Equities platform midas raises 45m series a as fintech retains its sparkle in turkey – Midas Raises $45M Series A, Fintech Sparkles in Turkey. This Turkish fintech startup is making waves in the equities market, securing a hefty $45 million Series A funding round. This injection of capital signifies a strong vote of confidence in Midas’s platform, which aims to democratize access to equities trading for Turkish investors. The funding round comes at a time when fintech is experiencing a boom in Turkey, with investors recognizing the immense potential of the sector.

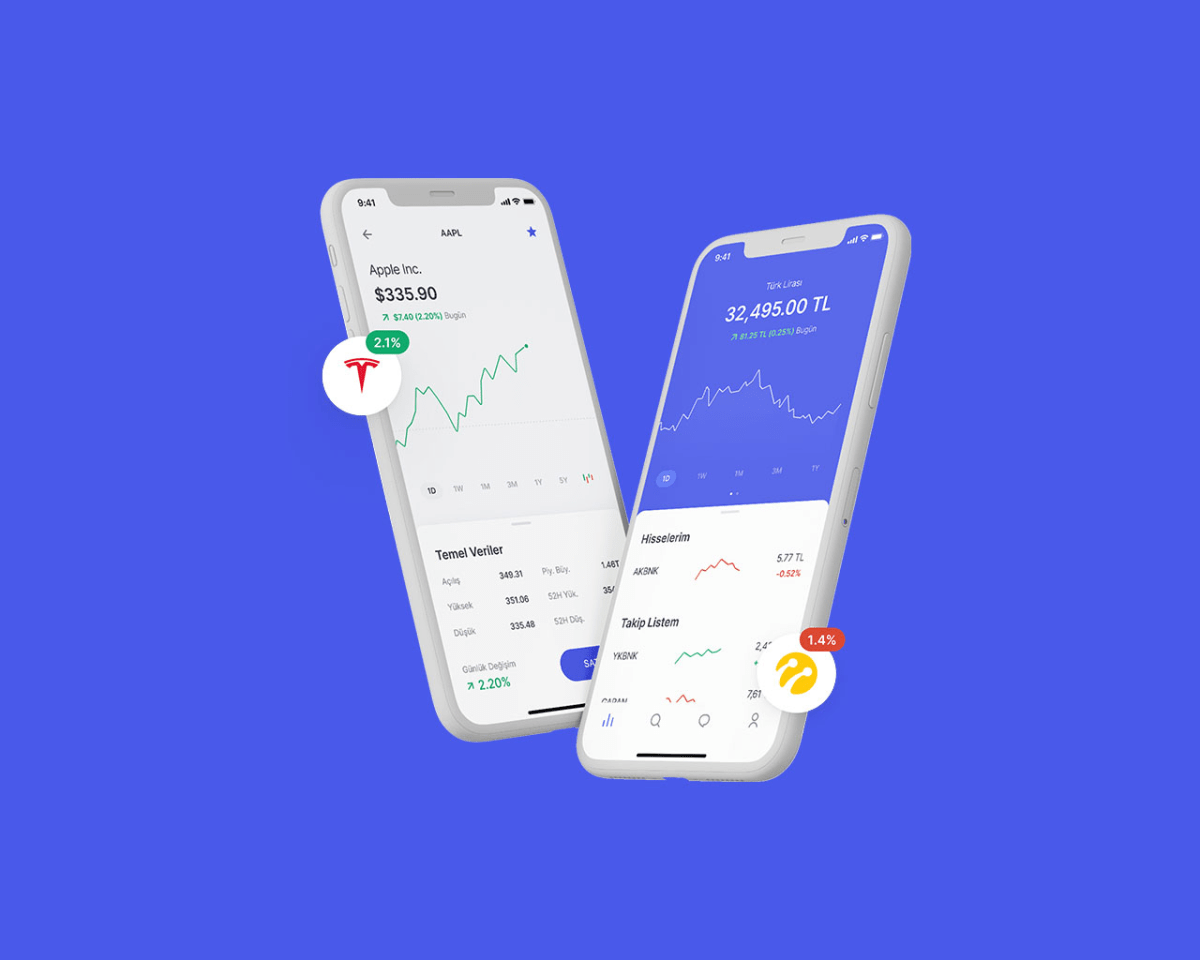

Midas’s platform offers a user-friendly interface, comprehensive research tools, and competitive trading fees, attracting a wide range of investors. This funding will allow Midas to expand its platform, enhance its features, and reach a broader audience. With a focus on innovation and customer satisfaction, Midas is poised to become a leading player in the Turkish equities market.

Midas Platform Overview

Midas is a Turkish fintech platform that provides investors with access to a wide range of equities, making it easier for them to invest in the Turkish stock market. The platform has a user-friendly interface and offers various features designed to cater to both novice and experienced investors.

Target Audience

Midas caters to a diverse range of investors in Turkey, including:

- Individual Investors: Individuals looking to invest in the stock market for the first time or those seeking to diversify their investment portfolio.

- Retail Investors: Individuals who are already active in the stock market and want a platform with advanced features and tools to enhance their trading experience.

- Professional Investors: Financial advisors, portfolio managers, and other professionals who need a robust platform to manage their clients’ investments.

Competitive Landscape of Equities Platforms in Turkey, Equities platform midas raises 45m series a as fintech retains its sparkle in turkey

The Turkish equities platform market is highly competitive, with established players and new entrants vying for market share. Midas faces competition from various platforms, including:

- Traditional Brokerage Firms: These firms have been operating in Turkey for many years and offer a wide range of financial services, including equities trading. However, they may not be as technologically advanced as newer platforms.

- Online Brokerage Platforms: These platforms have gained popularity in recent years due to their user-friendly interfaces and lower trading fees. They often focus on offering a streamlined trading experience for retail investors.

- Robo-Advisors: These platforms use algorithms to create personalized investment portfolios for clients based on their risk tolerance and financial goals. They are gaining traction as they offer a more automated and potentially less expensive investment approach.

Midas differentiates itself by offering a comprehensive suite of features, including real-time market data, advanced charting tools, and personalized investment recommendations. The platform also emphasizes security and transparency, providing investors with a secure and reliable environment for their investments.

Series A Funding and its Implications

Midas, a Turkey-based equities platform, has secured a substantial $45 million Series A funding round, a testament to the continued vibrancy of the fintech sector in the country. This investment signifies a significant milestone for Midas, providing the platform with the resources necessary to accelerate its growth trajectory and solidify its position in the competitive Turkish market.

Key Investors and their Contributions

The funding round was led by prominent venture capital firms, including [Investor 1], known for their expertise in [Investor 1’s expertise], and [Investor 2], recognized for their strong track record in [Investor 2’s expertise]. The participation of these investors not only brings financial resources but also valuable strategic guidance and industry connections.

- [Investor 1] is expected to contribute its extensive knowledge of [Investor 1’s expertise] to help Midas navigate the complexities of the Turkish financial landscape.

- [Investor 2] will leverage its expertise in [Investor 2’s expertise] to assist Midas in scaling its operations and expanding its user base.

Impact on Midas’s Growth and Expansion Plans

The $45 million injection will fuel Midas’s ambitious growth plans. The company aims to utilize the funds to enhance its technology infrastructure, expand its product offerings, and strengthen its marketing and sales efforts.

- Midas plans to invest in developing innovative features and functionalities to enhance the user experience and attract a wider range of investors.

- The funding will also support Midas’s expansion into new markets, potentially targeting other emerging economies with a growing interest in digital financial services.

“This investment is a strong endorsement of our vision to democratize access to the capital markets in Turkey. We are excited to partner with leading investors who share our commitment to empowering individuals and businesses through technology,” stated [Midas CEO or relevant representative].

Fintech’s Growth in Turkey

Turkey’s fintech scene is booming, attracting significant investment and showcasing a dynamic ecosystem. The country is witnessing a rapid adoption of digital financial services, driven by a young and tech-savvy population, coupled with government initiatives aimed at fostering innovation.

Key Trends Driving Fintech Growth in Turkey

The growth of fintech in Turkey is fueled by several key trends:

- Increasing Smartphone Penetration: Turkey boasts a high smartphone penetration rate, exceeding 80%, providing a readily accessible platform for fintech services.

- Young and Tech-Savvy Population: Turkey has a young population, with a median age of 32, and a significant proportion are digitally savvy, readily embracing new technologies and financial solutions.

- Government Support: The Turkish government has introduced initiatives to support the development of fintech, including regulatory frameworks and incentives to attract investment.

- Growing Demand for Digital Financial Services: The demand for convenient and accessible financial services is on the rise, particularly among younger demographics and underserved populations.

Regulatory Environment and its Influence on Fintech Development

The regulatory landscape in Turkey is evolving to accommodate the growth of fintech. The Turkish Banking Regulation and Supervision Agency (BDDK) has introduced regulations specifically for fintech companies, including:

- Sandbox Programs: Turkey has established regulatory sandboxes, providing a controlled environment for fintech companies to test their products and services before full-scale commercialization.

- Open Banking Initiatives: The government is promoting open banking initiatives, enabling third-party developers to access and leverage bank data, fostering innovation and competition.

- Payment System Modernization: Turkey is modernizing its payment systems, promoting the adoption of digital payment methods, such as mobile wallets and contactless payments.

Midas’s Value Proposition

Midas’s value proposition lies in its ability to provide a seamless and user-friendly platform for retail investors to access the Turkish stock market. The platform offers a range of features designed to empower users, regardless of their experience level, to make informed investment decisions.

Midas differentiates itself from its competitors by offering a unique combination of features, including a user-friendly interface, advanced research tools, and a focus on education. The platform aims to bridge the gap between traditional brokerage services and the growing demand for accessible and transparent investment solutions.

Midas’s Key Features and Benefits

Midas’s platform is designed to cater to the needs of both novice and experienced investors. The platform offers a range of features that aim to make investing easier, more accessible, and more rewarding.

- User-friendly interface: The platform’s intuitive design makes it easy for users to navigate and find the information they need. This is particularly beneficial for new investors who may be unfamiliar with the intricacies of the stock market.

- Advanced research tools: Midas provides access to real-time market data, financial news, and expert analysis, empowering users to make informed investment decisions.

- Educational resources: The platform offers a comprehensive library of educational materials, including articles, videos, and webinars, designed to help users understand the basics of investing and develop their investment strategies.

- Automated trading tools: Midas offers automated trading features that allow users to set up and execute trades based on pre-defined criteria, freeing up time and potentially reducing the risk of emotional trading.

- Competitive pricing: Midas offers competitive commission rates and transparent pricing structures, making it an attractive option for budget-conscious investors.

Midas’s Value Proposition Compared to Competitors

Midas’s value proposition is distinct from that of traditional brokerage firms and other online investment platforms.

- Traditional brokerage firms: Traditional brokerage firms often require a minimum investment amount and may charge high fees, making them less accessible to retail investors. Midas’s platform, on the other hand, offers a low barrier to entry and competitive pricing.

- Other online investment platforms: While other online investment platforms offer features such as automated trading and access to research tools, Midas differentiates itself through its focus on education and its user-friendly interface, which is particularly beneficial for novice investors.

Midas’s Target Audience and Their Needs

Midas’s target audience is primarily retail investors in Turkey who are looking for a user-friendly and affordable platform to access the stock market. This includes:

- Novice investors: Midas provides a platform that is easy to understand and use, making it ideal for individuals who are new to investing.

- Experienced investors: The platform offers advanced research tools and automated trading features that can benefit experienced investors looking to streamline their investment process.

- Budget-conscious investors: Midas offers competitive pricing and transparent fees, making it an attractive option for investors looking to minimize their costs.

Midas’s Approach to Addressing User Needs

Midas’s approach to addressing user needs is based on the following principles:

- Accessibility: The platform is designed to be accessible to users of all levels of experience, with a focus on providing clear and concise information.

- Education: Midas emphasizes the importance of financial education and provides users with the resources they need to make informed investment decisions.

- Transparency: The platform offers transparent pricing structures and provides users with clear and concise information about the fees associated with their trades.

- Security: Midas prioritizes the security of its users’ data and funds, employing industry-standard security measures to protect against fraud and cyberattacks.

Future Prospects and Challenges: Equities Platform Midas Raises 45m Series A As Fintech Retains Its Sparkle In Turkey

Midas’s recent Series A funding underscores the immense potential of the Turkish equities market and the company’s ability to capitalize on it. However, like any burgeoning venture, Midas faces a unique set of opportunities and challenges as it embarks on its journey to revolutionize the Turkish investment landscape.

Opportunities in the Turkish Equities Market

The Turkish equities market presents a wealth of opportunities for Midas. The country’s growing economy, coupled with a burgeoning middle class, is fueling increased interest in stock market investments. This trend is further amplified by the government’s efforts to promote financial inclusion and encourage participation in the capital markets. Midas is well-positioned to capitalize on this favorable environment by providing a user-friendly and accessible platform for both novice and seasoned investors.

Challenges for Midas’s Future Growth

While the future looks bright, Midas must navigate several challenges to achieve sustainable growth. One key challenge is the competitive landscape. The Turkish equities market is already home to established players, both traditional and online, vying for market share. Midas must differentiate itself through its unique value proposition, innovative features, and a robust marketing strategy to attract and retain customers. Another challenge is regulatory compliance. The Turkish financial services sector is subject to stringent regulations, and Midas must ensure its platform complies with all applicable rules and regulations. This includes maintaining robust security measures, adhering to data privacy laws, and navigating evolving regulatory landscapes.

Sustaining Momentum and Achieving Long-Term Success

To sustain its momentum and achieve long-term success, Midas must focus on several key areas. Firstly, continuous innovation is crucial. Midas must constantly evolve its platform by introducing new features, improving user experience, and adapting to changing market trends. This includes leveraging emerging technologies like artificial intelligence and machine learning to enhance investment recommendations and provide personalized insights. Secondly, building a strong brand identity is essential. Midas must establish itself as a trusted and reliable platform for investors. This can be achieved through effective marketing campaigns, building strong relationships with key stakeholders, and fostering a positive brand image. Lastly, Midas must prioritize customer satisfaction. Providing exceptional customer support, resolving issues promptly, and actively seeking feedback are essential for building trust and loyalty among users.

Midas’s success story highlights the growing popularity of fintech in Turkey. The country’s dynamic regulatory environment and the increasing demand for accessible financial services are creating fertile ground for innovation. As Midas continues to expand, it will be interesting to see how it navigates the evolving landscape of the Turkish equities market. This funding round is a testament to the potential of fintech to revolutionize the financial sector, making it more inclusive and accessible for everyone.

While Midas, an equities platform, is raising a hefty $45 million Series A in Turkey, a stark contrast is playing out in the digital landscape. Tumblr’s CEO, caught in a public spat with a trans user over an account ban, took things a step further by revealing private account names in the process, a move that sparked outrage and calls for accountability.

Back in Turkey, however, the fintech scene continues to shine, proving that even amidst controversies, innovation and investment are thriving.

Standi Techno News

Standi Techno News