Fintech 5 7 24, a phrase that evokes a world of instant, always-on financial services, has revolutionized how we manage our money. This shift, from traditional banking to digital platforms, has been driven by a perfect storm of technological advancements, changing customer expectations, and a regulatory landscape that embraces innovation. Think of it as a digital revolution that puts financial power in your pocket, offering convenience, accessibility, and a level of personalization never seen before.

From mobile banking apps that let you check your balance on the go to online payment systems that let you shop globally with a click, fintech 5 7 24 has made financial services more accessible than ever. Imagine a world where you can open a bank account, apply for a loan, and even invest in stocks, all from the comfort of your smartphone. That’s the power of fintech 5 7 24.

Fintech 5-7-24

The world of finance has undergone a dramatic transformation, shifting from traditional brick-and-mortar institutions to a dynamic, digital landscape. This evolution, driven by technological advancements, changing customer expectations, and regulatory changes, has ushered in an era of 5-7-24 – anytime, anywhere access to financial services.

The Rise of Fintech

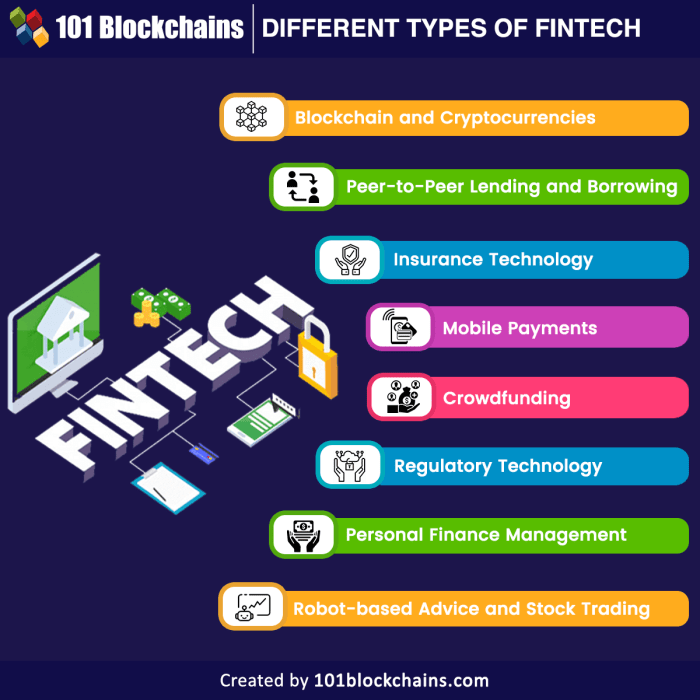

The emergence of fintech, a blend of finance and technology, has fundamentally reshaped the financial services industry. Traditional banks, once the sole providers of financial services, are now facing competition from innovative fintech startups. These startups leverage technology to offer a wider range of services, improved customer experiences, and greater accessibility.

The Impact of 5-7-24

The concept of 5-7-24 – access to financial services around the clock – has transformed the financial landscape. This shift has been fueled by the rise of smartphones, mobile banking apps, and online platforms.

Key Drivers of Evolution

The evolution of financial services from traditional banking to the rise of fintech is driven by several key factors:

- Technological Advancements: The rapid pace of technological advancements, particularly in areas like cloud computing, artificial intelligence, and blockchain, has empowered fintech companies to develop innovative solutions. These technologies enable faster transactions, enhanced security, and personalized customer experiences.

- Changing Customer Expectations: Consumers today demand convenience, transparency, and personalized experiences. Fintech companies have responded to these demands by offering intuitive mobile apps, user-friendly platforms, and tailored financial products.

- Regulatory Changes: Regulatory changes, such as the introduction of open banking initiatives, have fostered a more competitive environment and enabled fintech companies to access customer data and build new financial services. These changes have also paved the way for collaboration between traditional banks and fintech startups.

The Impact of Fintech 5-7-24 on Consumers and Businesses

Fintech 5-7-24, a revolutionary concept that embraces the constant evolution of financial technology, has significantly reshaped the landscape for both consumers and businesses. This paradigm shift has brought about a plethora of benefits, including increased convenience, accessibility, and personalized financial services for consumers, while streamlining operations, reducing costs, and opening new revenue streams for businesses.

Impact on Consumers

Fintech 5-7-24 has empowered consumers with greater control over their finances, offering a range of innovative solutions that cater to their individual needs.

The most notable impact is the enhanced convenience and accessibility of financial services. Consumers can now access their accounts, make payments, and manage their finances anytime, anywhere, through mobile apps and online platforms. This accessibility has broken down geographical barriers and provided financial services to previously underserved populations.

Fintech 5-7-24 has also revolutionized the way consumers access financial products and services. With the rise of online lending platforms, peer-to-peer (P2P) lending, and digital investment platforms, consumers have a wider range of options to choose from, with lower fees and faster processing times. This increased competition has also led to more personalized financial solutions tailored to individual needs and risk profiles.

Impact on Businesses, Fintech 5 7 24

Fintech 5-7-24 has been a game-changer for businesses, enabling them to operate more efficiently, reduce costs, and generate new revenue streams.

One of the most significant impacts is the streamlining of business operations. Fintech solutions have automated many manual processes, such as accounting, payroll, and payment processing, leading to increased efficiency and reduced errors. This has freed up valuable time for businesses to focus on core competencies and strategic initiatives.

Fintech has also helped businesses reduce costs. By leveraging digital platforms and automation, businesses can minimize administrative overhead, lower transaction fees, and improve cash flow management. This has been particularly beneficial for small and medium-sized enterprises (SMEs), which often face limited resources and tight budgets.

Fintech has also opened up new revenue streams for businesses. By offering innovative financial products and services, businesses can tap into new markets and expand their customer base. For example, businesses can now offer embedded finance solutions, integrating financial services directly into their existing products and services. This creates a seamless and convenient experience for customers, leading to increased customer loyalty and revenue generation.

Empowering Individuals and Businesses

Fintech 5-7-24 has empowered both individuals and businesses with greater control over their finances. Consumers have access to a wider range of financial products and services, allowing them to make informed decisions about their money. Businesses can leverage technology to optimize their operations, manage risks effectively, and make data-driven decisions.

This increased control fosters financial inclusion and empowers individuals and businesses to achieve their financial goals.

Key Fintech 5-7-24 Innovations: Fintech 5 7 24

The rise of 5-7-24 financial services is a testament to the rapid evolution of fintech, driven by groundbreaking innovations that have transformed the way we interact with money. These innovations have not only made financial services more accessible and convenient for consumers but also empowered businesses to operate more efficiently and effectively.

Key Fintech Innovations Enabling 5-7-24 Financial Services

The following table highlights some of the key fintech innovations that have made 5-7-24 financial services a reality:

| Innovation | Description | Benefits for Consumers | Benefits for Businesses |

|---|---|---|---|

| Mobile Banking | Mobile banking apps allow users to access their bank accounts, transfer funds, pay bills, and manage their finances from their smartphones or tablets. | Convenience, accessibility, real-time transaction tracking, improved security through multi-factor authentication. | Reduced operating costs, improved customer engagement, increased efficiency through automated processes. |

| Online Payments | Online payment platforms enable secure and convenient transactions between individuals and businesses. Examples include PayPal, Stripe, and Apple Pay. | Faster and more secure payments, reduced reliance on cash and physical cards, increased transaction transparency. | Simplified payment processing, reduced transaction fees, expanded customer reach, access to valuable customer data. |

| Digital Wallets | Digital wallets store payment information and allow users to make contactless payments using their smartphones or wearable devices. | Convenience, security, reduced reliance on physical wallets, faster checkout processes. | Increased transaction speed, reduced fraud risk, improved customer experience, access to valuable customer data. |

| Open Banking | Open banking allows third-party apps and services to access customer financial data with their consent. | Enhanced financial management tools, personalized financial advice, improved access to credit. | Increased competition and innovation in financial services, development of new products and services, access to valuable customer data. |

Role of AI, ML, and Big Data Analytics in 5-7-24 Financial Services

Artificial intelligence (AI), machine learning (ML), and big data analytics play a crucial role in shaping 5-7-24 financial services. They enable:

Personalized financial services: AI and ML algorithms analyze customer data to provide personalized financial advice, recommendations, and tailored products.

Fraud detection and prevention: AI and ML algorithms can identify and prevent fraudulent transactions in real-time, enhancing security and protecting both consumers and businesses.

Improved risk assessment: AI and ML algorithms can analyze vast amounts of data to assess creditworthiness and loan risk, leading to faster and more accurate lending decisions.

Automated customer service: AI-powered chatbots and virtual assistants provide 24/7 customer support, answering queries and resolving issues efficiently.

Predictive analytics: Big data analytics can help predict future financial trends, enabling businesses to make informed decisions and optimize their strategies.

The Future of Fintech 5-7-24

Fintech 5-7-24 is poised to revolutionize the financial landscape, and its future is brimming with exciting possibilities. From the rise of embedded finance to the integration of the metaverse, the industry is on the cusp of a transformative era.

The Rise of Embedded Finance

Embedded finance refers to the integration of financial services into non-financial platforms and applications. Imagine ordering groceries online and seamlessly applying for a loan at checkout or booking a flight and securing travel insurance with a few clicks. This seamless integration is transforming how consumers access financial services, making them more convenient and accessible.

The Adoption of Blockchain Technology

Blockchain technology is set to disrupt the financial industry, particularly in areas like payments, lending, and securities trading. Its decentralized nature and inherent security features promise faster, cheaper, and more transparent transactions. For example, blockchain-based platforms are enabling cross-border payments without the need for intermediaries, reducing transaction costs and processing times.

The Integration of the Metaverse

The metaverse, a virtual world where users can interact and conduct business, presents a new frontier for fintech. Imagine virtual banks offering financial services within the metaverse or investing in virtual assets. While still in its early stages, the metaverse holds immense potential for reshaping financial interactions and creating new opportunities for fintech innovation.

The Impact of Emerging Technologies

The Internet of Things (IoT) and 5G are transforming the way we live and work, and their impact on financial services is profound.

The Internet of Things (IoT)

The IoT is connecting everyday devices to the internet, creating a vast network of data. This data can be used to develop innovative financial services. For example, insurance companies can use IoT sensors to monitor driving behavior and offer personalized insurance rates.

5G

5G technology enables ultra-fast internet speeds and low latency, paving the way for real-time financial transactions. This is particularly important for applications like mobile payments and stock trading, where speed and reliability are crucial.

Challenges and Opportunities

The future of fintech 5-7-24 is not without its challenges. Regulatory uncertainty, cybersecurity threats, and the need for financial literacy are some of the hurdles that need to be addressed. However, the opportunities for growth and innovation are vast.

Challenges

- Regulatory Uncertainty: The rapid pace of innovation in fintech creates challenges for regulators to keep up with new technologies and develop appropriate frameworks.

- Cybersecurity Threats: As financial services become increasingly digital, cybersecurity becomes paramount. Fintech companies need to invest heavily in robust security measures to protect sensitive data.

- Financial Literacy: The adoption of new financial technologies requires consumers to be financially literate. Educating consumers about fintech and its implications is crucial for its widespread adoption.

Opportunities

- Increased Financial Inclusion: Fintech 5-7-24 has the potential to bring financial services to underserved populations, including those in rural areas and low-income communities.

- Personalized Financial Services: The ability to collect and analyze vast amounts of data allows fintech companies to offer personalized financial products and services tailored to individual needs.

- New Business Models: Fintech 5-7-24 is creating new business models and disrupting traditional financial institutions. This is leading to increased competition and innovation in the financial services industry.

The future of fintech 5 7 24 is bright, with exciting innovations like embedded finance, blockchain technology, and the metaverse poised to transform the financial landscape. As technology continues to evolve, we can expect even more seamless, personalized, and secure financial experiences. This means that the days of visiting a bank branch for every financial transaction are fading fast, replaced by a digital world where our financial lives are at our fingertips, available 24/7. Fintech 5 7 24 is not just a trend; it’s the future of finance.

Fintech 5 7 24 is all about pushing the boundaries of financial technology, and that includes embracing the latest tools. It’s no surprise then that the news of GitHub’s Copilot Enterprise hitting general availability has the fintech world buzzing. This AI-powered coding assistant promises to revolutionize software development, and with its enterprise-grade features, it could be a game-changer for fintech companies looking to build innovative solutions faster and more efficiently.

Fintech 5 7 24 is all about embracing the future, and Copilot Enterprise is definitely a part of that future.

Standi Techno News

Standi Techno News