Flutterwave Cleared in Kenya: A FinTech Revolution has swept through the nation, transforming the way Kenyans interact with financial services. This dynamic platform has emerged as a pivotal player in the Kenyan FinTech landscape, offering a suite of solutions that cater to a diverse range of users. From facilitating seamless online payments to enabling cross-border transactions, Flutterwave has redefined financial accessibility and inclusion in Kenya.

Flutterwave’s presence in Kenya has been marked by a strategic approach that aligns with the country’s evolving financial needs. The company has established itself as a trusted partner for businesses and individuals alike, providing a secure and user-friendly platform for managing finances. The platform’s versatility has attracted a wide array of users, including individuals, businesses, and even government agencies.

Flutterwave’s Presence in Kenya: Flutterwave Cleared In Kenya

Flutterwave, a leading pan-African payments platform, has established a strong presence in Kenya, playing a significant role in the country’s growing digital economy. Its journey in Kenya is marked by strategic partnerships, innovative solutions, and a commitment to empowering businesses and individuals.

History of Flutterwave’s Operations in Kenya

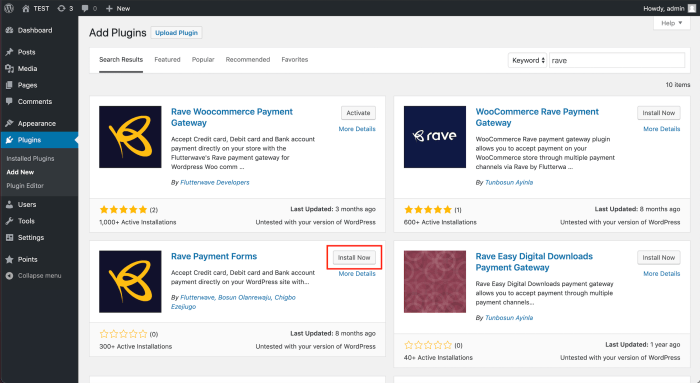

Flutterwave’s entry into the Kenyan market dates back to 2016, with the launch of its payment gateway services. The company’s initial focus was on enabling businesses to accept online payments from customers both locally and internationally. Recognizing the growing demand for mobile money solutions, Flutterwave partnered with leading mobile money providers in Kenya, such as M-Pesa, to offer seamless integration for businesses.

Services Offered by Flutterwave in Kenya

Flutterwave offers a comprehensive suite of payment solutions tailored to the Kenyan market. These services include:

* Payment Gateway: Flutterwave’s payment gateway enables businesses to accept payments from various sources, including credit/debit cards, mobile money, bank transfers, and more.

* Mobile Money Integration: Flutterwave provides seamless integration with popular mobile money platforms in Kenya, allowing businesses to receive and send payments through M-Pesa, Airtel Money, and others.

* Mass Payouts: Flutterwave’s mass payout solution facilitates efficient and secure distribution of funds to multiple recipients, streamlining payroll, vendor payments, and other disbursement processes.

* Virtual Accounts: Flutterwave offers virtual accounts that allow businesses to receive payments from customers without disclosing their bank account details, enhancing security and streamlining transactions.

* API Integration: Flutterwave’s APIs allow businesses to integrate its payment solutions into their existing systems and applications, simplifying the payment process.

* Currency Conversion: Flutterwave provides currency conversion services, allowing businesses to receive payments in multiple currencies and automatically convert them to their preferred currency.

* Fraud Prevention: Flutterwave employs robust fraud detection and prevention mechanisms to safeguard businesses and customers from fraudulent activities.

Target Audience in Kenya

Flutterwave’s target audience in Kenya encompasses a wide range of sectors and demographics, including:

* E-commerce Businesses: Flutterwave empowers online retailers to accept payments from customers across Kenya and internationally, facilitating growth and expansion.

* Fintech Startups: Flutterwave provides innovative payment solutions for fintech startups, enabling them to develop and launch disruptive financial products and services.

* SMEs: Flutterwave’s solutions help small and medium-sized enterprises (SMEs) in Kenya to streamline their payment processes, manage cash flow, and grow their businesses.

* NGOs and Charities: Flutterwave’s platform enables NGOs and charities to receive donations and manage funds securely and efficiently.

* Individuals: Flutterwave’s mobile money integration and virtual accounts empower individuals to send and receive money conveniently and securely.

Regulatory Landscape and Compliance

Navigating the Kenyan regulatory landscape is crucial for any FinTech company, especially one like Flutterwave that operates in the sensitive realm of financial transactions. This section delves into the regulatory frameworks governing FinTechs in Kenya, examining Flutterwave’s compliance with these regulations and the impact of regulatory changes on its operations.

Kenya’s Regulatory Framework for FinTech

Kenya has emerged as a hub for FinTech innovation, attracting numerous startups and established players like Flutterwave. The country boasts a progressive regulatory environment that aims to foster growth while ensuring financial stability and consumer protection. The key regulatory bodies shaping the FinTech landscape in Kenya include:

- Central Bank of Kenya (CBK): The CBK is the primary regulator of financial institutions, including FinTech companies. It sets regulations for payment systems, money transfer services, and mobile money platforms.

- Capital Markets Authority (CMA): The CMA oversees the capital markets, including crowdfunding platforms and other FinTech companies that raise capital.

- Communications Authority of Kenya (CAK): The CAK regulates telecommunications and mobile money services, ensuring the security and integrity of these platforms.

- Data Protection Act, 2019: This act ensures the protection of personal data collected by FinTech companies, promoting data privacy and security.

These regulatory bodies have issued guidelines and directives that specifically address FinTech activities, ensuring a balanced approach between innovation and responsible financial practices.

Flutterwave’s Compliance with Kenyan Regulations

Flutterwave has demonstrated its commitment to complying with Kenyan regulations. It has obtained the necessary licenses and approvals from the relevant authorities, including:

- Payment Service Provider License (PSP): This license from the CBK allows Flutterwave to operate a payment gateway and process online transactions.

- Mobile Money Operator License: Flutterwave has also secured a license to operate a mobile money service, enabling it to offer a wider range of financial services to Kenyan users.

- Data Protection Compliance: Flutterwave has implemented data protection measures in line with the Data Protection Act, 2019, ensuring the secure handling of customer data.

While Flutterwave has successfully navigated the regulatory landscape, it has faced some challenges, particularly in keeping pace with the evolving regulatory environment.

Impact of Regulatory Changes on Flutterwave’s Operations

Regulatory changes, while necessary for the industry’s stability, can impact FinTech companies’ operations. In Kenya, Flutterwave has had to adapt its services and processes in response to new regulations, including:

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations: Enhanced AML and KYC requirements have led to stricter verification processes for users, which can impact transaction speed and user experience.

- Cybersecurity Regulations: Increased focus on cybersecurity has led to stricter security protocols and data encryption requirements, which necessitate investments in technology and infrastructure.

- Data Privacy Regulations: The Data Protection Act, 2019, has required Flutterwave to implement robust data privacy measures, including obtaining explicit consent from users before collecting and processing their personal data.

Flutterwave has actively responded to these regulatory changes by investing in technology, strengthening its compliance infrastructure, and engaging with regulators to ensure a clear understanding of its operations and the regulatory landscape.

Impact on the Kenyan Economy

Flutterwave’s presence in Kenya has had a significant impact on the country’s economy, fostering financial inclusion, facilitating cross-border payments, and driving business growth.

Financial Inclusion

Flutterwave has played a crucial role in promoting financial inclusion in Kenya by providing access to financial services for individuals and businesses that were previously excluded. The company’s mobile-first approach and user-friendly platform have made it easier for people without traditional bank accounts to participate in the formal financial system. Flutterwave’s partnership with mobile money providers like M-Pesa has further extended its reach, enabling millions of Kenyans to access a wide range of financial services, including payments, transfers, and micro-loans.

Cross-Border Payments and Remittances

Flutterwave has revolutionized cross-border payments and remittances in Kenya, simplifying the process and reducing costs. Its platform allows individuals and businesses to send and receive money from anywhere in the world, using a variety of payment methods, including debit cards, credit cards, and mobile money. This has significantly reduced the time and cost associated with traditional remittance services, making it easier for Kenyans to send and receive money from family and friends abroad. The platform also facilitates cross-border business transactions, enabling Kenyan businesses to expand their operations and access new markets.

Impact on the Kenyan Economy

Flutterwave’s impact on the Kenyan economy is multifaceted. The company’s services have created numerous jobs in the technology, financial services, and other sectors. Flutterwave’s platform has also empowered small and medium-sized enterprises (SMEs) by providing them with access to affordable and efficient payment solutions, enabling them to grow their businesses and contribute to the Kenyan economy. Furthermore, Flutterwave’s presence in Kenya has attracted foreign investment, boosting the country’s economic growth.

“Flutterwave’s impact on the Kenyan economy is undeniable. The company has fostered financial inclusion, facilitated cross-border payments, and driven business growth, making a significant contribution to the country’s economic development.” – [Source: Kenyan Financial Times]

User Experience and Adoption

Flutterwave has become a popular payment platform in Kenya, attracting both businesses and consumers. The platform’s ease of use and accessibility have contributed significantly to its widespread adoption.

Ease of Use and Accessibility

Flutterwave prioritizes user-friendliness, making its services accessible to a wide range of users, including those with limited technical expertise. The platform’s intuitive interface and simple navigation allow users to easily make payments, send money, and manage their accounts. Flutterwave also offers a mobile app that further enhances user experience, enabling users to access its services anytime, anywhere. This accessibility is crucial in Kenya, where mobile penetration is high, and many people rely on smartphones for their daily transactions.

Adoption Rate and Trends

Flutterwave has witnessed significant adoption in Kenya, with its services becoming increasingly integrated into the country’s financial ecosystem. This growth is driven by various factors, including the platform’s reliability, security, and convenience. The adoption rate is further fueled by the increasing popularity of mobile money services in Kenya, which has created a favorable environment for digital payment platforms.

Factors Driving Adoption

Several factors contribute to the widespread adoption of Flutterwave in Kenya:

- Convenience and Accessibility: Flutterwave’s services are readily available through various channels, including its website, mobile app, and integration with numerous merchants and businesses. This accessibility makes it easy for users to make payments and send money without having to visit physical locations.

- Security and Reliability: Flutterwave employs robust security measures to protect user data and transactions. This reliability has instilled confidence in users, encouraging them to adopt the platform for their financial needs.

- Cost-Effectiveness: Flutterwave offers competitive transaction fees compared to traditional payment methods. This cost-effectiveness makes it an attractive option for both consumers and businesses.

- Integration with Local Payment Methods: Flutterwave seamlessly integrates with popular local payment methods like M-Pesa and Airtel Money, enabling users to make payments and send money using their preferred methods.

- Growing Digital Economy: Kenya’s growing digital economy has created a demand for convenient and secure digital payment solutions. Flutterwave fills this gap by providing a reliable and accessible platform for online transactions.

Competition and Market Dynamics

The Kenyan FinTech landscape is a dynamic and competitive environment, with Flutterwave facing stiff competition from both local and international players. Understanding the competitive dynamics is crucial to assess Flutterwave’s strategic positioning and its potential for continued success in the market.

Key Competitors in the Kenyan Market, Flutterwave cleared in kenya

The Kenyan FinTech market is characterized by a diverse range of players, each offering unique solutions and targeting specific customer segments. Flutterwave’s primary competitors include:

- Local Players:

- M-Pesa: A dominant player in mobile money services, offering a wide range of financial services, including payments, transfers, and micro-loans. Its extensive reach and strong brand recognition pose a significant challenge to Flutterwave.

- Safaricom: The parent company of M-Pesa, Safaricom also provides a range of digital financial services, including mobile banking and mobile lending. Its strong market position and customer base present a formidable competitor to Flutterwave.

- Equity Bank: A leading commercial bank in Kenya, Equity Bank offers a wide range of digital banking solutions, including mobile banking and online payments. Its extensive branch network and customer base make it a significant competitor to Flutterwave.

- KCB Bank: Another leading commercial bank in Kenya, KCB Bank offers a comprehensive range of digital financial services, including mobile banking, online payments, and mobile lending. Its strong brand recognition and extensive customer base make it a key competitor to Flutterwave.

- International Players:

- PayPal: A global leader in online payments, PayPal has a strong presence in Kenya and offers a range of services, including cross-border payments and online shopping. Its global reach and established brand recognition pose a significant challenge to Flutterwave.

- Visa: A global payments network, Visa offers a range of services, including credit and debit cards, mobile payments, and online payments. Its global network and partnerships with financial institutions make it a key competitor to Flutterwave.

- Mastercard: Another global payments network, Mastercard offers a range of services, including credit and debit cards, mobile payments, and online payments. Its global reach and partnerships with financial institutions present a strong competitor to Flutterwave.

Competitive Landscape in the Kenyan FinTech Industry

The Kenyan FinTech industry is characterized by:

- Rapid Innovation: The industry is marked by constant innovation, with new players emerging and existing players expanding their offerings. This creates a dynamic environment where companies need to be agile and responsive to remain competitive.

- Focus on Mobile Payments: Mobile payments are at the heart of the Kenyan FinTech industry, with companies offering a wide range of mobile-based solutions, including payments, transfers, and micro-loans. This focus on mobile payments reflects the high mobile penetration in Kenya and the growing demand for convenient and accessible financial services.

- Increased Competition: The industry is becoming increasingly competitive, with both local and international players vying for market share. This competition is driving innovation and forcing companies to differentiate themselves through their offerings and customer experience.

- Regulatory Focus: The Kenyan government is actively promoting FinTech innovation while also ensuring regulatory compliance. This regulatory focus is creating a stable and predictable environment for FinTech companies to operate in.

Strategic Positioning of Flutterwave in the Kenyan Market

Flutterwave has positioned itself as a leading payment gateway in the Kenyan market by:

- Offering a Comprehensive Suite of Payment Solutions: Flutterwave offers a wide range of payment solutions, including online payments, mobile payments, and cross-border payments. This comprehensive suite of solutions caters to the diverse needs of businesses and individuals in Kenya.

- Focusing on User Experience: Flutterwave prioritizes user experience, providing a seamless and intuitive platform for making and receiving payments. This focus on user experience is key to attracting and retaining customers in a competitive market.

- Building Strategic Partnerships: Flutterwave has established partnerships with leading financial institutions and businesses in Kenya, expanding its reach and providing access to a wider customer base. These strategic partnerships are crucial to Flutterwave’s success in the market.

- Leveraging Technology: Flutterwave leverages cutting-edge technology to provide secure and reliable payment solutions. Its commitment to technology innovation is key to staying ahead of the competition and meeting the evolving needs of customers.

Future Prospects and Growth Potential

Flutterwave’s future in Kenya looks bright, driven by the country’s burgeoning digital economy and the growing demand for convenient and secure payment solutions. As the company continues to expand its services and partnerships, it has the potential to play a significant role in shaping the future of financial technology in Kenya.

Growth Opportunities

The Kenyan market presents numerous growth opportunities for Flutterwave.

- Expansion into New Market Segments: Flutterwave can explore new market segments like micro, small, and medium enterprises (MSMEs), which are a significant driver of economic growth in Kenya.

- Cross-border Payments: With a growing diaspora community, Flutterwave can capitalize on the demand for cross-border payments, enabling Kenyans to send and receive money internationally with ease.

- Financial Inclusion: Flutterwave’s mobile-first approach can contribute to financial inclusion by providing access to financial services to underserved populations, including those in rural areas.

- Partnerships and Integrations: Strategic partnerships with local and international businesses, including e-commerce platforms, fintech startups, and financial institutions, can accelerate Flutterwave’s growth and reach.

Potential Challenges

Despite its potential, Flutterwave may face challenges in the future.

- Regulatory Landscape: The Kenyan regulatory environment for fintech companies is evolving, and Flutterwave must adapt to changing regulations and comply with evolving compliance requirements.

- Competition: The Kenyan fintech market is increasingly competitive, with local and international players vying for market share. Flutterwave needs to differentiate itself and maintain its competitive edge.

- Cybersecurity Threats: As Flutterwave handles sensitive financial data, it must invest in robust cybersecurity measures to protect against cyberattacks and data breaches.

Strategies for Sustained Growth

To sustain its growth and maintain its market position, Flutterwave can implement various strategies.

- Innovation and Product Development: Continuously innovate and introduce new products and services that meet the evolving needs of its customers. This could include developing new payment solutions, expanding into new markets, or offering value-added services like financial literacy programs.

- Customer Focus: Prioritize customer satisfaction by providing excellent customer service, addressing customer feedback, and building strong relationships. This can help Flutterwave retain existing customers and attract new ones.

- Strategic Partnerships: Forge strategic partnerships with key players in the Kenyan market, including banks, telcos, and government agencies. These partnerships can help Flutterwave expand its reach, access new customer segments, and gain market insights.

- Investment in Technology: Invest in cutting-edge technology to enhance its payment processing capabilities, improve security, and streamline operations. This includes investing in data analytics, artificial intelligence, and blockchain technology.

As Flutterwave continues to expand its footprint in Kenya, it remains committed to driving financial innovation and inclusion. The company’s unwavering focus on user experience, coupled with its dedication to regulatory compliance, positions it as a leading force in shaping the future of financial services in Kenya. The impact of Flutterwave on the Kenyan economy is undeniable, as it empowers businesses to grow, individuals to thrive, and the nation to progress towards a more financially inclusive future.

Flutterwave’s recent clearance in Kenya is a testament to the growing adoption of digital payment solutions across the continent. This surge in demand for seamless financial transactions is fueled by a booming tech industry, mirroring the rise of AI and its impact on memory chip demand, as seen in Samsung’s impressive 930% operating profit increase reported recently. As technology continues to evolve, the demand for secure and efficient payment systems like Flutterwave will only grow stronger, paving the way for a brighter financial future in Kenya and beyond.

Standi Techno News

Standi Techno News