Climate tech investment roars back with an 8 1b start to 2024 – Climate tech investment roars back with an $8.1B start to 2024, signaling a renewed commitment to tackling climate change. This surge in investment is driven by a growing awareness of the urgency of the climate crisis, coupled with advancements in climate tech solutions that are finally starting to show promise. This trend is a stark contrast to the previous years, where investment in climate tech saw a decline, primarily due to economic uncertainties.

The money is flowing into a diverse range of climate tech sectors, with a particular focus on renewable energy, carbon capture, and sustainable agriculture. This investment is not just about making a profit; it’s about creating a more sustainable future for all of us.

The Climate Tech Investment Boom

The start of 2024 saw a remarkable surge in climate tech investments, reaching a staggering $8.1 billion. This significant figure signals a growing global commitment to tackling climate change through innovative technological solutions. This trend signifies a shift in the investment landscape, where sustainability and climate action are no longer seen as optional but rather as essential drivers of economic growth and a sustainable future.

Factors Driving Investment Surge

Several key factors have fueled this surge in climate tech investments. One of the most prominent drivers is the increasing awareness of the urgency of climate change. The world is experiencing more frequent and intense extreme weather events, and the consequences of climate change are becoming increasingly evident. This heightened awareness is pushing governments, businesses, and individuals to prioritize solutions. Additionally, the increasing availability of innovative climate tech solutions is attracting investors. These technologies offer promising solutions to address various aspects of climate change, including renewable energy, carbon capture, and sustainable agriculture. Furthermore, the growing demand for sustainable products and services is driving investors to support companies that are developing solutions that meet these demands.

Investment Trends Compared to Previous Years

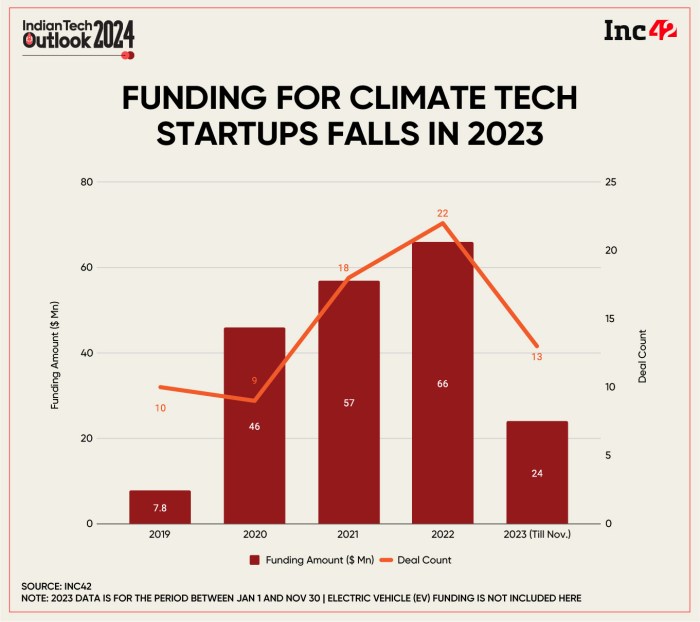

The current climate tech investment boom represents a significant shift from previous years. In 2023, climate tech investments totaled $40 billion, marking a notable increase compared to previous years. This growth signifies a growing confidence in the climate tech sector and its potential to deliver impactful solutions. The current trend suggests that climate tech is becoming a mainstream investment category, attracting a broader range of investors, including venture capitalists, private equity firms, and even traditional financial institutions.

Key Areas of Investment

The climate tech sector encompasses a wide range of technologies and solutions, attracting investment across various areas.

- Renewable Energy: This sector continues to be a significant recipient of climate tech investments, with a focus on solar, wind, and hydropower technologies. This area is experiencing rapid innovation, with companies developing more efficient and cost-effective solutions for renewable energy generation and storage.

- Carbon Capture and Storage: Carbon capture technologies are gaining momentum, attracting significant investments. These technologies aim to remove carbon dioxide from the atmosphere or industrial processes, contributing to reducing greenhouse gas emissions. This area is crucial for achieving net-zero emissions targets and mitigating climate change.

- Sustainable Agriculture: Climate tech investments are also flowing into sustainable agriculture, which aims to improve food production while minimizing environmental impact. This area includes technologies that promote efficient water usage, reduce fertilizer and pesticide use, and enhance soil health.

- Green Buildings: The construction industry is increasingly focusing on sustainable building practices, leading to investments in green building technologies. These technologies aim to improve energy efficiency, reduce emissions, and enhance resource conservation within buildings.

Key Players and Investment Strategies

The resurgence of climate tech investment is driven by a diverse range of players, each employing unique strategies to capitalize on the burgeoning sector. From venture capitalists to corporations, these investors are actively seeking to fund innovative solutions addressing the climate crisis.

Prominent Investors in Climate Tech, Climate tech investment roars back with an 8 1b start to 2024

The landscape of climate tech investment is marked by the presence of several prominent players, including:

- Venture Capital Firms: These firms, such as Breakthrough Energy Ventures, Lowercarbon Capital, and Climate Capital, specialize in early-stage investments in climate tech startups. They often focus on technologies with the potential for significant impact and high growth potential.

- Corporations: Companies like Microsoft, Google, and Amazon are increasingly investing in climate tech, both through direct investments and through corporate venture capital arms. This strategy allows them to access cutting-edge technologies and align their business operations with sustainability goals.

- Government Agencies: Governments around the world are actively supporting climate tech innovation through grants, subsidies, and public-private partnerships. The US Department of Energy, for instance, invests heavily in research and development of clean energy technologies.

- Philanthropic Organizations: Foundations and NGOs, such as the Bezos Earth Fund and the ClimateWorks Foundation, are playing a significant role in funding climate tech solutions. They often focus on supporting organizations tackling climate change in developing countries.

Investment Strategies in Climate Tech

Investors employ a range of strategies to navigate the climate tech landscape:

- Seed Stage Investing: This strategy involves investing in early-stage companies with promising ideas but limited track records. Investors hope to identify companies with the potential to disrupt the market and generate substantial returns.

- Growth Stage Investing: This strategy focuses on companies that have already demonstrated market traction and are seeking capital to scale their operations. Investors aim to support companies with proven business models and strong growth potential.

- Impact Investing: This strategy prioritizes investments in companies that generate positive social and environmental impact alongside financial returns. Investors seek to align their portfolios with their values and contribute to a more sustainable future.

- Strategic Investments: Corporations often make strategic investments in climate tech companies to gain access to technologies that complement their existing operations or enhance their sustainability initiatives.

Top 10 Climate Tech Investors and Their Investment Focus Areas

| Rank | Investor | Investment Focus Areas |

|---|---|---|

| 1 | Breakthrough Energy Ventures | Clean energy, carbon capture, sustainable agriculture, and transportation |

| 2 | Lowercarbon Capital | Renewable energy, energy storage, and sustainable materials |

| 3 | Climate Capital | Climate adaptation, climate finance, and sustainable infrastructure |

| 4 | Microsoft Climate Innovation Fund | Carbon removal, renewable energy, and sustainable agriculture |

| 5 | Google Ventures | Clean energy, energy efficiency, and smart cities |

| 6 | Amazon Climate Pledge Fund | Renewable energy, sustainable transportation, and carbon removal |

| 7 | US Department of Energy | Clean energy research and development, energy efficiency, and carbon capture |

| 8 | Bezos Earth Fund | Climate change mitigation, climate adaptation, and nature conservation |

| 9 | ClimateWorks Foundation | Climate change mitigation, climate adaptation, and climate policy |

| 10 | Rockefeller Foundation | Climate resilience, sustainable agriculture, and clean energy |

Impact of Climate Tech Investments: Climate Tech Investment Roars Back With An 8 1b Start To 2024

The surge in climate tech investments is not just a financial phenomenon; it signifies a pivotal shift in the global approach to combating climate change. These investments are acting as a catalyst for the development and widespread adoption of innovative solutions, paving the way for a more sustainable future.

Accelerated Development of Climate Solutions

The influx of capital into climate tech is fueling rapid innovation across various sectors. This translates to a faster development cycle for technologies that can mitigate climate change and adapt to its effects.

- Renewable Energy: Investments are driving the development of more efficient and affordable solar, wind, and geothermal energy technologies, making them increasingly competitive with traditional fossil fuels.

- Carbon Capture and Storage: Companies are developing and deploying advanced technologies to capture and store carbon dioxide emissions from industrial processes and power plants, reducing greenhouse gas emissions.

- Sustainable Agriculture: Investments are supporting the development of climate-smart agricultural practices, such as precision farming, regenerative agriculture, and vertical farming, which aim to increase food production while minimizing environmental impact.

Increased Adoption of Climate Solutions

Beyond research and development, climate tech investments are also crucial for scaling up and deploying existing solutions.

- Energy Efficiency: Investments are enabling the widespread adoption of energy-efficient technologies, such as smart grids, energy management systems, and building retrofits, reducing energy consumption and lowering carbon emissions.

- Electric Vehicles: Investments in electric vehicle manufacturing, charging infrastructure, and battery technology are driving the transition to a cleaner transportation sector, reducing reliance on fossil fuels.

- Climate Adaptation: Investments are supporting the development and implementation of adaptation measures, such as flood defenses, drought-resistant crops, and early warning systems, to build resilience against the impacts of climate change.

Examples of Climate Tech Companies and Their Innovations

Several climate tech companies are leading the charge in developing and deploying innovative solutions.

- Tesla: A pioneer in electric vehicles and energy storage, Tesla’s innovations have significantly accelerated the adoption of electric vehicles and renewable energy solutions.

- Beyond Meat: This company develops plant-based meat alternatives, offering a sustainable alternative to traditional meat production, reducing greenhouse gas emissions associated with animal agriculture.

- Carbon Engineering: This company develops technology to capture and store carbon dioxide from the atmosphere, offering a potential solution for removing existing carbon emissions.

The Future of Climate Tech Investment

The climate tech investment landscape is poised for explosive growth in the coming years, driven by a confluence of factors including increasing awareness of climate change, government policies, and technological advancements.

The Trajectory of Climate Tech Investment

The global climate tech investment market is expected to experience significant growth, with estimates suggesting a compound annual growth rate (CAGR) of over 20% from 2023 to 2030. This growth is driven by several factors, including:

- Increased Investor Interest: More investors are recognizing the potential of climate tech to deliver both financial returns and positive environmental impact. Venture capitalists, private equity firms, and even traditional asset managers are allocating capital to climate tech startups and companies.

- Government Support: Governments worldwide are enacting policies and regulations that incentivize climate tech development and deployment. This includes tax credits, grants, and regulations that promote clean energy technologies and sustainable practices.

- Technological Advancements: Continuous advancements in renewable energy, energy storage, carbon capture, and other climate-related technologies are driving down costs and improving efficiency, making these solutions more attractive to investors.

The Impact of Government Policies and Regulations on Climate Tech Investment

Government policies play a crucial role in shaping the climate tech investment landscape. These policies can influence investment decisions by:

- Creating Market Demand: Policies like carbon pricing mechanisms, renewable energy mandates, and fuel efficiency standards create demand for climate tech solutions, making them more attractive to investors.

- Reducing Investment Risk: Government support through subsidies, tax credits, and grants can reduce the risk associated with investing in climate tech, making it more appealing to investors.

- Promoting Innovation: Government-funded research and development programs can accelerate the development of new climate tech solutions, attracting investors seeking early-stage opportunities.

The Role of Technology and Innovation in Driving Future Investments

Technological innovation is the driving force behind the growth of climate tech investment. Emerging technologies are continuously creating new solutions and opportunities for investors. Examples include:

- Artificial Intelligence (AI): AI is being used to optimize energy consumption, improve renewable energy generation, and develop new carbon capture technologies. AI-powered platforms are also being used to analyze climate data and predict weather patterns, enabling better climate risk management.

- Blockchain: Blockchain technology is being used to create transparent and secure systems for tracking carbon emissions and managing renewable energy credits. It can also facilitate peer-to-peer energy trading and create new business models for clean energy.

- Biotechnology: Biotechnology is playing a role in developing sustainable agriculture practices, creating biofuels, and developing new materials with lower environmental impact.

As climate tech investment continues to surge, the future looks bright for the development and adoption of climate solutions. With the right investments and continued innovation, we can create a future where climate change is no longer a threat but a challenge we have overcome. It’s a testament to the growing understanding of the urgency of the climate crisis and the potential of climate tech to address it. The journey to a sustainable future is a collective effort, and these investments are a crucial step in the right direction.

While climate tech investment roars back with an 8.1B start to 2024, another tech sector is grappling with its own set of challenges. This week, AI is facing scrutiny for its potential to perpetuate racism in image generators, a topic explored in detail in this week in ai addressing racism in ai image generators. As climate tech seeks to solve our planet’s problems, AI must find ways to address its own biases to ensure a more equitable future for everyone.

Standi Techno News

Standi Techno News