Fidelity marks down x to almost a third of the investment price – Fidelity Marks Down X to Almost a Third of Investment Price – a move that’s sent shockwaves through the investment world. This drastic price reduction has left many scratching their heads, wondering what prompted such a significant markdown and what it means for investors. Is this a sign of a larger market trend, a strategic move by Fidelity, or something else entirely?

The implications of this price reduction are far-reaching, impacting not just the investors holding this asset but also the broader market sentiment. This article delves into the factors behind this decision, analyzes the potential market implications, and explores what this means for investors moving forward.

Fidelity’s Discount Impact

Fidelity’s decision to mark down an investment by almost a third is a significant event, potentially signaling a shift in market sentiment or a reassessment of the investment’s value. This move has implications for both existing and potential investors, as well as the broader market.

Potential Implications for Investors

The price reduction could present both opportunities and challenges for investors.

- Lower Entry Point: For new investors, the markdown provides an opportunity to acquire the investment at a lower price, potentially leading to higher returns if the investment recovers or appreciates in value.

- Potential for Loss: Existing investors who bought the investment at a higher price may face losses on their investment, particularly if the markdown reflects a fundamental change in the investment’s outlook.

- Market Sentiment: The markdown could also signal a broader shift in market sentiment, prompting other investors to reassess their holdings and potentially leading to further price adjustments.

Factors Contributing to the Markdown

Several factors could have contributed to Fidelity’s decision to mark down the investment, including:

- Performance: The investment’s performance may have fallen short of expectations, leading Fidelity to re-evaluate its value. For example, if the investment is tied to a specific company or industry, poor financial results or negative industry trends could justify the markdown.

- Market Conditions: Broader market conditions, such as a decline in investor confidence or a shift in market preferences, could also influence Fidelity’s decision. For instance, a general downturn in the stock market or a change in investor appetite for certain asset classes might necessitate a markdown.

- Valuation: Fidelity may have conducted a thorough valuation of the investment and concluded that its current price is inflated, leading to the markdown. This could involve analyzing the investment’s fundamentals, comparing it to similar investments, and considering future growth prospects.

Market Analysis

Fidelity’s decision to mark down the investment price by almost a third reflects a complex interplay of market dynamics and company-specific factors. The discount signifies a potential shift in the market landscape, prompting investors to assess the investment’s current value and future prospects.

Market Trends Influencing Fidelity’s Decision

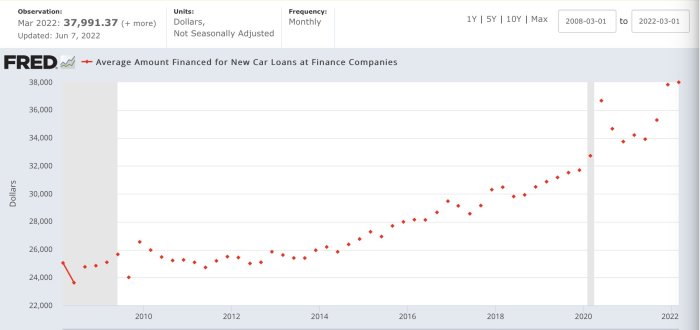

The current market landscape is characterized by volatility and uncertainty, influenced by several factors. The recent surge in interest rates, coupled with ongoing inflation, has created a challenging environment for investments. This has led to a decline in investor sentiment and a potential shift in investment strategies.

The market’s current state is a reflection of the interplay of economic indicators, investor sentiment, and geopolitical events.

Fidelity’s decision to mark down the investment price may be a response to these market trends. By reducing the price, Fidelity aims to attract investors who are seeking value in the current market. This strategy could be particularly appealing to investors who are seeking to diversify their portfolios or capitalize on potential growth opportunities.

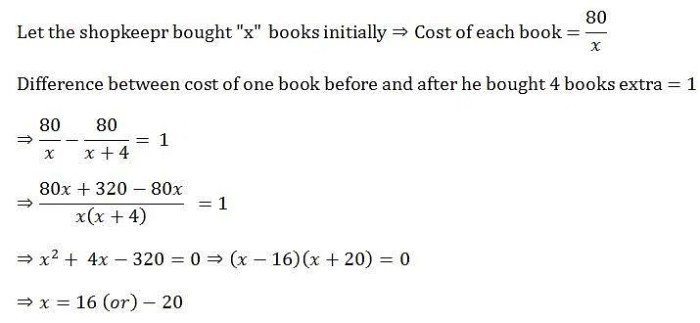

Historical Data and Market Averages, Fidelity marks down x to almost a third of the investment price

To gain a better understanding of the significance of the discount, it is essential to compare the discounted price to historical data and market averages. This analysis can provide insights into the investment’s historical performance and its current valuation relative to similar investments.

Historical data can serve as a valuable benchmark for assessing the current market conditions and the investment’s potential.

For instance, comparing the discounted price to the investment’s average price over the past year can reveal the extent of the markdown and its potential impact on investors. Similarly, comparing the discounted price to the average price of similar investments in the market can provide insights into the investment’s relative valuation.

Investor Perspective

Investors are likely to be drawn to Fidelity’s markdown, as it presents an opportunity to acquire assets at a significantly reduced price. However, it’s crucial to analyze the underlying reasons for the price reduction before making any investment decisions.

Potential Risks and Opportunities

Investors should carefully assess the potential risks and opportunities associated with investing in a discounted asset.

- Potential for further price decline: If the underlying reasons for the markdown are not addressed, the asset’s price could continue to decline, leading to further losses for investors.

- Market sentiment: The market’s perception of the asset can significantly influence its price. If the market remains pessimistic about the asset’s future prospects, even with the discount, the price may not rebound.

- Opportunity for value appreciation: If the reasons for the markdown are temporary or if the asset’s fundamentals improve, the price could rebound, potentially offering significant gains for investors.

- Diversification: Investing in a discounted asset can help diversify an investment portfolio, reducing overall risk.

Psychological Impact on Investor Confidence

The price markdown can have a psychological impact on investor confidence, leading to a range of reactions.

- Increased confidence: Some investors may be encouraged by the markdown, viewing it as an opportunity to buy at a lower price and potentially benefit from future price appreciation.

- Increased skepticism: Others may be skeptical of the markdown, questioning the reasons behind it and fearing that the asset’s value may be permanently impaired.

- Fear of missing out: The markdown can create a sense of urgency and a fear of missing out (FOMO), prompting some investors to act quickly without conducting thorough due diligence.

Potential Future Scenarios: Fidelity Marks Down X To Almost A Third Of The Investment Price

The significant price reduction in Fidelity’s investment marks a pivotal moment, prompting investors to assess potential future scenarios and the factors that could influence the investment’s performance. While the discounted price offers an attractive entry point, understanding the risks and rewards associated with this investment is crucial.

Factors Influencing Future Performance

Several factors can influence the future performance of the investment, including:

- Market Conditions: The broader market environment can significantly impact the investment’s performance. A robust economy and positive market sentiment can boost valuations, while economic downturns or market volatility can lead to price fluctuations. For instance, during the 2008 financial crisis, many investments experienced significant declines, even those with solid fundamentals.

- Company Performance: The investment’s future performance is intrinsically linked to the underlying company’s financial health and growth prospects. Factors like revenue growth, profitability, and innovation play a critical role. For example, a company that consistently outperforms its industry peers and delivers strong earnings is likely to see its stock price appreciate.

- Industry Trends: Industry-specific trends can influence the investment’s performance. Technological advancements, regulatory changes, and competitive landscape shifts can all have a bearing on the investment’s value. For instance, the rise of e-commerce has significantly impacted the retail sector, leading to both opportunities and challenges for traditional brick-and-mortar businesses.

- Investor Sentiment: Investor sentiment can influence market prices, even in the absence of fundamental changes. Positive investor sentiment can drive prices higher, while negative sentiment can lead to declines. This can be seen in the “meme stock” phenomenon, where social media hype fueled significant price fluctuations in certain stocks, regardless of their underlying fundamentals.

Potential Risks and Rewards

Investing in a discounted asset presents both potential risks and rewards:

- Potential Rewards: The discounted price offers an opportunity to acquire the investment at a lower cost, potentially leading to higher returns if the investment performs well in the future. For instance, if a company’s stock price doubles after a significant price reduction, investors who bought at the discounted price would realize substantial gains.

- Potential Risks: There is a risk that the investment may not recover to its previous levels or may even decline further. The price reduction may indicate underlying issues with the company or its industry, such as declining profitability or increased competition. For example, a company facing declining sales and profits may see its stock price continue to fall despite a recent price reduction.

The Fidelity markdown raises important questions about market dynamics, investor psychology, and the future of this particular investment. While the discounted price might appear tempting, investors must carefully consider the risks and opportunities involved before making any decisions. Ultimately, this move serves as a reminder of the volatile nature of the market and the importance of conducting thorough research before investing.

Fidelity marking down their investment in X by almost a third is a pretty big deal, especially when you consider the recent buzz around SpaceX’s mega rocket, Starship. This beast of a rocket, capable of reaching the moon and Mars, has just completed a test flight that took it farther than ever before. So, while Fidelity’s move might seem like a downer, it could also be a sign of shifting priorities in the investment world, as companies like SpaceX continue to push the boundaries of space exploration.

Standi Techno News

Standi Techno News