Fearless Fund Trial AAER is more than just a financial metric; it represents a bold mission to level the playing field for underrepresented entrepreneurs. Founded on the principle of investing in the power of diversity, Fearless Fund aims to unlock the potential of Black and Latinx founders, fueling innovation and economic empowerment. This trial AAER, an indicator of investment performance, serves as a benchmark for the fund’s success in achieving its ambitious goals.

The fund’s investment strategies are carefully crafted to identify promising businesses across various industries, with a focus on building a diverse portfolio that reflects the richness and potential of the target demographic. Fearless Fund’s commitment to impact investing goes beyond financial returns; it seeks to create lasting change by fostering entrepreneurship and economic mobility within historically marginalized communities.

Fearless Fund

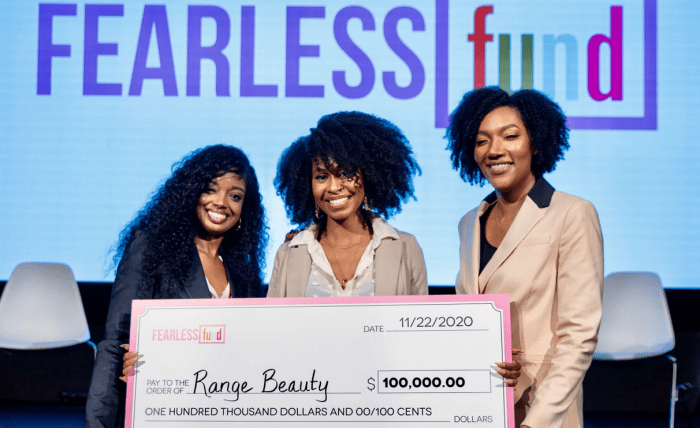

Fearless Fund is a venture capital firm that aims to empower and invest in underrepresented founders in the United States. Founded by Arian Simone and Ayana Ledford, the firm is a powerful advocate for diversity and inclusion in the tech and startup world.

Mission and Goals

Fearless Fund’s primary mission is to bridge the funding gap for Black and Latinx entrepreneurs. The organization aims to create a more equitable and inclusive ecosystem for startups by providing capital, mentorship, and resources to underrepresented founders.

Target Demographic and Investment Focus

Fearless Fund primarily invests in early-stage startups founded by Black and Latinx entrepreneurs. The firm’s investment focus spans various industries, including technology, consumer goods, healthcare, and education. The organization prioritizes companies with a strong social impact and the potential to create positive change in their communities.

Trial AAER

The term “Trial AAER” likely refers to a projected or estimated annualized average equity return for a specific investment period. This concept is crucial in understanding the potential performance of an investment before it is fully realized.

Definition and Purpose of AAER

AAER, or Annualized Average Equity Return, is a metric used to measure the average rate of return on an investment over a specific period. It’s a way to express the performance of an investment in a standardized way, making it easier to compare different investment options. AAER is calculated by considering the total return generated by the investment, including capital appreciation and any dividends or interest received, and then adjusting it for the time period over which the investment was held.

AAER = [(Ending Value / Beginning Value)^(1 / Number of Years)] – 1

The AAER is essential in evaluating investment performance because it provides a clear picture of the average return an investor can expect to earn over time. This metric helps investors make informed decisions about where to allocate their capital.

Implications of a Trial AAER for Fearless Fund

A trial AAER for Fearless Fund can be used to assess the potential returns on investments made through the fund. It allows investors to gauge the expected performance of the fund and compare it to other investment opportunities. This information can help investors determine whether Fearless Fund aligns with their investment goals and risk tolerance.

For example, a trial AAER of 15% might suggest that Fearless Fund could deliver a significant return on investment over the long term. However, it’s important to remember that trial AAERs are estimates and do not guarantee actual returns.

Investment Strategies and Portfolio Composition

Fearless Fund, a venture capital firm dedicated to supporting women of color founders, employs a strategic investment approach focused on identifying high-potential businesses led by diverse talent. The fund’s investment strategy and portfolio composition reflect its commitment to fostering inclusive entrepreneurship and driving positive societal impact.

Investment Strategies

Fearless Fund’s investment strategies are designed to support early-stage businesses led by women of color. These strategies aim to bridge the funding gap and provide access to capital for diverse entrepreneurs.

- Seed and Series A Investments: Fearless Fund primarily invests in seed and Series A rounds, providing crucial capital for startups in their early growth stages. This focus allows the fund to be actively involved in shaping the direction of promising businesses from the outset.

- Sector Diversification: The fund invests across a range of sectors, including technology, consumer goods, healthcare, and education. This diversified approach reduces risk and allows Fearless Fund to capitalize on emerging trends in various industries.

- Value-Added Support: Beyond financial capital, Fearless Fund provides founders with mentorship, networking opportunities, and access to its network of experienced investors and advisors. This comprehensive support system helps businesses navigate the challenges of early-stage growth and achieve long-term success.

Portfolio Composition

Fearless Fund’s portfolio is comprised of a diverse range of companies led by women of color across various industries. This diversity reflects the fund’s commitment to fostering inclusivity and supporting a broad range of entrepreneurs.

- Technology: The fund invests in technology companies developing innovative solutions across various sectors, including fintech, e-commerce, and artificial intelligence. These companies are at the forefront of technological advancement and are poised to disrupt traditional industries.

- Consumer Goods: Fearless Fund supports consumer goods companies offering unique products and services that cater to the needs and preferences of diverse consumer demographics. These businesses are often focused on sustainability, social impact, and inclusivity.

- Healthcare: The fund invests in healthcare companies developing innovative solutions to address health disparities and improve access to quality healthcare for underserved communities. These companies are committed to improving the health and well-being of diverse populations.

- Education: Fearless Fund supports education companies developing innovative solutions to improve educational outcomes and create more equitable access to learning opportunities for all students. These companies are transforming the educational landscape and empowering future generations.

Risk Profile

Investing in early-stage businesses inherently carries a higher risk profile than investing in established companies. However, Fearless Fund mitigates risk by employing a rigorous due diligence process and focusing on companies with strong fundamentals, experienced leadership teams, and a clear path to profitability. The fund’s investment strategy also includes a focus on sector diversification, which further reduces risk by spreading investments across a range of industries.

“Fearless Fund is not just about writing checks. It’s about building a community of support for women of color founders. We believe that by investing in diverse talent, we can create a more equitable and prosperous future for all.” – Arian Simone, Co-Founder of Fearless Fund

Impact of Fearless Fund Investments

Fearless Fund’s investments are not just about financial returns; they are about creating a ripple effect of positive change in the lives of underrepresented entrepreneurs and their communities. By providing funding and mentorship, Fearless Fund empowers these entrepreneurs to build successful businesses, generate economic growth, and contribute to the overall well-being of their communities.

Economic Impact of Fearless Fund Investments

Fearless Fund’s investments directly contribute to the economic empowerment of Black and Latinx entrepreneurs. By providing access to capital, these entrepreneurs can launch and grow their businesses, creating jobs, generating revenue, and contributing to local economies.

Social Impact of Fearless Fund Investments

Fearless Fund’s investments go beyond economic impact. They create a more inclusive and equitable entrepreneurial ecosystem, fostering a sense of community and opportunity for underrepresented groups.

Examples of Successful Companies Funded by Fearless Fund

Fearless Fund has a portfolio of diverse and impactful companies, including:

- The Honey Pot Company: Founded by Beatrice Dixon, The Honey Pot Company offers natural feminine hygiene products designed to address the unique needs of women of color. The company has experienced significant growth since receiving funding from Fearless Fund, expanding its product line and reaching a wider market.

- Partake Foods: Founded by Denise Woodard, Partake Foods produces allergy-friendly snacks that are delicious and inclusive. The company has become a popular choice for families with dietary restrictions, and Fearless Fund’s investment has helped Partake Foods scale its operations and reach a wider audience.

- Golde: Founded by Trinity Mouzon Wofford and Issey Kobori, Golde offers a range of superfood-based beauty and wellness products. The company has gained popularity for its commitment to natural ingredients and inclusivity, and Fearless Fund’s investment has supported Golde’s growth and expansion.

Role of Fearless Fund in Fostering Entrepreneurship and Innovation

Fearless Fund plays a crucial role in fostering entrepreneurship and innovation by:

- Providing access to capital: Fearless Fund addresses the historical lack of access to capital for Black and Latinx entrepreneurs, providing funding that allows them to launch and grow their businesses.

- Offering mentorship and support: Fearless Fund provides mentorship and guidance to its portfolio companies, helping them navigate the challenges of starting and growing a business.

- Creating a community of entrepreneurs: Fearless Fund connects entrepreneurs with each other, fostering collaboration and shared learning opportunities.

Challenges and Opportunities for Fearless Fund: Fearless Fund Trial Aaer

Fearless Fund, a venture capital firm focused on investing in businesses founded by women of color, faces both challenges and opportunities in its mission to empower underrepresented entrepreneurs. The firm’s commitment to diversity and inclusion comes with unique hurdles, but also presents avenues for growth and expansion within the broader venture capital landscape.

Challenges Faced by Fearless Fund

Fearless Fund’s commitment to investing in businesses founded by women of color presents unique challenges. The firm must navigate the complexities of a venture capital industry historically dominated by white men.

- Limited Access to Capital: Women of color founders often face significant barriers to accessing capital due to systemic biases and lack of networks within the traditional venture capital ecosystem. Fearless Fund must actively work to overcome these obstacles by building relationships with diverse investors and creating pathways for women of color founders to secure funding.

- Lack of Representation in Venture Capital: The venture capital industry has a significant lack of diversity, with women and people of color underrepresented in leadership positions. This lack of representation can create challenges for Fearless Fund in attracting and retaining talented investment professionals who share its values and understand the unique needs of women of color founders.

- Measuring Impact: Quantifying the impact of Fearless Fund’s investments on the broader economy and the lives of women of color founders is crucial. The firm must develop robust metrics and frameworks to track the social and economic outcomes of its portfolio companies, showcasing the value of investing in diverse entrepreneurs.

Opportunities for Growth and Expansion

Despite the challenges, Fearless Fund has the potential to grow and expand its impact in the venture capital industry.

- Growing Demand for Diversity and Inclusion: There is a growing awareness of the importance of diversity and inclusion in venture capital. Increasingly, institutional investors and limited partners are seeking to invest in funds like Fearless Fund that are committed to backing diverse founders. This shift presents a significant opportunity for the firm to attract new capital and expand its investment capacity.

- Expansion of the Venture Capital Ecosystem: The venture capital industry is becoming more accessible to diverse founders, with the emergence of new funds, accelerators, and networks focused on supporting underrepresented entrepreneurs. Fearless Fund can leverage these resources to connect with promising founders and build a more inclusive venture capital ecosystem.

- Focus on Impact Investing: Impact investing, which prioritizes both financial returns and positive social and environmental impact, is gaining momentum. Fearless Fund is well-positioned to capitalize on this trend by demonstrating the strong financial and social returns generated by investing in businesses founded by women of color.

Competitive Landscape for Fearless Fund, Fearless fund trial aaer

Fearless Fund operates in a competitive venture capital landscape, with numerous other funds and organizations seeking to invest in promising startups. However, Fearless Fund differentiates itself through its unique focus on women of color founders.

- Specialized Focus: Fearless Fund’s commitment to investing in women of color founders provides a distinct competitive advantage. The firm has established itself as a leading player in this niche market, attracting a pipeline of high-quality founders seeking investment and support from a firm that understands their unique challenges and opportunities.

- Strong Network and Relationships: Fearless Fund has built a strong network of investors, mentors, and advisors who are passionate about supporting women of color entrepreneurs. This network provides the firm with access to deal flow, expertise, and resources that are invaluable in identifying and nurturing promising startups.

- Brand Recognition and Reputation: Fearless Fund has gained significant brand recognition and a positive reputation for its commitment to diversity and inclusion. This reputation attracts talented founders and investors who align with the firm’s values and mission.

The Fearless Fund Trial AAER is a powerful testament to the transformative potential of inclusive investing. By measuring success not just in financial terms but also in its social and economic impact, Fearless Fund is paving the way for a more equitable and prosperous future for all. As the fund continues to grow and evolve, its commitment to empowering underrepresented entrepreneurs will undoubtedly continue to shape the landscape of venture capital and leave a lasting legacy of innovation and opportunity.

The Fearless Fund trial AAER is a testament to the growing importance of cybersecurity in today’s digital landscape. This is especially true for companies like Silence Laboratories, a cryptographic security startup that recently secured funding , which are developing innovative solutions to protect sensitive data. The Fearless Fund trial AAER is a valuable resource for companies like Silence Laboratories, providing insights into the latest threats and best practices for mitigating risk.

Standi Techno News

Standi Techno News