The Integration: Facebook Messenger Gets An American Express Bot

Facebook Messenger and American Express have joined forces to bring you a seamless and convenient way to manage your finances right from your fingertips. This partnership allows you to access a range of American Express services through a familiar platform – Facebook Messenger.

Features and Functionalities

The American Express bot on Facebook Messenger offers a plethora of features designed to simplify your card management experience.

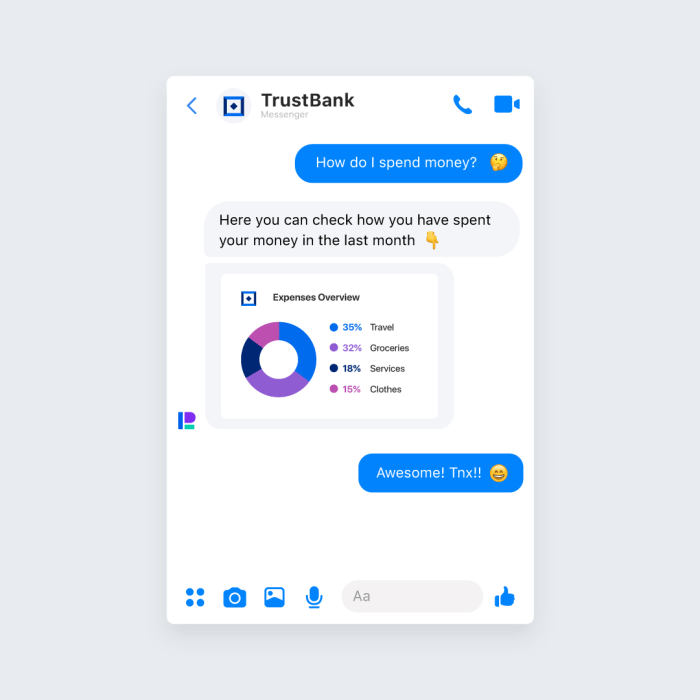

- Account Balance and Transaction History: Check your account balance, view recent transactions, and get insights into your spending patterns.

- Make Payments: Pay your bills, transfer funds, and manage your finances with ease.

- Customer Support: Connect with American Express customer service representatives for assistance with any queries or issues.

- Rewards and Offers: Access exclusive rewards and offers tailored to your spending habits.

- Card Control: Lock and unlock your card, set spending limits, and manage your card security.

Benefits for Facebook Messenger Users

This integration brings a host of benefits for Facebook Messenger users, including:

- Convenience: Manage your American Express card without switching between apps.

- Accessibility: Access your account and services anytime, anywhere.

- Seamless Integration: Enjoy a familiar and intuitive interface within the Facebook Messenger platform.

Benefits for American Express Cardholders

For American Express cardholders, the integration offers:

- Enhanced Security: Benefit from the secure and encrypted environment of Facebook Messenger.

- Personalized Experience: Receive tailored offers and rewards based on your spending habits.

- Streamlined Management: Effortlessly manage your card and finances from a single platform.

User Experience and Convenience

The American Express bot on Facebook Messenger is designed to provide a user-friendly and convenient experience for cardholders. It allows them to access key features and services directly through the messaging app, eliminating the need to navigate through multiple websites or apps.

The bot’s interface is intuitive and straightforward, guiding users through various tasks with clear prompts and options. This seamless experience makes it easy for cardholders to manage their accounts and utilize their benefits, even on the go.

Checking Account Balances

The bot allows users to check their account balances quickly and easily. By simply typing “balance” or “check balance,” users can instantly access their current balance and recent transactions.

Making Payments

The bot simplifies the payment process, allowing users to make payments directly from their Facebook Messenger chat. Users can easily select the account they want to pay from, enter the amount, and confirm the payment.

Managing Rewards

The bot provides access to rewards programs and allows users to manage their points. Users can view their accumulated points, redeem them for rewards, and track their progress towards achieving specific milestones.

Convenience and Accessibility

The bot’s accessibility and convenience make it a valuable tool for cardholders. It eliminates the need to log in to multiple websites or apps, streamlining the process of managing finances and accessing benefits.

Customer Service and Support

The American Express bot is designed to provide a seamless and efficient customer service experience. It utilizes advanced AI technology to understand your inquiries and provide relevant and helpful responses.

Answering Frequently Asked Questions

The bot is equipped with a comprehensive knowledge base that covers a wide range of frequently asked questions. This includes inquiries about account balances, statement details, reward programs, and travel benefits. You can ask the bot questions in natural language, and it will provide clear and concise answers. For example, if you want to know your current balance, you can simply type “What’s my balance?” and the bot will display the information.

Resolving Issues

The bot can also assist with resolving common issues, such as forgotten passwords, lost or stolen cards, and transaction disputes. It will guide you through the necessary steps to resolve the issue, and in some cases, it can even automate the process. For example, if you’ve forgotten your password, the bot can guide you through the password reset process.

Providing Support

Beyond answering questions and resolving issues, the bot can also provide personalized support. It can recommend relevant products and services based on your spending habits and preferences. It can also notify you about important updates, such as changes to your account or new benefits. For example, if you’re planning a trip, the bot can provide you with information about travel insurance options and other relevant benefits.

Effectiveness Compared to Traditional Customer Service

The American Express bot offers several advantages over traditional customer service channels. First, it’s available 24/7, so you can get help whenever you need it. Second, it’s significantly faster than waiting on hold for a customer service representative. Third, it can handle multiple inquiries simultaneously, so you don’t have to wait in a queue.

Security and Privacy

When using the American Express bot on Facebook Messenger, your security and privacy are top priorities. American Express implements robust security measures and adheres to strict privacy practices to safeguard your personal information.

Security Measures

American Express takes a multi-layered approach to security, ensuring your interactions with the bot are protected.

- Encryption: All communication between your device and the bot is encrypted using industry-standard protocols like HTTPS, preventing unauthorized access to your data during transmission.

- Authentication: To access your American Express account through the bot, you’ll need to authenticate using your existing American Express login credentials, adding an extra layer of security.

- Fraud Detection: American Express employs sophisticated fraud detection systems to monitor transactions and identify suspicious activity, helping to protect your account from unauthorized access.

Privacy Considerations

While the bot offers convenience and access to your account information, it’s important to understand the privacy implications of using it.

- Data Collection: The bot collects information about your interactions, including your messages, account details, and transaction history. This data is used to provide personalized services, enhance the bot’s functionality, and improve customer experiences.

- Data Sharing: American Express may share your data with third-party service providers who assist in delivering the bot’s functionality. However, they are bound by confidentiality agreements to protect your information.

- Privacy Policy: It’s crucial to review American Express’s privacy policy to understand how your data is collected, used, and shared. The policy provides detailed information about your privacy rights and how to manage your data preferences.

Best Practices for Protecting Personal Information

- Strong Passwords: Use a strong, unique password for your American Express account, and avoid using the same password for other online services.

- Two-Factor Authentication: Enable two-factor authentication on your American Express account to add an extra layer of security, requiring a code sent to your phone or email in addition to your password.

- Limit Information Shared: Avoid sharing sensitive personal information, such as your Social Security number or credit card details, through the bot.

- Monitor Account Activity: Regularly review your account activity and report any suspicious transactions immediately to American Express.

- Keep Software Updated: Ensure your device’s operating system and apps are up to date with the latest security patches to protect against vulnerabilities.

Marketing and Promotion

The American Express bot can be a powerful tool for marketing and promoting products and services to customers. By leveraging the power of conversational AI, the bot can engage customers in a personalized and interactive way, ultimately driving conversions and brand loyalty.

Targeted Marketing

The bot can be used to target specific customer segments based on their demographics, purchase history, and other relevant data. This allows for personalized messaging that resonates with each customer, increasing the chances of engagement and conversion. For example, the bot can send targeted offers and promotions to customers who have recently made a purchase, or who have shown interest in specific products or services.

- Demographics: The bot can target customers based on their age, gender, location, and other demographic factors. For example, the bot could send targeted offers to young professionals in major cities who are known to be frequent travelers.

- Purchase history: The bot can target customers based on their past purchases. For example, the bot could send offers for complementary products to customers who have recently purchased a specific item.

- Interests and preferences: The bot can target customers based on their interests and preferences. For example, the bot could send offers for events and experiences to customers who have expressed an interest in travel or entertainment.

Personalized Messages

The bot can deliver personalized messages to customers based on their individual preferences and needs. This can include customized recommendations, offers, and support. For example, the bot can suggest products or services that are relevant to a customer’s recent purchases, or offer assistance with a specific issue.

- Welcome messages: The bot can greet new customers with a personalized welcome message, introducing them to the benefits of using the bot.

- Product recommendations: The bot can recommend products and services that are relevant to a customer’s interests and needs.

- Personalized offers: The bot can send targeted offers and promotions to customers based on their purchase history and preferences.

- Customer support: The bot can provide personalized support to customers who have questions or need assistance.

Successful Marketing Campaigns, Facebook messenger gets an american express bot

Several successful marketing campaigns have leveraged the power of chatbots to engage customers and drive conversions. For example, a major airline used a chatbot to provide personalized travel recommendations and booking assistance to customers. The chatbot was able to successfully increase bookings and customer satisfaction.

Future of Messenger Bots

The integration of American Express with Facebook Messenger marks a significant step forward for the world of chatbot technology. This move has the potential to revolutionize how businesses interact with customers, transforming the landscape of customer service, marketing, and even commerce.

Emerging Trends in Bot Development

The American Express integration showcases several key trends shaping the future of bot development.

- Integration with Existing Platforms: Bots are increasingly being integrated into existing social media platforms and messaging apps, providing a seamless user experience. This strategy allows businesses to reach customers where they already are, fostering engagement and accessibility. The American Express bot leverages this trend by integrating with Facebook Messenger, a platform already familiar to millions of users.

- AI-Powered Conversational Experiences: Bots are becoming more sophisticated, utilizing artificial intelligence (AI) to understand and respond to complex queries. This advanced AI enables more natural and engaging conversations, leading to improved customer satisfaction. The American Express bot utilizes AI to provide personalized financial advice and transaction management, enhancing the user experience.

- Focus on Personalized Interactions: Businesses are recognizing the importance of personalization in customer interactions. Bots are being designed to collect data about users and tailor their responses accordingly. The American Express bot uses data to provide customized recommendations and offers, enhancing the user experience and driving engagement.

Predictions for the Role of Messenger Bots

The American Express integration provides a glimpse into the potential impact of Messenger bots across various industries.

- Enhanced Customer Service: Bots will play a crucial role in providing 24/7 customer support, handling routine inquiries and resolving simple issues quickly and efficiently. This will free up human agents to focus on more complex tasks, improving overall customer service efficiency.

- Personalized Marketing: Bots will enable businesses to deliver highly targeted marketing messages based on individual user preferences and behavior. This personalized approach will lead to increased engagement and conversion rates.

- Simplified Transactions: Bots will streamline transactions, allowing users to make purchases, manage accounts, and access financial services directly within messaging apps. This will create a more convenient and accessible experience for customers.

Facebook messenger gets an american express bot – The integration of Facebook Messenger and American Express is a game-changer for both users and the financial industry. It highlights the growing role of Messenger bots in providing convenient and personalized financial services. As technology continues to evolve, we can expect to see even more innovative integrations that make managing our finances easier and more accessible than ever before.

Facebook Messenger just got a whole lot more convenient with the new American Express bot. Now you can manage your Amex card right from your chats, which is pretty cool, especially if you’re the kind of person who prefers to avoid phone calls. And speaking of cool tech, did you know that the Apple Watch Series 2 is made up of 2 million individual components ?

That’s a lot of tiny parts working together to make a sleek, functional smartwatch. So, while you’re chatting with your Amex bot, remember that even the simplest-looking tech can be incredibly complex underneath the surface.

Standi Techno News

Standi Techno News