Facebook’s Secondary Stock Offering

Facebook, the social media giant, announced a secondary stock offering, aiming to raise nearly $4 billion. This offering is a significant event in the tech world and has sparked widespread interest among investors.

Purpose of the Offering

Facebook’s secondary stock offering serves a dual purpose: firstly, it allows the company to raise capital for future growth initiatives, and secondly, it provides existing shareholders with an opportunity to sell their shares and realize their investment gains. The company plans to use the proceeds from the offering to invest in new products and technologies, expand its global reach, and enhance its platform’s features. This strategic move underscores Facebook’s commitment to staying ahead of the curve in the ever-evolving digital landscape.

Potential Impact on Stock Price and Market Capitalization

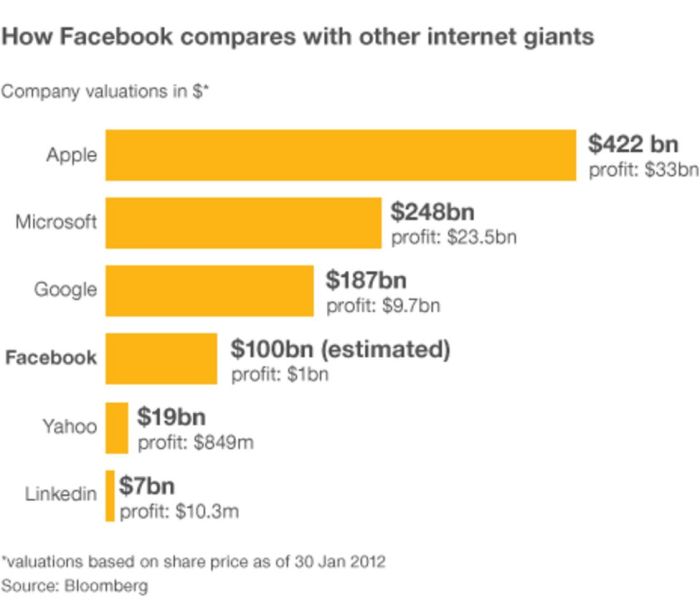

The impact of the offering on Facebook’s stock price is a complex issue. While the influx of new shares into the market could dilute the existing stock price, the potential for growth fueled by the raised capital could offset this dilution. Moreover, the offering could boost investor confidence in Facebook’s future prospects, potentially driving up the stock price. The offering could also significantly increase Facebook’s market capitalization, solidifying its position as a tech behemoth.

Comparison with Other Offerings

Facebook’s secondary stock offering aligns with a trend of recent offerings in the tech sector. Companies like Google, Amazon, and Microsoft have also tapped into the capital markets through secondary offerings to fund expansion, acquisitions, and research and development initiatives. These offerings highlight the robust growth and innovation within the tech sector and the confidence investors have in these companies’ long-term prospects.

The $4 Billion Raised

Facebook’s secondary stock offering aimed to raise nearly $4 billion, a significant amount even for a tech giant like Facebook. This move underscores the company’s continued ambition and its need for substantial capital to fuel future growth.

Factors Influencing the Amount

The amount Facebook aimed to raise was likely influenced by several key factors. The company’s growth trajectory, including expansion plans and potential acquisitions, would have played a significant role. Furthermore, Facebook’s desire to maintain a strong financial position and secure its future in a rapidly evolving tech landscape likely influenced the decision.

Potential Uses of the Funds

Facebook’s $4 billion fundraising effort will likely be used for a variety of purposes, including:

* Expansion Plans: The funds could be used to expand into new markets or invest in existing ones. Facebook has already demonstrated its commitment to growth, particularly in emerging markets, and this offering could further accelerate these plans.

* Investments: The company might allocate a portion of the funds towards strategic investments in promising startups or technologies. This could involve acquisitions or partnerships that enhance Facebook’s core offerings or create new opportunities.

* Debt Reduction: A portion of the funds could be used to reduce existing debt, improving Facebook’s financial leverage and freeing up resources for other strategic initiatives.

Comparison to Previous Fundraising Efforts

This secondary stock offering represents a significant fundraising effort for Facebook, but it’s not unprecedented. The company has previously raised billions of dollars through various means, including initial public offerings (IPOs) and debt financing. However, the sheer scale of this offering reflects the company’s continued growth and its ambitious plans for the future.

Investor Response and Market Impact

Facebook’s secondary stock offering, aimed at raising nearly $4 billion, sparked considerable interest among investors. The offering, designed to provide liquidity for early investors and employees, was met with a positive response, indicating strong confidence in the company’s future prospects.

Investor Sentiment and Stock Performance

Investor sentiment towards Facebook’s secondary stock offering was generally positive, as evidenced by the strong demand for the shares. The offering was oversubscribed, indicating that investors were willing to purchase more shares than were initially available. This strong demand drove the stock price higher, reflecting the confidence investors had in the company’s future growth potential.

Following the announcement and execution of the offering, Facebook’s stock price experienced a slight dip, which was attributed to the influx of new shares into the market. However, the stock price quickly rebounded, indicating that the offering did not significantly impact investor confidence in the long term.

Impact on the Technology Market

Facebook’s secondary stock offering had a limited impact on the broader technology market. The offering was primarily driven by the company’s need to provide liquidity to early investors and employees, rather than a strategic move to raise capital for expansion or acquisitions.

The offering did, however, contribute to a broader trend of secondary stock offerings in the technology sector. Several other technology companies have also undertaken secondary stock offerings in recent years, driven by a combination of factors, including strong growth, the desire to provide liquidity to employees, and the need to raise capital for strategic initiatives.

Implications for Facebook’s Future

Facebook’s $4 billion secondary stock offering is a significant event that could have far-reaching implications for the company’s future. This move suggests a strategic shift, potentially influencing its financial health, growth strategy, and competitive landscape.

Impact on Financial Health and Growth Strategy, Facebooks secondary stock offering to raise nearly 4 billion

The secondary stock offering provides Facebook with a substantial influx of cash. This capital can be utilized to fuel various initiatives that contribute to the company’s long-term growth.

- Increased Investments: This injection of capital empowers Facebook to invest heavily in research and development, potentially leading to innovative features and services. This could involve expanding into new markets, enhancing existing platforms, or developing entirely new technologies. For example, Facebook’s investment in augmented and virtual reality (AR/VR) could be accelerated, further strengthening its position in the metaverse.

- Strategic Acquisitions: Facebook can use this capital to acquire promising startups or companies that complement its existing portfolio. This could involve expanding its reach into new areas or acquiring technologies that strengthen its core offerings. For instance, Facebook might acquire a company specializing in social commerce, further integrating e-commerce into its platform.

- Debt Reduction: The influx of cash could also be used to reduce existing debt, improving Facebook’s financial stability and providing greater flexibility for future investments. This strategy would strengthen its creditworthiness and reduce interest payments, freeing up resources for other initiatives.

Impact on Competitive Landscape

The secondary stock offering positions Facebook more strategically within the competitive social media landscape. This injection of capital can be used to enhance its existing platforms, develop new offerings, or even acquire competitors.

- Enhanced Features and Services: Facebook can use the capital to invest in improving its existing platforms, such as Instagram, WhatsApp, and Messenger, by adding new features and functionalities. This could involve enhancing user experience, expanding monetization strategies, or integrating new technologies. This could further solidify its dominance in social media and potentially attract users away from competing platforms.

- Expansion into New Markets: Facebook can utilize the capital to expand into new markets, potentially reaching audiences that are not currently engaged with its platforms. This could involve developing localized versions of its services or acquiring companies with established presence in emerging markets. For example, Facebook could target developing countries with higher internet penetration, potentially gaining a significant user base.

- Acquisitions and Partnerships: The capital can be used to acquire smaller social media platforms or enter strategic partnerships with other companies. This could involve acquiring companies that offer unique functionalities or partnerships that allow Facebook to leverage complementary technologies. For instance, Facebook might acquire a social audio platform, similar to Clubhouse, to expand its offerings and compete directly with rivals like Twitter.

Comparisons and Contrasts: Facebooks Secondary Stock Offering To Raise Nearly 4 Billion

Facebook’s secondary stock offering, raising nearly $4 billion, stands as a significant event in the tech sector. It’s important to analyze its similarities and differences with other recent major secondary offerings, particularly in the tech industry. This comparison allows us to understand the broader trends and implications for future secondary offerings in the tech sector.

Comparison with Other Secondary Offerings

Facebook’s offering shares similarities and differences with other notable secondary offerings in the tech sector. Examining these aspects provides valuable insights into the evolving landscape of secondary offerings and their impact on the tech industry.

- Size and Purpose: Facebook’s offering is comparable in size to other recent secondary offerings by major tech companies, such as the $2.5 billion offering by Alphabet (Google’s parent company) in 2021. However, the purpose of these offerings can differ. Facebook’s offering primarily aimed to unlock value for early investors and employees, while Alphabet’s offering was focused on funding strategic acquisitions and investments.

- Market Conditions: The market conditions surrounding these offerings also play a crucial role. Facebook’s offering occurred in a relatively stable market environment, allowing for a successful execution. In contrast, some recent secondary offerings, such as the $1 billion offering by Uber in 2020, were launched during a period of market volatility, which impacted their success.

- Investor Response: Investor response to these offerings varies depending on factors such as the company’s performance, market conditions, and the offering’s structure. Facebook’s offering received strong investor interest, reflecting the company’s strong fundamentals and positive market sentiment. However, other offerings, such as the $1.5 billion offering by Robinhood in 2021, faced challenges due to concerns about the company’s business model and market volatility.

Strategic Considerations

The strategies employed by companies in secondary offerings can significantly impact their success.

- Pricing Strategy: Facebook’s offering utilized a traditional auction process to determine the offering price, ensuring a competitive and transparent process. Other companies, such as Airbnb, have opted for a fixed-price offering, which can offer greater certainty but may limit potential upside.

- Lock-Up Provisions: Lock-up provisions restrict the sale of shares by early investors and employees for a specified period. Facebook’s offering included lock-up provisions, ensuring stability and preventing a flood of shares into the market. Other companies, such as Peloton, have experimented with shorter lock-up periods, aiming to provide greater liquidity for early investors.

- Communication Strategy: Effective communication is essential for successful secondary offerings. Facebook’s offering involved a well-coordinated communication strategy, including investor presentations and press releases, to generate interest and ensure a smooth execution. Other companies, such as Spotify, have employed a more targeted communication approach, focusing on specific investor segments.

Implications for Future Offerings

The comparison between Facebook’s offering and other recent secondary offerings in the tech sector offers valuable insights into the future of secondary offerings in the tech industry.

- Growing Importance of Secondary Offerings: Secondary offerings are becoming increasingly important for tech companies as they mature and seek to unlock value for early investors and employees.

- Focus on Transparency and Investor Confidence: The success of secondary offerings hinges on transparency and investor confidence. Companies need to carefully consider pricing, lock-up provisions, and communication strategies to ensure a successful execution.

- Market Conditions and Timing: Market conditions play a significant role in the success of secondary offerings. Companies need to carefully evaluate the timing of their offerings to maximize their potential.

Facebooks secondary stock offering to raise nearly 4 billion – Facebook’s secondary stock offering to raise nearly $4 billion is a game-changer in the tech industry. It represents a significant shift in the company’s financial strategy and has implications that extend far beyond the immediate impact on its stock price. The move signifies a bold ambition, a commitment to future growth, and a willingness to adapt to the ever-changing dynamics of the digital landscape. This bold move has sparked a wave of speculation and analysis, leaving investors and industry experts alike pondering the potential impact on Facebook’s future trajectory and its place within the competitive landscape of social media.

Facebook’s secondary stock offering, aimed at raising nearly $4 billion, is a big deal. While they’re busy making money, the FCC is busy making sure our devices can stay charged without plugging them in, with their recent approval of power at a distance charging. Who knows, maybe Mark Zuckerberg will be using this tech to power his Metaverse, making the whole thing even more immersive.

But for now, let’s focus on Facebook’s massive stock offering, and how it could shape the future of the social media giant.

Standi Techno News

Standi Techno News