Dili wants to automate due diligence with AI: It sounds like a sci-fi movie plot, right? But in reality, it’s a revolutionary concept that’s changing the way businesses operate. Traditionally, due diligence has been a manual process, riddled with paperwork, human error, and time-consuming investigations. But with the rise of AI, a new era of efficiency and accuracy is dawning. Imagine a world where AI algorithms sift through mountains of data, identify potential risks, and flag inconsistencies, all in a fraction of the time it would take a human. That’s the power of AI-driven due diligence, and it’s transforming industries across the board.

The impact of AI in due diligence is undeniable. From automating document review to analyzing market trends, AI is streamlining processes, reducing costs, and helping businesses make more informed decisions. But it’s not just about speed and efficiency. AI also brings a new level of precision to the table, helping businesses mitigate risks and uncover hidden opportunities. In a world where information is king, AI is empowering businesses to make smarter, faster, and more data-driven decisions.

The Current Landscape of Due Diligence

Due diligence is a crucial process in any business transaction, ensuring that both parties have a comprehensive understanding of the risks and opportunities involved. Traditionally, due diligence has been a manual, time-consuming, and resource-intensive process.

The current landscape of due diligence is characterized by a combination of traditional methods and emerging technologies. While traditional methods remain prevalent, they face significant limitations in today’s complex and rapidly evolving business environment.

Challenges and Complexities of Manual Due Diligence

Manual due diligence processes often involve extensive document review, data analysis, and communication with multiple stakeholders. This can lead to several challenges and complexities, including:

- Time-consuming and resource-intensive: Manual due diligence requires significant time and effort, involving numerous hours of document review, data analysis, and communication. This can significantly delay transaction timelines and increase costs.

- Risk of human error: Manual processes are prone to human errors, such as overlooking critical information or misinterpreting data. This can lead to inaccurate assessments and potentially costly mistakes.

- Difficulty in managing large volumes of data: With the increasing volume and complexity of data, manually processing and analyzing information can become overwhelming. This can hinder the ability to identify key insights and make informed decisions.

- Lack of standardization: Manual due diligence processes often lack standardization, leading to inconsistencies in methodology and results. This can make it difficult to compare different transactions and identify trends.

Real-World Examples of Challenges, Dili wants to automate due diligence with ai

The challenges of manual due diligence can have significant real-world impacts on businesses. For example:

- Delayed transactions: A lengthy due diligence process can delay transactions, leading to missed opportunities and lost revenue.

- Increased costs: The time and resources required for manual due diligence can significantly increase transaction costs.

- Reputational damage: Inaccurate due diligence assessments can lead to reputational damage, particularly in cases of fraud or misrepresentation.

- Regulatory compliance issues: Failing to conduct thorough due diligence can result in regulatory compliance issues and penalties.

The Power of AI in Due Diligence

The integration of Artificial Intelligence (AI) into due diligence processes is revolutionizing the way businesses conduct thorough investigations. AI’s ability to process vast amounts of data, identify patterns, and generate insights empowers organizations to make more informed decisions, reducing risks and improving efficiency.

AI Automation in Due Diligence

AI can automate various aspects of due diligence, significantly streamlining the process and freeing up human resources for more strategic tasks.

- Data Extraction and Analysis: AI algorithms can quickly extract relevant data from various sources, including financial statements, contracts, and regulatory filings. This data can be analyzed to identify trends, anomalies, and potential risks.

- Risk Assessment: AI-powered risk assessment models can analyze historical data and current market conditions to predict potential risks and vulnerabilities. This helps companies proactively mitigate risks and make informed decisions.

- Document Review: AI-powered document review tools can automatically analyze large volumes of documents, identifying key clauses, red flags, and potential legal issues. This accelerates the review process and ensures thoroughness.

- Fraud Detection: AI algorithms can detect fraudulent activities by analyzing patterns in financial data, identifying anomalies, and flagging suspicious transactions. This helps prevent financial losses and maintain regulatory compliance.

Examples of AI Applications in Due Diligence

AI is being implemented in various real-world scenarios to enhance due diligence processes.

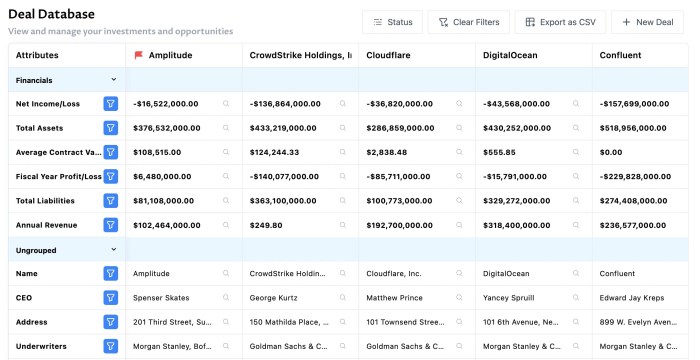

- Financial Due Diligence: AI-powered tools are used by investment banks and private equity firms to analyze financial statements, identify potential red flags, and assess the financial health of target companies.

- Legal Due Diligence: Law firms are utilizing AI for contract analysis, identifying potential legal risks and ensuring compliance with relevant regulations.

- Environmental, Social, and Governance (ESG) Due Diligence: AI algorithms can analyze ESG data to assess a company’s environmental impact, social responsibility, and governance practices. This helps investors make informed decisions based on sustainability criteria.

Benefits of Using AI in Due Diligence

The adoption of AI in due diligence offers numerous advantages, including:

| Benefit | Description |

|---|---|

| Increased Efficiency | AI automation significantly reduces the time and effort required for due diligence, freeing up human resources for more strategic tasks. |

| Enhanced Accuracy | AI algorithms can analyze data with greater precision than humans, reducing the risk of errors and ensuring more reliable insights. |

| Cost Savings | By automating tasks and reducing the need for manual labor, AI can significantly reduce the overall cost of due diligence. |

| Improved Risk Management | AI-powered risk assessment models can identify potential risks and vulnerabilities, enabling proactive risk mitigation and better decision-making. |

| Enhanced Compliance | AI can help companies comply with regulatory requirements by identifying potential violations and ensuring adherence to legal and ethical standards. |

Key AI Technologies for Due Diligence Automation

The due diligence process, traditionally a manual and time-consuming endeavor, is undergoing a significant transformation with the advent of AI. Several AI technologies are revolutionizing this critical stage of business transactions, enabling faster, more accurate, and more comprehensive analysis.

Natural Language Processing (NLP)

NLP is a branch of AI that focuses on enabling computers to understand and interpret human language. In the context of due diligence, NLP plays a pivotal role in extracting valuable insights from large volumes of unstructured data, such as contracts, financial statements, and news articles.

- Contract Analysis: NLP algorithms can analyze contracts to identify key clauses, risks, and obligations, providing a comprehensive understanding of the contractual terms. For example, NLP can identify clauses related to termination, indemnification, and intellectual property rights, highlighting potential areas of concern.

- Due Diligence Reports: NLP can automate the generation of due diligence reports by extracting relevant information from various sources and summarizing it in a concise and readable format. This significantly reduces the time and effort required to compile reports, allowing for faster decision-making.

- Sentiment Analysis: NLP can analyze the sentiment expressed in various documents, such as news articles and social media posts, to gauge public perception and identify potential risks. This can help due diligence teams understand the broader context surrounding a target company and identify potential red flags.

Machine Learning (ML)

ML is a subset of AI that enables computers to learn from data without explicit programming. In due diligence, ML algorithms can be trained on historical data to identify patterns and anomalies, helping to predict potential risks and opportunities.

- Fraud Detection: ML algorithms can analyze financial data to identify patterns that may indicate fraudulent activity, such as unusual transactions or inconsistencies in financial statements. This can help prevent financial losses and ensure the integrity of the due diligence process.

- Risk Assessment: ML algorithms can be trained on historical data of successful and unsuccessful transactions to identify key risk factors and assess the overall risk profile of a target company. This allows for more informed decision-making and reduces the likelihood of unforeseen issues.

- Valuation: ML algorithms can analyze market data and financial statements to provide more accurate and reliable valuations of target companies. This can help investors make more informed investment decisions and avoid overpaying or underpaying for assets.

Computer Vision

Computer vision is a field of AI that enables computers to “see” and interpret images and videos. In due diligence, computer vision can be used to analyze physical assets, such as property, equipment, and infrastructure, to identify potential risks and opportunities.

- Property Inspection: Computer vision algorithms can analyze images and videos of properties to identify structural defects, damage, or other issues that may not be immediately apparent to human inspectors. This can help prevent costly repairs and ensure the safety of the property.

- Equipment Assessment: Computer vision can be used to assess the condition of equipment and machinery, identifying potential wear and tear or malfunctions that could lead to downtime or safety hazards. This can help ensure the smooth operation of a target company’s operations.

- Environmental Compliance: Computer vision can be used to monitor environmental compliance, such as identifying illegal dumping or unauthorized construction activities. This can help ensure that a target company is operating in compliance with all relevant environmental regulations.

Table of AI Technologies and Their Applications in Due Diligence

| AI Technology | Applications in Due Diligence |

|---|---|

| Natural Language Processing (NLP) | Contract analysis, due diligence report generation, sentiment analysis |

| Machine Learning (ML) | Fraud detection, risk assessment, valuation |

| Computer Vision | Property inspection, equipment assessment, environmental compliance |

Case Studies of Successful AI-Powered Due Diligence

The adoption of AI in due diligence is not just a theoretical concept. Real-world companies are actively using AI to streamline their processes and achieve tangible results. These case studies showcase the diverse ways AI is being leveraged and the impressive outcomes it delivers.

Financial Institutions Employing AI for Due Diligence

The financial sector is at the forefront of AI adoption in due diligence. This is because of the inherent complexity of their transactions and the need for rigorous risk assessments.

- Bank of America: Bank of America implemented an AI-powered system to automate the analysis of vast amounts of financial data. This enabled them to identify potential risks and fraud more effectively, leading to a significant reduction in manual effort and improved accuracy in risk assessment. The system also facilitated faster decision-making, allowing for quicker approval of loans and investments.

- JPMorgan Chase: JPMorgan Chase developed a chatbot called COIN (Contract Intelligence) to automate the review of commercial loan agreements. This AI-powered tool significantly reduced the time required for contract analysis from 360,000 hours per year to a mere seconds. COIN’s ability to extract key information and identify potential risks has revolutionized the due diligence process for commercial loans.

Future Trends in AI-Driven Due Diligence: Dili Wants To Automate Due Diligence With Ai

The landscape of due diligence is rapidly evolving, driven by advancements in artificial intelligence (AI). AI is transforming how businesses conduct due diligence, offering greater efficiency, accuracy, and insights. Looking ahead, several emerging trends will further shape the future of AI-powered due diligence.

Emerging AI Trends and their Impact

AI is rapidly advancing, leading to new trends that will significantly impact due diligence practices. These trends are not just about improving existing processes but fundamentally changing how due diligence is conducted.

- Explainable AI (XAI): As AI models become more complex, understanding their decision-making process is crucial. XAI focuses on making AI models transparent and interpretable, allowing users to understand the reasoning behind their outputs. This is critical for due diligence, where transparency and accountability are paramount.

- Generative AI: Generative AI models, such as large language models (LLMs), are capable of creating new content, including text, code, and images. These models can be used to generate reports, summaries, and even legal documents, streamlining the due diligence process.

- AI-powered Data Extraction: Extracting relevant information from vast amounts of data is a key challenge in due diligence. AI-powered data extraction tools use natural language processing (NLP) and machine learning to automatically identify and extract key data points from various sources, including contracts, financial statements, and regulatory documents.

Future of AI-Powered Due Diligence

The future of AI-powered due diligence is bright, with the technology expected to play a central role in the industry. Here’s how AI will continue to reshape due diligence:

- Automated Risk Assessment: AI algorithms can analyze vast datasets to identify potential risks and red flags, enabling more comprehensive and accurate risk assessments. This allows due diligence teams to focus on high-risk areas and make more informed decisions.

- Enhanced Due Diligence: AI can automate routine tasks, freeing up human analysts to focus on more complex and strategic aspects of due diligence. This allows for deeper analysis and more insightful conclusions, leading to better-informed investment decisions.

- Real-Time Due Diligence: AI can provide real-time insights and updates, allowing businesses to stay informed about changing risks and opportunities. This enables more agile and responsive due diligence practices, ensuring timely and accurate information for decision-making.

Impact of AI Trends on Due Diligence Practices

The table below summarizes the potential impact of emerging AI trends on due diligence practices:

| Trend | Impact on Due Diligence |

|---|---|

| Explainable AI (XAI) | Increased transparency and accountability in AI-driven due diligence. |

| Generative AI | Automated report generation, summarizing, and document creation, leading to increased efficiency. |

| AI-powered Data Extraction | Faster and more accurate data extraction from various sources, enabling comprehensive analysis. |

| Automated Risk Assessment | Proactive identification of potential risks and red flags, improving risk management. |

| Enhanced Due Diligence | Improved accuracy and depth of analysis, leading to better-informed investment decisions. |

| Real-Time Due Diligence | Continuous monitoring of risks and opportunities, enabling agile and responsive decision-making. |

As AI continues to evolve, we can expect even more innovative applications in due diligence. The future of this field is bright, with AI poised to become an indispensable tool for businesses of all sizes. From automating tedious tasks to providing valuable insights, AI is revolutionizing due diligence and empowering businesses to thrive in a complex and ever-changing world. So, are you ready to embrace the future of due diligence? It’s time to get on board with AI and unlock the potential for greater efficiency, accuracy, and success.

Dili wants to automate due diligence with AI, streamlining the process and saving time. This focus on efficiency mirrors the approach of SpaceX, who, according to internal pre-Starlink SpaceX financials , have been pouring resources into ambitious “moonshot” projects. While Dili’s AI aims to improve due diligence, SpaceX’s moonshots are pushing the boundaries of space exploration. Both are examples of organizations embracing innovation to achieve ambitious goals.

Standi Techno News

Standi Techno News