German Financial Regulator Lifts Restrictions on N26 Signups sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. N26, a German-founded digital bank, has experienced a rollercoaster ride in recent years, facing both rapid growth and regulatory scrutiny. The German financial regulator, BaFin, imposed restrictions on N26’s signups in 2020, citing concerns about the bank’s anti-money laundering measures. These restrictions hampered N26’s expansion and growth, leaving many potential customers in limbo. However, the recent decision to lift these restrictions marks a turning point for the digital bank, signaling a potential shift in the regulatory landscape for fintech companies in Germany.

This decision is significant not only for N26 but also for the broader digital banking industry in Germany. It reflects a growing acceptance of innovative financial solutions and a recognition of the potential benefits of digital banking. The lifting of restrictions could pave the way for increased competition and innovation in the German banking sector, challenging traditional institutions and offering consumers more choices and better services.

N26 Background and Operations

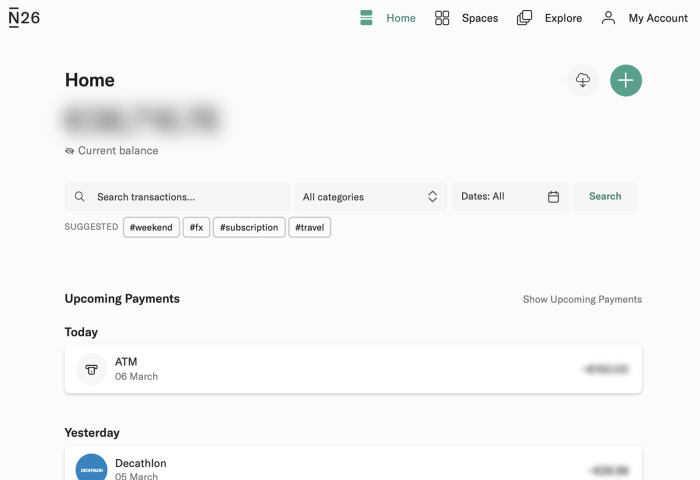

N26 is a German neobank that has gained significant traction in the European market and beyond. Established in 2013, the company has become a leading player in the digital banking landscape, offering a range of financial services through its mobile app.

N26’s mission is to provide a seamless and convenient banking experience to its customers. It aims to simplify traditional banking processes by offering a fully digital platform that allows users to manage their finances from their smartphones.

Business Model and Target Market

N26 operates a subscription-based business model, offering different account tiers with varying features and benefits. Its target market consists of digitally savvy individuals and millennials who value convenience, transparency, and accessibility.

N26’s key services include:

- Current accounts

- Debit cards

- Money transfers

- Savings accounts

- Investment products

- Insurance services

Global Presence and Regulatory Landscape

N26 has expanded its operations to over 25 countries across Europe, North America, and Asia. The company has secured licenses and operates under the regulatory frameworks of each country it operates in.

N26’s regulatory landscape is diverse, with varying rules and regulations across different jurisdictions. The company must comply with local laws and regulations, including those related to data privacy, financial security, and anti-money laundering.

The German Financial Regulator’s Restrictions

The German financial regulator, BaFin (Bundesanstalt für Finanzdienstleistungsaufsicht), imposed several restrictions on N26’s signups in 2020 and 2021, citing concerns about the bank’s anti-money laundering (AML) and know-your-customer (KYC) practices. These restrictions aimed to ensure N26’s compliance with German and European financial regulations.

Reasons Behind the Restrictions

The restrictions stemmed from BaFin’s concerns about N26’s ability to adequately prevent money laundering and identify high-risk customers. These concerns were based on several factors, including:

- Rapid Growth and Scalability Challenges: N26’s rapid growth, particularly in international markets, presented challenges in effectively implementing and maintaining robust AML and KYC processes.

- Compliance Issues: BaFin identified several instances of non-compliance with AML and KYC regulations, including inadequate customer due diligence, insufficient risk assessments, and shortcomings in transaction monitoring systems.

- Increased Scrutiny of Fintechs: The financial industry was undergoing increased scrutiny, with regulators focusing on the compliance of new and innovative financial institutions, such as fintech companies.

Impact of the Restrictions

The restrictions imposed by BaFin had a significant impact on N26’s growth and operations:

- Limited New Signups: The restrictions capped the number of new customers N26 could acquire, hindering its expansion plans and market penetration.

- Operational Challenges: The restrictions required N26 to implement stricter KYC and AML processes, which slowed down account opening times and increased operational costs.

- Reputational Damage: Public scrutiny and media attention surrounding the restrictions potentially damaged N26’s reputation and brand image.

Lifting the Restrictions: German Financial Regulator Lifts Restrictions On N26 Signups

The German financial regulator, BaFin, has lifted restrictions on N26’s ability to onboard new customers in Germany. This decision comes after a period of scrutiny and a series of measures implemented by N26 to address concerns regarding its anti-money laundering (AML) and know-your-customer (KYC) practices.

Reasons for Lifting the Restrictions

The decision to lift the restrictions was likely influenced by several factors, including:

- N26’s Improvements: N26 has implemented significant changes to its AML and KYC procedures, including increased staffing, enhanced technology, and improved internal controls. These improvements were aimed at strengthening its ability to identify and prevent financial crime.

- BaFin’s Satisfaction: The German regulator appears to be satisfied with the progress N26 has made in addressing the concerns raised. BaFin’s decision to lift the restrictions indicates that they are confident in N26’s ability to comply with AML and KYC regulations.

- Positive Impact on German Consumers: Lifting the restrictions will allow N26 to resume onboarding new customers in Germany, providing consumers with access to its digital banking services. This increased competition in the German banking market could benefit consumers with greater choice and potentially more favorable terms.

Benefits for N26 and German Consumers

The lifting of restrictions has several potential benefits for both N26 and German consumers:

- Increased Customer Base: For N26, the ability to onboard new customers in Germany will allow it to expand its customer base and potentially increase its market share. This could lead to greater revenue and profitability for the company.

- Improved Brand Reputation: Lifting the restrictions could help N26 repair its brand reputation, which was tarnished by the initial concerns about its AML and KYC practices. This could lead to increased trust and confidence from potential customers.

- Greater Competition: For German consumers, the return of N26 to the market will increase competition, potentially leading to better products, services, and lower fees. This could benefit consumers with greater choice and more favorable banking options.

Potential Risks and Challenges

While the lifting of restrictions is positive news for N26 and German consumers, it’s important to consider potential risks and challenges:

- Maintaining Compliance: N26 will need to continue to maintain robust AML and KYC practices to ensure compliance with regulations and avoid future issues. This will require ongoing investments in technology, staffing, and internal controls.

- Customer Trust: N26 will need to rebuild trust with potential customers who may still have concerns about its past practices. This will require transparency, clear communication, and continued focus on compliance.

- Market Competition: N26 will face intense competition from established banks and other fintech companies in the German market. It will need to differentiate itself and offer compelling products and services to attract and retain customers.

N26’s Future Prospects

The lifting of the restrictions on N26 signups in Germany represents a significant opportunity for the digital bank to accelerate its growth and expansion plans. With the regulatory hurdles removed, N26 can now focus on capitalizing on the strong demand for its services and solidify its position as a leading player in the German financial landscape.

Impact on Growth and Expansion, German financial regulator lifts restrictions on n26 signups

The lifted restrictions will likely have a positive impact on N26’s future growth and expansion plans. N26 can now actively pursue its growth strategy by:

- Increased Customer Acquisition: N26 can now ramp up its marketing and customer acquisition efforts without any regulatory constraints. This will enable the bank to reach a wider audience and attract new customers at a faster pace.

- Expansion into New Markets: The successful resolution of the regulatory issues in Germany can serve as a positive precedent for N26’s expansion into new markets. The bank can now leverage its proven business model and strong brand reputation to enter new territories with greater confidence.

- Enhanced Product Development: With the regulatory uncertainty lifted, N26 can now focus on developing new products and services that cater to the evolving needs of its customer base. This will allow the bank to remain competitive in the dynamic digital banking landscape.

Leveraging the Opportunity in the German Market

N26 can leverage this opportunity to strengthen its position in the German market by:

- Building Brand Awareness: N26 can capitalize on the increased media attention surrounding the lifting of the restrictions to build brand awareness and attract new customers. This can be achieved through targeted marketing campaigns, partnerships with key influencers, and strategic media outreach.

- Strengthening Customer Relationships: N26 can focus on building strong customer relationships by providing exceptional service, personalized experiences, and innovative features. This will foster customer loyalty and drive long-term growth.

- Expanding Product Offerings: N26 can expand its product offerings to cater to the specific needs of the German market. This could include tailored investment products, insurance solutions, and other financial services that resonate with local customers.

Comparison with Competitors

N26’s future prospects are promising, particularly when compared to its competitors in the digital banking space. N26 has several advantages that position it for continued success:

- Strong Brand Recognition: N26 has established a strong brand reputation in Germany and beyond. This brand recognition will be crucial in attracting new customers and retaining existing ones.

- Innovative Products and Services: N26 is known for its innovative product offerings, such as its mobile-first banking platform and its suite of financial tools. This focus on innovation will be key in staying ahead of the competition.

- Global Expansion Strategy: N26 has a well-defined global expansion strategy, which allows the bank to tap into new markets and diversify its customer base. This expansion strategy will provide N26 with significant growth opportunities in the years to come.

The Impact on the Digital Banking Landscape

The German financial regulator’s decision to lift restrictions on N26 signups sends ripples through the digital banking landscape in Germany. It signifies a potential shift in the regulatory environment, opening doors for increased competition and innovation within the sector.

The Potential for Increased Competition

This regulatory change creates a more welcoming environment for digital banks, potentially attracting new entrants and boosting competition in the German banking sector. The influx of new players can lead to:

- Enhanced product offerings: Digital banks, known for their innovative approach, could introduce new products and services tailored to specific customer needs, potentially pushing traditional banks to adapt and innovate.

- Lower fees and better rates: Competition can drive down fees and improve interest rates for customers, offering more attractive financial solutions.

- Improved customer experience: Digital banks often prioritize user-friendly interfaces and seamless online experiences, potentially setting a higher standard for customer service across the industry.

The Impact on the Regulatory Environment

The regulator’s decision to ease restrictions on N26 suggests a potential shift towards a more flexible and supportive regulatory environment for digital banks in Germany. This could:

- Encourage further innovation: A more favorable regulatory landscape can incentivize digital banks to invest in research and development, leading to the emergence of new financial technologies and solutions.

- Set a precedent for other digital banks: The lifting of restrictions on N26 could pave the way for other digital banks seeking to operate in Germany, creating a more competitive and dynamic market.

- Promote financial inclusion: Digital banks often target underserved populations with innovative solutions, and a more accommodating regulatory environment can help expand access to financial services for a wider range of individuals.

The lifting of restrictions on N26 signups marks a pivotal moment for the digital banking landscape in Germany. It signals a growing acceptance of fintech innovation and the potential for a more competitive banking market. While the future holds both opportunities and challenges, N26’s ability to leverage this opportunity and solidify its position in the German market will be key to its long-term success. The implications of this regulatory shift extend beyond N26, influencing the future of digital banking in Germany and potentially inspiring similar regulatory changes in other countries.

The German financial regulator has lifted restrictions on N26 signups, paving the way for more people to experience the digital banking revolution. While this opens doors for financial accessibility, it’s important to remember that the world of finance is also evolving in other ways, like the fascinating intersection between linguistics and AI, explored by women in AI like Anna Korhonen.

These innovations are reshaping how we interact with technology, and it’s exciting to see how N26 will integrate these advancements into their platform in the future.

Standi Techno News

Standi Techno News