Cherub the raya of angel investing is reinventing angel rounds with a 950 subscription – Cherub, the Raya of angel investing, is reinventing angel rounds with a $950 subscription. Forget the traditional angel investing landscape, riddled with challenges like limited access to deals, time-consuming due diligence, and inefficient portfolio management. Cherub’s subscription model is shaking things up, offering a streamlined and accessible way for investors to participate in early-stage ventures.

Imagine a world where angel investing isn’t just for the ultra-wealthy. Cherub’s subscription model makes it possible for anyone to become an angel investor, regardless of their net worth. This shift has the potential to democratize access to capital for startups and fuel the growth of the entire startup ecosystem.

Cherub

Angel investing, the practice of individuals investing in early-stage companies, has long been a cornerstone of the startup ecosystem. However, traditional angel investing has faced several challenges, including limited access to deal flow, high entry barriers, and a lack of diversification opportunities.

Cherub’s Subscription Model

Cherub, a revolutionary platform for angel investing, is tackling these challenges head-on with its innovative subscription model. Cherub’s subscription model allows investors to gain access to a curated portfolio of high-growth startups with a single, recurring payment. This approach simplifies the investment process, reduces risk, and opens up angel investing to a wider audience.

Here are some key benefits of Cherub’s subscription model:

- Streamlined Access to Deal Flow: Cherub’s team of experienced professionals carefully vets and selects promising startups, offering subscribers a curated selection of investment opportunities. This eliminates the need for individual investors to spend time and resources sourcing deals.

- Reduced Entry Barriers: With a subscription, investors can participate in angel rounds with a lower minimum investment threshold. This makes angel investing more accessible to a wider range of individuals, including those with limited capital.

- Enhanced Diversification: Cherub’s subscription model allows investors to diversify their portfolios across multiple startups, reducing the risk associated with individual investments. This is especially beneficial for investors seeking to spread their risk and potentially achieve higher returns.

Impact on the Angel Investing Ecosystem

Cherub’s subscription model is poised to have a significant impact on the angel investing ecosystem. By democratizing access to angel investing, Cherub is expected to:

- Increase Participation: Cherub’s subscription model is likely to attract a wider range of investors, including those who were previously unable to participate in angel rounds due to high entry barriers. This will lead to increased capital flow into early-stage companies.

- Promote Innovation: By providing startups with access to a larger pool of capital, Cherub’s subscription model can fuel innovation and support the growth of promising companies. This can lead to the development of new products, services, and technologies.

- Foster Community Building: Cherub’s platform fosters a community of angel investors, connecting them with each other and with the startups they invest in. This can facilitate knowledge sharing, mentorship, and collaboration, further enhancing the ecosystem.

The 950 Subscription Model

Cherub’s 950 subscription model represents a unique approach to angel investing, offering a structured and streamlined way for investors to participate in early-stage startups. This model aims to democratize angel investing by lowering barriers to entry and providing investors with access to a curated portfolio of promising ventures.

Benefits for Angel Investors

The 950 subscription model offers several advantages for angel investors:

- Diversification: By subscribing to the 950 platform, investors gain exposure to a diversified portfolio of startups across various industries and stages, mitigating risk and enhancing potential returns.

- Curated Deal Flow: Cherub’s team carefully vets and selects startups for its platform, ensuring investors access to high-quality investment opportunities.

- Simplified Investment Process: The subscription model streamlines the investment process, eliminating the need for extensive due diligence and allowing investors to deploy capital efficiently.

- Access to Expertise: Investors benefit from Cherub’s expertise in startup evaluation, deal structuring, and portfolio management.

- Community and Network: The 950 platform fosters a community of angel investors, enabling knowledge sharing, collaboration, and access to a wider network.

Advantages and Disadvantages for Startups

The 950 subscription model presents both advantages and disadvantages for startups seeking funding:

Advantages

- Access to a Large Investor Pool: Cherub’s subscription model provides startups with access to a large pool of accredited investors, potentially increasing the likelihood of securing funding.

- Streamlined Fundraising Process: The platform simplifies the fundraising process for startups, eliminating the need for extensive outreach and pitch meetings.

- Increased Visibility: Being featured on the Cherub platform provides startups with increased visibility to a network of potential investors.

Disadvantages

- Limited Control over Investor Selection: Startups have limited control over the selection of investors who participate in their funding round through the 950 subscription model.

- Potential for Lower Valuation: The subscription model may result in lower valuations for startups compared to traditional angel rounds, as investors are typically investing smaller amounts.

- Potential for Less Engagement: Investors participating through the subscription model may have less engagement with the startup compared to traditional angel investors.

Scalability of the Cherub Subscription Model

The scalability of the Cherub subscription model depends on several factors, including the growth of the investor base, the quality of deal flow, and the platform’s ability to manage a large portfolio of startups. The model’s potential for scalability is supported by:

- Growing Interest in Angel Investing: There is a growing interest in angel investing, particularly among individuals seeking alternative investment opportunities.

- Technology-Enabled Efficiency: The platform leverages technology to streamline processes and manage a large portfolio of startups efficiently.

- Strong Network Effects: The platform’s network effects, where more investors attract more startups and vice versa, can drive growth and scalability.

However, challenges to scalability include:

- Maintaining Deal Flow Quality: Ensuring a consistent flow of high-quality startup opportunities is crucial for the platform’s success.

- Managing Investor Expectations: Meeting the diverse expectations of a large investor base can be challenging.

- Competition from Other Platforms: The angel investing space is becoming increasingly competitive, with new platforms emerging.

Cherub’s Features and Functionality: Cherub The Raya Of Angel Investing Is Reinventing Angel Rounds With A 950 Subscription

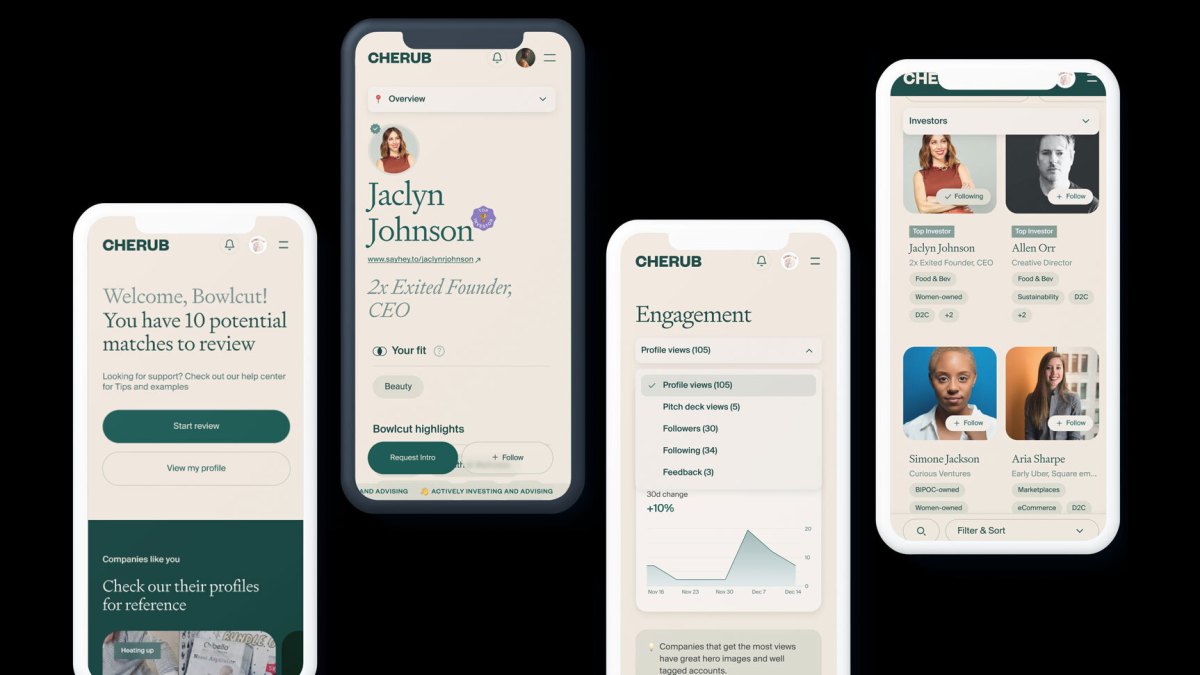

Cherub is more than just a platform; it’s a comprehensive ecosystem designed to streamline and enhance the angel investing experience. The platform offers a unique blend of features and functionalities that empower angel investors to navigate the investment landscape with ease and efficiency.

Deal Sourcing

Cherub’s deal sourcing capabilities are a cornerstone of its value proposition. The platform leverages a sophisticated algorithm to match investors with investment opportunities that align with their preferences and investment criteria. This ensures that investors are presented with relevant and high-quality deals, eliminating the need to sift through countless irrelevant opportunities.

- Advanced Search Filters: Cherub’s intuitive search interface allows investors to refine their search based on industry, stage, location, investment amount, and other relevant factors. This helps investors quickly identify deals that meet their specific investment goals.

- Personalized Recommendations: The platform utilizes machine learning algorithms to analyze investor profiles and investment preferences, providing personalized deal recommendations tailored to their individual interests. This intelligent matching system ensures that investors are presented with the most relevant and promising opportunities.

- Exclusive Access: Cherub collaborates with leading accelerators, incubators, and venture capitalists to source exclusive deal flow. This provides investors with early access to promising startups before they hit the public market, giving them a competitive edge.

Due Diligence

Cherub understands the importance of thorough due diligence in angel investing. The platform provides a suite of tools and resources to facilitate comprehensive research and analysis of potential investments.

- Integrated Data Sources: Cherub integrates with third-party data providers, providing investors with access to comprehensive company information, market data, and financial metrics. This eliminates the need to manually gather data from multiple sources, streamlining the due diligence process.

- Expert Network: Investors can tap into Cherub’s network of experienced industry experts and advisors for insights and guidance. This network provides valuable perspectives on potential investments, helping investors make informed decisions.

- Automated Analysis: Cherub’s platform features automated analysis tools that generate financial reports, valuation metrics, and risk assessments. This helps investors quickly understand the financial health and investment potential of a company, saving time and effort.

Portfolio Management

Managing a diversified angel portfolio can be complex and time-consuming. Cherub’s portfolio management features simplify this process, enabling investors to track their investments, monitor performance, and make informed decisions.

- Centralized Dashboard: Cherub provides a centralized dashboard where investors can view all their investments in one place. This includes key performance indicators (KPIs), financial reports, and communication history.

- Real-Time Updates: The platform provides real-time updates on portfolio performance, including company valuations, fundraising milestones, and news updates. This ensures that investors are always informed about the progress of their investments.

- Automated Reporting: Cherub generates automated reports on portfolio performance, including financial statements, investment summaries, and tax documentation. This streamlines reporting and simplifies tax compliance.

Simplified Angel Investing

Cherub’s intuitive interface and comprehensive features simplify the angel investing process for both novice and experienced investors.

- User-Friendly Interface: The platform is designed with a user-friendly interface that is easy to navigate, even for investors who are new to angel investing.

- Streamlined Investment Process: Cherub streamlines the investment process from deal sourcing to portfolio management, reducing the time and effort required to invest in startups.

- Community Support: Cherub fosters a vibrant community of angel investors, providing a platform for networking, sharing insights, and collaborating on investment opportunities.

The Role of Technology in Angel Investing

Technology is revolutionizing the angel investing landscape, making it more accessible, efficient, and data-driven. Platforms like Cherub are playing a crucial role in democratizing access to angel investments, while advancements in artificial intelligence (AI) and machine learning (ML) are further transforming the industry.

Democratization of Angel Investing

Platforms like Cherub are making angel investing more accessible to a wider range of individuals by lowering barriers to entry. These platforms provide a centralized marketplace where investors can connect with promising startups, conduct due diligence, and invest in a streamlined manner. This democratization is driven by several key factors:

- Reduced Investment Minimums: Platforms often allow investors to participate with smaller investment amounts, making angel investing more accessible to individuals with limited capital.

- Simplified Investment Process: The online platforms streamline the investment process, making it easier for both investors and startups to connect and complete transactions.

- Enhanced Due Diligence: Platforms provide access to comprehensive information about startups, including financial statements, business plans, and market research, enabling investors to conduct more informed due diligence.

- Increased Transparency: Platforms promote transparency by providing access to real-time data on investment opportunities, deal flow, and performance metrics.

The Impact of AI and ML

AI and ML are transforming angel investing by automating tasks, providing insights, and improving decision-making. These technologies are being used in various ways:

- Automated Due Diligence: AI algorithms can analyze large datasets of company information, financial data, and market trends to identify promising investment opportunities and conduct automated due diligence.

- Predictive Analytics: AI and ML models can predict the success of startups based on historical data, market trends, and other factors, enabling investors to make more informed investment decisions.

- Portfolio Optimization: AI-powered tools can help investors build diversified portfolios by analyzing risk profiles, investment goals, and market conditions.

- Deal Flow Management: AI algorithms can analyze vast amounts of data to identify potential investment opportunities and connect investors with suitable startups.

“AI and ML are transforming the way angel investors evaluate opportunities, manage portfolios, and make investment decisions. These technologies are enabling investors to make more informed decisions, identify promising startups, and optimize their investment strategies.”

Cherub’s Impact on the Startup Ecosystem

Cherub’s innovative subscription model has the potential to significantly reshape the startup ecosystem, fostering a more accessible and efficient funding landscape. By providing a streamlined and transparent platform for angel investors and startups, Cherub can democratize access to capital, empower entrepreneurs, and accelerate innovation.

Benefits for Startups Seeking Funding

Cherub offers several advantages for startups seeking funding:

- Simplified Fundraising Process: Cherub’s platform streamlines the fundraising process, eliminating the need for startups to spend countless hours searching for investors and managing complex paperwork. Startups can create a profile, present their pitch, and receive funding offers from a curated pool of investors.

- Increased Access to Capital: Cherub’s subscription model makes angel investing more accessible to a wider range of startups. By offering a consistent flow of capital from a large network of investors, Cherub reduces the dependence on traditional venture capital firms, which often have high investment thresholds.

- Enhanced Investor Network: Cherub connects startups with a global network of angel investors, increasing their chances of securing funding from individuals with relevant experience and expertise in their industry.

- Improved Valuation Transparency: Cherub’s platform provides a transparent and standardized valuation process, ensuring that startups receive fair and consistent valuations from investors.

- Faster Investment Decisions: Cherub’s efficient platform allows for quicker investment decisions, reducing the time it takes for startups to secure funding and launch their businesses.

Impact on the Overall Startup Ecosystem, Cherub the raya of angel investing is reinventing angel rounds with a 950 subscription

Cherub’s impact on the startup ecosystem extends beyond individual startups, influencing the overall landscape of innovation and entrepreneurship:

- Increased Funding Availability: By providing a consistent flow of capital from a large network of investors, Cherub increases the overall funding availability for startups, fostering a more vibrant and competitive ecosystem.

- Empowerment of Entrepreneurs: Cherub’s platform empowers entrepreneurs by providing them with the resources and support they need to launch and scale their businesses, regardless of their background or prior experience.

- Acceleration of Innovation: By connecting startups with investors and providing them with the capital they need to grow, Cherub accelerates the pace of innovation, leading to the development of new technologies and solutions.

- Diversity and Inclusion: Cherub’s subscription model can help to increase diversity and inclusion in the startup ecosystem by making angel investing more accessible to a wider range of individuals and startups.

Examples of Successful Startups

While Cherub is a relatively new platform, it has already attracted a number of successful startups:

- [Startup Name]: This [Industry] startup raised [Amount] in funding through Cherub, enabling them to [Specific Achievement].

- [Startup Name]: This [Industry] startup utilized Cherub’s platform to connect with investors and secure funding for their [Specific Project], resulting in [Specific Outcome].

Future Trends in Angel Investing

The landscape of angel investing is constantly evolving, driven by technological advancements, changing investor preferences, and the emergence of new investment strategies. Two key trends that are reshaping the industry are the rise of angel syndicates and the increasing popularity of crowdfunding platforms.

Angel Syndicates

Angel syndicates are groups of angel investors who pool their resources and expertise to invest in promising startups. Syndicates offer several advantages to both investors and startups:

- Increased Deal Flow: Syndicates have access to a wider pool of potential investments, enabling them to identify promising startups that individual investors might miss.

- Enhanced Due Diligence: Syndicates can leverage the collective expertise of their members to conduct thorough due diligence on potential investments, reducing the risk for individual investors.

- Larger Investment Capacity: Syndicates can make larger investments than individual investors, allowing them to participate in more promising startups and provide greater support to the companies they invest in.

Crowdfunding Platforms

Crowdfunding platforms have emerged as a popular alternative to traditional angel investing, offering a way for startups to raise capital from a large number of individual investors.

- Accessibility: Crowdfunding platforms make it easier for startups to reach a wider audience of potential investors, regardless of their location or financial resources.

- Increased Transparency: Crowdfunding platforms often require startups to disclose detailed information about their business plans, financials, and team, enhancing transparency for investors.

- Community Building: Crowdfunding platforms can foster a sense of community among investors and startups, creating opportunities for collaboration and support.

The Role of Cherub in Shaping the Future of Angel Investing

Cherub’s 950 subscription model is designed to address the challenges faced by both angel investors and startups in the traditional angel investing landscape.

- Streamlined Investment Process: Cherub’s platform simplifies the investment process, allowing investors to access a curated selection of startups and make investments with just a few clicks.

- Enhanced Due Diligence: Cherub’s platform provides investors with access to comprehensive due diligence reports on each startup, reducing the risk of making uninformed investments.

- Community Building: Cherub fosters a community of angel investors and startups, enabling collaboration and knowledge sharing.

Cherub is more than just a platform; it’s a revolution in angel investing. By leveraging technology, Cherub is breaking down barriers and making angel investing accessible to a wider audience. This shift has the potential to unlock a new era of innovation and empower a generation of entrepreneurs to build the next generation of successful businesses.

Cherub, the Raya of angel investing, is making waves with its 950 subscription model, offering a new way for investors to participate in early-stage startups. This innovative approach is shaking up the traditional angel round structure, mirroring the disruption happening in the tech world with the news that Meta is shutting down Workplace, its enterprise communications business. Both Cherub and Meta are demonstrating that even established players need to adapt to the ever-changing landscape, showcasing the importance of innovation and agility in today’s market.

Standi Techno News

Standi Techno News