines and penalties if found liable for violating securities laws or other regulations.

- Reputational Damage: The allegations could damage Carta’s reputation, leading to loss of clients and investors.

- Legal Costs: Defending against lawsuits and regulatory investigations can be costly, potentially impacting Carta’s financial stability.

- Disruption to Startup Operations: The startup could experience delays or disruptions to its operations if its cap table is in dispute or subject to legal proceedings.

- Loss of Investor Confidence: The allegations could damage the startup’s reputation and make it difficult to raise capital in the future.

The recent controversy surrounding Carta highlights the critical need for ethical practices in cap table management. While cap table management software can streamline the process of tracking equity ownership, it’s essential to ensure that these tools are used responsibly and ethically.

Transparency and Disclosure

Transparency is paramount in building trust and maintaining fairness in cap table management. Open communication and clear disclosure of information are crucial for fostering a positive relationship between startups and their investors.

- Clearly Define Equity Ownership: Startups should ensure that all equity ownership details, including share classes, vesting schedules, and voting rights, are clearly defined and documented. This information should be readily accessible to all stakeholders.

- Regularly Update Stakeholders: Startups should regularly update stakeholders on changes to the cap table, such as new equity grants, share transfers, or option exercises. This can be achieved through periodic reports or email updates.

- Provide Access to Cap Table Data: Startups should provide investors with access to their cap table data, either through a secure online platform or by providing regular reports. This allows investors to monitor their investments and understand the company’s equity structure.

Informed Consent

Informed consent is essential for ethical cap table management, ensuring that all stakeholders are fully aware of and agree to any changes affecting their equity interests.

- Obtain Explicit Consent: Startups should obtain explicit consent from shareholders before making any changes to their equity ownership. This consent should be documented and readily available.

- Clearly Explain the Implications: When seeking consent, startups should clearly explain the implications of any changes to the cap table, including potential financial or legal consequences. This ensures that stakeholders make informed decisions.

- Provide Sufficient Time for Review: Startups should provide stakeholders with sufficient time to review the proposed changes and ask questions before providing consent. This allows stakeholders to make informed decisions without feeling pressured.

Conflict of Interest Management

Conflicts of interest can arise in cap table management, potentially leading to biased decisions or unfair outcomes. It’s essential to implement robust mechanisms to identify and manage these conflicts.

- Identify Potential Conflicts: Startups should proactively identify potential conflicts of interest that may arise in cap table management. This includes conflicts between the interests of founders, investors, and employees.

- Establish Clear Policies: Startups should establish clear policies for managing conflicts of interest. These policies should Artikel procedures for disclosing, mitigating, and avoiding potential conflicts.

- Seek Independent Advice: In situations involving potential conflicts, startups should seek independent advice from legal or financial professionals. This ensures that decisions are made in a fair and impartial manner.

Illustrative Scenario

Imagine a startup, “TechNova,” is preparing for a Series A funding round. They engage Carta to manage their cap table and facilitate the investment process. TechNova’s founders are eager to secure funding and have a strong relationship with a specific investor, “VentureFund.” Carta, aware of this relationship, proposes a deal structure that favors VentureFund, potentially disadvantaging other potential investors.

Following ethical best practices, TechNova should:

- Transparency: Clearly disclose to all potential investors the proposed deal structure, including any potential conflicts of interest related to VentureFund.

- Informed Consent: Obtain explicit consent from all existing shareholders, including founders, before finalizing the deal structure. This ensures that all stakeholders are fully aware of and agree to the proposed changes.

- Conflict of Interest Management: Seek independent legal or financial advice to ensure that the deal structure is fair and does not unfairly disadvantage other potential investors.

The allegations against Carta highlight the importance of transparency, consent, and ethical conduct in cap table management. As the startup ecosystem continues to grow, ensuring trust and integrity in these practices is crucial for fostering a healthy and sustainable environment for entrepreneurs and investors alike. The outcome of this situation could have significant implications for Carta’s future and the broader startup landscape.

The Carta drama, with its accusations of unethical tactics and unauthorized share deals, raises questions about trust in the tech world. But while Carta is busy navigating this ethical storm, it’s worth looking at the bigger picture: the future of mobility. Alex Kendall, co-founder of Wayve, offers a glimpse into this future in his interview about the autonomous future for cars and robots.

Kendall’s vision, however, hinges on a foundation of trust – something Carta is struggling to regain. The irony? Trust is the fuel that will drive the autonomous future, just as it’s the fuel that drives investor confidence in a company’s cap table.

Standi Techno News

Standi Techno News