The Galaxy S5 and Fingerprint Technology

The Samsung Galaxy S5, released in 2014, marked a significant milestone in smartphone security by becoming the first device to integrate a fingerprint sensor. This innovation, while not entirely novel (earlier attempts existed), revolutionized user authentication and security on mobile devices.

The Galaxy S5’s Fingerprint Sensor: A Paradigm Shift in Security

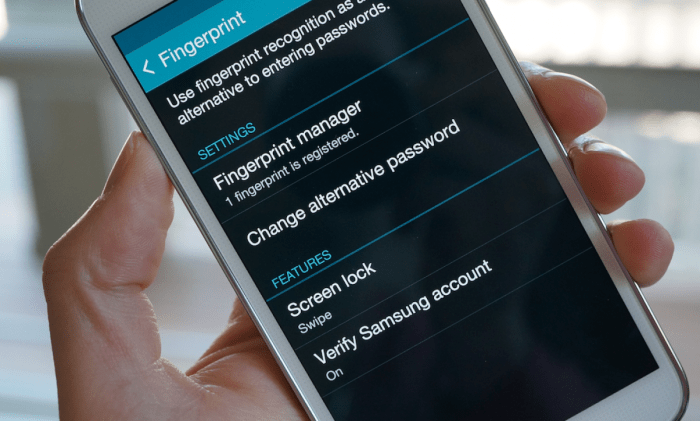

The Galaxy S5’s fingerprint sensor, strategically placed on the home button, provided a more secure and user-friendly alternative to traditional PINs and passwords. This technology significantly enhanced security by offering a unique and difficult-to-duplicate biometric identifier, making it significantly harder for unauthorized individuals to access sensitive data. The sensor allowed users to unlock their devices, authenticate payments, and even access private apps, all with the simple touch of a finger.

Comparing the Galaxy S5’s Fingerprint Sensor to Earlier Methods

Prior to the Galaxy S5, smartphone security primarily relied on PINs, passwords, or pattern locks. These methods, while effective to some extent, were susceptible to vulnerabilities. PINs and passwords could be easily forgotten or guessed, while pattern locks could be deciphered with a little observation. The Galaxy S5’s fingerprint sensor addressed these shortcomings by introducing a more secure and convenient method of authentication.

The Impact of the Galaxy S5’s Innovation: A Wave of Fingerprint Adoption

The Galaxy S5’s fingerprint sensor paved the way for widespread adoption of this technology across the smartphone industry. Following Samsung’s lead, numerous other manufacturers, including Apple, Google, and Huawei, incorporated fingerprint sensors into their devices. This rapid adoption highlighted the immense potential of fingerprint technology to enhance user security and convenience.

PayPal Integration and Mobile Payments

The Galaxy S5’s groundbreaking integration of PayPal with its fingerprint sensor marked a significant leap in the mobile payment landscape. This innovation not only enhanced convenience but also significantly boosted the security of online transactions.

Convenience and Security Benefits

The integration of PayPal with the Galaxy S5’s fingerprint sensor introduced a new level of convenience and security for users. Instead of relying on traditional methods like PINs or passwords, users could now authenticate their PayPal transactions with a simple fingerprint scan. This streamlined process eliminated the need to remember multiple passwords or fumble with PIN entry, making online shopping smoother and more efficient.

Furthermore, fingerprint authentication provided a robust layer of security. Unlike PINs or passwords, which could be easily forgotten or stolen, fingerprints are unique and difficult to replicate. This inherent security feature made it significantly harder for unauthorized individuals to access PayPal accounts and make fraudulent transactions.

Comparison to Traditional Methods

Fingerprint payment authorization offered a distinct advantage over traditional methods like PINs or passwords. PINs, while relatively secure, could be easily forgotten or guessed. Passwords, on the other hand, were susceptible to phishing attacks and data breaches. Fingerprint authentication, with its inherent uniqueness and difficulty in replication, provided a more secure and reliable form of authentication.

Factors Contributing to Mobile Payment Adoption

The adoption of mobile payment technologies like PayPal’s fingerprint authorization was driven by a confluence of factors. The widespread adoption of smartphones with advanced security features, coupled with the growing popularity of online shopping, created a fertile ground for mobile payment solutions. The increasing demand for convenience and security in online transactions further fueled the adoption of these technologies.

Moreover, the rise of mobile wallets and payment platforms, such as Apple Pay and Google Pay, further accelerated the shift towards mobile payments. These platforms offered users a seamless and secure way to make transactions using their smartphones, eliminating the need for physical cards or cash.

The Evolution of Mobile Payment Security

The introduction of fingerprint authentication on the Galaxy S5 in 2014 marked a significant leap forward in mobile payment security. This innovative feature allowed users to authorize transactions with a simple touch, adding an extra layer of protection beyond traditional PINs and passwords. However, the landscape of mobile payment security has evolved significantly since then, with advancements in technology and the emergence of new platforms.

The Rise of Mobile Payment Platforms

The introduction of fingerprint authentication on the Galaxy S5 spurred a wave of innovation in the mobile payment space. Apple Pay, launched in 2014, and Google Pay, launched in 2015, quickly gained traction, offering users secure and convenient ways to make payments using their smartphones. These platforms leveraged near-field communication (NFC) technology, allowing users to tap their phones against payment terminals to complete transactions.

The Role of Biometrics and Multi-Factor Authentication

Biometrics and multi-factor authentication have become integral components of modern mobile payment security. Beyond fingerprint recognition, facial recognition, iris scanning, and voice recognition have emerged as additional biometric authentication methods. These technologies offer greater security by making it more difficult for unauthorized individuals to access sensitive payment information. Multi-factor authentication, which requires users to provide multiple forms of identification, further enhances security by adding an extra layer of protection.

A Timeline of Mobile Payment Security Advancements

The evolution of mobile payment security can be traced through a timeline of key advancements:

- 2014: The Galaxy S5 becomes the first smartphone to feature fingerprint authentication for PayPal payments, marking a significant step towards enhanced mobile payment security.

- 2014: Apple Pay launches, introducing NFC technology and tokenization to protect payment information during transactions.

- 2015: Google Pay launches, offering similar features to Apple Pay and expanding the reach of secure mobile payments.

- 2016: Samsung Pay introduces Magnetic Secure Transmission (MST) technology, enabling payments at traditional magnetic stripe terminals.

- 2017: Facial recognition technology becomes increasingly prevalent in mobile payments, offering an alternative to fingerprint authentication.

- 2018: Biometric authentication methods like iris scanning and voice recognition gain traction, further strengthening mobile payment security.

- 2019: Multi-factor authentication becomes a standard security practice for many mobile payment platforms, requiring users to provide multiple forms of identification for enhanced security.

- 2020: The COVID-19 pandemic accelerates the adoption of contactless payments, further emphasizing the importance of secure mobile payment solutions.

The Galaxy S5’s Legacy: Galaxy S5 First To Support Paypal Fingerprint Payment Authorization

The Galaxy S5, launched in 2014, was a significant milestone in the evolution of smartphones, particularly in the realm of mobile payment technology. Its introduction of fingerprint scanning for PayPal authorization not only revolutionized the way people paid online but also set a precedent for future mobile payment innovations. This pioneering move established the Galaxy S5 as a frontrunner in the mobile payment landscape, influencing subsequent smartphone designs and payment ecosystems.

The Galaxy S5’s Impact on Mobile Payment Technology

The Galaxy S5’s fingerprint sensor, integrated with PayPal, offered a secure and convenient alternative to traditional passwords and PINs. This feature allowed users to authorize payments with a simple touch, streamlining the checkout process and enhancing user experience. This breakthrough paved the way for widespread adoption of fingerprint authentication in mobile payments, inspiring other smartphone manufacturers to incorporate similar features in their devices.

Key Features Contributing to the Galaxy S5’s Success

The Galaxy S5’s success can be attributed to several key features that resonated with consumers:

- Fingerprint Sensor: As discussed, the fingerprint sensor was a game-changer, offering a secure and convenient way to authenticate payments.

- Fast Processor: The Galaxy S5 boasted a powerful processor, enabling smooth performance and seamless multitasking.

- High-Resolution Display: Its vibrant and sharp display enhanced the overall user experience, particularly for multimedia consumption.

- Water and Dust Resistance: The IP67 rating provided peace of mind, allowing users to use the phone in challenging environments without worrying about damage.

- Long Battery Life: The Galaxy S5’s battery life was impressive, enabling users to use the phone for extended periods without needing to recharge.

While the Galaxy S5 was a groundbreaking device in its time, modern flagship smartphones have surpassed its features in several ways:

- Improved Processors: Modern flagship smartphones feature significantly more powerful processors, enabling even faster performance and smoother multitasking.

- Larger Displays: Flagship smartphones now offer larger displays with higher resolutions, providing an immersive viewing experience.

- Advanced Cameras: Camera technology has evolved dramatically, with modern flagship smartphones boasting multi-lens systems, advanced image processing, and high-quality video recording capabilities.

- 5G Connectivity: Modern flagship smartphones support 5G connectivity, offering significantly faster download and upload speeds.

- Enhanced Security Features: Modern flagship smartphones offer enhanced security features beyond fingerprint scanning, including facial recognition, iris scanning, and secure enclaves for sensitive data.

Galaxy s5 first to support paypal fingerprint payment authorization – The Galaxy S5’s innovative integration of fingerprint technology with PayPal marked a significant turning point in the mobile payment landscape. It showed the world that mobile payments could be both secure and convenient, laying the groundwork for the mobile payment revolution we see today. From Apple Pay to Google Pay, the Galaxy S5’s legacy continues to influence the way we make payments, proving that sometimes, the simplest solutions are the most impactful.

Remember when the Galaxy S5 was the first to support PayPal fingerprint payment authorization? It was a game-changer for mobile payments, and it seems like things are heating up again in the mobile tech world. With the alleged Sony Xperia Z4 hitting the FCC , we might be seeing some serious competition in the fingerprint payment arena soon. Who knows what innovative features Sony might be cooking up to take on Samsung’s lead?

Only time will tell!

Standi Techno News

Standi Techno News