How vcs can assess and attract winners in a landscape thats now crowded with ai startups – How VCs can assess and attract winners in a landscape that’s now crowded with AI startups? It’s a question that’s keeping many venture capitalists up at night. The AI boom has led to a surge of startups vying for funding, creating a landscape where separating the wheat from the chaff is more challenging than ever. The key for VCs lies in going beyond the hype and digging deeper into the fundamentals of each company.

This means evaluating not just the technology, but also the team behind it, the market opportunity, and the competitive landscape. VCs need to be able to identify startups with a clear vision, a strong team, and a product that solves a real problem. It’s about finding the companies with the potential to disrupt industries and create lasting value.

The AI Startup Landscape

The AI startup landscape is booming, with a surge in new companies and a flood of investment capital. This rapid growth has created a highly competitive environment, making it challenging for venture capitalists (VCs) to identify promising AI startups from the pack.

Challenges in Identifying Promising AI Startups

VCs face numerous challenges when evaluating AI startups. These challenges stem from the complexity of AI technology, the rapid pace of innovation, and the abundance of startups vying for funding. One of the biggest hurdles is discerning genuine innovation from hype. Many startups make bold claims about their AI capabilities, but it can be difficult to determine the true potential and viability of their solutions. Furthermore, the lack of standardized metrics for evaluating AI performance makes it difficult to compare different startups objectively.

Statistics on AI Startups and Funding, How vcs can assess and attract winners in a landscape thats now crowded with ai startups

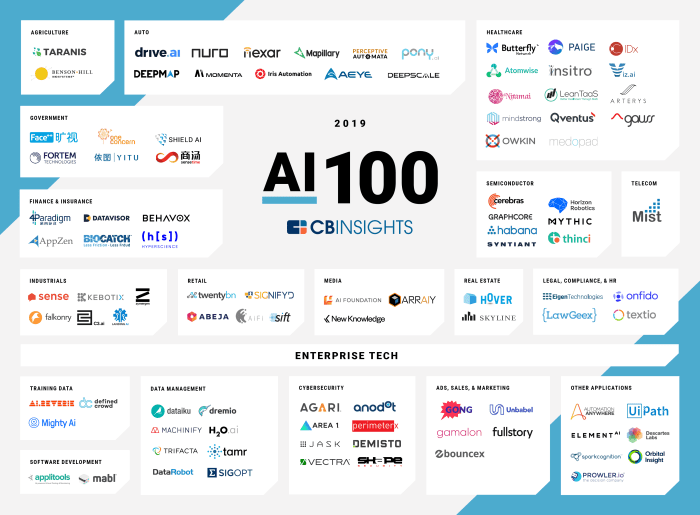

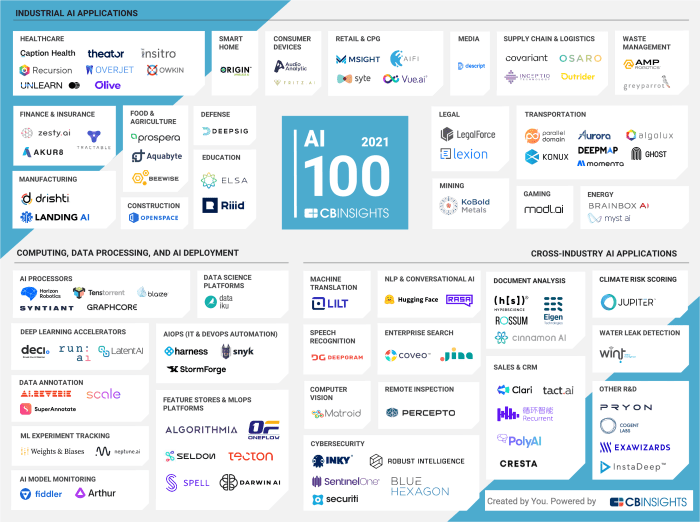

The number of AI startups and funding activity in the AI sector has grown exponentially in recent years. According to CB Insights, there were over 1,400 AI startups founded between 2010 and 2020. In 2021 alone, AI startups raised over $100 billion in funding. This surge in funding reflects the immense potential of AI to revolutionize various industries. However, it also creates a highly competitive landscape, with many startups competing for limited funding.

Assessing AI Startup Potential

The AI startup landscape is bursting with innovation, but separating the genuine game-changers from the hype requires a discerning eye. Venture capitalists (VCs) are tasked with identifying promising AI startups with the potential to disrupt industries and generate substantial returns. This means going beyond the buzzwords and delving into the core elements that drive success.

Evaluating Key Factors

VCs meticulously assess various factors to determine the potential of an AI startup. This involves a comprehensive evaluation of the team, technology, market opportunity, and competitive landscape.

Team

The team behind an AI startup is paramount. VCs look for:

- Domain expertise: Founders with deep knowledge of the industry they are targeting, coupled with a strong understanding of AI and its applications.

- Technical prowess: A team with a proven track record in building and deploying AI solutions, demonstrating their ability to execute complex projects.

- Leadership and vision: Effective leaders with a clear vision for the company’s future, capable of attracting and retaining top talent.

Technology

The AI technology itself is crucial, and VCs evaluate:

- Differentiation: Unique AI algorithms, models, or approaches that provide a competitive advantage.

- Scalability: Technology that can be scaled to handle large volumes of data and meet the demands of a growing market.

- Data strategy: A robust plan for data acquisition, processing, and security, as AI models rely heavily on high-quality data.

Market Opportunity

The market opportunity is another critical aspect. VCs assess:

- Market size and growth: A large and rapidly growing market with substantial potential for AI adoption.

- Target customer: Well-defined target customers with a clear need for the AI solution being offered.

- Competitive landscape: A thorough understanding of existing players and their strengths and weaknesses.

Competitive Landscape

Understanding the competitive landscape is crucial. VCs look for:

- Differentiation: A clear understanding of how the startup’s AI solution stands out from competitors.

- Go-to-market strategy: A well-defined plan for reaching target customers and achieving market penetration.

- Barriers to entry: Identifying factors that make it difficult for competitors to enter the market, such as intellectual property or strong brand recognition.

Identifying Red Flags

While promising AI startups abound, certain red flags can indicate potential risks for investors. VCs are cautious about:

- Overly ambitious claims: Startups that make unrealistic promises about the capabilities of their AI technology or its impact on the market.

- Lack of clear business model: Startups that fail to articulate a clear path to revenue generation or a sustainable business model.

- Inadequate data strategy: Startups that lack a robust plan for acquiring, processing, and securing the data necessary for AI model training.

- Weak team or leadership: Startups with a team lacking domain expertise, technical skills, or leadership experience.

Attracting Winning AI Startups: How Vcs Can Assess And Attract Winners In A Landscape Thats Now Crowded With Ai Startups

In a landscape teeming with AI startups, VCs need to refine their strategies to attract the most promising ventures. This requires understanding the unique needs and aspirations of AI entrepreneurs and crafting compelling value propositions that resonate with them.

Building a Strong Reputation and Network

Establishing a reputation as a trusted and knowledgeable partner within the AI community is paramount. VCs can achieve this by actively engaging with the AI ecosystem, participating in industry events, conferences, and workshops.

- Deepen Industry Knowledge: VCs should invest time in understanding the nuances of specific AI subfields, such as machine learning, natural language processing, and computer vision. This expertise enables them to identify promising startups with strong technical foundations.

- Develop Relationships: Cultivating relationships with leading AI researchers, professors, and industry experts can provide invaluable insights into emerging trends and identify promising startups early on.

- Partner with Incubators and Accelerators: Collaborating with AI-focused incubators and accelerators allows VCs to tap into a pipeline of promising startups and gain access to a network of mentors and advisors.

Crafting a Compelling Pitch Deck

A well-structured pitch deck is crucial for capturing the attention of AI startups. It should highlight the VC’s expertise in AI, demonstrate a deep understanding of the startup’s industry, and articulate a clear value proposition.

- Focus on AI Expertise: The pitch deck should showcase the VC’s track record in backing successful AI startups, highlighting their understanding of the technical challenges and opportunities in the field.

- Tailor the Pitch: Each pitch should be tailored to the specific startup, demonstrating a thorough understanding of their technology, market, and competitive landscape. This personalization demonstrates genuine interest and deep understanding.

- Articulate a Clear Value Proposition: VCs should clearly articulate the unique value they bring to AI startups, whether it’s industry connections, mentorship, or access to strategic resources. This value proposition should resonate with the startup’s needs and aspirations.

Offering a Unique Value Proposition

Beyond financial investment, VCs can attract promising AI startups by offering a compelling value proposition that extends beyond traditional funding.

- Mentorship and Guidance: VCs with deep expertise in AI can provide invaluable mentorship and guidance to startups, helping them navigate the complexities of product development, market entry, and scaling their business.

- Strategic Partnerships: VCs can leverage their network to connect AI startups with potential partners, customers, and strategic collaborators, accelerating their growth and market penetration.

- Access to Resources: VCs can provide access to critical resources such as data sets, cloud computing infrastructure, and specialized talent, enabling startups to accelerate their development and overcome key hurdles.

Beyond the Investment

In the competitive landscape of AI startups, VCs play a crucial role beyond just providing funding. They are instrumental in nurturing and guiding these companies to achieve their full potential. This goes beyond financial support and extends to offering valuable mentorship, strategic guidance, and access to essential resources.

Mentorship and Guidance

Mentorship is a vital component of supporting AI startup success. VCs can provide valuable insights and guidance from their own experience, network, and expertise. This mentorship can encompass various aspects of the startup journey, including:

- Product Development: VCs can help refine product strategy, identify market opportunities, and optimize product-market fit.

- Team Building: VCs can assist in recruiting and retaining top talent, fostering a strong and diverse team culture.

- Go-to-Market Strategy: VCs can guide startups in developing effective go-to-market strategies, including marketing, sales, and distribution.

- Fundraising and Financial Management: VCs can provide guidance on financial planning, fundraising rounds, and strategic financial management.

Access to Resources

Beyond mentorship, VCs can unlock access to critical resources that can significantly accelerate startup growth. These resources can include:

- Industry Networks: VCs have extensive networks of industry experts, potential customers, and strategic partners that can open doors for AI startups.

- Technical Expertise: VCs can connect startups with leading researchers, engineers, and technical advisors who can provide valuable support and guidance.

- Operational Expertise: VCs can offer access to resources and expertise in areas like legal, accounting, and marketing, which are essential for startup success.

- Incubators and Accelerators: VCs can provide access to specialized incubators and accelerators that offer tailored programs, mentorship, and funding for AI startups.

Hypothetical VC Roadmap

A VC firm can create a structured roadmap to effectively engage with its AI portfolio companies. This roadmap can include:

- Initial Investment: Conduct thorough due diligence, provide initial funding, and establish a clear investment thesis.

- Mentorship and Guidance: Regularly meet with startup founders, offer strategic advice, and connect them with relevant experts.

- Access to Resources: Introduce startups to industry networks, technical advisors, and operational resources.

- Performance Tracking: Monitor startup progress, provide feedback, and adjust strategies based on performance metrics.

- Exit Strategy: Collaborate on long-term plans, including potential acquisition, IPO, or other exit options.

Future Trends

The AI startup landscape is constantly evolving, driven by rapid advancements in AI technologies and the increasing adoption of AI solutions across various industries. VCs need to stay ahead of the curve and understand the emerging trends that will shape the future of AI startups. This section explores key trends and their implications for VCs.

Emergence of New AI Technologies

The emergence of new AI technologies, such as generative AI, federated learning, and edge AI, is significantly impacting the AI startup landscape. These technologies are opening up new possibilities for innovation and disrupting existing markets.

- Generative AI: Generative AI models, like Kami and DALL-E, are capable of creating realistic and novel content, including text, images, and even code. This technology has immense potential in various sectors, from content creation and marketing to drug discovery and design. VCs should closely monitor the development and applications of generative AI to identify promising startups.

- Federated Learning: Federated learning allows AI models to be trained on decentralized data sets without sharing the data itself. This technology addresses privacy concerns and enables the development of AI solutions in data-sensitive domains like healthcare and finance. VCs should look for startups leveraging federated learning to address specific industry needs.

- Edge AI: Edge AI enables AI processing to occur at the edge of the network, closer to the data source. This technology reduces latency and improves responsiveness, making it suitable for applications like autonomous vehicles, industrial automation, and real-time monitoring. VCs should explore startups developing innovative edge AI solutions.

In the end, success in the AI startup landscape requires a combination of savvy investment strategies, a deep understanding of the technology, and a willingness to take calculated risks. VCs who can navigate this complex environment and identify the true winners will be rewarded with significant returns and the satisfaction of shaping the future of AI. But for those who get caught up in the hype, the consequences could be costly. The AI startup landscape is a game of high stakes, and the rules are constantly changing. But for those who play their cards right, the rewards can be immense.

VCs need to be extra discerning in this AI startup boom. It’s not just about hype – they’re looking for real potential, not another Fisker-style flameout. The key is to assess the team’s expertise, the market fit, and the product’s real-world impact. That’s how you find the unicorns in the crowded AI field.

Standi Techno News

Standi Techno News