Crezco aims to make integrating bill payments easier, taking on the complex world of financial transactions with a user-friendly approach. The company recognizes the frustration of businesses and individuals grappling with outdated and cumbersome payment systems, and they’ve developed a solution designed to streamline the process. Crezco’s vision is to create a seamless and efficient bill payment experience, one that empowers users to focus on what truly matters – their core business or personal life.

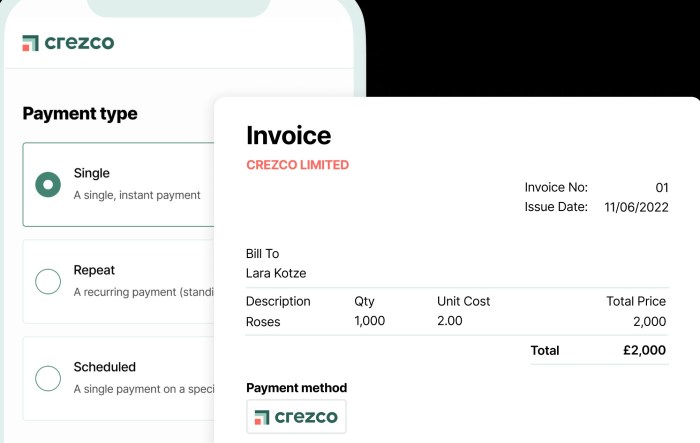

At the heart of Crezco’s solution is a commitment to simplicity. Their platform is built with an intuitive interface that makes navigating and managing payments a breeze. Gone are the days of clunky interfaces and complicated processes. Instead, Crezco offers a streamlined experience that’s accessible to users of all technical backgrounds. Whether you’re a seasoned entrepreneur or a tech-savvy individual, Crezco makes bill payments a hassle-free affair.

Crezco’s Mission and Vision

Crezco is a company dedicated to making bill payment integration simpler and more efficient for businesses and individuals alike. They believe that bill payments should be a seamless and stress-free experience, not a complicated and time-consuming chore.

Crezco’s vision is to create a future where bill payment integration is effortless, regardless of the platform or device being used. They aim to achieve this by developing innovative solutions that streamline the entire bill payment process, from initial setup to final confirmation.

Key Problems Crezco Aims to Solve

Crezco’s solutions address several key problems faced by individuals and businesses when it comes to bill payment integration:

- Complex Integration Processes: Many existing bill payment systems require complex integrations that can be time-consuming and costly to implement. Crezco simplifies the process by offering user-friendly APIs and pre-built integrations that can be easily implemented across various platforms.

- Lack of Standardization: The bill payment industry lacks standardization, leading to inconsistencies in data formats and communication protocols. Crezco addresses this by establishing standardized interfaces and communication protocols that ensure seamless data exchange between different systems.

- Security Concerns: Bill payments involve sensitive financial data, making security a top priority. Crezco prioritizes data security by implementing robust security measures, including encryption, authentication, and access control, to safeguard user information.

Crezco’s Solution

Crezco understands the complexities of integrating bill payment systems and offers a streamlined solution designed to simplify the process for businesses of all sizes. The platform aims to reduce development time, minimize integration headaches, and empower businesses to focus on what truly matters: their core operations.

Crezco’s approach is built on a foundation of user-friendly design, robust API capabilities, and a commitment to providing comprehensive support. The platform is designed to be intuitive and adaptable, allowing businesses to tailor the integration process to their specific needs and requirements.

Crezco’s mission is to simplify the way we pay our bills, aiming to make the process as smooth as possible. Just like how the boox ereaders poke 5 palma page review simplifies reading, Crezco hopes to make paying bills a breeze. Ultimately, both Crezco and the Boox readers aim to improve our daily lives by streamlining processes and making things easier.

Key Features and Functionalities

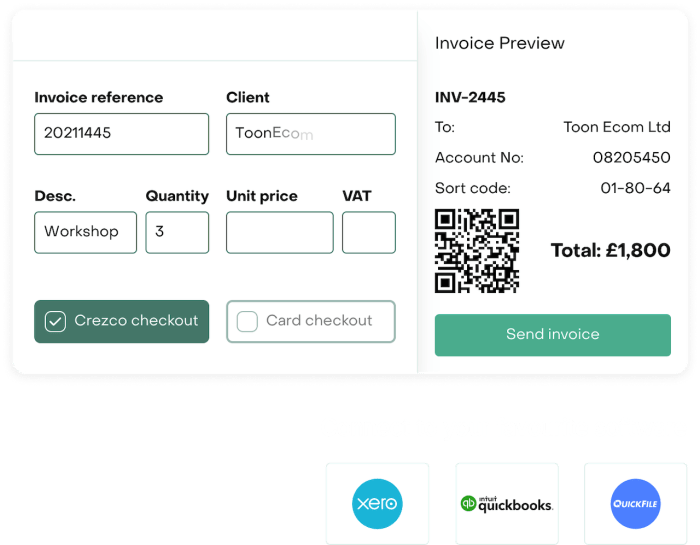

Crezco’s platform is packed with features designed to simplify and expedite the bill payment integration process. Here are some of the key highlights:

- Pre-built Integrations: Crezco offers pre-built integrations with popular payment gateways and financial institutions, eliminating the need for extensive custom development. This significantly reduces time to market and allows businesses to start accepting bill payments quickly.

- Flexible API: Crezco’s API is designed to be flexible and scalable, allowing businesses to seamlessly integrate with their existing systems and workflows. Whether it’s a CRM, ERP, or any other platform, Crezco’s API can handle the integration with ease.

- Secure Payment Processing: Security is paramount. Crezco’s platform is built with robust security measures to protect sensitive financial data and ensure compliance with industry standards.

- Real-time Reporting and Analytics: Crezco provides real-time reporting and analytics, giving businesses valuable insights into payment trends, customer behavior, and overall financial performance.

- Dedicated Support: Crezco offers dedicated support to help businesses navigate the integration process and address any challenges they may encounter. The team is available to provide technical assistance, answer questions, and ensure a smooth transition.

Comparison with Traditional Methods

Traditionally, integrating bill payment systems involved complex coding, custom development, and extensive testing. This process could be time-consuming, expensive, and prone to errors.

Crezco’s solution stands out by offering a more streamlined and efficient approach. The platform’s pre-built integrations, flexible API, and comprehensive support significantly reduce the effort and complexity associated with traditional integration methods. This translates into faster implementation times, lower development costs, and reduced risk of integration issues.

Crezco’s platform empowers businesses to focus on what truly matters: their core operations.

Benefits of Using Crezco: Crezco Aims To Make Integrating Bill Payments Easier

Crezco offers a range of benefits for both businesses and individuals, streamlining bill payments and simplifying financial management. Whether you’re a small business owner, a freelancer, or simply looking for a more efficient way to pay your bills, Crezco provides a user-friendly and secure platform to manage your finances effectively.

Time Savings

Crezco significantly reduces the time spent on bill payments. With automated bill payments and reminders, you can say goodbye to manually entering payment details, chasing due dates, and worrying about late fees. Instead, you can focus on your business or personal priorities, knowing that your bills are taken care of automatically.

Cost Reduction

Crezco helps businesses and individuals save money by minimizing late payment fees and reducing the administrative burden associated with bill payments. By automating the process, Crezco eliminates the need for manual data entry, paper checks, and postage, leading to significant cost savings in the long run.

Improved Efficiency

Crezco enhances financial management by providing a centralized platform to track all your bills and payments. You can easily access your payment history, monitor your spending, and identify areas for potential savings. This increased transparency and control over your finances empower you to make informed decisions and optimize your financial well-being.

Real-World Examples

- A small business owner using Crezco was able to save over $500 per year in late payment fees by automating bill payments and receiving timely reminders.

- A freelancer using Crezco was able to free up several hours per week by eliminating the need to manually track and pay bills, allowing them to focus on their core business activities.

- A family using Crezco was able to gain a better understanding of their monthly expenses and identify areas where they could reduce their spending, ultimately improving their financial health.

Crezco’s Target Audience

Crezco is designed to cater to a diverse range of businesses and individuals who are seeking to streamline their bill payment processes. From small businesses to large corporations, and from individual consumers to freelancers, Crezco offers a comprehensive solution to simplify bill management.

Crezco’s target audience encompasses a broad spectrum of individuals and businesses across various industries. The platform’s versatility makes it suitable for a wide range of use cases, providing a seamless and efficient bill payment experience for everyone.

Industries and Use Cases

The following table highlights the diverse industries and specific use cases where Crezco can be effectively implemented:

| Industry | Use Cases |

|—|—|

| Small and Medium Businesses (SMBs) | – Automate recurring bill payments

– Track expenses and generate reports

– Improve cash flow management

– Reduce late payment penalties |

| Large Corporations | – Streamline bill payment processes for multiple departments

– Integrate with existing accounting systems

– Enhance security and compliance

– Improve vendor relationships |

| Freelancers and Independent Contractors | – Manage client invoices and payments

– Track expenses and income

– Improve time management

– Reduce administrative burden |

| Non-Profit Organizations | – Simplify donation processing

– Manage membership fees and other recurring payments

– Improve transparency and accountability

– Reduce administrative costs |

| Educational Institutions | – Streamline tuition and fee payments

– Manage vendor invoices and payments

– Improve student financial aid administration

– Reduce administrative workload |

| Healthcare Providers | – Automate patient billing and payments

– Manage insurance claims and reimbursements

– Improve patient satisfaction

– Reduce administrative costs |

Catering to Unique Needs

Crezco caters to the specific needs of each target audience by offering a range of features and functionalities. For instance, SMBs can benefit from automated bill payments and expense tracking, while large corporations can leverage Crezco’s integration with existing accounting systems for enhanced security and compliance. Freelancers can use Crezco to manage client invoices and payments, while non-profit organizations can utilize the platform to streamline donation processing.

Crezco’s customizable features allow users to tailor the platform to their specific needs, making it a versatile solution for a wide range of businesses and individuals.

Crezco’s Future and Growth

Crezco’s journey is just beginning. The company has a clear vision for the future, aiming to become the leading platform for seamless bill payments. Crezco’s growth strategy involves expanding its reach, enhancing its features, and building strategic partnerships.

Crezco’s Expansion Plans

Crezco’s expansion plans focus on reaching a wider audience and offering its services in new markets. The company is actively exploring opportunities to partner with financial institutions, businesses, and government agencies. This will allow Crezco to integrate its payment solutions into existing systems, making bill payments even more accessible.

Crezco’s Roadmap for New Features

Crezco’s roadmap for new features is driven by user feedback and market trends. The company plans to introduce features like:

- Automated Bill Payment: This feature will allow users to set up automatic payments for recurring bills, eliminating the need for manual intervention.

- Bill Negotiation: Crezco will explore partnerships with bill providers to offer users the ability to negotiate lower rates and better payment terms.

- Personalized Bill Management: Crezco will develop tools that help users categorize their bills, track spending, and set budgets for better financial control.

- Bill Payment Reminders: Crezco will send timely reminders to users about upcoming bill due dates, reducing the risk of late payments and associated fees.

Crezco’s Impact on the Bill Payment Industry, Crezco aims to make integrating bill payments easier

Crezco’s innovative approach to bill payments has the potential to revolutionize the industry. The company’s user-friendly platform, advanced features, and commitment to security are poised to attract a large user base. This will lead to increased competition and innovation in the bill payment market, ultimately benefiting consumers.

“Crezco is not just about making bill payments easier; it’s about empowering people to take control of their finances.” – Crezco Founder

Crezco’s Partnerships

Crezco is actively seeking strategic partnerships with leading financial institutions, technology companies, and government agencies. These partnerships will enable Crezco to reach a wider audience, integrate its services into existing systems, and enhance its offerings.

Crezco’s User Base Growth

Crezco is experiencing rapid user base growth. The company’s focus on user experience, security, and convenience has attracted a large number of users. As Crezco continues to expand its features and reach, its user base is expected to grow significantly.

Crezco’s Impact on Financial Inclusion

Crezco’s user-friendly platform and accessible services have the potential to improve financial inclusion. By providing a secure and convenient way to pay bills, Crezco can help individuals who may not have access to traditional banking services. This will contribute to a more inclusive and equitable financial system.

“Crezco is committed to making financial services accessible to everyone, regardless of their background or financial situation.” – Crezco CEO

In a world where time is money, Crezco offers a compelling alternative to traditional bill payment methods. Their focus on ease of use and efficiency empowers businesses to streamline their operations and individuals to manage their finances with greater control. By removing the complexities of bill payment integration, Crezco opens the door to a future where financial transactions are seamless, efficient, and stress-free.

Standi Techno News

Standi Techno News