Hackers stole money from the Starbucks app, leaving customers reeling from a security breach that exposed their financial information and left them feeling vulnerable. This isn’t just a tech story; it’s a tale of trust betrayed and the urgent need for stronger security measures in the digital age. The breach, which occurred in [Insert Date], targeted [Number] users, exploiting vulnerabilities in the app’s security system. Hackers gained access to sensitive data, including credit card information, by [Insert Specific Method].

The impact of this breach extends far beyond financial losses. Customers are grappling with feelings of betrayal and frustration, questioning the safety of their online transactions. The incident raises serious concerns about the security of mobile payment systems and the need for greater vigilance in protecting personal information.

The Starbucks App Security Breach

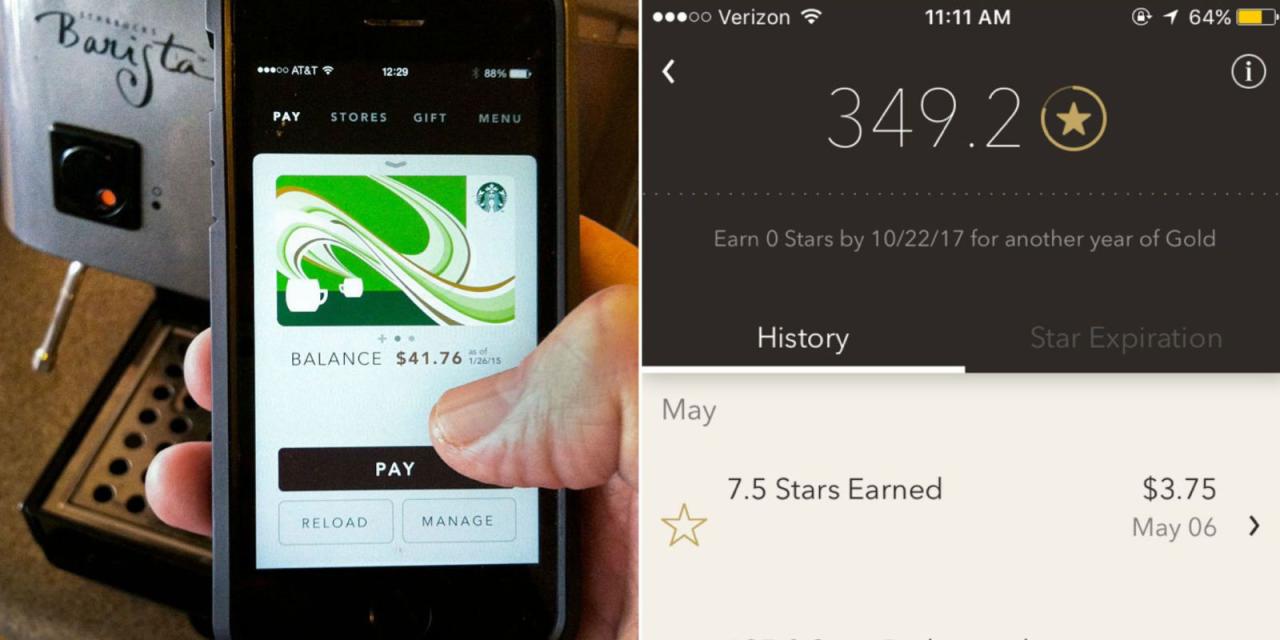

In 2020, Starbucks faced a significant security breach that compromised the personal and financial information of its customers. Hackers exploited vulnerabilities in the Starbucks app, allowing them to steal money from users’ accounts. This incident raised concerns about the security of mobile payment apps and the need for robust security measures to protect user data.

Vulnerabilities Exploited

The hackers targeted specific vulnerabilities in the Starbucks app, allowing them to gain unauthorized access to user accounts and financial information. These vulnerabilities included:

- Weak password security: Hackers exploited weak passwords or reused passwords across multiple accounts to gain access to Starbucks accounts.

- Lack of two-factor authentication: The absence of two-factor authentication allowed hackers to bypass security measures and access accounts without requiring additional verification steps.

- Insufficient data encryption: The Starbucks app lacked sufficient encryption for sensitive data, making it easier for hackers to intercept and steal user information.

Timeline of the Breach

The Starbucks app security breach occurred in late 2020, with the discovery of the breach taking place in early 2021. The duration of the attack is estimated to have lasted for several months, during which hackers gained access to and exploited user accounts. The exact number of affected users is not publicly known, but it is believed to be significant, considering the widespread use of the Starbucks app.

Methods Used by Hackers

Hackers employed various methods to gain access to user accounts and financial information. These methods included:

- Phishing attacks: Hackers sent phishing emails or messages disguised as legitimate communications from Starbucks, tricking users into revealing their login credentials.

- Malware: Hackers distributed malicious software that infected users’ devices, allowing them to steal login credentials and financial information.

- Credential stuffing: Hackers used stolen credentials from other data breaches to attempt to log in to Starbucks accounts.

Impact on Starbucks Customers

The Starbucks app security breach had a significant impact on customers, both financially and emotionally. The hack resulted in unauthorized access to sensitive personal and financial information, leaving many customers feeling violated and vulnerable.

Financial Losses

The financial losses suffered by Starbucks customers varied depending on the extent of the breach. Some customers reported unauthorized transactions on their Starbucks accounts, while others had their credit card information compromised. The financial impact on customers ranged from a few dollars to hundreds of dollars, depending on the amount of money stolen and the extent of the damage to their credit scores.

Emotional and Psychological Impact

The Starbucks app security breach had a significant emotional and psychological impact on victims. Many customers felt betrayed by Starbucks, a company they trusted with their personal information. The breach also caused feelings of frustration and insecurity, as customers worried about the potential for identity theft and other forms of financial fraud.

Long-Term Consequences

The long-term consequences of the Starbucks app security breach could be significant for customers. Stolen credit card information can lead to increased susceptibility to future scams, and damage to credit scores can make it more difficult to obtain loans or other forms of credit. Customers may also face challenges in restoring their financial security and rebuilding their trust in online services.

Cybersecurity Best Practices for Mobile Apps: Hackers Stole Money From The Starbucks App

The Starbucks app security breach serves as a stark reminder of the importance of robust cybersecurity measures for mobile applications. Mobile apps have become integral to our lives, handling sensitive data like financial information, personal details, and even health records. Therefore, developers must prioritize security to protect user data and maintain trust.

Multi-Factor Authentication

Multi-factor authentication (MFA) adds an extra layer of security by requiring users to provide multiple forms of authentication before granting access to an app. This significantly reduces the risk of unauthorized access, even if a hacker steals a user’s password.

- Example: A user might be required to enter their password and then receive a one-time code on their phone or email.

- Benefits: MFA significantly increases the difficulty for attackers to gain access to user accounts, even if they have stolen one authentication factor. This is because they would need to compromise multiple factors, making it much more challenging.

Data Encryption

Data encryption is crucial for protecting sensitive information stored and transmitted by mobile apps. Encryption transforms data into an unreadable format, making it incomprehensible to unauthorized individuals.

- Example: When a user enters their credit card information into a mobile app, the data is encrypted before being sent to the server.

- Benefits: Encryption ensures that even if an attacker intercepts the data, they cannot decipher it without the appropriate decryption key. This protects sensitive information from unauthorized access, even if the app itself is compromised.

Regular Security Audits, Hackers stole money from the starbucks app

Regular security audits are essential to identify and address vulnerabilities in mobile apps. These audits involve a thorough examination of the app’s code, infrastructure, and security practices to detect potential weaknesses.

- Example: A security audit might identify a vulnerability in the app’s authentication process or a weak encryption algorithm.

- Benefits: Regular audits help identify security vulnerabilities early on, before they can be exploited by attackers. This allows developers to patch vulnerabilities and improve the overall security of the app.

Implications for the Future of Mobile Payments

The Starbucks app security breach, while a significant incident for the coffee giant, also serves as a stark reminder of the vulnerabilities inherent in mobile payment systems. This event has far-reaching implications for the future of mobile payments, prompting critical conversations about consumer trust, regulatory frameworks, and the need for enhanced security measures.

The Impact on Consumer Trust

The Starbucks app security breach has undoubtedly shaken consumer confidence in mobile payment systems. This breach, which resulted in unauthorized access to sensitive financial data, highlights the potential risks associated with storing financial information on mobile devices. The incident has raised concerns about the security of mobile payment apps in general, leading some consumers to question the reliability and safety of these systems.

The impact of the breach on consumer trust in mobile payment systems is likely to be significant. Consumers are increasingly reliant on mobile payments for their daily transactions, and this breach has eroded their confidence in the security of these systems.

Increased Regulation and Oversight

In the wake of the Starbucks app security breach, there is a growing demand for increased regulation and oversight of mobile payment apps. Regulators are likely to scrutinize the security practices of mobile payment providers more closely, demanding stricter standards for data protection and security protocols. This increased scrutiny could lead to new regulations and guidelines aimed at enhancing the security of mobile payment systems and protecting consumer data.

The Starbucks app security breach is likely to trigger a wave of new regulations and oversight measures aimed at improving the security of mobile payment apps. Regulators will likely require mobile payment providers to implement stronger security measures and to be more transparent about their data security practices.

The Future of Mobile Payment Security

The Starbucks app security breach has underscored the need for continuous innovation and improvement in mobile payment security. Emerging technologies and strategies are being developed to enhance the protection of mobile payment systems.

- Biometric Authentication: Biometric authentication, such as fingerprint scanning and facial recognition, offers a more secure and user-friendly alternative to traditional passwords. This technology adds an extra layer of security by verifying the user’s identity through unique biological traits.

- Tokenization: Tokenization involves replacing sensitive card details with unique, random tokens. These tokens are used for transactions, while the actual card details are stored securely on a separate server. This approach protects card data from unauthorized access.

- Blockchain Technology: Blockchain technology offers a decentralized and secure platform for storing and managing financial data. Its immutability and transparency features make it a promising solution for enhancing mobile payment security.

The Starbucks app hack serves as a stark reminder of the ever-present threat of cybercrime. It highlights the critical importance of robust security measures and the need for businesses to prioritize customer data protection. As we move towards a more digital world, ensuring the safety of mobile payment systems is paramount. This incident should prompt a deeper examination of existing security protocols and the development of more sophisticated safeguards to prevent future breaches.

While hackers were busy siphoning funds from Starbucks accounts, Nintendo was celebrating a different kind of victory. Mario Kart 8 sales crossed the 5 million mark , proving that even in the digital age, people still love a good ol’ fashioned race. Maybe those Starbucks hackers should have invested in some virtual karts instead – they might have made more money that way.

Standi Techno News

Standi Techno News